Lecture 1t (PDF)

File information

This PDF 1.4 document has been generated by LaTeX with beamer class version 3.07 / pdfTeX-1.40.3, and has been sent on pdf-archive.com on 13/05/2013 at 18:52, from IP address 90.197.x.x.

The current document download page has been viewed 1036 times.

File size: 274.7 KB (38 pages).

Privacy: public file

File preview

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

MN50429 - Financial Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Lecture 1

A partial review: Black-Scholes and beyond

Dr Andreas Krause and Dr XiaoHua Chen

The Black-Scholes option pricing model: Main

assumptions and formula

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Main assumptions:

The stock price follows Brownian motion (i.e. Wiener

process). Thus, the distribution of stock prices is

log-normal.

The volatility of stock return is constant.rre

There are no riskless arbitrage opportunities.

The option is European.

Security trading is continuous.

The short selling of securities with full use of proceeds is

permitted.

...

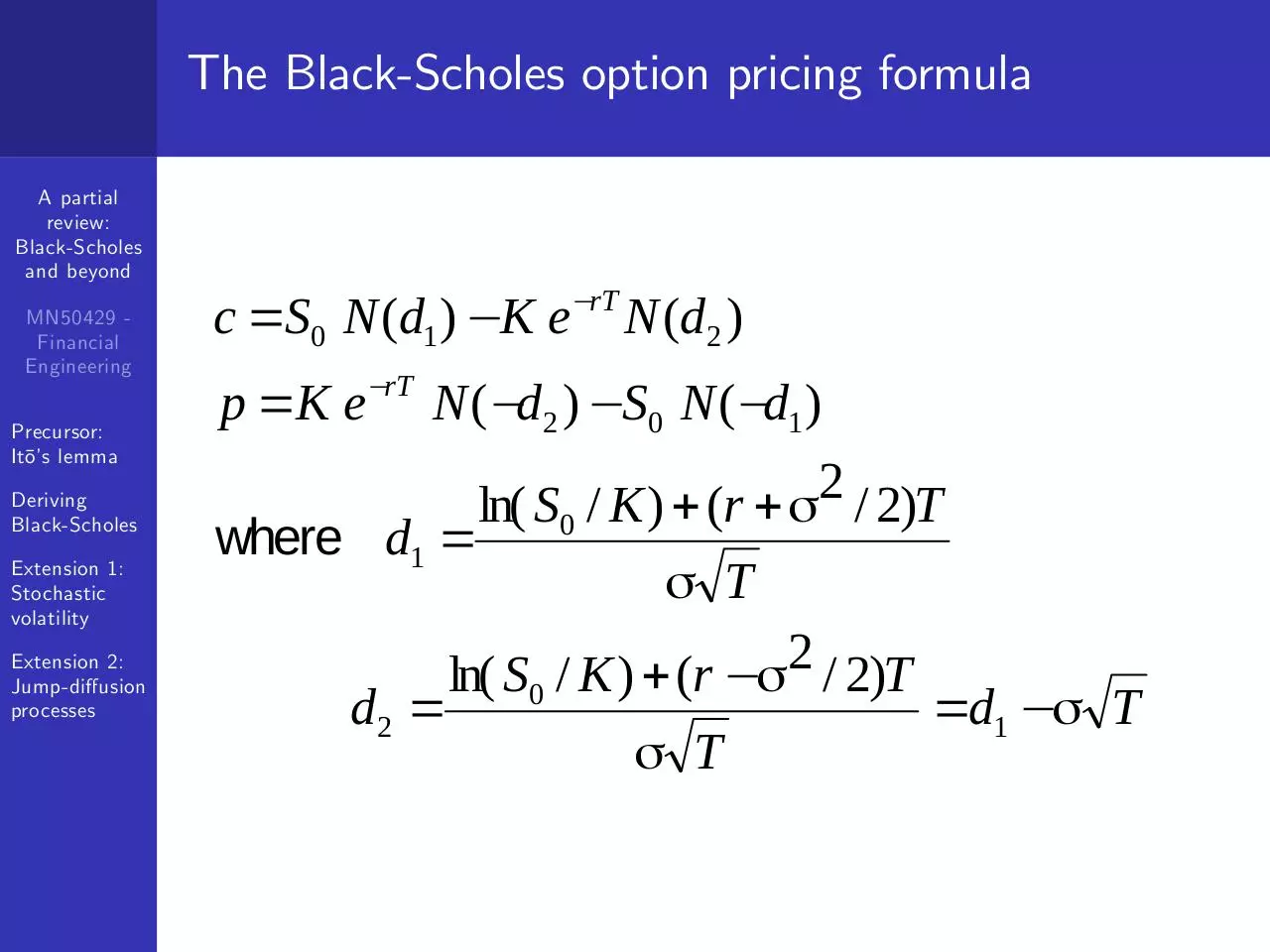

The Black-Scholes option pricing formula

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

c = S0 N (d1 ) − K e−rT N (d2 )

