RON BOROWSKI FEB 2015 (PDF)

File information

Title: RON BOROWSKI NOVEMBER 2014

This PDF 1.3 document has been generated by Pages / Mac OS X 10.10.2 Quartz PDFContext, and has been sent on pdf-archive.com on 20/02/2015 at 17:55, from IP address 70.209.x.x.

The current document download page has been viewed 485 times.

File size: 624.85 KB (2 pages).

Privacy: public file

File preview

Feb. 2015

Ron Borowski

What’s in Store for the

National Housing Market

in 2015?

REALTOR®

Call Ron: 602-684-4959

Email: ron@ronborowski.com

Website: www.ronborowski.com

"Expect The Best!"

"I Always Appreciate Referrals!"

The calendar reads February 2015, and that can mean only one thing: it’s prime-time

predictions season. Everyone, it seems, is clamoring to know what the future holds for

the national housing market. It’s easy to understand why.

It’s been nine years since the housing bubble peaked and three years since home prices

bottomed out. In 2014 alone, we weathered a Polar Vortex blamed for slowing home

sales at the beginning of the year and witnessed various stops and starts throughout the

remaining months as the economy — and the housing market — two-stepped toward

full recovery.

Did You

Know?

A lobsters blood is colorless but

when exposed to oxygen it turns

blue

The safest car color is white

A piece of paper cannot be folded

more than 7 times

The WD in WD-40 stands for Water

Displacer

Your tongue is the fastest healing

part of your body

Rubber bands last longer when kept

refrigerated

In every episode of Seinfeld there is a

reference to Superman

Hawaii is the only US state that grows

coffee

Iceland consumes more Coca Cola

per capita than any other country

We, too, were eager to know what the experts had to say about the year ahead. So, we

surveyed the road ahead, consulted the soothsayers and compiled a short list of what we

consider to be sound projections for the coming months. Here are three to consider.

Single-family housing is poised to take off. A growing economy, rising household

formations and pent-up demand will help boost new-home construction this year,

according to economists from the National Association of Homebuilders (NAHB). NAHB

predicts single-family home production will rise 26 percent, to 802,000 units, and reach

1.1 million in 2016. Setting the years between 2000-2003 — when single-family production

averaged 1.3 million units annually — as a benchmark for normal housing activity, singlefamily starts are expected to steadily rise to 90 percent of normal by fourth quarter 2016.

Consumer optimism will continue. Jed Kolko, chief economist for real estate data firm

Trulia, said consumers have had a confident outlook since the recovery started, and their

sunny disposition isn’t about to wane now. Nearly three-quarters of respondents in a

recent Trulia survey agreed home ownership is part of achieving their personal American

Dream — roughly the same results as in a similar survey the year prior and slightly above

levels of the three previous years. Fully 36 percent of survey respondents said this year will

be a better year to sell than 2014.

The millennial generation will begin to make its mark on housing. According to Realtor.com

Chief Economist Jonathan Smoke, more than two-thirds of household growth in the next

five years is expected to come from this influential generation. Millenials have been slow

to form new households for a number of reasons, but 2015 may well be the year when

they leave their parents’ nest and become first-time homebuyers.

