20121129 PrésentationAREVA PremiumReviewSG (PDF)

File information

Title: 20121129 - Présentation AREVA - Premium Review SG_vDEF en ligne

Author: aramon

This PDF 1.4 document has been generated by PDFCreator Version 1.4.0 / GPL Ghostscript 9.05, and has been sent on pdf-archive.com on 16/10/2013 at 22:28, from IP address 217.5.x.x.

The current document download page has been viewed 1087 times.

File size: 2.88 MB (27 pages).

Privacy: public file

File preview

AREVA: Global leader

in low-carbon power generation

Premium Review – Société Générale

Paris, November 29th, 2012

Agenda

►AREVA overview

►Strategy & performance

►Financial Outlook

AREVA Presentation – November 29, 2012

p.2

Energy market:

continued growth announced

Macroeconomics

Energy demand: x2 by 2050

Geopolitics

Energy independence and

security of supply imperative

Resources

Increasing difficulties in

extracting resources leading to

higher prices

Demand in

nuclear energy*

+1.9%

/ year

Environment

GHG emissions reduction goal of

50% by 2050

Demand in

renewable

energies*

+2.5%**

/ year

WEO 2012

2010 – 2035

New Policies Scenario

* Billions of toe

** Including hydraulic energy

Economics

Need of mastered, stable and

predictable energy costs

AREVA Presentation – November 29, 2012

p.3

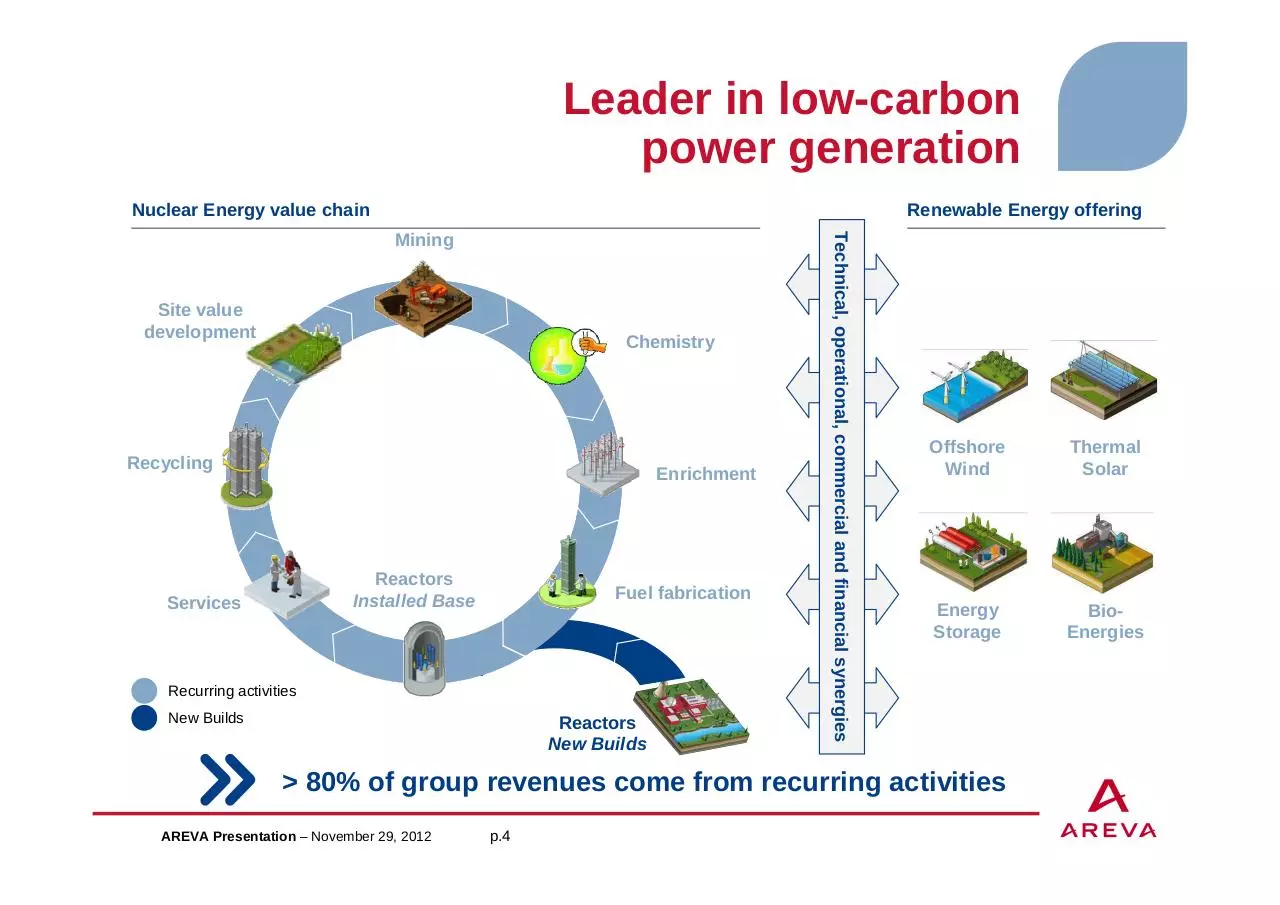

Leader in low-carbon

power generation

Nuclear Energy value chain

Renewable Energy offering

Site value

development

Chemistry

Recycling

Enrichment

Reactors

Installed Base

Services

Fuel fabrication

Recurring activities

New Builds

Reactors

New Builds

Technical, operational, commercial and financial synergies

Mining

Offshore

Wind

Thermal

Solar

Energy

Storage

BioEnergies

> 80% of group revenues come from recurring activities

AREVA Presentation – November 29, 2012

p.4

Nuclear scenario:

differed but confirmed growth

AREVA 2011 scenario

Change in global installed base

(GWe)

GWe)

(GWe)

GWe)

Reassessed at end-June 2011

o.w

47 GWe in Japan

20 GWe in Germany

AREVA’s business model allows it to capture market

opportunities in all segments