p = K e−rT N (−d 2 ) − S0 N (−d1 )

ln( S0 / K ) + (r + σ2 / 2)T

where d1 =

σ T

ln( S0 / K ) + (r − σ2 / 2)T

d2 =

= d1 − σ T

σ T

The need to go beyond Black-Scholes

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

The market consists of a wide variety of derivatives

Deriving

Black-Scholes

Payo¤ structures are di¤erent

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Underlying assets’stochastic processes are di¤erent

Need for accurate pricing

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Issuers need to be able to price derivatives in order to sell

them appropriately

Hedgers need to be able to price derivatives in order to

obtain cost-e¢ cient solutions to their risk exposures

Traders need to be able to price derivatives in order to

ensure an e¢ cient market

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

1

Precursor: It¯o’s lemma

2

Deriving Black-Scholes

3

Extension 1: Stochastic volatility

4

Extension 2: Jump-di¤usion processes

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Brownian motion

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

A common assumption is that stock returns are normally

distributed

St St

St

For

t

t

ln St

ln St

t

N

t;

2

t

t ! 0 we can write the dynamics as

dSt

= dt + dzt

St

(1)

is the drift (expected return)

is the volatility

p

dZt = "t dt is a Wiener process, " N(0; 1). Wiener

process is a partricular type of Markov stochastic process

with a mean change of 0 and a variance rate of 1.

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Source: Hull, J, Options, futures, and other derivatives, 7th ed., p.264.

Functions of stochastic processes

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

The value of a derivative will be a function of the value of

the underlying asset and time

Second order Taylor series approximation:

C (St ; t)

C (St

t; t

t) +

@C

(St

@S

@C

(t (t

t))

@t

1 @2C

+

(St St t )2

2 @S 2

1 @2C

+

(t (t

t))2

2 @t 2

@2C

+

(St St t ) (t (t

@S@t

St

t)

+

t)) (2)

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Note: second order Taylor series approximation formula:

f (x) = f (x0 + h) = f (x0 ) + f 0 (x0 )h + 12 f 00 (x0 )h2

It¯o’s lemma

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

In Eq.(2), If we move C (St

t ! 0, this becomes

dC

=

t; t

t) to LHS and, let

@C

1 @2C

@C

dS +

dt +

(dS)2

@S

@t

2 @S 2

@2C

1 @2C

2

(dt)

+

dSdt

+

2 @t 2

@S@t

@C

@C

1 @2C

dS +

dt +

(dS)2

@S

@t

2 @S 2

This relationship is knows as It¯o’s lemma

(3)

Application to Brownian motion

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

From Eq.(1), we have

p

dS = Sdt + Sdz = Sdt + S dt"

As dt ! 0 and E ["2 ] = 1, we have

(dS)2 =

2 2

S (dt)2 + 2

=

2 2

) dC =

+ S

2 2

S dt"2

S dt

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

3

S 2 (dt) 2 " +

S

@C

dz

@S

(4)

@C

1

+

@S

2

2 2@

S

2C

@S 2

+

@C

@t

dt

(5)

This is the basis from which to derive the Black-Scholes

formula

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

1

Precursor: It¯o’s lemma

2

Deriving Black-Scholes

3

Extension 1: Stochastic volatility

4

Extension 2: Jump-di¤usion processes

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Hedge portfolio

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

De…ne a portfolio V of the option C and a short position

of units of S, i.e. the underlying asset

V =C

S

) dV = dC

(6)

dS

(7)

Eliminating risk

Using Eqs. (1) and (5), the above portfolio of Eq.(7)

becomes

1 2 2 @2C

@C

@C

+

S

+

S dt

dV =

S

2

@S

2

@S

@t

@C

+ S

dz

(8)

@S

Eliminate risk by setting

) dV =

=

@C

@S

@C

1

+

@t

2

2 2@

S

2C

@S 2

dt

(9)

Riskless portfolio

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

This portfolio is riskless, hence dV = rVdt, where r is the

risk-free asset rate of return.

