document (PDF)

File information

Title: The Buzz: SPX skew hits a 3y high

Author: The Goldman Sachs Group, Inc.

This PDF 1.4 document has been generated by PScript5.dll Version 5.2.2 / Acrobat Distiller 9.3.0 (Windows); modified using iText 2.1.7 by 1T3XT, and has been sent on pdf-archive.com on 17/03/2014 at 16:01, from IP address 71.201.x.x.

The current document download page has been viewed 1319 times.

File size: 590.9 KB (14 pages).

Privacy: public file

File preview

March 17, 2014

The Buzz: SPX skew hits a 3y high

Options Research

The VXST (9-day VIX index) was up 62% last week

SPX skew highest since October 2011

VIX market

The VXST ended last week at 20.6, up 7.9 vol

points (+62%) week-over-week but it still remains

well off its early February high of 24. Although

VIX option 1m implied volatility also spiked, 1m

call skew remains near average levels relative to

the last year vs. S&P 500 skew at highs.

SPX 1m implied vol was up 3.4 pts last week,

the most among global indices. 1m implieds

are 15 vs. 1m realized vol at 9.3, 10d at 11.6.

Increased hedging demand drove S&P 500

skew to its highest level since October 2011.

The bid for shorter-dated options pushed

implied vol for options expiring this Friday

above 17, causing a checkmark pattern in the

term structure.

S&P 500 1m skew hits a multi-year high

We analyze the performance of VIX calls and

SPX puts across all listed strikes and

expirations from Wednesday March 12 market

close through Friday March 14.

A top 10 list shows payouts of $3.6 to $4-to-1

for investors who used near-the-money SPX

weekly puts expiring March 14.

March 17 and 18 strike calls were the two top

performers in VIX space; with payouts of

$3.7:1 and $3.8:1 respectively, just behind the

SPX weeklies. Those VIX options were 11%

and 18% otm versus the closing March futures

level last Wednesday.

0.30

0.25

0.20

Jan-13

Jul-13

Jan-14

Source: Goldman Sachs Global Investment Research.

(212) 357-3770 krag.gregory@gs.com

Goldman, Sachs & Co.

SPX puts vs. VIX calls last week

0.40

0.35

Krag Gregory, Ph.D.

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US

affiliates are not registered/qualified as research analysts with FINRA in the U.S. This report is intended for distribution to GS institutional clients only.

The Goldman Sachs Group, Inc.

Global Investment Research

March 17, 2014

Global Snapshot: S&P 500 saw the largest shift in 1m vol last week among global indices

Exhibit 1: S&P 500 1m implieds jumped 3.4 vol points last week, the most among global indices. XLI vol was up the most across U.S. sectors.

Top Exhibit: Level of 1m 50 delta implied volatility as of March 14 market close. Bottom exhibit: Change in 1m implied volatility level from March 7 to March 14, 2014.

