RYG Full Report Aug 2012 (PDF)

File information

This PDF 1.7 document has been generated by Nitro Pro 7 / Unknown, and has been sent on pdf-archive.com on 30/11/2012 at 21:38, from IP address 71.43.x.x.

The current document download page has been viewed 21238 times.

File size: 2.96 MB (256 pages).

Privacy: public file

File preview

Red-Yellow-Green

Report on All SEC-Registered Investment Advisors

Securities & Exchange Commission Form ADV Data as of July 2, 2012

Report Date: August 1, 2012

© Diligence Review Corp, 2012, New York, NY, USA. All rights reserved.

Diligence Review Corp. does not market, sell, or promote any investment products. The information in this report does not constitute an offer to sell, or a solicitation of an offer

to buy, any securities or investment products. This report could serve to supplement an investor’s larger due diligence efforts. It is no substitute for a comprehensive due

diligence effort. Diligence Review Corp. does not provide legal, accounting or tax advice. The information contained in this report is for general guidance only. Due to the

changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained in this report. Diligence Review Corp. will make every

effort to ensure the accuracy and quality of information provided. The information in this report is provided with the understanding that through its transmission, Diligence

Review Corp. is not engaged in rendering legal, accounting, tax, or other professional advice or services. As such, it should not be used as a substitute for consultation with

professional legal, tax or other competent advisers. Before making any decision or taking any action, you should consult a Diligence Review Corp. professional or other

specialized professional. While we have made every attempt to ensure that the information contained in this report has been obtained from reliable sources, Diligence Review

Corp. is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this report is provided "as is," with no

guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but

not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Diligence Review Corp., the Managing Directors, the firm’s

employees, or contractors, be liable to anyone for any decision made or action taken in reliance on the information in this report or for any consequential, special or similar

damages, even if advised of the possibility of such damages. Certain links in this report connect to other websites maintained by third parties over whom Diligence Review Corp.

has no control. Diligence Review Corp. makes no representations as to the accuracy of information contained in other websites.

This report is divided into three sections, Red List, Yellow List, and Green List. Firms names appear only once in this report. Although Red List firms often have one or more

yellow flags, only the firms’ red flags are listed. Any firm that has an item disclosed in Item 11 of Form ADV will either be in the Red List or in the Yellow List, but not both.

Placement on the Green List does not necessarily mean that there are no organizational or due diligence concerns at these firms. It simply means that the most obvious red

flags and yellow flags did not turn up in a review of SEC Form ADV.

Page 2 of 17

Executive Summary of Findings

Investment advisors are those firms that offer mutual funds, ETFs, pooled and separate account management arrangements. In

general, US investment advisory firms that manage $100 million in assets or greater are required to register with the U.S. Securities

and Exchange Commission (“SEC”) via Form ADV. Our firm recently downloaded the July 2, 2012 SEC Form ADV data. The data

consisted of files from 11,622 advisors submitting Form ADV as a registered advisor.

These advisors include many private fund advisors, including hedge fund and private equity fund advisors. Venture capital advisors,

foreign private advisors, and small private fund advisors (those who manage less than $150 million) are currently classified by the

SEC as “exempt” advisors. Data relating to exempt advisors are not included in this report.

Key Findings:

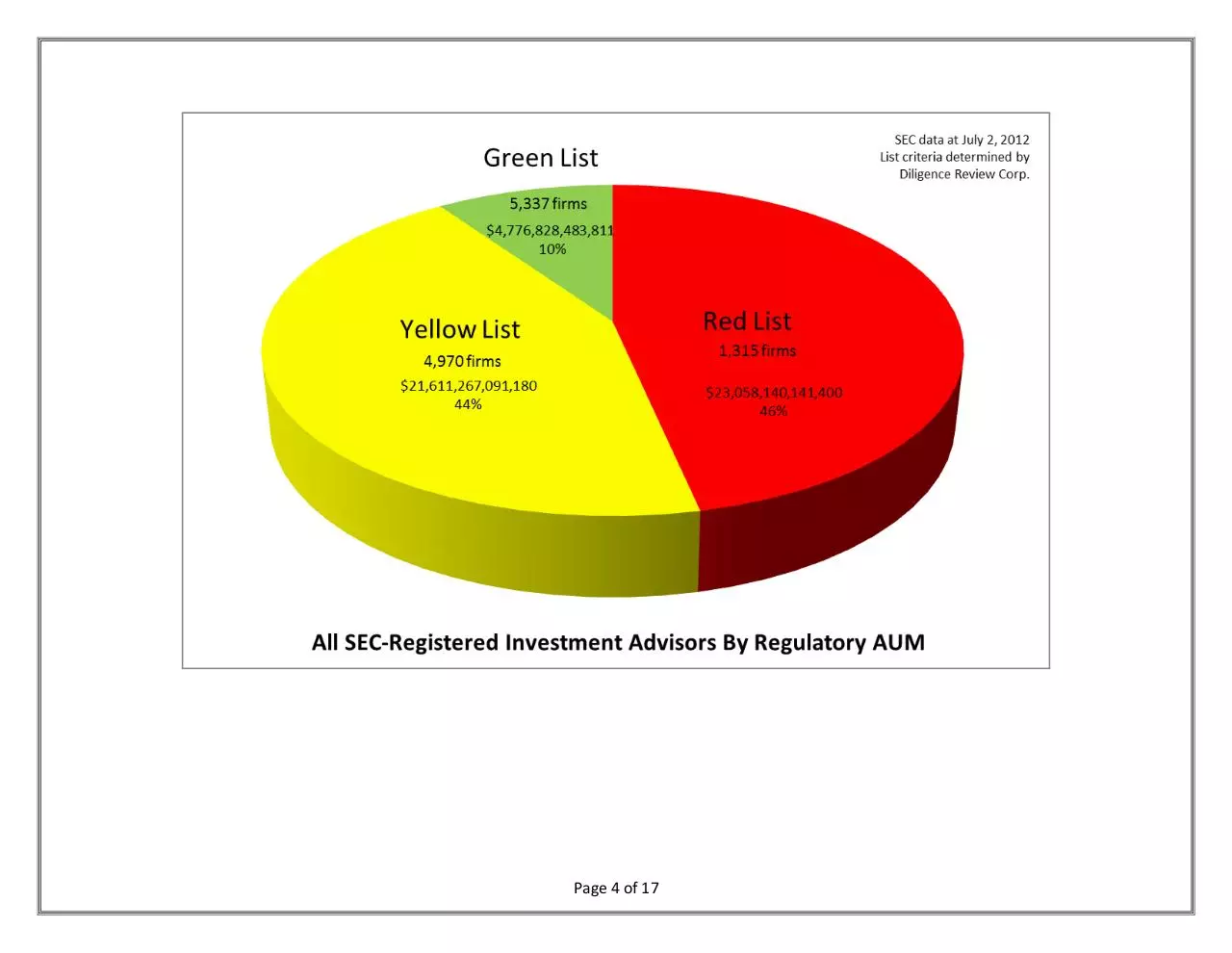

A total of 11,622 investment advisors are registered with the SEC, as of July 2, 2012. These advisors have total regulatory

AUM of $49,446,235,716,391. In other words, they manage nearly $50 trillion dollars.

Red List: Of the 11,622 registered advisors, we identified 1,315 advisors (11.31%) that answered “yes” to one or more

questions that constitute a “significant adverse regulatory event” in Form ADV. Red List firms manage over $23 trillion

dollars, or 46% of all assets managed by SEC-registered investment advisors.