Inserting Eq.(9) in the above and substituting V we have

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

rv =

@C

1

+

@t

2

2 2@

S

2C

(10)

@S 2

Using Eq.(6), delta hedge = @C

@S and Eq.(10) we get the

Black-Scholes partial di¤erential equation:

@C

1

+

@t

2

2 2@

S

2C

@S 2

+ rS

@C

@S

rC = 0

(11)

Black-Scholes partial di¤erential equation

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

This equation holds for all derivatives where the

underlying follows a Brownian motion

Solution for a derivative depends on boundary conditions

Because a solution of a PDE is generally not unique,

additional conditions must generally be speci…ed on the

boundary of the region where the solution is de…ned.

Boundary conditions are typically values at expiry, values

at low or high prices of the underlying, etc.

Partial di¤erential equations can in general not be solved

analytically

Many can be solved numerically

European call option

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

For a European call option the boundary conditions are:

C (0; t) = 0

limS !1 C (S; t) = S

C (S; T ) = maxfS

E ; 0g

Solving for the Black-Scholes formula

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

With these boundary conditions exceptionally an analytical

solution exists

Derivation via variable substitution and Heat equation

using Fourier transforms (See Hull, J, Options, futures,

and other derivatives, 7th ed., p.307)

In future lectures we will look at numerical procedures to

solve such equations as well as other approaches to

determine the value of derivatives

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

1

Precursor: It¯o’s lemma

2

Deriving Black-Scholes

3

Extension 1: Stochastic volatility

4

Extension 2: Jump-di¤usion processes

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Changing volatility

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Volatility is the main drive of the option value in

Black-Scholes

Volatility is not constant over time in real markets

More realistic to assume that it changes by some

mechanism, e.g. stochastic di¤erential equations (SDEs):

dS = Sdt +

d

2

= dt +

t SdzS

(12)

dz

(13)

dzS dz = dt

(14)

where is the volatility of , is a function of (S; 2 ; t).

is the correlation between the two stochastic processes.

Multivariate It¯o’s lemma

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

The multivariate version of It¯o’s lemma is

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

dC

=

@C

@C

@C

dS +

d 2+

dt

2

@S

@

@t

1 @2C

1 @2C

2

+

(dS)

+

d

2 @S 2

2@ 4

(15)

2 2

+

@C

dSd

@S@ 2

2

Preliminaries

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

In Eq.(4) we derive

(dS)2 =

2 2

S dt

p

From Eq.(13), let dt ! 0, dz = "t dt, we have

d

2 2

=

2

=

2 2

t dt

dSd

2

3

2

2

t t (dt)

(dt)2 + 2

=

=

2 2 2

t t dt

(16)

3

S (dt)2 +

+

+

tS

t

S (dt) 2

(dt) 2 +

2

t Sdt

2

t Sdt

3

(17)

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Plug Eqs.(4,16,17) in Eq.(15), we have

dC

@C

@t

=

+

+

1

2

2 S 2 @2 C + 1 2 2 @2 C

@S 2 2 2

@ 4

2S @ C

+

@S @ 2

@C

dS

|@S{z }

Uncertainty

+

1

@C

d 2

2

@

| {z }

Uncertainty

!

dt

(18)

2

Hedge portfolio

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

We have two uncertainties, so we need two instruments to

hedge

One instrument is the underlying asset S, the other is

b on the same asset S.

another option C

V =C

) dV = dC

b follows the same rules as C

C

S

dS

bC

b

b dC

b

(19)

(20)

Riskless portfolio

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Plug Eq.(18) in Eq.(20), we have

dV

=

@C

@t

b

@C

+

@S

|

!

2 S 2 @2 C + 1 2 2 @2 C

@S 2 2 2

@ 4

dt

2S @ C

+

2

@S @

!

b

b

b

@C

1 2 2 @2 C

1 2 2 @2 C

+

+

S

@t

2

2

@S 2

@ 4

dt

b

2 S @2 C

+

@S @ 2

+

1

2

b

b @C

@S

{z

Uncertainty

!

1

dS +

}

|

@C

@ 2

b

b @C

@ 2

{z

Uncertainty

(21)

!