Level of 1m implied volatility March 14

50

45

Country ETFs

Global Equity Indices

42

US Sector ETFs

40

35

31

30

30

26 26

25

20

23 23 22

20 20 19

19 18

15

26

24 24

21 20

16 16 15 14

14 13

12 11

18

16 15

17 17 17 17 17 16

16

13 12

10

5

0

5

4

3

1 week change in 1m implied volatility

3.4 3.2

4.2

3.4

3.0 2.9 2.9 2.9

2.5

2

2.3

2.4

2.1 2.0 1.9

1.9 1.9

1.7 1.6 1.6

1.2

1

3.2 3.2

2.7

2.5

2.0

1.7 1.6

1.5

1.1 0.9

0.9

3.0

0.7

1.1

0.3

0

-1

0.0

-0.3 -0.5

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

2

March 17, 2014

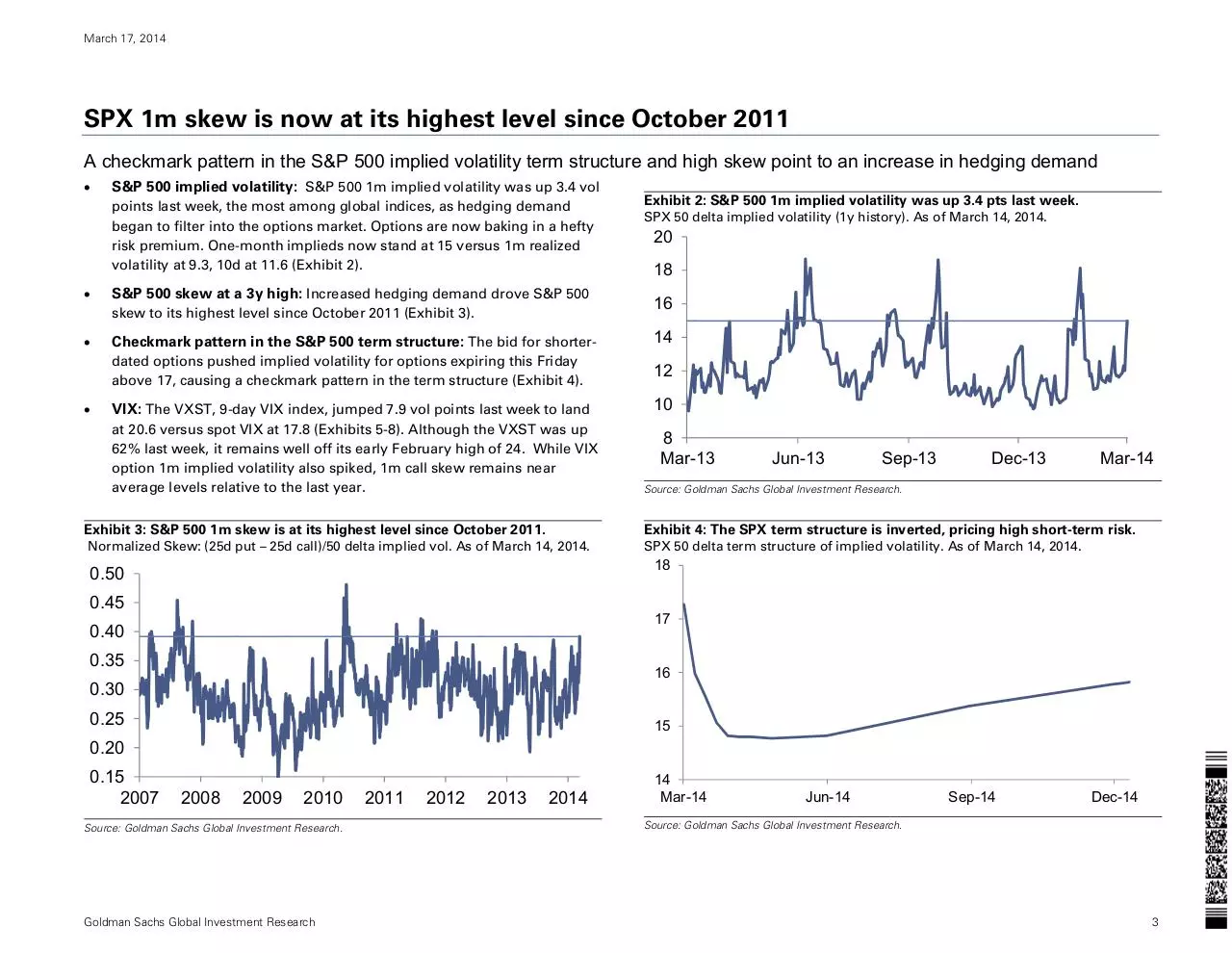

SPX 1m skew is now at its highest level since October 2011

A checkmark pattern in the S&P 500 implied volatility term structure and high skew point to an increase in hedging demand

S&P 500 implied volatility: S&P 500 1m implied volatility was up 3.4 vol

points last week, the most among global indices, as hedging demand

began to filter into the options market. Options are now baking in a hefty

risk premium. One-month implieds now stand at 15 versus 1m realized

volatility at 9.3, 10d at 11.6 (Exhibit 2).

S&P 500 skew at a 3y high: Increased hedging demand drove S&P 500

skew to its highest level since October 2011 (Exhibit 3).

Exhibit 2: S&P 500 1m implied volatility was up 3.4 pts last week.

SPX 50 delta implied volatility (1y history). As of March 14, 2014.

20

18

16

Checkmark pattern in the S&P 500 term structure: The bid for shorter-

14

dated options pushed implied volatility for options expiring this Friday

above 17, causing a checkmark pattern in the term structure (Exhibit 4).

12

VIX: The VXST, 9-day VIX index, jumped 7.9 vol points last week to land

10

at 20.6 versus spot VIX at 17.8 (Exhibits 5-8). Although the VXST was up

62% last week, it remains well off its early February high of 24. While VIX

option 1m implied volatility also spiked, 1m call skew remains near

average levels relative to the last year.

8

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Source: Goldman Sachs Global Investment Research.

Exhibit 3: S&P 500 1m skew is at its highest level since October 2011.

Exhibit 4: The SPX term structure is inverted, pricing high short-term risk.

Normalized Skew: (25d put – 25d call)/50 delta implied vol. As of March 14, 2014.

SPX 50 delta term structure of implied volatility. As of March 14, 2014.

18

0.50

0.45

17

0.40

0.35

16

0.30

0.25

15

0.20

0.15

2007

2008

2009

2010

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

2011

2012

2013

2014

14

Mar-14

Jun-14

Sep-14

Dec-14

Source: Goldman Sachs Global Investment Research.