Yellow List: Of the 11,622 SEC-registered investment advisors, we identified 4,970 advisors (42.76%) that had a “yellow flag”

uncovered in the review of their Form ADV. Yellow List firms manage over $21 trillion dollars, or 44% of all assets managed

by SEC-registered investment advisors. Many yellow flags relate to a firm’s organizational structure, although some yellow

flags relate to adverse regulatory events disclosed on Form ADV that do not rise to the level of a red flag.

Green List: The Green List contains firms that have no significant adverse items on Form ADV. In other words, these are the

firms that do not have red or yellow flags. Of the 11,622 registered investment advisors, we identified 5,337 advisors

(45.92%) that meet these criteria. Green List firms manage over $4.7 trillion dollars, or approximately 10% of all assets

managed by SEC-registered investment advisors.

Page 3 of 17

Page 4 of 17

What is Form ADV?

U.S. investment advisory firms that manage $100 million in assets or greater are required to register with the SEC. So-called “midsized” advisors (those firms that manage between $25 million and $100 million in assets) are required to register with state

securities authorities. There are some exceptions. Mid-sized investment advisory firms with principal offices and places of business

in Wyoming and New York and are not state supervised are required to register with the SEC. For more information about mid-sized

investment advisors, please visit the SEC’s FAQ on this subject. Data related to mid-sized advisors are not included in this report.

Form ADV is the document that investment advisors use to register with the SEC and state securities authorities. Form ADV consists

of two parts. Part 1 requires information about the investment advisor’s business, ownership, clients, employees, business

practices, affiliations, and any disciplinary events of the advisor or its employees. Part 2 requires investment advisors to prepare

narrative brochures written in plain English that contain information such as the types of advisory services offered, the advisor’s fee

schedule, disciplinary information, conflicts of interest, and the educational and business background of management and key

personnel.

Those advisors that register with the SEC have their filings available to the public on the SEC’s Investment Adviser Public Disclosure

(“IAPD”) website. Although performance data are not included in the information, data about recent criminal and regulatory

violations, organizational structure and other key due diligence information is disclosed. An investment advisor’s Form ADV

information can change frequently. SEC-registered investment advisors are required to file annual amendments to Form ADV

within 90 days of the close of the investment advisor’s fiscal year. Additionally, investment advisors must update Form ADV within

30 days of any material (i.e., significant) changes at the firm.

Page 5 of 17

What is Regulatory AUM?

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires investment advisors to calculate

their regulatory assets under management (“regulatory AUM”). Regulatory AUM is a very complex subject and if the reader needs

to know the specifics of how this is calculated, please do further research and/or consult your legal, tax and compliance

professionals. The SEC provides a method of calculation in the instructions to Form ADV.

At its essence, regulatory AUM represents the total assets over which the asset management firm provides “continuous and regular”

oversight. Put more plainly, it’s the amount of assets on which the firm provides investment advice. When counting assets, the

investment advisor is required to include all gross assets (without deducting debt or leverage). In addition, the investment advisor

must include uncalled capital commitments, which primarily affects private equity fund advisors. In addition, all assets must be

valued at their market value or fair value. This last point poses a bit more complexity for advisors that trade in illiquid assets such as

private equity and some hedge fund advisors.

We included discretionary and non-discretionary assets that each firm listed on Form ADV. Some of the firms listed in this report

have a regulatory AUM of $0. Investment consultants, financial planners, and other firms that select investment advisors and do not

themselves provide “continuous and regular” management services to securities portfolios are among those firms that list their

regulatory AUM as $0. We included those firms in this report because these firms complete a full Form ADV and are fully registered

with the SEC.

Section 1: The Red List & Methodology

Of the 11,622 registered advisors, we identified 1,315 advisors (11.31%) that answered “yes” to one or more questions that

constitute a “significant adverse regulatory event” in Form ADV. The names of those 1,315 firms are listed in alphabetical order in

the Red List section of this report.

We consider significant adverse regulatory events to be red flags in the investor due diligence process. A “red flag” is any high risk

item that a prudent investor would seek to investigate and understand prior to investing. Although Red List firms often have one or

Page 6 of 17

more yellow flags, we list only the red flags for each Red List firm in this report. We do not include any Red List firms in the Yellow

List report.

While the Red List firms are relatively few in terms of number, these firms control nearly half of the total assets invested in

registered investment advisors. Red List firms manage over $23 trillion dollars, or 46% of all assets managed by SEC-registered

investment advisors.

WHAT IS A “SIGNIFICANT ADVERSE REGULATORY EVENT?”

There are 24 questions on the Form ADV within Item 11, a section of Form ADV that relates to the disclosure of legal and regulatory

violations. Of these 24 questions Diligence Review Corp. selected the eight that, in our view, constitute the most significant

regulatory areas. The firms listed on the Red List answered “yes” to one or more of those eight questions.

The eight questions are:

1)

In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a

domestic, foreign, or military court to any felony?

2)

In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a

domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud,

false statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy

to commit any of these offenses?

3)

Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you

or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4)

Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related

activity?

5)

Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found

you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

Page 7 of 17

6)

Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past

10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7)

Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved

in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8)

Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investmentrelated statues or regulations?

Significant adverse regulatory events can turn up on a record with the passage of time and sometimes, events will fall off the record.

For example, some felonies and other regulatory events need not be disclosed if they happened over 10 years prior to the filing

date.

When reviewing regulatory violations, we believe it is important to focus on the nature of the violation. Does the violation have to

do with operational issues, such as trading? Or do the violations concern a lack of disclosure to clients? Is there more than one

violation listed and if so, does this behavior represent a chronic inability of the firm to comply with regulations, including applicable

laws? We suggest that investors review the entire Form ADV to better understand the firm as a whole and better understand

regulatory violations, if any. Each answer provided by the advisors in Form ADV will take the investor along a separate path of

inquiry in the due diligence process.

WHAT IS AN AFFILIATE?

The SEC’s instructions for Form ADV contain a glossary of terms. In it, the SEC describes an “advisory affiliate” as follows:

Your advisory affiliates are:

(1) all of your officers, partners, or directors (or any person performing similar functions);

(2) all persons directly or indirectly controlling or controlled by you; and

Page 8 of 17

(3) all of your current employees (other than employees performing only clerical, administrative, support or similar

functions).

Significant adverse regulatory events may occur for the firm itself or an “advisory affiliate.” In our experience, when asked about

these events, some investment advisors begin the discussion by dismissing these events as unimportant or irrelevant. However, a

violation is listed on Form ADV only if it is relevant to the advisory firm and relevant for the investor to consider. One can consider

affiliates to be a stronger tie than merely the “company one keeps.” An affiliate is a person or company that is associated with the

advisory firm.

Section 2: The Yellow List & Methodology

We uncovered one or more “yellow flags” in the ADV Review process for the firms listed in the Yellow List section of this report. We

define a “yellow flag” as a potential risk item that a prudent investor would seek to investigate and understand prior to investing. As

described earlier in this report, red flags are high risk items. Yellow flags are other risk items.

Of the 11,622 SEC- registered investment advisors, we identified 4,970 advisors (42.76%) that had a “yellow flag” uncovered in the

review of their Form ADV. The names of those 4,970 firms are listed in alphabetical order in the Yellow List section of this report.

Yellow List firms manage just over $21 trillion dollars, or 44% of all assets managed by SEC-registered investment advisors.

Many yellow flags relate to a firm’s organizational structure, although some yellow flags relate to adverse regulatory events

disclosed on the ADV that do not rise to the level of a red flag. A “yes’ response in the following areas constitute a yellow flag.