2

d

2

}

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

To elimiate dS terms, Delta hedge:

@C

@S

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

To elimiate d

2

b

b @C

@S

=0

(22)

terms, Vega hedge:

@C

@ 2

b

b @C = 0

@ 2

(23)

First step towards a solution

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Inserting the hedges and noting that dV = rVdt, plug

Eq.(19, 22, 23) in Eq.(21), we have:

@C

@t

+

=

b

@C

@t

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

1

2

+

2 S 2 @2 C

@S 2

1

2

+

b

2 S 2 @2 C

@S 2

+

2 S @ 2 C + 1 2 2 @ 2 C + rS @C

rC

2

@S

@S @ 2

@ 4

@C

@ 2

2b

b

b

2 S @2 C

+ 12 2 2 @@ C4 + rS @@SC

@S @ 2

b

@C

@ 2

(24)

To hold Eq.(24), both side have to be equal to certain

function. We deduce the following function (ignore the

reasoning here):

b

rC

Linear structure

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

f (S;

where

2

and

; t) =

(S;

2

; t) +

(S;

2

; t)

(25)

are de…nded in Eq.(13)

and will in general be non-linear. Since they depend

on other variables so it’s not necessarily linear.

Combining the RHS and this function gives us a solution

to the di¤erential equation

Interpretation of

A partial

review:

Black-Scholes

and beyond

Assume we have a delta hedged portfolio:

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

V =C

@C

S

@S

(26)

and applying It¯o’s Lemma in Eq.(18), we have:

dV

@C

@t

=

+

+

@C

d

@ 2

1

2

2 S 2 @2 C +

@S 2

2

+ 21 2 2 @@ C4

2

This portfolio still has volatility risk!

2 S @2 C

@S @ 2

!

dt

(27)

A partial

review:

Black-Scholes

and beyond

To elimiate the volatility risk, we plug Eq.(26) in the

following expression:

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

dV

rVdt = dV

(28)

Plug Eqs.(13, 25, 27) in the above Eq.(28), we have

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

@C

S)dt

@S

r (C

dV

rVdt = (

+

Extension 2:

Jump-di¤usion

processes

=

+

)

@C

dt

@ 2

@C

( dt +

@ 2 0

@C @

(S;

@ 2

dz )

2

; t)dt +

dz

|{z}

Uncertainty

1

A

(29)

Market price of volatility risk

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

This expression dV

risk free rate

Deriving

Black-Scholes

Taking expectations, the last term dz vanishes

Extension 1:

Stochastic

volatility

The excess return (premium) increases in

Extension 2:

Jump-di¤usion

processes

rVdt is the excess return over the

is the market price of volatility risk

at a rate of

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

1

Precursor: It¯o’s lemma

2

Deriving Black-Scholes

3

Extension 1: Stochastic volatility

4

Extension 2: Jump-di¤usion processes

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Jumps in stock prices

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Sometimes stock prices move by discrete amounts

Reasons can be crashes but also news arrivals, e.g

unexpected changes to earning, merger announcements,

etc.

Such discrete movements are called jumps

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Representing jumps

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

dS

S

=(

m) dt + JdP( ) + dz

is the intensity, i.e. probability of observing a jump in

one time period

J is the size of the jump, which has some distribution with

m = E [J]

P( ) is a Poisson process

f (x) =

x

e

x!

;

> 0; E (x) = var (x) =

Other representations of jump-di¤usion processes exist

Known jump size

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

If we know the jump size we have two sources of risk: dz

and dP( )

As with stochastic volatility we proceed using a hedge

portfolio with two assets

Di¤erent di¤erential equation as stochastic process is

di¤erent

Unknown jump size

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

This is not a third uncertainty

Uncertainty is about jump of size J1 , J2 , J3 ,....

For real valued jumps an in…nite number of uncertainties

exists

Market is then not complete

Derivative would then be a bene…t to the market, not a

mere replication of existing assets

It could not be perfectly priced, only price bounds be

determined

A partial

review:

Black-Scholes

and beyond

MN50429 Financial

Engineering

Precursor:

It¯o ’s lemma

Deriving

Black-Scholes

Extension 1:

Stochastic

volatility

Extension 2:

Jump-di¤usion

processes

Summary: The general steps to price derivative C

Use It¯o’s Lemma to derive dC

Construct riskless hedge portfolio V

Derive dV in the terms of stochastic process

Derive PDE by elimiating the risk in dV expression

through hedging

Solve the PDE either analytically or numerically. If

solution is numerical, set the boundary conditions for the

PDE and then solve.

Download Lecture 1t

Lecture_1t.pdf (PDF, 274.7 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000104725.