Visit me online@

www.ronborowski.com

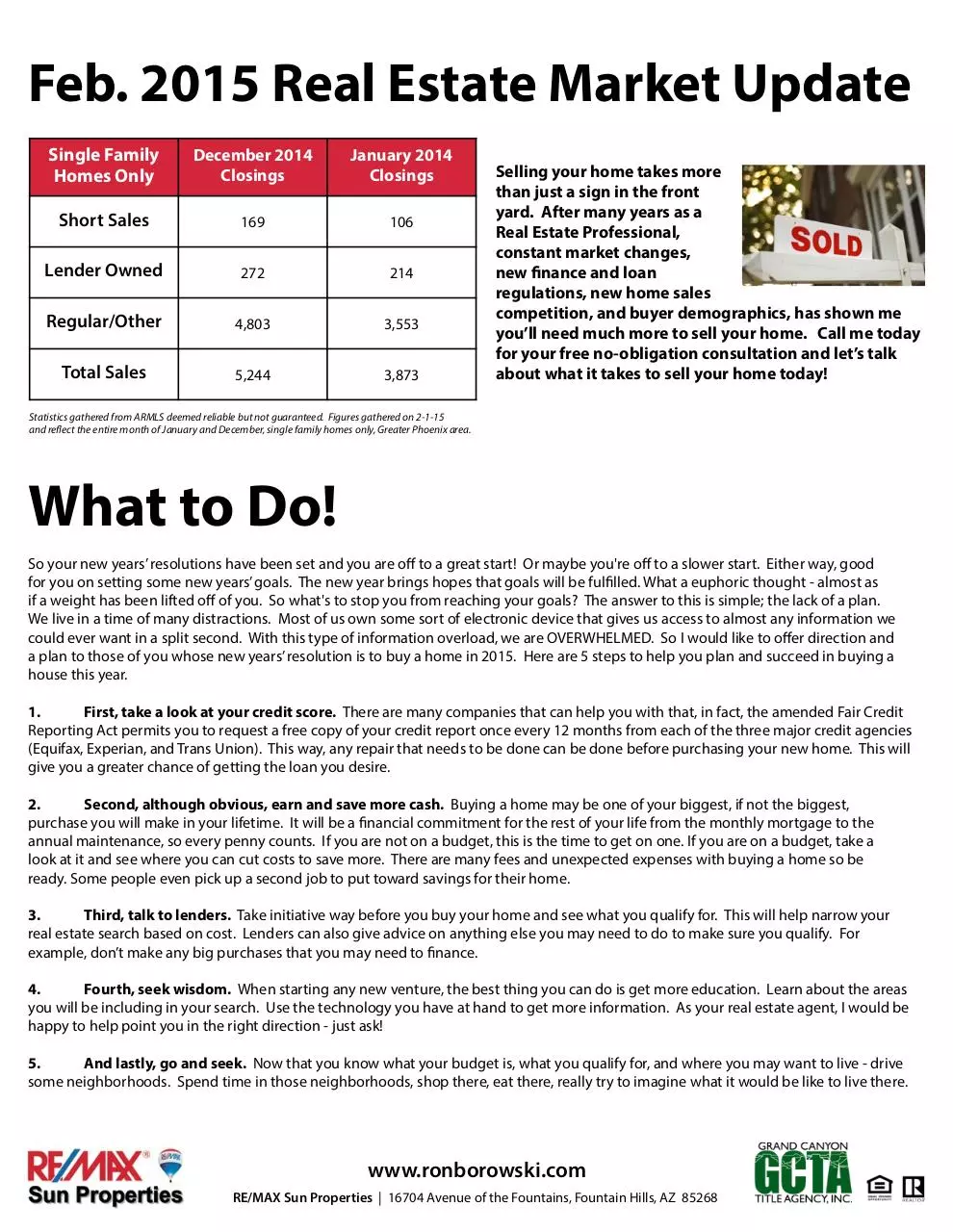

Feb. 2015 Real Estate Market Update

Single Family

Homes Only

December 2014

Closings

January 2014

Closings

Short Sales

169

106

Lender Owned

272

214

Regular/Other

4,803

3,553

Total Sales

5,244

3,873

Selling your home takes more

than just a sign in the front

yard. After many years as a

Real Estate Professional,

constant market changes,

new finance and loan

regulations, new home sales

competition, and buyer demographics, has shown me

you’ll need much more to sell your home. Call me today

for your free no-obligation consultation and let’s talk

about what it takes to sell your home today!

Statistics gathered from ARMLS deemed reliable but not guaranteed. Figures gathered on 2-1-15

and reflect the entire month of January and December, single family homes only, Greater Phoenix area.

What to Do!

So your new years’ resolutions have been set and you are off to a great start! Or maybe you're off to a slower start. Either way, good

for you on setting some new years’ goals. The new year brings hopes that goals will be fulfilled. What a euphoric thought - almost as

if a weight has been lifted off of you. So what's to stop you from reaching your goals? The answer to this is simple; the lack of a plan.

We live in a time of many distractions. Most of us own some sort of electronic device that gives us access to almost any information we

could ever want in a split second. With this type of information overload, we are OVERWHELMED. So I would like to offer direction and

a plan to those of you whose new years’ resolution is to buy a home in 2015. Here are 5 steps to help you plan and succeed in buying a

house this year.

1.

First, take a look at your credit score. There are many companies that can help you with that, in fact, the amended Fair Credit

Reporting Act permits you to request a free copy of your credit report once every 12 months from each of the three major credit agencies

(Equifax, Experian, and Trans Union). This way, any repair that needs to be done can be done before purchasing your new home. This will

give you a greater chance of getting the loan you desire.

2.

Second, although obvious, earn and save more cash. Buying a home may be one of your biggest, if not the biggest,

purchase you will make in your lifetime. It will be a financial commitment for the rest of your life from the monthly mortgage to the

annual maintenance, so every penny counts. If you are not on a budget, this is the time to get on one. If you are on a budget, take a

look at it and see where you can cut costs to save more. There are many fees and unexpected expenses with buying a home so be

ready. Some people even pick up a second job to put toward savings for their home.

3.

Third, talk to lenders. Take initiative way before you buy your home and see what you qualify for. This will help narrow your

real estate search based on cost. Lenders can also give advice on anything else you may need to do to make sure you qualify. For

example, don’t make any big purchases that you may need to finance.

4.

Fourth, seek wisdom. When starting any new venture, the best thing you can do is get more education. Learn about the areas

you will be including in your search. Use the technology you have at hand to get more information. As your real estate agent, I would be

happy to help point you in the right direction - just ask!

5.

And lastly, go and seek. Now that you know what your budget is, what you qualify for, and where you may want to live - drive

some neighborhoods. Spend time in those neighborhoods, shop there, eat there, really try to imagine what it would be like to live there.

www.ronborowski.com

RE/MAX Sun Properties | 16704 Avenue of the Fountains, Fountain Hills, AZ 85268

Download RON BOROWSKI FEB 2015

RON BOROWSKI FEB 2015.pdf (PDF, 624.85 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000210606.