WRAP PROGRAM SPONSOR

A wrap program is one in which an investor pays a bundled fee, generally for brokerage commissions, consulting advice and asset

management services. It is generally sold to the investor as “one stop shopping” or to provide access to “exclusive” advisors. In

reality, these arrangements limit investor choice, expose investors to numerous potential conflicts of interest by the managing

advisory firm, and generally result in a poor to mediocre investment outcome for investors. In the early 1980’s when the financial

services industry was not highly differentiated and when technological advances had not yet driven down trading costs, these

arrangements might have made sense for investors. Today, they are outdated and often serve as a way to keep investors “captive”

Page 9 of 17

to the sponsoring organization’s sales machine. As such, we view any firm sponsoring these outdated programs as a yellow flag. It

suggests to us a firm has its sales culture predominant, rather than a firm that has carefully structured its firm for its clients’ success.

OTHER BUSINESS & RELATED PARTY ACTIVITIES

A registered investment advisory firm is assigned a yellow flag if the firm or its affiliates is actively engaged in one of the following

businesses, as indicated in Item 6 or item 7 in Form ADV. We have identified the following 9 business activities as those that bring

the greatest potential for conflicts of interest with the firm’s investment advisory clients. These relationships require further

investigation to identify the specific risks to the investor client. In general, the investor must determine which business the advisor

is in, whether the firm is focused on generating performance or transactions, and whether the investor client’s interests are primary.

1. Broker-dealer: A broker-dealer is a person, company or other organization that trades securities for its own account or on

behalf of its customers. When executing trade orders on behalf of a customer, the entity is acting as a broker. When

executing trades for its own account, the entity is acting as a dealer.

2. Registered representative of a broker dealer: A “registered rep” is a person employed by a broker-dealer and who is

authorized to sell securities such as stocks, bonds, mutual funds, and limited partnership programs. Registered

representatives must be sponsored by a broker-dealer firm and pass the FINRA-administered Series 7 exam. FINRA is a selfregulatory organization that is subject to the oversight of the SEC.

3. Futures commission merchant: All registered futures commission merchants must be members of the National Futures

Association (NFA) in order to conduct futures business with the public. According to the NFA, a futures commission merchant

is an individual or organization which does both of the following: 1) solicits or accepts orders to buy or sell futures contracts,

options on futures or retail off-exchange forex contracts and 2) accepts money or other assets from customers to support

such orders.

4. Real estate broker, dealer or agent: A real estate broker or real estate agent is a person, company or organization that acts

as an intermediary between sellers and buyers of real estate/real property and attempts to find sellers who wish to sell and

Page 10 of 17

buyers who wish to buy. When engaging in a transaction on behalf of a customer, the entity is acting as a broker. When

executing trades for its own inventory, the entity is acting as a dealer.

5. Bank: A bank is a financial entity that accepts deposits from customers and directs those deposits into investment activities,

either by lending directly or through the capital markets. Banks are typically highly regulated and are generally subject to

minimum capital requirements.

6. Registered municipal advisor: The Dodd-Frank Act greatly expanded the definition of “municipal advisor” and these

definitions are being clarified at the time of the publication of this report. A “municipal advisor” includes anyone who solicits

or provides advice to or for a municipality or obligated person regarding municipal financial products or securities (including

their structure, timing, terms or similar aspects). The definition may also include financial advisors, guaranteed investment

contract brokers, third-party marketers, placement agents, solicitors, finders, and swap advisors that engage in municipal

advisory activities. Municipal advisors must register with the Municipal Securities Rulemaking Board (the MSRB) and the SEC

before engaging in municipal securities or advisory activities. The municipal securities market consists of securities such as

tax-exempt and taxable municipal bonds, municipal notes, and other securities issued by states, cities, and counties or their

agencies.

7. Registered security-based swap dealer: The Dodd-Frank Act greatly impacted the definition of “security-based swap dealer”

and these definitions are still being clarified at the time of the publication of this report. A “security-based swap dealer” is a

person or entity that engages in one or more of the following activities: 1) holding oneself out as a swap dealer or securitybased swap dealer; 2) making markets in swaps or security-based swaps; 3) regularly entering into swaps or security-based

swaps with counterparties in the ordinary course of business for one’s own account; or 4) engaging in activities that cause

oneself to be commonly known in the trade as a dealer or market maker in swaps or security-based swaps. A “swap” is a

financial derivative contract where a set of future cash flows are agreed to be exchanged between two counterparties at set

dates in the future.

Page 11 of 17

8. Insurance company or agency: An insurance company sells insurance to a policyholder. Insurance is a form of risk

management wherein the person or company buying the insurance policy pays a premium in exchange for transferring risk.

Insurance companies can be broadly classified into two groups: 1) life insurance companies, which sell life insurance,

annuities and retirement products. 2) non-life, general, or property/casualty insurance companies, which sell other types of

insurance that tend to extend over longer periods of time.

9. Sponsor or syndicator of limited partnerships (or equivalent), excluding pooled investment vehicles: A sponsor or

syndicator is a person or company that sells interests to investors. In this case, the interests sold are limited partnership

interests, meaning private equity investments.

INTEREST IN CLIENT TRANSACTIONS

Investment advisors are hired by investor clients because the investor wishes to gain the advisor’s expertise. In these relationships,

there is an information asymmetry, with the investment advisory firm having the information advantage over the client. Clients pay

advisors for these professional services and it should be a fair exchange. But sometimes, asset management firms like to gain more

from their clients than just the professional fees charged. Some investment advisors use their clients’ portfolios as dumping grounds

for undesirable securities owned by the firm or an affiliate of the firm. Although this has been happening for decades, the practice

gained more attention in 2008 with the auction rate securities scandals.

In Item 8 of Form ADV, firms indicate if the investment advisor or a related person also has a proprietary interest in client

transactions. A “yes” answer to either of the following two questions in Item 8 generates a yellow flag. Those Form ADV questions

are:

1. Do you or any related person buy securities for yourself from advisory clients, or sell securities you own to advisory clients

(principal transactions)?

2. Do you or any related party recommend securities (other than investment products) to advisory clients in which you or any

related person has some other propriety (ownership) interest (other than those mentioned in Items 8A(1) or (2)?

Page 12 of 17

OTHER REGULATORY ITEMS

As mentioned previously in this report, firms listed in the Red List have “significant adverse regulatory events” disclosed in one of

eight categories of Item 11 on Form ADV. A Yellow List firm answered “yes” to one of 16 other questions in Item 11 of Form ADV.

Any firm that has an item disclosed in Item 11 of Form ADV will either be in the Red List or in the Yellow List, but not both.

Yellow List firms with one or more yellow flags in this category answered “yes” to one or more of the following 16 questions:

1) In the past ten years, have you or any advisory affiliate been charged with any felony?

2) In the past ten years, have you or any advisory affiliate been charged with a misdemeanor listed in Item 11B(1)?

3) Has the SEC or the Commodity Futures Trading Commission (CFTC) ever found you or any advisory affiliate to have made a

false statement or omission?

4) Has the SEC or the Commodity Futures Trading Commission (CFTC) ever found you or any advisory affiliate to have been a

cause of an investment-related business having its authorization to do business denied, suspended, revoked, or restricted?

5) Has the SEC or the Commodity Futures Trading Commission (CFTC) ever imposed a civil money penalty on you or any

advisory affiliate, or ordered you or any advisory affiliate to cease and desist from any activity?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found

you or any advisory affiliate to have made a false statement or omission, or been dishonest, unfair, or unethical?

7) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found

you or any advisory affiliate to have been a cause of an investment-related business having its authorization to do business

denied, suspended, revoked, or restricted?

8) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever

denied, suspended, or revoked your or any advisory affiliate’s registration or license, or otherwise prevented you or any

advisory affiliate, by order, from associating with an investment-related business or restricted your or any advisory affiliate’s

activity?

9) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have made a false

statement or omission?