3

March 17, 2014

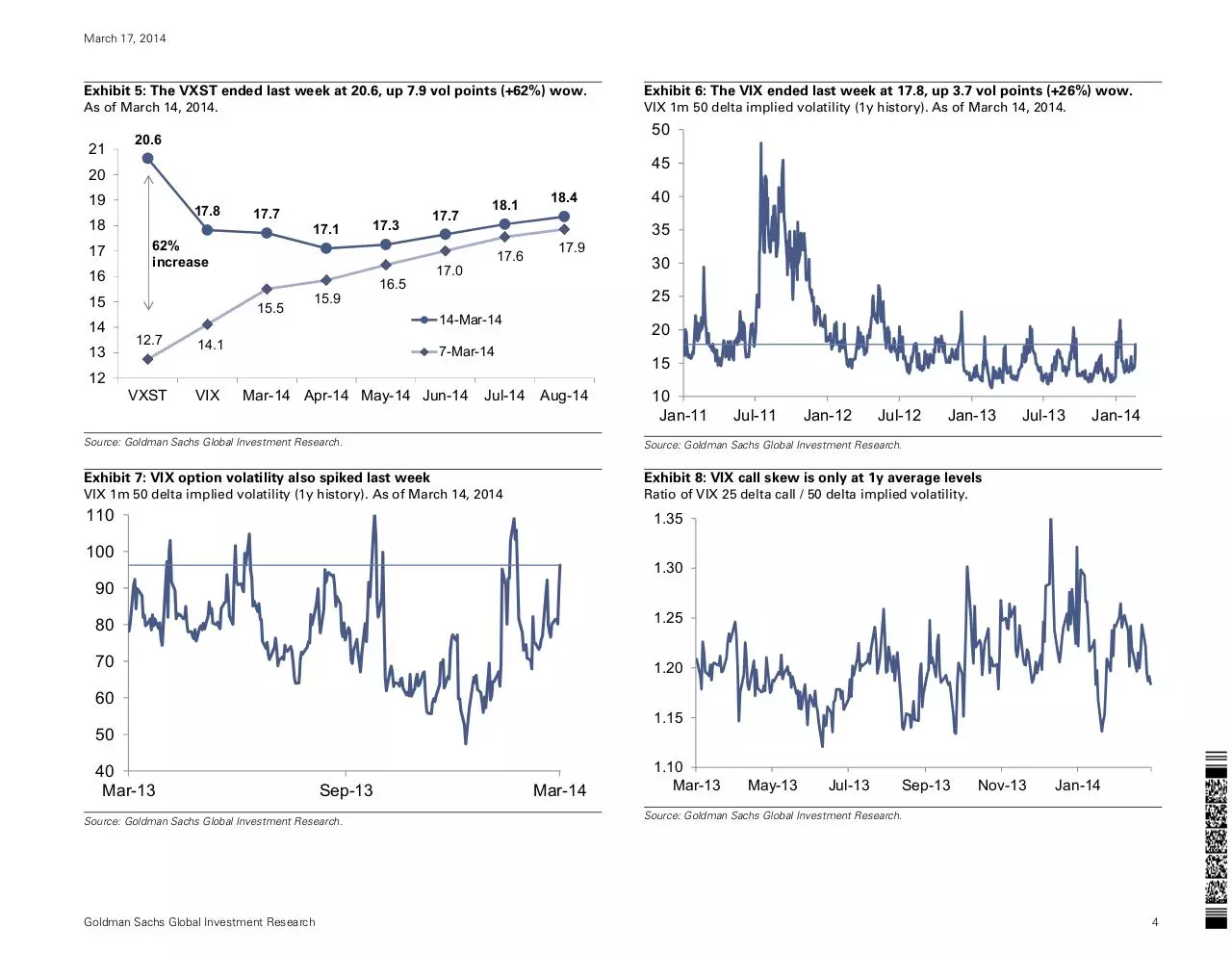

Exhibit 5: The VXST ended last week at 20.6, up 7.9 vol points (+62%) wow.

Exhibit 6: The VIX ended last week at 17.8, up 3.7 vol points (+26%) wow.

As of March 14, 2014.

VIX 1m 50 delta implied volatility (1y history). As of March 14, 2014.

21

50

20.6

45

20

19

17.8

18

17

16

13

17.1

17.3

62%

increase

15

14

17.7

15.5

12.7

15.9

16.5

17.7

18.1

18.4

35

17.6

17.0

17.9

20

7-Mar-14

15

12

VXST

VIX

30

25

14-Mar-14

14.1

40

Mar-14 Apr-14 May-14 Jun-14

Jul-14 Aug-14

10

Jan-11

Jul-11

Jan-12

Jul-12

Jan-13

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

Exhibit 7: VIX option volatility also spiked last week

Exhibit 8: VIX call skew is only at 1y average levels

VIX 1m 50 delta implied volatility (1y history). As of March 14, 2014

Ratio of VIX 25 delta call / 50 delta implied volatility.

110

Jul-13

Jan-14

1.35

100

1.30

90

80

1.25

70

1.20

60

1.15

50

40

Mar-13

Sep-13

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

Mar-14

1.10

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Source: Goldman Sachs Global Investment Research.