AREVA Presentation – November 29, 2012

p.5

AREVA is present on the full

nuclear value chain

Nuclear Reactor lifecycle

Construction

Operations

End of life

Mining

Front End

Reactors and

Services

Back End

AREVA covers all phases of nuclear reactors’ lifecycle

AREVA Presentation – November 29, 2012

p.6

Construction

AREVA benefits from strong

competitive edge in new constructions

A competitive value proposition

► Highest safety standards

Air plane crash protection

Core meltdown protection systems

Avoidance of nuclear materials discharge

Resistance to earthquakes and flooding

► Amongst lowest levelized cost

of electricity

Investment cost per MW close

to other technologies in recent bids

Up to 25% lower operations cost

► Excellent operational performance

Optimized outage strategy with fuel

cycle flexibility

Increased closed cycle profitability

with 100% MOX compatibility

► EPR: most advanced technology in

terms of construction worldwide

All AREVA reactors meet generation III nuclear safety criteria

AREVA Presentation – November 29, 2012

p.7

Construction

AREVA is involved in major

tenders for new nuclear worldwide

Ongoing negotiations

(bilateral)

Ongoing bids

Upcoming bids

(in 3-5 years)

ESKOM

Hinkley Point

C-D

JAEC

EDF

PGE

Saudi Arabia

Pyhäjoki

Taishan 3-4

CGNPC

(GDF Suez – Iberdrola JV)

Temelin 3-4

Jaitapur 1-2

NPCIL

EDF

PPL

Duke Energy

NuGen

Fennovoima

CEZ *

Calvert Cliff 3

Bell Bend

Piketon

Delta

New Brunswick Power

OL 4

Vattenfall

TVO

MVM

MNPC

NA-SA

* Suspended, waiting for arbitration of Czech national competition body UOHS

AREVA Presentation – November 29, 2012

p.8

Operations

AREVA’s recurring activities allow

utilities to operate nuclear reactors

Utility

Fuel

assemblies

Used fuel

External services & maintenance

Outages

Replacement of

components

Upgrades

Uprates

AREVA seizes opportunities in all segments of nuclear operations

irrespective of reactors technology

AREVA Presentation – November 29, 2012

p.9

Operations

95% of all nuclear utilities are

AREVA customers

AREVA references:

Europe, CIS and Africa

98 reactors built

188 reactors in operation

~140 reactors

4 reactors under construction

served by AREVA

114 for services

135 for fuel

North and

South Americas

Asia

119 reactors in operation

~90 reactors

130 reactors in

operation

~130 reactors

served by AREVA

17 for services

90 for fuel

served by AREVA

126 for services

100 for fuel

AREVA provides products and services to 360 reactors worldwide

AREVA Presentation – November 29, 2012

p.10

Operations

Forecasted growth in

worldwide nuclear installed capacity

2030

2011

377 GW

583 GW

Europe

- 13%

North America

+ 11%

Japan & Korea

+ 31%

Russia & CIS

+ 19%

China (including

Taiwan) & India

x8

Rest of world

x3

Source: AREVA 2011 scenario

+ 54% installed base capacity by 2030 will drive market opportunities

across all regions for AREVA

AREVA Presentation – November 29, 2012

p.11

An organization designed to seize

opportunities all over the world

AREVA worldwide presence

Regional headquarters

America regional offices

Europe regional offices

Asia-Pacific regional offices

AREVA Presentation – November 29, 2012

p.12

End of life

Dismantling: broad expertise in

managing customer projects

Reactor vessel / internals: decontamination and dismantling (D&D)

Stade, Würgassen,

Obrigheim

Dismantling of the reactor vessel and internals

Decontamination of primary and auxiliary circuits

Millstone, Rancho Seco,

Yankee Rowe

Dismantling of the reactor vessel and internals

Used fuel, effluent / radioactive waste management

Fukushima

Design and implementation of a full water treatment system

Dounreay

Special equipment to retrieve damaged fuel in research reactor

Assistance to the project owner / Design and engineering

Creys-Superphénix

Support to the sodium retrieval and D&D preparation

M&O (maintenance and operations) for D&D projects

Hanford

High level waste treatment (customer: DOE)

Savannah

Vitrification of high level waste (customer: DOE)

Marcoule

D&D of a large fuel treatment facility (customer: CEA)

Sellafield

Member of the site's M&O consortium

Creation of an expertise center for decommissioning and dismantling in Germany

AREVA Presentation – November 29, 2012

p.13

AREVA Renewables currently

operates in 4 market segments

Offshore Wind

More electricity output

than onshore turbines

More Wind hours

Higher wind levels

Larger turbine

sizes

Concentrated Solar

Power

Enables steam

production for hybrid

fossil/solar plants and

industrial applications

Possibility of thermal

storage increasing

production hours

AREVA Presentation – November 29, 2012

p.14

Bioenergy

Energy production

from biomass sources

AREVA also active in

upstream biomass

treatment market

through its torrefaction

technology

Energy Storage

Hydrogen production

through electrolysis

technology

Power production from

hydrogen in fuel cells

Other energy storage

technologies

considered for largescale applications

Renewable Energies market:

accelerated growth expected

Estimated average annual market size in volume

Sources: IEA World Energy Outlook for CSP and Bioenergy, AREVA forecasts for Offshore Wind (WEO does not distinguish onshore/offshore)

Offshore wind market (Europe)

Solar CSP market (World)

Bioenergy market (World)

(MW)

(MW)

(MW)

7,317

Other Asia / Oceania

Other Asia / Oceania

India

Middle-East / Africa

China

India

Europe

4,700

Latin America

5,160

North America

Europe

Middle-East and Africa

North America

Other Europe

France

2,340

Germany

1,561

China

1,010

UK

2011-2015

2016-2020

2011-2015

2016-2020

2011-2015

2016-2020

AREVA’s positioning on renewable market: selected growing activities

AREVA Presentation – November 29, 2012

p.15

Agenda

►AREVA overview

►Strategy & performance

►Financial Outlook

AREVA Presentation – November 29, 2012

p.16

“Action 2016” Strategic Action Plan

Safety Security Transparency

Commercial

priority given

to value

creation

Selectivity

in capital

spending

• Installed Base:

doubling profitability

by 2016

• New Builds:

becoming the reference

technology

• €7.7bn over the

2012-2016 period,

i.e. -34% vs. 2007-2011

• Several projects on

hold

Debt

management

• Disposal plan

> €1.2bn over the

2012-2013 period

• Fully self-financed

Capex on a cumulative

basis over the 2012-2016

period

Improving our performance

-€1bn on annual operating costs base and -€500m in WCR by 2015

Concrete progress in all strategic orientations

AREVA Presentation – November 29, 2012

p.17

Safety

Commercial

priority given

to value

creation

Security Transparency

Selectivity

in capital

spending

Debt

management

Improving our performance

Improvement

of AREVA’s financial structure

Asset disposals program

ahead of schedule

Strengthening our

balance sheet

2 bond issues:

December 14, 2011: 01dB-Metravib

March 8, 2012: €400m bond issue (maturity:

October 5, 2017)