Page 13 of 17

10) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been the

cause of an investment-related business having its authorization to do business denied, suspended, revoked, or restricted?

11) Has any self-regulatory organization or commodities exchange ever disciplined you or any advisory affiliate by expelling or

suspending you or the advisory affiliate from membership, barring or suspending you or the advisory affiliate from

association with other members, or otherwise restricting your or the advisory affiliate’s activities?

12) Has an authorization to act as an attorney, accountant, or federal contractor granted to you or any advisory affiliate ever

been revoked or suspended?

13) Are you or any advisory affiliate now the subject of any regulatory proceeding that could result in a “yes” answer to any part

of Item 11C, 11D, or 11E?

14) Has any domestic or foreign court in the past ten years, enjoined you or any advisory affiliate in connection with any

investment-related activity?

15) Has any domestic or foreign court ever dismissed, pursuant to a settlement agreement, an investment-related civil action

brought against you or any advisory affiliate by a state or foreign financial regulatory authority?

16) Are you or any advisory affiliate now the subject of any civil proceeding that could result in a “yes” answer to any part of Item

11H(1)?

Section 3: The Green List & Methodology

The Green List is a list of firms that have no significant adverse items identified in Form ADV. In other words, these are the firms

that do not have red or yellow flags. Of the 11,622 registered investment advisors, we identified 5,337 advisors (45.92%) that met

the Green List criteria.

While the Green List is relatively large when considering the number of firms, these firms control a much smaller portion of the total

investment assets managed. Green List firms manage over $4.7 trillion dollars, or just 10% of all assets managed by SEC-registered

investment advisors.

Placement on the Green List does not necessarily mean that there are no organizational or due diligence concerns at these firms. It

simply means that the most obvious ADV Review issues did not turn up.

Page 14 of 17

How Should an Investor Use this Report?

The SEC provides useful guidance to investors on its website, including the statement: “Before you invest or pay for any investment

advice, make sure your brokers, investment advisers, and investment adviser representatives have not had disciplinary problems or

been in trouble with regulators or other investors.” We recommend that investors also periodically review Form ADV for their

current advisors.

For investors who are already working with a firm that has a “significant adverse regulatory event” on its record, the investor may

wish to investigate further the nature of the violation. The first step we recommend is to read the advisor’s full Form ADV, which

may be found by looking up the advisor’s name or SEC Number on the SEC’s website, paying special attention to the answers to all

questions in Item 11, Part 2 (the “Brochures”), Schedule A, Schedule B, Schedule D and the Disclosure Reporting Pages (“DRPs”). The

DRPs are the location in the advisor’s Form ADV that more fully describe any “yes” answer provided in Item 11.

Some very large firms have a number of affiliated companies. Although firms may often refer to affiliates in their marketing

materials as contributing to their strength, they may seek to distance themselves from violations of affiliates, if any. This report may

allow the investor to see a more complete picture of the affiliates. The investor may wish to consult legal or investment

professionals to understand the relevance of any disclosed violations on the investor’s particular investment situation.

For firms with yellow flags, we again recommend that investors read the advisor’s full Form ADV, which may be found by looking up

the advisor’s name or SEC Number on the SEC’s website. For firms with yellow flags, we recommend that investors pay special

attention to the advisor’s answers to all questions in Item 11 and the DRPs. In addition, we recommend that investors read carefully

Part 2 (the “Brochures”), Schedule A, Schedule B, Item 6, Item 7 and Item 8.

In addition, there are a number of other areas an investor should investigate in any firm, including Green List firms:

Concentration of ownership: Although each investment advisory firm is unique, when one person overwhelming controls

the firm (e.g., 75% or more) they can effectively neutralize checks and balances within the firm. Knowing who the majority

owners of the firm are helps the investor to understand who’s setting the agenda at the firm and may also help to identify

business risks. An investor can learn ownership information by examining Schedules A and B of Form ADV.

Page 15 of 17

For private fund advisors, including hedge fund advisors: An in-depth review of Schedule D is necessary to get a grasp of the

specific funds offered by the advisor. Schedule D also lists key service providers for the private funds. Examining a hedge

fund’s service providers is critical to understanding whether related parties are acting in key roles at the funds (e.g.,

custodian or fund administrator). It is generally undesirable for related parties to serve in key service provider roles as this

weakens the fund’s checks and balances. Information is also provided in Schedule D concerning audits. An investor can

examine Schedule D to learn which firms are performing the audits and whether those audits have been accompanied by

unqualified opinions.

Legal and other background checks can catch items that might not be disclosed on Form ADV: Investors should remember

that firms can advertently or inadvertently leave information off their Form ADV, especially those items relating to private

legal actions. There are penalties if it is later discovered that a firm leaves items off the Form ADV, but for unscrupulous

firms, this is a real possibility.

For investors who believe they may be at risk, we recommend that those investors implement more detailed, specific, and relevant

due diligence practices. These practices may include:

1)

Identify those advisory relationships that pose the greatest potential risk to the investor;

2)

Structure or restructure the advisory relationship or investment in a manner that reduces the risk to the investor;

3)

Add additional independent, professional, and regular oversight, as needed; and

4)

Determine “hold” or “exit” recommendations concerning the investment, as appropriate, over time and as conditions

change.

Page 16 of 17

Final Comments

Many investment advisory firms act in many different roles for their clients (asset manager, consultant, and/or broker) and these

roles can sometimes lead to potential conflicts of interest. In our experience, some firms navigate and appropriately manage

potential conflicts of interest. Other firms demonstrate a chronic problem of not placing clients’ interests first. We believe that,

simply by design, some firms are destined to fail the investor. On the bright side, many firms are engineered from the ground up for

the success of the client.

This report is intended to highlight many facts that an investor might wish to consider when conducting due diligence of an

investment advisor. Each investor is responsible for his or her own due diligence effort and this report is no substitute for that

process. We assume the reader is considering the advisor to manage (or to continue to manage) an investor’s assets. This report

makes no statement about the quality of a firm’s brokerage or banking business. Nor does it make assessments about whether

these advisors are capable of delivering superior after-fee investment performance. However, it is our view that investing in today’s

global market is sufficiently complex without the added risk that an investment advisor might not be working in full alignment with

the investor’s interests.

Diligence Review Corp.

http://www.diligencereviewcorp.com

Jennifer A. Cooper, CFA, Managing Director

Michael K. Crist, Managing Director

Page 17 of 17

801-70447

801-68111

801-41517

801-69608

801-17857

801-7566

801-61063

801-72865

801-69619

801-17402

801-67871

801-61336

801-48092

801-58103

801-73457

801-71557

801-72778

801-71135

801-67983

801-55640

801-57013

801-56217

801-69551

801-58105

801-73098

801-62731

801-71386

801-46901

801-53421

801-71094

801-64757

801-70159

801-72010

801-74223

801-62417

801-67660

801-55761

801-10334

801-57623

801-12566

801-57662

801-57874

801-67105

801-71312

801-43569

801-39910

801-40414

801-32361

801-56720

801-69803

1492 CAPITAL MANAGEMENT, LLC

1914 ADVISORS

1ST GLOBAL ADVISORS INC

1ST WORLDWIDE ADVISORS, LLC.

40/86 ADVISORS, INC.

A. R. SCHMEIDLER & CO., INC.

AA CAPITAL PARTNERS, INC.

ABBOT DOWNING INVESTMENT ADVISORS

ABG CONSULTANTS

ABNER HERRMAN & BROCK, LLC

ABSOLUTE ASIA ASSET MANAGEMENT LIMITED (F/K/A IXIS AM ASIA LTD)

ABSOLUTE CAPITAL MANAGEMENT, LLC

ACCESS FINANCIAL GROUP, INC.