4

March 17, 2014

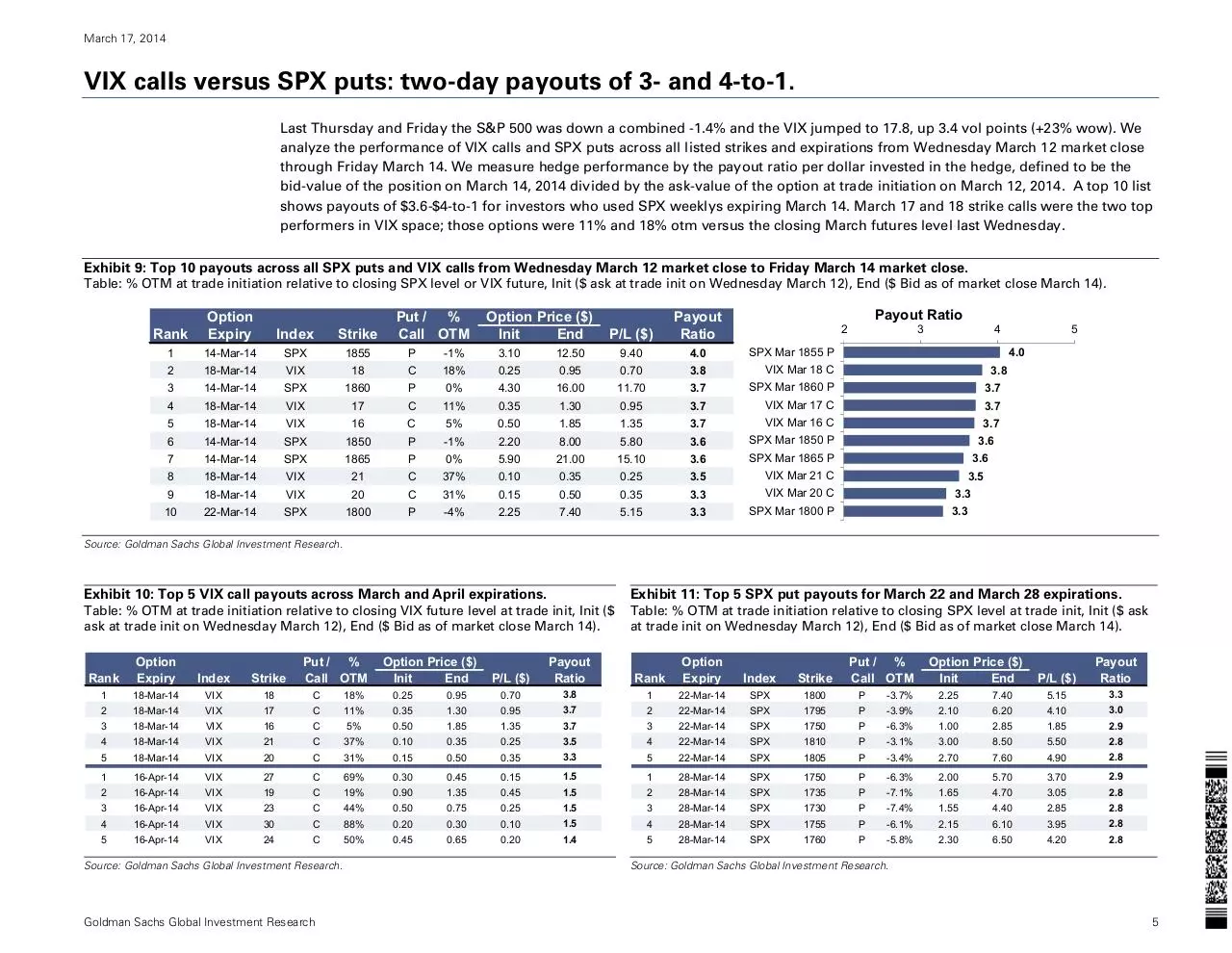

VIX calls versus SPX puts: two-day payouts of 3- and 4-to-1.

Last Thursday and Friday the S&P 500 was down a combined -1.4% and the VIX jumped to 17.8, up 3.4 vol points (+23% wow). We

analyze the performance of VIX calls and SPX puts across all listed strikes and expirations from Wednesday March 12 market close

through Friday March 14. We measure hedge performance by the payout ratio per dollar invested in the hedge, defined to be the

bid-value of the position on March 14, 2014 divided by the ask-value of the option at trade initiation on March 12, 2014. A top 10 list

shows payouts of $3.6-$4-to-1 for investors who used SPX weeklys expiring March 14. March 17 and 18 strike calls were the two top

performers in VIX space; those options were 11% and 18% otm versus the closing March futures level last Wednesday.

Exhibit 9: Top 10 payouts across all SPX puts and VIX calls from Wednesday March 12 market close to Friday March 14 market close.

Table: % OTM at trade initiation relative to closing SPX level or VIX future, Init ($ ask at trade init on Wednesday March 12), End ($ Bid as of market close March 14).