January 30, 2012: Sofradir

March 21, 2012: €200m private placement

maturing in 10 years

May 16, 2012: ERAMET

c.€1.2bn

June 1, 2012: AREVA Lesedi

June 11, 2012: Millennium

No major debt refinancing required before

2016

Average debt maturity: 7 years

August 28, 2012: La Mancha

Liquidity: €1.9bn in net cash

available at 6/30/2012 (+€462m

vs end of 2011)

2012-2013 objective for

disposals has been reached

AREVA Presentation – November 29, 2012

p.18

Safety

Commercial

priority given

to value

creation

Security Transparency

Selectivity

in capital

spending

Debt

management

65% of the operating cost

reduction goal secured

Improving our performance

OBJECTIVE of improving performance

€1bn reduction in annual operating costs by 2015

€1.0bn

Objective

Achieved(1)

Secured(2)

Identified(3)

~€450m

(1) Contribution to savings by actions

completed at end-June 2012, based on

annual costs excluding technology

transition in Front End

(2) Contribution to savings by actions

secured at end-June 2012, based on

annual costs excluding technology

transition in Front End

(3) Contribution to savings by actions

identified at end-June 2012, based on

annual costs

45% of the 2015 goal

is secured

~€150m

2015

objective

~€200m

~€200m

2011-2012

actions

2011-2015

actions

20% of the 2015

objective has been

achieved

€350m secured at the end of 2012 65% of the €1bn secured by 2015

AREVA Presentation – November 29, 2012

p.19

€47bn of backlog:

5 years of revenue secured

Backlog at September 30, 2012

In value

Number of years

Approximate coverage of 2012

of 2011 revenue in backlog

revenue by BG (rounded)

Mining

€12.8bn

Front End

€18.5bn

Reactors

& Services

€8.5bn

Back End

€5.8bn

4

~100%

Renewable

Energies

€1.3bn

4

~75%

AREVA Presentation – November 29, 2012

p.20

10

8

3

~100%

~95%

~90%

Commercial dynamism and

improved profitability

Backlog (€bn)

Revenue (€m)

+10.1%

7,589

42.5

43.3

44.2

8,089

8,529 9,104 8,872

5,950

47.0

45.6

+10.0%

6,542

42.7

34.9

2007

2008

2009

2010

2011

Sept.

2011

Sept.

2012

Restated EBITDA* (€m)

2007

2008

2009

2010

2011

9M

2011

9M

2012

H1

2011

H1

2012

Restated FCF before tax*(€m)

2007

2008

2009

-900

-919

2010

2011

+€508m

908

725

684

-591

421

402

262

2008

2009

2010

2011

H1

H1

2011

2012

*Restated for Siemens impacts in 2011and capital gains on disposal of stakes in Mining and Enrichment projects

AREVA Presentation – November 29, 2012

p.21

-1,090

-1,366

217

-2,218

2007

-919

+€328m

Agenda

►AREVA overview

►Strategy & performance

►Financial Outlook

AREVA Presentation – November 29, 2012

p.22

Financial outlook

Action 2016:

2012-2013 outlook

Upward revision

for 2012

Action 2016:

2015-2016 outlook

Nuclear: +3 to 6% per year

Nuclear: +4 to 6%

Nuclear: +5 to 8% p.a

Renewables

> €750m

Renewables: ~€600m

Renewables: >€1.25bn

Revenue

EBITDA

> €750m

> €1.25bn

> €950m

Free operating

cash flow

excl. disposals

> -€1.5bn

Break-even

> -€1.25bn

> +€1.0bn p.a

from 2015

At constant consolidation scope

2012 outlook revised upward at the occasion of H1 2012 results

AREVA Presentation – November 29, 2012

p.23

Appendix

2012 half-year results – AREVA – July 27, 2012 - p.24

AREVA in figures

€47bn

backlog at 09/30/2012

Seizing growth opportunities on the worldwide existing

fleet and on new markets

Geographic distribution of 2011 revenue

€8.872bn

in revenue in 2011

Europe

61%

47,541 employees

in 25 countries

900 experts

8,000 patents

Incl. France 36%

Incl. Germany 9%

North & South

America

20%

2%

devoted to R&D

p.25

Incl. Japan 8%

Asia – Pacific

Africa &

Middle East

4% of sales

AREVA Presentation – November 29, 2012

17%

Download 20121129-PrésentationAREVA-PremiumReviewSG

20121129-PrésentationAREVA-PremiumReviewSG.pdf (PDF, 2.88 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000128900.