ACCESS FINANCIAL RESOURCES INC.

ACCRETIVE, LLC

ACIS CAPITAL MANAGEMENT, L.P.

ACM INVESTMENT ADVISOR, LLC

ACTINVER WEALTH MANAGEMENT, INC.

ADVANCED EQUITIES, INC.

ADVANTAGE ADVISERS MANAGEMENT, LLC

ADVANTAGE ADVISERS MULTI-MANAGER, L.L.C.

ADVANTAGE ADVISERS PRIVATE EQUITY MANAGEMENT LLC

ADVANTAGE INVESTMENT MANAGEMENT, LLC

ADVISED ASSETS GROUP, LLC

ADVISER INVESTMENTS

ADVISORS ASSET MANAGEMENT, INC.

AEGIS CAPITAL CORP.

AEGIS FINANCIAL CORPORATION

AEW CAPITAL MANAGEMENT LP

AFC ASSET MANAGEMENT SERVICES, INC.

AFT, FORSYTH AND COMPANY, INC.

AIG ASSET MANAGEMENT (U.S.), LLC

AKA "ANRIA" OR "ANRIA, INC."

ALCENTRA LIMITED

ALCENTRA NY, LLC

ALDUS CAPITAL, LLC

ALETHEIA RESEARCH AND MANAGEMENT INC

ALEXANDER INVESTMENT SERVICES CO.

ALLBRIGHT FINANCIAL ADVISORS INC

ALLEGHENY FINANCIAL GROUP LTD

ALLEGHENY INVESTMENTS, LTD.

ALLEN & COMPANY OF FLORIDA, INC.

ALLIANCE ADVISORY & SECURITIES, INC

ALLIANCE CONSULTING, LLC

ALLIANCE CORPORATE FINANCE GROUP INC

ALLIANCEBERNSTEIN CORPORATION

ALLIANCEBERNSTEIN GLOBAL DERIVATIVES CORPORATION

ALLIANCEBERNSTEIN HOLDING L.P.

ALLIANCEBERNSTEIN L.P.

ALLIANZ GLOBAL INVESTORS CAPITAL LLC

$91,401,592

$549,585,462

$4,379,426,709

$28,517,445

$26,881,041,744

$1,230,827,902

$99,918,297

$53,855,746

$90,500,000

$849,215,285

$717,810,000

$226,482,280

$283,416,598

$246,677,774

$441,054,719

$293,127,000

$173,215,542

$109,000,000

$867,926,632

$396,518,602

$1,916,570,770

$7,171,763

$296,720,572

$14,997,130,922

$1,365,000,000

$385,528,455

$74,199,454

$279,010,649

$22,830,784,759

$31,365,633

$550,680,306

$312,918,557,307

$205,725,026

$9,799,827,555

$3,888,184,399

$3,783,000,000

$4,233,298,722

$319,965,508

$298,773,771

$3,022,337,801

$3,022,337,801

$1,760,818,485

$201,982,489

$61,000,000

$0

$0

$0

$0

$405,896,821,645

$12,555,379,222

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-57798

801-60167

801-68510

801-70249

801-62448

801-65375

801-65726

801-55110

801-73296

801-71496

801-73015

801-62960

801-64191

801-41518

801-70730

801-67985

801-14979

801-8074

801-66163

801-71330

801-28543

801-55153

801-55501

801-72274

801-71581

801-29930

801-72679

801-64559

801-72226

801-73152

801-74125

801-18767

801-64502

801-63738

801-65340

801-69196

801-65018

801-20784

801-72099

801-16194

801-58249

801-65228

801-71639

801-40532

801-68754

801-62103

801-14065

801-72220

801-56080

801-67131

ALLIANZ GLOBAL INVESTORS FUND MANAGEMENT LLC

ALLIANZ INVESTMENT MANAGEMENT LLC

ALLSTATE FINANCIAL ADVISORS, LLC

ALPHABET MANAGEMENT, LLC

ALPHASIMPLEX GROUP, LLC

ALPINE ASSOCIATES ADVISORS

ALPINE ASSOCIATES MANAGEMENT INC.

ALPINE WOODS CAPITAL INVESTORS, LLC

ALTARIS CAPITAL PARTNERS, LLC

ALTEGRIS ADVISORS, LLC

ALTEGRIS FUNDS

ALTERNATIVE INVESTMENT SOLUTIONS

ALTERNATIVE STRATEGIES GROUP, INC.

AMERICAN BLUE CHIP INVESTMENT MANAGEMENT

AMERICAN EQUITY ADVISORS, INC.

AMERICAN PEGASUS LDG, LLC

AMERICAN RESEARCH & MANAGEMENT CO

AMERICAN UNITED LIFE INSURANCE COMPANY

AMERICAN WEALTH MANAGEMENT, INC.

AMERIGO ASSET MANAGEMENT CORPORATION

AMERIPRISE FINANCIAL SERVICES, INC.

AMERITAS INVESTMENT CORP

AMERIVEST INVESTMENT MANAGEMENT, LLC

AMUNDI INVESTMENTS USA, LLC

ANDREW GARRETT, INC.

ANNACO INVESTMENT MANAGEMENT

AON HEWITT FINANCIAL ADVISORS, LLC

AON RETIREMENT PLAN ADVISORS, LLC

APIDOS CAPITAL MANAGEMENT, LLC

APPALOOSA MANAGEMENT L.P.

ARCHON GROUP, L.P.

ARIEL INVESTMENTS, LLC

ARISTEIA CAPITAL, LLC

ARVEST ASSET MANAGEMENT

ASCEND CAPITAL LLC

ASCENT INVESTMENT ADVISORS, LLC

ASCENTIA CAPITAL PARTNERS, LLC

ASSET & FINANCIAL PLANNING, LTD

ASSET ADVISORS OF AMERICA, LLC

ASSET MANAGEMENT CORP

ASSET MANAGEMENT SERVICES, INC.

ASSET VALUE INVESTORS LIMITED

ASSOCIATED INVESTMENT SERVICES, INC.

AST INVESTMENT SERVICES, INC.

ASTERA FINANCIAL GROUP, LLC

AURORA INVESTMENT MANAGEMENT L.L.C.

AXA ADVISORS, LLC

AXA EQUITABLE FUNDS MANAGEMENT GROUP, LLC

AXA ROSENBERG INVESTMENT MANAGEMENT LLC

AXIOM INVESTMENT MANAGEMENT LLC

$48,095,078,938

$14,325,202,865

$0

$3,298,770,035

$3,527,739,529

$4,015,399,074

$3,402,159,164

$5,167,654,184

$596,100,000

$1,517,702,321

$263,171,894

$26,795,600,000

$2,789,854,145

$39,365,474

$24,258,594,647

$0

$295,576,222

$5,565,734,762

$103,152,910

$5,500,000

$103,385,339,354

$1,916,841,587

$1,702,386,259

$4,110,022,025

$62,024,746

$91,895,990

$768,132,085

$6,697,037

$5,549,802,489

$14,605,972,000

$9,991,463,386

$4,383,718,404

$2,584,137,207

$793,532,947

$4,860,484,955

$30,000,000

$34,418,325

$589,939,176

$0

$93,571,504

$37,000,000

$2,257,985,816

$110,381,340

$101,611,429,776

$333,000,000

$11,617,896,876

$9,090,257,764

$126,173,028,787

$290,607,350

$150,400,556

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-19699

801-73074

801-241

801-64916

801-21051

801-29654

801-63671

801-69238

801-56539

801-64612

801-69666

801-57737

801-68489

801-73720

801-25587

801-27754

801-29080

801-72483

801-60464

801-29606

801-67092

801-72475

801-69700

801-73526

801-56176

801-4611

801-15160

801-18656

801-56082

801-69396

801-56131

801-57962

801-62704

801-29862

801-62290

801-34305

801-30987

801-61433

801-67134

801-68608

801-62277

801-56469

801-57022

801-62775

801-68856

801-64260

801-47710

801-57038

801-48433

801-22609

B. C. ZIEGLER AND COMPANY

BABSON CAPITAL GLOBAL ADVISORS LIMITED

BABSON CAPITAL MANAGEMENT LLC

BAILLIE GIFFORD INTERNATIONAL LLC

BAILLIE GIFFORD OVERSEAS LTD

BAINCO INTERNATIONAL INVESTORS LLC

BAIRD ASIA PARTNERS MANAGEMENT COMPANY I, L.L.C.