Rank

Option

Expiry

Index

Strike

Put / %

Call OTM

Option Price ($)

Init

End

1

14-Mar-14

SPX

1855

P

-1%

3.10

2

18-Mar-14

VIX

18

C

18%

0.25

3

14-Mar-14

SPX

1860

P

0%

4

18-Mar-14

VIX

17

C

11%

5

18-Mar-14

VIX

16

C

6

14-Mar-14

SPX

1850

P

7

14-Mar-14

SPX

1865

P

8

18-Mar-14

VIX

21

C

Payout Ratio

P/L ($)

Payout

Ratio

12.50

9.40

4.0

SPX Mar 1855 P

0.95

0.70

3.8

VIX Mar 18 C

4.30

16.00

11.70

3.7

SPX Mar 1860 P

3.7

0.35

1.30

0.95

3.7

VIX Mar 17 C

3.7

5%

0.50

1.85

1.35

3.7

VIX Mar 16 C

-1%

2.20

8.00

5.80

3.6

SPX Mar 1850 P

0%

5.90

21.00

15.10

3.6

SPX Mar 1865 P

37%

0.10

0.35

0.25

3.5

VIX Mar 21 C

2

9

18-Mar-14

VIX

20

C

31%

0.15

0.50

0.35

3.3

VIX Mar 20 C

10

22-Mar-14

SPX

1800

P

-4%

2.25

7.40

5.15

3.3

SPX Mar 1800 P

3

4

5

4.0

3.8

3.7

3.6

3.6

3.5

3.3

3.3

Source: Goldman Sachs Global Investment Research.

Exhibit 10: Top 5 VIX call payouts across March and April expirations.

Exhibit 11: Top 5 SPX put payouts for March 22 and March 28 expirations.

Table: % OTM at trade initiation relative to closing VIX future level at trade init, Init ($

ask at trade init on Wednesday March 12), End ($ Bid as of market close March 14).

Table: % OTM at trade initiation relative to closing SPX level at trade init, Init ($ ask

at trade init on Wednesday March 12), End ($ Bid as of market close March 14).

Rank

Option

Expiry

Index

Strike

Put / %

Call OTM

P/L ($)

Payout

Ratio

Rank

Option

Expiry

Index

Strike

1

18-Mar-14

VIX

18

C

18%

0.25

2

18-Mar-14

VIX

17

C

11%

0.35

0.95

0.70

3.8

1

22-Mar-14

SPX

1800

P

-3.7%

2.25

1.30

0.95

3.7

2

22-Mar-14

SPX

1795

P

-3.9%

2.10

3

18-Mar-14

VIX

16

C

5%

0.50

1.85

1.35

3.7

3

22-Mar-14

SPX

1750

P

-6.3%

4

18-Mar-14

VIX

21

C

37%

0.10

0.35

0.25

3.5

4

22-Mar-14

SPX

1810

P

5

18-Mar-14

VIX

20

C

31%

0.15

0.50

0.35

3.3

5

22-Mar-14

SPX

1805

1

16-Apr-14

VIX

27

C

69%

0.30

0.45

0.15

1.5

1

28-Mar-14

SPX

2

16-Apr-14

VIX

19

C

19%

0.90

1.35

0.45

1.5

2

28-Mar-14

3

16-Apr-14

VIX

23

C

44%

0.50

0.75

0.25

1.5

3

4

16-Apr-14

VIX

30

C

88%

0.20

0.30

0.10

1.5

5

16-Apr-14

VIX

24

C

50%

0.45

0.65

0.20

1.4

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

Option Price ($)

Init

End

Put / %

Call OTM

Option Price ($)

Init

End

P/L ($)

Payout

Ratio

7.40

5.15

3.3

6.20

4.10

3.0

1.00

2.85

1.85

2.9

-3.1%

3.00

8.50

5.50

2.8

P

-3.4%

2.70

7.60

4.90

2.8

1750

P

-6.3%

2.00

5.70

3.70

2.9

SPX

1735

P

-7.1%

1.65

4.70

3.05

2.8

28-Mar-14

SPX

1730

P

-7.4%

1.55

4.40

2.85

2.8

4

28-Mar-14

SPX

1755

P

-6.1%

2.15

6.10

3.95

2.8

5

28-Mar-14

SPX

1760

P

-5.8%

2.30

6.50

4.20

2.8

Source: Goldman Sachs Global Investment Research.

5

March 17, 2014

Exhibit 12: Euro Stoxx 50 1m implied volatility.

Exhibit 13: DAX 1m implied volatility.

Exhibit 14: EEM 1m implied volatility.

1m 50 delta implied volatility. As of March 13, 2014.

1m 50 delta implied volatility. As of March 13, 2014.

1m 50 delta implied volatility. As of March 13, 2014.

25

25

35

30

20

20

15

15

25

20

15

10

Mar-13

Sep-13

Mar-14

10

Mar-13

Sep-13

Mar-14

10

Mar-13

Sep-13

Mar-14

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

Exhibit 15: RDXUSD 1m implied volatility.

Exhibit 16: HSCEI 1m implied volatility.

Exhibit 17: KOSPI 200 1m implied volatility.

1m 50 delta implied volatility. As of March 13, 2014.

50 delta implied term structure. As of March 13,

1m 50 delta implied volatility. As of March 13, 2014.

50

36

22

Source: Goldman Sachs Global Investment Research.

34

45

20

32

40

30

18

28

35

26

30

16

24

22

25

14

20

20

18

15

Mar-13

16

Mar-13

Sep-13

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

Mar-14

Sep-13

Source: Goldman Sachs Global Investment Research.

Mar-14

12

Mar-13

Sep-13

Mar-14

Source: Goldman Sachs Global Investment Research.

6

March 17, 2014

Skew View: Highest in S&P 500, Russell 2000 and Euro Stoxx 50. EWH near a high.

Exhibit 18: S&P 500 and Russell 2000 skew are near 7 year highs, Euro Stoxx 50 skew is 77th %-ile relative to a 7y history. EWH skew highest among country

ETFs.

Normalized skew: (25 delta put – 25 delta call) / 50 delta implied volatility. Percentiles are calculated using data from January 2, 2007 – March 14, 2014.

Global

Indices

Option Volatility

(1m Implied)

1m Skew: Current %-ile

(Since Jan. 2007)

Option Skew

(Norm. 1m 25 delta)

1m Imp Chg Curr Skew Curr Overall Peak

% to

Current (1w) %-ile Current %-ile Peak

Date

Peak

S&P 500

15.0

3.4

34

0.39

96

0.48

5/21/10

23

Russell 2000

19.2

2.9

28

0.32

86

0.41

8/11/11

30

EuroStoxx 50

20.3

2.9

43

0.27

77

0.39 10/16/08 44

Taiwan

11.2

1.2

3

0.18

75

0.55

8/16/07 215

UK (FTSE 100)

14.2

1.7

27

0.29

75

0.46

8/10/11

57

Russia

41.9

-0.5

75

0.22

73

0.32 11/17/11 47

France (CAC)

19.0

3.4

37

0.27

68

0.40 10/17/08 50

KOSPI 200

13.9

1.6

6

0.19

66

0.48

8/19/11 147

Australia

12.7

2.3

17

0.26

63

0.53

12/1/08 108

Switzerland

14.9

2.4

42

0.23

52

0.38 10/17/08 66

Hang Seng

17.5

1.6

27

0.14

51

0.38

8/8/11

169

China (HSCEI)

22.7

0.9

27

0.11

48

0.37

8/9/11

234

NDX

16.4

3.2

31

0.25

48

0.43

5/21/10

77

TOPIX

24.8

1.9

68

0.15

47

0.50

3/17/11 228

Nikkei 225

26.4

2.1

74

0.15

46

0.55

3/17/11 259

Germany (DAX)

19.7

2.5

50

0.23

45

0.39

8/15/07

67

Spain (IBEX)

22.6

3.0

38

0.20

29

0.42 11/13/08 113

Canada

11.7

0.0

10

0.21

21

0.46

11/8/11 120

India (NIFTY)

15.5

0.3

13

0.13

12

0.40

2/21/07 207

Italy (MIB)

21.5

2.0

40

0.14

10

0.40 10/17/08 182

Bovespa

26.3

1.9

57

0.11

5

0.42 10/30/08 299

Average

19.4

1.9 35.6

0.21

52

0.43

131

Low - Risk Aversion - High

US Sector

ETFs

Option Volatility

(1m Implied)

1m Skew: Current %-ile

(Since Jan. 2007)

Option Skew

(Norm. 1m 25 delta)

1m Imp Chg Curr Skew Curr Overall Peak % to

Index

Current (1w) %-ile Current %-ile Peak

Date Peak

XXLE (Energy)

17.3

2.7

15

0.23

76

0.44 12/11/07 90

XXLF (Financials)

17.5

3.2

20

0.23

74

0.44 08/11/11 92

XXLI (Industrials)

17.5

4.2

32

0.28

68

0.53 08/16/07 91

XXLY (Discretionary) 16.1

3.0

29

0.26

55

0.50 08/01/07 92

XXLB (Materials)

16.6

2.5

13

0.22

49

0.41 08/24/07 83

XXLP (Staples)

12.1

1.5

38

0.25

38

0.46 08/24/07 83

XXLV (Healthcare)

16.8

2.0

63

0.23

34

0.45 05/17/07 93

XXLK (Tech)

15.5

3.2

26

0.22

27

0.44 10/29/08 100

XXLU (Utilities)

12.8

1.1

29

0.16

14

0.68 04/26/07 326

Average

15.8

2.6

29

0.23

48

0.48

117

0

25

50

75

100

EEWH (Hong Kong)

EEWC (Canada)

EEEM (Emer. Mkts.)