BAIRD CAPITAL PARTNERS ASIA MANAGEMENT I LIMITED PARTNERSHIP

BAIRD CAPITAL PARTNERS MANAGEMENT COMPANY III, LLC

BAIRD CAPITAL PARTNERS MANAGEMENT COMPANY IV, LLC

BAIRD CAPITAL PARTNERS MANAGEMENT COMPANY V, LLC

BAIRD VENTURE PARTNERS MANAGEMENT COMPANY I, L.L.C.

BAIRD VENTURE PARTNERS MANAGEMENT COMPANY III, LLC

BAKER CAPITAL CORP.

BALDWIN & CLARKE ADVISORY SERVICES, INC.

BALTIMORE WASHINGTON FINANCIAL ADVISORS INC

BAMCO, INC.

BAML CAPITAL ACCESS FUNDS MANAGEMENT, LLC

BANK OF AMERICA CAPITAL ADVISORS LLC

BANK OF IRELAND ASSET MANAGEMENT (U.S.) LTD.

BANYAN PARTNERS, LLC

BARCLAYS ASSET MANAGEMENT GROUP LLC

BARCLAYS CAPITAL INC.

BARCLAYS PRIVATE CREDIT PARTNERS LLC

BARING ASSET MANAGEMENT (ASIA) LIMITED

BARING ASSET MANAGEMENT LLC

BARING INTERNATIONAL INVESTMENT LTD

BARON CAPITAL MANAGEMENT, INC.

BARR ROSENBERG RESEARCH CENTER LLC

BAYVIEW INVESTMENT COUNSEL, INC

BBVA WEALTH SOLUTIONS INC.

BEACON FINANCIAL GROUP

BEACON WEALTH MANAGEMENT, LLC

BEAR STEARNS ASSET MANAGEMENT INC.

BELLE HAVEN INVESTMENTS, L.P.

BENCHMARK CAPITAL ADVISORS

BENJAMIN SECURITIES, INC.

BERKSHIRE ADVISORS, INC.

BERNARD L. MADOFF INVESTMENT SECURITIES LLC

BERNARDI ASSET MANAGEMENT, LLC

BERTHEL FISHER & COMPANY FINANCIAL SERVICES, INC.

BERWYN FINANCIAL SERVICES CORP.

BFT FINANCIAL GROUP, LLC

BIONDO INVESTMENT ADVISORS LLC

BISHOP & COMPANY INVESTMENT MANAGEMENT, LLC

BLACKROCK KELSO CAPITAL ADVISORS LLC

BLACKROCK ADVISORS, LLC

BLACKROCK CAPITAL MANAGEMENT, INC.

BLACKROCK FINANCIAL MANAGEMENT, INC

BLACKROCK FUND ADVISORS

$317,360,037

$231,941,426

$100,623,161,754

$0

$77,341,077,594

$451,864,575

$22,586,903

$29,401,575

$31,939,005

$174,543,982

$106,833,523

$52,295,601

$73,162,613

$511,609,946

$122,783,694

$276,949,577

$15,731,528,409

$667,252,660

$3,579,254,526

$0

$1,109,824,290

$2,369,019,137

$12,038,139,389

$1,003,511,656

$8,187,464,746

$6,417,780,214

$10,877,637,161

$1,334,882,887

$20,884,166,424

$37,450,437

$443,480,831

$328,000,000

$237,579,529

$1,392,869,653

$1,047,438,763

$304,318,839

$47,759,650

$14,660,000

$17,091,640,696

$111,274,795

$630,430,000

$9,100,248

$321,535,244

$351,779,093

$103,690,395

$1,091,175,327

$399,091,822,952

$44,822,220,656

$574,757,232,488

$494,356,268,543

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-51087

801-56972

801-54217

801-57237

801-69758

801-15483

801-73047

801-64847

801-14882

801-69636

801-50372

801-70049

801-53600

801-72493

801-71662

801-64901

801-60229

801-68519

801-44173

801-39088

801-68768

801-44394

801-62276

801-69742

801-66123

801-70688

801-72031

801-70596

801-69070

801-68010

801-14895

801-60634

801-26326

801-30781

801-32111

801-70605

801-8293

801-65646

801-42709

801-29688

801-67787

801-66098

801-9219

801-70036

801-63930

801-64117

801-55780

801-60841

801-64792

801-35935

BLACKROCK INTERNATIONAL LIMITED

BLACKROCK INVESTMENT MANAGEMENT, LLC

BLACKROCK REALTY ADVISORS INC

BLUE OAK CAPITAL LLC

BLUECREST CAPITAL MANAGEMENT LLP

BMI CAPITAL LLC

BMO CAPITAL MARKETS CORP.

BMO HARRIS FINANCIAL ADVISORS, INC

BNP PARIBAS ASSET MANAGEMENT, INC.

BNY MELLON ARX INVESTIMENTOS LTDA

BOFA ADVISORS, LLC

BONDWAVE ADVISORS

BOSC, INC.

BOSTON STANDARD WEALTH MANAGEMENT, LLC

BOULDER INVESTMENT GROUP, LLC

BOUSSARD & GAVAUDAN ASSET MANAGEMENT LP

BPU INVESTMENT MANAGEMENT, INC.

BRADLEY WEALTH MANAGEMENT, LLC

BRANSON FOWLKES & CO INC

BRANSON FOWLKES RUSSELL INC

BREWER INVESTMENT ADVISORS LLC

BRIDGEWAY CAPITAL MANAGEMENT INC

BRIGHTON SECURITIES CORP.

BROKERS INTERNATIONAL FINANCIAL SERVICES, LLC

BROKERSXPRESS LLC

BROOKFIELD ASSET MANAGEMENT PIC CANADA, LP

BROOKFIELD ASSET MANAGEMENT PIC US, LLC

BROOKLYN CAPITAL MANAGEMENT, LLC

BROOKSIDE CAPITAL, LLC

BROOKSTONE CAPITAL MANAGEMENT LLC

BTS ASSET MANAGEMENT, INC.

BUCHANAN STREET PARTNERS

BUCKINGHAM CAPITAL MANAGEMENT INC

BUDGE FINANCIAL INC

BURGESS CHAMBERS & ASSOCIATES INC

BURKE-LESLIE PROFESSIONAL ASSET MANAGEMENT, LLC

BURNHAM ASSET MANAGEMENT CORP

BURNHAM SECURITIES INC

CADARET GRANT & CO INC

CALAMOS ADVISORS LLC

CALAMOS WEALTH MANAGEMENT LLC

CALDWELL SECURITIES, INCORPORATED

CALLAN ASSOCIATES INC.

CALTON & ASSOCIATES, INC.

CAMBRIDGE INVESTMENT RESEARCH ADVISORS, INC.

CAMBRIDGE LEGACY ADVISORS, INC.

CAMERON MURPHY & SPANGLER INC

CANTELLA & CO., INC.