EEWZ (Brazil )

FFXI (China)

EEWY (Korea)

EEWJ (Japan)

EEWT (Taiwan)

Average

0

25

50

75

100

Low - Risk Aversion - High

International ETFs

0

25

50

Vol %-ile

16.2

15.4

23.7

30.4

25.6

20.8

20.0

17.9

21.2

0.7

3.4

1.9

0.9

2.4

1.9

1.6

1.7

1.8

16

17

31

47

39

19

50

13

29

0.34

0.28

0.26

0.22

0.14

0.16

0.13

0.13

0.21

98

90

70

59

38

28

25

13

53

0.46

0.46

0.42

0.44

0.34

0.45

0.58

0.55

0.46

8/15/12

6/19/12

8/11/11

8/11/11

5/21/10

12/11/07

7/17/09

2/16/07

36

67

64

103

139

182

361

332

161

Vol %-ile

75

100

Skew %-ile

Skew %-ile

1m Normalized Skew

0.50

0.45

0.40

Global Indices

Country ETFs

0.39

0.35

0.32

0.30

Sectors

0.34

0.29

0.25

0.20

0.27 0.27

0.26 0.25

0.23 0.23

0.22 0.21

0.20 0.19

0.28 0.26

0.25 0.23

0.23 0.23 0.22

0.22

0.28 0.26

0.22

0.18

0.15

0.15 0.15 0.14 0.14

0.13

0.16

0.11 0.11

0.16

0.14 0.13

0.13

0.10

0.05

XLU (Utilities)

XLK (Tech)

XLB (Materials)

XLF (Financials)

XLE (Energy)

XLV (Healthcare)

XLP (Staples)

XLY (Discretionary)

XLI (Industrials)

EWJ (Japan)

EWT (Taiwan)

FXI (China)

EWY (Korea)

EWZ (Brazil )

EEM (Emer. Mkts.)

EWC (Canada)

EWH (Hong Kong)

Bovespa

China (HSCEI)

India (NIFTY)

Italy (MIB)

Hang Seng

Nikkei 225

TOPIX

Taiwan

KOSPI 200

Spain (IBEX)

Canada

Russia

Switzerland

Germany (DAX)

NDX

Australia

France (CAC)

EuroStoxx 50

UK (FTSE 100)

S&P 500

Russell 2000

0.00

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

7

March 17, 2014

Exhibit 1: EEM normalized skew (1m)

Exhibit 2: IWM normalized skew (1m)

Exhibit 3: QQQ normalized skew (1m)

As of March 14, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

As of March 13, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

As of March 13, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

0.35

0.30

0.35

0.30

0.25

0.30

0.25

0.20

0.20

0.25

0.15

0.15

0.10

Jan-13 Apr-13

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

0.20

Jan-13 Apr-13

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

0.10

Jan-13 Apr-13

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

Exhibit 4: Euro Stoxx 50 normalized skew (1m)

Exhibit 5: FTSE 100 normalized skew (1m)

Exhibit 6: HSCEI normalized skew (1m)

As of March 13, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

As of March 13, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

As of March 13, 2014 market close. Normalized skew:

(25 delta put–25 delta call) / 50 delta implied vol.

0.35

0.35

0.30

0.30

0.25

0.25

0.25

0.20

0.15

0.10

0.20

0.20

0.15

0.15

0.10

Jan-13 Apr-13

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

0.10

Jan-13 Apr-13

0.05

0.00

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

-0.05

Jan-13 Apr-13

Jul-13

Oct-13 Jan-14

Source: Goldman Sachs Global Investment Research.

8

March 17, 2014

Cross Asset Risk Barometer: RDXUSD implieds remain elevated

Exhibit 7: RDXUSD 1m implied vol remains elevated. S&P 500 1m implieds are up +29% in March, copper implieds are up 26%.

Data: January 2, 2007 – March 14, 2014. Spanish and Italian 10y bond spreads in the table below refer to the spreads versus 10y German bonds. In the bar graph below we

benchmark changes relative to February 28, 2014.

Overall % to

Curr

Peak

Peak Peak Date %-ile

1022

212 23-Oct-08

84

552

182 9-Nov-11

62

633

246 24-Jul-12

52

650

401 24-Oct-08

49

361

284 25-Nov-11 32

217

179 5-Dec-08

20

283

319 20-Nov-08 12

1674

399 9-Mar-09

9

1158

317 5-Mar-09

8

387

701 25-Nov-11

1

0.1

0.5

-0.1

0.9

-0.1

0.3

0.4

0.3

0.9

0.3

18.7

13.3

17.6

15.2

20.1

17.5

12.5

9.7

15.8

9.8

75.0

75.4

74.9

47.8

70.0

37.3

25.3

28.8

42.8

30.8

541 23-Oct-08

872 24-Oct-08

725 22-Oct-08

403 27-Oct-08

420 23-Oct-08

341 27-Oct-08

232 18-Dec-08

333 30-Oct-08

357 27-Oct-08

389 27-Oct-08

33

32

30

23

20

18

14

11

10

10

30.0

27.2

31.9

60.0

83.6

117.4

269

318

459

31

13

9

25

50

75

100

0

25

50

75

100

50

75

Curr %-ile

100

0

25

WTI

Gold

BRL

JPY

US HY CDX 5y

EU XO CDX 5y

EU IG CDX 5y

iTraxx Senior Fin.