CAPITAL CITY ASSET MANAGEMENT GROUP, LLC

CAPITAL GROWTH MANAGEMENT LTD PARTNERSHIP

$49,701,762,158

$271,789,563,951

$0

$260,236,144

$63,639,769,455

$313,045,200

$3,000,000,000

$891,546,510

$20,807,366,385

$5,508,666,947

$78,604,315,957

$0

$160,054,539

$60,795,000

$60,895,430

$1,701,614,519

$500,877,702

$39,200,000

$204,000,000

$0

$377,560,419

$1,984,243,337

$57,130,250

$86,242,025

$829,141,012

$6,000,000,000

$26,160,000,000

$408,339,055

$11,188,000,000

$363,977,552

$1,519,182,406

$579,673,602

$1,551,317,116

$117,806,485

$0

$6,855,444

$477,132,518

$85,781,293

$2,100,160,707

$32,249,310,803

$901,679,201

$98,070,499

$3,487,792,458

$76,390,176

$20,892,307,350

$130,000,000

$74,283,292

$615,876,718

$27,912,499

$4,340,613,889

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-63969

801-72532

801-69846

801-36824

801-61042

801-40001

801-17691

801-20826

801-70333

801-41033

801-17695

801-73004

801-71905

801-71345

801-60758

801-74214

801-65968

801-63093

801-72366

801-64239

801-72923

801-60343

801-60138

801-60606

801-56332

801-61902

801-74484

801-56882

801-17274

801-43561

801-52094

801-70987

801-29938

801-35905

801-36407

801-7333

801-69779

801-72494

801-9707

801-72883

801-9678

801-73075

801-70860

801-72524

801-71561

801-60990

801-72542

801-3387

801-71181

801-67527

CAPITAL GUARDIAN WEALTH MANAGEMENT, LLC

CAPITAL INVESTMENT ADVISORS, LLC

CAPITAL INVESTMENT ADVISORY SERVICES, LLC

CAPITAL INVESTMENT COUNSEL INC

CAPITAL INVESTMENT MANAGEMENT

CAPITAL MANAGEMENT ADVISORS INC

CAPITAL MANAGEMENT ASSOCIATES INC

CAPITAL STRATEGY GROUP LTD

CAPITAL WEALTH PLANNING, LLC

CAPITOL SECURITIES MANAGEMENT, INC.

CAPSTONE ASSET MANAGEMENT COMPANY

CAPSTONE INVESTMENT ADVISORS, LLC

CAREY, THOMAS, HOOVER & BREAULT ADVISORS

CARL M. LOEB ADVISORY PARTNERS L.P.

CARLSON CAPITAL, L.P.

CARMEL MANAGEMENT III, LLC

CAROLINA CAPITAL CONSULTING, INC.

CARRET ASSET MANAGEMENT, LLC

CARRINGTON CAPITAL MANAGEMENT, LLC

CARY STREET PARTNERS INVESTMENT ADVISORY LLC

CASTLE CREEK ADVISORS IV LLC

CAUSEWAY CAPITAL MANAGEMENT LLC

CAVANAL HILL INVESTMENT MANAGEMENT, INC.

CAZ INVESTMENTS L.P.

CBIZ RETIREMENT PLAN SERVICES

CCO INVESTMENT SERVICES CORP.

CENTAURUS CAPITAL

CENTAURUS FINANCIAL, INC.

CENTURY FUNDS MANAGEMENT INC

CENTURY SECURITIES ASSOCIATES INC

CENTURYLINK INVESTMENT MANAGEMENT COMPANY

CHAPIN DAVIS ASSET MANAGEMENT

CHARLES SCHWAB & CO., INC.

CHARLES SCHWAB INVESTMENT MANAGEMENT, INC

CHASE INVESTMENT SERVICES CORP.

CHELSEA MANAGEMENT COMPANY

CHELSEA MORGAN ADVISORS LLC

CI GLOBAL HOLDINGS INC.

CIBC GLOBAL ASSET MANAGEMENT INC.

CIFC ASSET MANAGEMENT LLC

CINCINNATI ANALYSTS, INC

CION INVESTMENT MANAGEMENT, LLC

CITADEL ADVISORS LLC

CITI CAPITAL ADVISORS LIMITED

CITI PRIVATE ADVISORY, LLC

CITIGROUP ALTERNATIVE INVESTMENTS LLC

CITIGROUP FIRST INVESTMENT MANAGEMENT AMERICAS LLC

CITIGROUP GLOBAL MARKETS INC.

CITY NATIONAL SECURITIES, INC.

CITY SECURITIES CORPORATION

$411,617,666

$885,381,533

$140,071,989

$1,873,269,360

$82,602,169

$96,467,612

$188,825,334

$35,396,828

$302,000,000

$303,202,000

$3,486,198,165

$3,696,308,353

$188,142,751

$0

$13,688,515,417

$3,282,200,000

$142,170,050

$1,530,000,000

$650,852,757

$738,280,253

$423,752,000

$13,880,216,891

$6,589,699,017

$313,200,000

$4,982,739,307

$1,173,802,381

$1,507,633,282

$469,941,097

$53,644,130

$284,932,746

$17,264,134,503

$609,921,939

$0

$214,842,000,000

$29,852,041,557

$920,574,353

$0

$3,083,654,606

$66,183,429,693

$7,432,996,948

$2,080,000,000

$0

$115,208,973,792

$1,951,000,000

$2,401,958,421

$18,051,000,000

$0

$21,243,954,278

$212,909,000

$537,165,111

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-68399

801-72937

801-55574

801-57265

801-71900

801-39379

801-48611

801-25943

801-41391

801-64897

801-66509

801-41541

801-56201

801-71429

801-61068

801-72184

801-72959

801-72666

801-67992

801-67705

801-74519

801-56975

801-18641

801-64791

801-36806

801-70784

801-67167

801-73394

801-67120

801-63659

801-63182

801-51633

801-71843

801-60153

801-56260

801-40177

801-37170

801-62782

801-60767

801-56264

801-72062

801-62434

801-67493

801-67246

801-57663

801-40916

801-73569

801-66538

801-41265

801-71215

CLEAN ENERGY CAPITAL, LLC

CLEARVIEW ADVISORS, INC.

CLEARY GULL INC.

CLS INVESTMENTS, LLC

CMS FUND ADVISERS, LLC

COLDSTREAM CAPITAL MANAGEMENT INC

COLLEY ASSET MANAGEMENT, INC.

COLUMBIA MANAGEMENT INVESTMENT ADVISERS, LLC

COLUMBIA WANGER ASSET MANAGEMENT, LLC

COMERICA SECURITIES

COMMERCE BROKERAGE SERVICES, INC

COMMONWEALTH FINANCIAL NETWORK

COMMUNITY CAPITAL MANAGEMENT, INC.

COMMUNITY INVESTMENT PARTNERS

COMPREHENSIVE CAPITAL MANAGEMENT, INC.

CONCEPT ASSET MANAGEMENT

CONCERT ADVISORS

CONCERT CAPITAL MANAGEMENT

CONCERT WEALTH MANAGEMENT

CONCORD EQUITY GROUP ADVISORS, LLC

CONCORDE ASSET MANAGEMENT, LLC

CONLEY INVESTMENT COUNSEL INC

CONNING ASSET MANAGEMENT

CONSULTING GROUP ADVISORY SERVICES LLC

CONSULTING SERVICES GROUP, LLC

CONTINUITY PARTNERS GROUP, LLC

CONVERGEX EXECUTION SOLUTIONS LLC

CONVERSUS ASSET MANAGEMENT, LLC

CORBY ASSET MANAGEMENT

CORNERSTONE ASSET MANAGEMENT

CORNERSTONE CAPITAL MANAGEMENT

CORNERSTONE REAL ESTATE ADVISERS LLC

COVARIANCE CAPITAL MANAGEMENT, INC.

CREATIVE FINANCIAL DESIGNS, INC.

CREDIT SUISSE (BERMUDA) LIMITED

CREDIT SUISSE ASSET MANAGEMENT LIMITED

CREDIT SUISSE ASSET MANAGEMENT, LLC

CREDIT SUISSE HEDGING-GRIFFO SERVIOS INTERNACIONAIS S.A.

CREDIT SUISSE PRIVATE ADVISORS

CREDIT SUISSE SECURITIES (USA) LLC

CRF FINANCIAL GROUP

CRI SECURITIES, LLC

CRISPIAN VENTURE CAPITAL, LLC

CROWELL, WEEDON & CO.

CROWN CAPITAL SECURITIES, L.P.

CS CAPITAL MANAGEMENT INC

CTC FUND MANAGEMENT, L.L.C.

CUE FINANCIAL GROUP, INC.

CUMBERLAND ASSOCIATES INVESTMENT COUNSEL INC.

CUMMINGS BAY CAPITAL MANAGEMENT, L.P.

$54,080,094

$0

$841,317,000

$10,999,790,803

$141,424,538

$1,118,785,004

$104,650,630

$300,515,811,231

$29,637,465,000

$389,787,896

$138,900,000

$27,737,959,102

$1,503,158,641

$135,974,030

$501,021,937

$229,872,074

$0

$27,269,092

$1,229,548,502

$0

$36,142,377

$91,995,628

$84,814,036,000

$6,169,831,189

$22,511,292,027

$0

$0

$2,149,900,000

$291,185,757

$21,902,665

$26,696,539

$21,649,594,069

$1,057,728,573

$524,332,000

$119,193,073

$4,577,585,297

$65,602,860,000

$2,500,000,000

$461,490,860

$14,573,062,575

$356,000,000

$514,780,385

$0

$829,009,941

$415,569,115

$2,075,955,277

$302,000,000

$164,772,670

$107,000,000

$173,402,205

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

1) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to any felony?

2) In the past 10 years, have you or any advisory affiliate been convicted of or pled guilty or nolo contender (“no contest”) in a domestic, foreign, or military court to a misdemeanor involving: investments or an investment-related business, or any fraud, false

statements, or omissions, wrongful taking of property, bribery, perjury, forgery, counterfeiting, extortion, or conspiracy to commit any of these offenses?

3) Has the Securities and Exchange Commission (“SEC”) or the Commodity Futures Trading Commission (“CFTC”) ever found you or any advisory affiliate to have been involved in a violation of SEC or CFTC regulations or statutes?

4) Has the SEC or the CFTC ever entered an order against you or an advisory affiliate in connection with investment-related activity?

5) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority ever found you or any advisory affiliate to have been involved in a violation of investment-related regulations or statutes?

6) Has any other federal regulatory agency, any state regulatory agency, or any foreign financial regulatory authority, in the past 10 years, entered an order against you or any advisory affiliate in connection with an investment-related activity?

7) Has any self-regulatory organization or commodities exchange ever found you or any advisory affiliate to have been involved in a violation of its rules (other than a rule designated as a “minor rule violation” under a plan approved by the SEC)?

8) Has any domestic or foreign court ever found that you or an advisory affiliate were involved in a violation of investment-related statues or regulations?

801-60099

801-61122

801-63553

801-60300

801-69737

801-56171

801-69171

801-64222

801-45761

801-56572

801-56278

801-73239

801-68541

801-31747

801-13057

801-67588

801-53272

801-31648

801-38089

801-71808

801-67166

801-35030

801-53728

801-70846

801-32108

801-66962

801-60486

801-66274

801-66285

801-60912

801-20289

801-9638

801-252

801-57743

801-55047

801-54930

801-65260

801-72615

801-32675

801-42910

801-60809

801-72947

801-72946

801-63247

801-69878

801-68000

801-62870

801-73232

801-35768

801-61795

CUNA BROKERAGE SERVICES, INC.

CURIAN CAPITAL, LLC

CURRAN INVESTMENT MANAGEMENT

CUSO FINANCIAL SERVICES, L.P.

CWCAPITAL INVESTMENTS LLC

D. E. SHAW & CO., L.P.

D. E. SHAW DIRECT CAPITAL, L.L.C.

D. E. SHAW INVESTMENT MANAGEMENT, L.L.C.

D.A. DAVIDSON & CO.

DALTON INVESTMENTS LLC

DANIEL FRISHBERG FINANCIAL SERVICES, INC.

DARBY OVERSEAS PARTNERS, L.P.

DARIUS CAPITAL PARTNERS SAS

DATATEX INVESTMENT SERVICES INC

DAVENPORT & COMPANY LLC

DAVID A. NOYES & COMPANY

DAVIS SELECTED ADVISERS - NY, INC.

DAVIS SELECTED ADVISERS LP

DB INVESTMENT MANAGERS, INC

DBX ADVISORS LLC

DBX STRATEGIC ADVISORS LLC

DECLARATION MANAGEMENT & RESEARCH LLC

DEERFIELD CAPITAL MANAGEMENT LLC

DELAWARE CAPITAL MANAGEMENT ADVISERS, INC

DELAWARE MANAGEMENT BUSINESS TRUST

DELTA GLOBAL ASSET MANAGEMENT

DELTA PARTNERS LLC

DEUTSCHE ALTERNATIVE ASSET MANAGEMENT (GLOBAL) LIMITED

DEUTSCHE ASSET MANAGEMENT (HONG KONG) LIMITED

DEUTSCHE ASSET MANAGEMENT (JAPAN) LIMITED

DEUTSCHE ASSET MANAGEMENT INTERNATIONAL GMBH

DEUTSCHE BANK SECURITIES INC.

DEUTSCHE INVESTMENT MANAGEMENT AMERICAS INC.

DEUTSCHE INVESTMENTS AUSTRALIA LIMITED

DIAM CO., LTD.

DIAM U.S.A., INC.

DIAMONDBACK CAPITAL MANAGEMENT, LLC

DIAPASON COMMODITIES MANAGEMENT S.A.

DIRECTED SERVICES LLC

DIVERSIFIED INVESTMENT ADVISORS, INC.

DKR CAPITAL PARTNERS L.P.

DME ADVISORS, LP

DME CAPITAL MANAGEMENT, LP

DOMINICK & DOMINICK LLC

DOMINION WEALTH ADVISORS, INC.

DONNELLY STEEN & COMPANY

DORION-GRAY RETIREMENT PLANNING, INC.

DORSET MANAGEMENT CORPORATION

DORSEY & COMPANY INC.

DU PASQUIER ASSET MANAGEMENT

$339,064,045

$6,823,892,866

$215,000,000

$469,215,000

$9,253,365,818

$49,315,000,000

$784,000,000

$7,298,000,000

$6,167,129,989

$1,924,303,043

$175,030,000

$1,855,042,950

$0

$31,000,000

$4,714,867,797

$320,770,903

$48,400,000,000

$55,291,000,000

$3,682,528,305

$44,000,000

$122,100,000

$9,137,750,812

$6,441,123,056

$0

$169,209,632,233

$513,224,513

$404,578,173

$5,714,401,296

$2,081,930,662

$7,423,575,990

$83,388,754,545

$5,947,049,689

$240,838,957,273

$252,044,026

$125,430,099,920

$3,167,936,669

$5,475,343,561

$2,230,741,602

$37,542,503,934

$4,399,388,432

$14,900,822

$1,775,086,039

$1,813,626,935

$321,908,889

$113,294,921

$270,601,215

$65,981,713

$1,440,342,799