RDXUSD

S&P/TSE 60

NIFTY

HSCEI

Bovespa

TOPIX

Nikkei 225

0

FX and Commodity Implied Volatility (1m)

Credit

EEM

29-Oct-08

31-Oct-08

14-Jan-09

CHF

50

75

Curr %-ile

1.8

4.1

2.1

EUR

25

16.3

20.0

21.0

KRW

0

Gold

100 Copper

WTI

Low - Risk Aversion - High

Copper

11.7

7.8

9.1

9.5

13.5

8.5

7.6

6.6

9.4

6.3

Commodity Vol (1m Implied)

Hang Seng

MIB

TWSE

KOSPI 200

FTSE 100

DAX

IBEX

EuroStoxx 50

Russell 2000

SMI

CAC40

ASX 200

Nasdaq 100

VIX

S&P 500

1y

Peak

378

348

379

171

200

133

98

478

528

107

FX Vol vs. USD (1m Implied)

BBRL

KKRW

MMXN

uAUD

ZZAR

JJPY

CCHF

uEUR

uNZD

uGBP

Equity Implied Volatility (1m)

% Change since February 28, 2014

Chg

(1w)

17.4

9.6

9.0

-2.3

8.3

6.0

4.0

20.6

19.5

1.8

MXN

Index

Current

328

EEMCDS

I Italy 10y Bond Spr.

196

183

SSpain 10y Bond Spr.

I iTraxx Asia ex Jap.

130

I iTraxx Senior Fin.

94

77

EEU IG CDX 5y

I US IG CDX 5y

68

US

HY

CDX

5y

336

H

EEU XO CDX 5y

278

48

SSovX WE 5y

ZAR

Low - Risk Aversion - High

AUD

Curr

Peak Date %-ile

26-Nov-08 75

27-Oct-08

74

27-Oct-08

68

27-Oct-08

57

10-Oct-08

50

16-Oct-08

43

16-Oct-08

43

16-Oct-08

40

27-Oct-08

38

20-Nov-08 38

16-Oct-08

37

20-Nov-08 34

20-Nov-08 31

24-Oct-08

31

20-Nov-08 28

16-Oct-08

27

27-Oct-08

27

27-Oct-08

27

28-Oct-08

17

27-Oct-08

13

13-Oct-08

10

29-Oct-08

6

28-Oct-08

3

36

iTraxx Asia ex Jap.

% to

Peak

286

236

273

263

314

273

356

225

242

354

286

382

353

358

308

434

529

402

425

548

607

522

496

368

SovX WE 5y

Overall

Peak

161.7

88.8

92.3

95.4

81.5

75.8

68.0

70.1

77.3

80.9

73.4

72.2

74.1

108.6

78.4

75.9

110.2

113.8

66.9

100.7

83.0

86.6

67.0

87.1

Italy 10y Bond Spr.

1y

Peak

46.7

39.0

39.0

33.6

22.2

23.4

20.1

26.2

26.2

21.4

21.9

18.7

19.7

32.1

23.0

19.6

25.7

34.7

19.2

29.4

16.9

20.7

17.5

26.0

Current %-ile

(Since Jan. 2007)

Since January 2007

Spain 10y Bond Spr.

Chg

(1w)

-0.5

2.1

1.9

1.9

2.5

2.9

2.4

2.0

3.0

3.7

3.4

3.4

3.2

1.9

2.9

1.7

1.6

0.9

2.3

0.3

0.0

1.6

1.2

2.0

Credit Metrics (Levels)

EMCDS

Index

Current

Russia

41.9

Nikkei 225

26.4

TOPIX

24.8

Bovespa

26.3

Germany (DAX)

19.7

Euro Stoxx 50

20.3

Switzerland

14.9

Italy (MIB)

21.5

Spain (IBEX)

22.6

VIX

17.8

France (CAC)

19.0

S&P 500

15.0

NDX

16.4

Em. Mkts. (EEM) 23.7

Russell 2000

19.2

UK (FTSE 100)

14.2

Hang Seng

17.5

China (HSCEI)

22.7

Australia

12.7

India (NIFTY)

15.5

Canada

11.7

KOSPI 200

13.9

Taiwan

11.2

Average

19.5

Current %-ile

(Since Jan. 2007)

Since January 2007

US IG CDX 5y

Equity Vol (1m Implied)

35

30

25

20

29

26

26

24

22 21

19

18 17

15

10

5

0

-5

15 15

13 13 12

11 10

9

8

8

10

8

4

2

0

-1

8

8

12 11

10

7

6

6

5

5

6

4

-2

5

5

3

1

0

-1

Source: Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research

9

Download document

document.pdf (PDF, 590.9 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000152374.