July Currency Matters (PDF)

File information

Author: Paul Lennox

This PDF 1.5 document has been generated by Microsoft® Word 2013, and has been sent on pdf-archive.com on 30/06/2015 at 19:36, from IP address 184.68.x.x.

The current document download page has been viewed 519 times.

File size: 577.44 KB (11 pages).

Privacy: public file

File preview

Currency Thoughts

July 2015

Paul Lennox, CFA, President EncoreFX

These are my observations regarding the US and Canadian dollars as of June 30 th. This report is for informational

purposes only and does not construe investment advice.

Long-term Perspective

Currency markets often move in 4-6 year trends reflecting underlying economic dynamics so it is

important to understand the big picture…

After more than a decade of devaluation the US dollar is back in favour. The dollar started its decline at

the turn of the century as the Federal Reserve lowered interest rates dramatically to limit the fallout

from the .com and NASDAQ bubble bursting in 2000. 9/11 leading the US to war and a sharp rise in US

government spending put further pressure on the dollar. The global credit crisis in 2008 and the PIIGS

crisis in 2010 caused the dollar to rally on a flight to safety play. The aggressive monetary easing by the

Federal Reserve through to mid-2014 kept the dollar contained in spite of signs of growing global

economic risks.

The US Federal Reserve remains extremely dovish, otherwise the US dollar would likely be much higher

given the state of the global economy. The liquidity provided by the Federal Reserve for almost 15 years

has flooded into emerging markets, stocks, commodities and real estate. With the Fed turning off the

liquidity taps and US interest rates on the rise companies and investors who have borrowed cheap

dollars are vulnerable and may have to scramble to cover their short dollar positions. This rush for

dollars caused the massive appreciation in the dollar in the 1980’s.

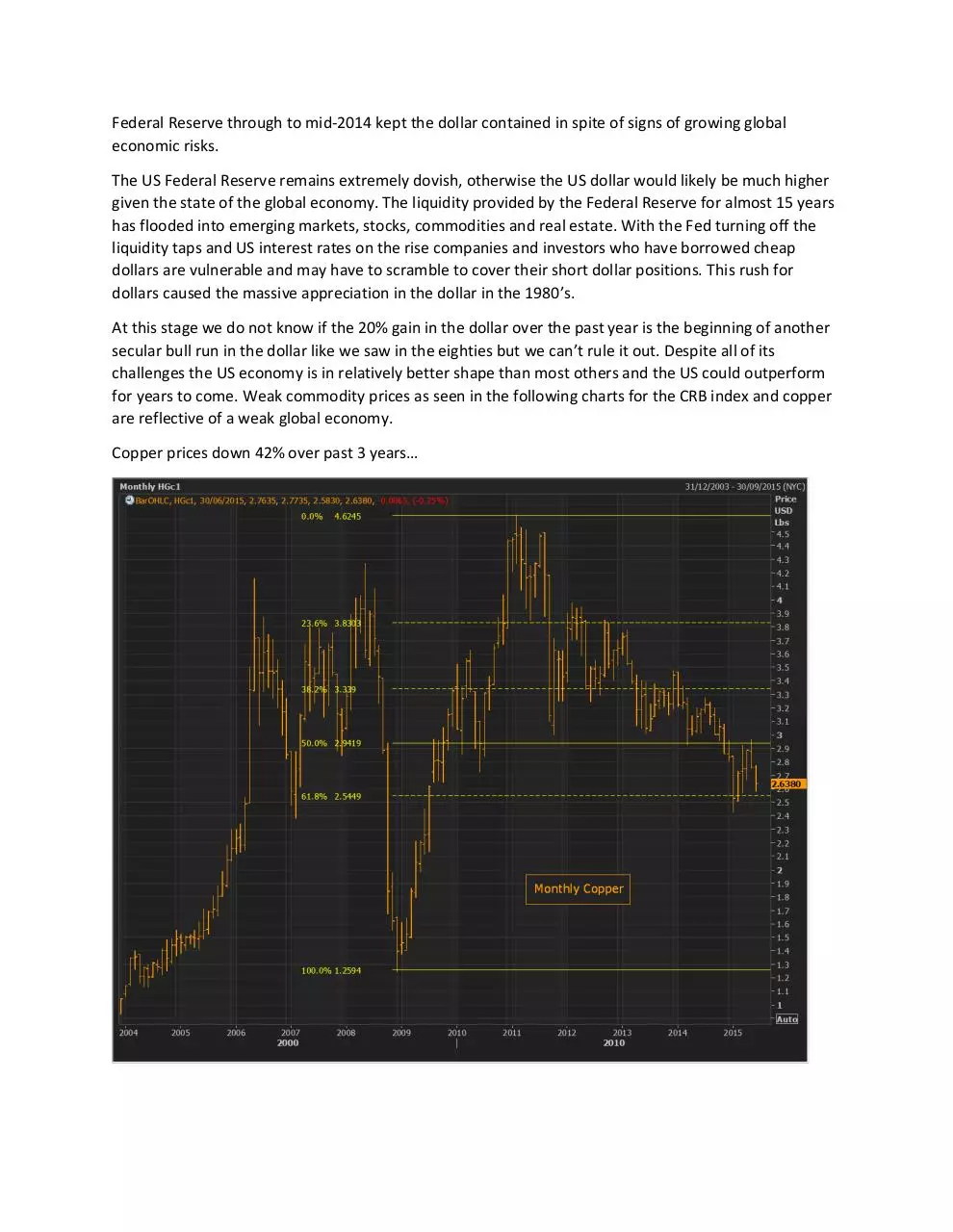

At this stage we do not know if the 20% gain in the dollar over the past year is the beginning of another

secular bull run in the dollar like we saw in the eighties but we can’t rule it out. Despite all of its

challenges the US economy is in relatively better shape than most others and the US could outperform

for years to come. Weak commodity prices as seen in the following charts for the CRB index and copper

are reflective of a weak global economy.

Copper prices down 42% over past 3 years…

Falling commodity prices reflect a weak global economy…

Weekly .TRJCRB

26/03/2010 - 24/07/2015 (NYC)

BarOHLC, .TRJCRB, 03/07/2015, 223.1196, 224.7078, 223.0840, 223.5840, -1.2957, (-0.58%)

Price

USD

360

CRB Index

350

340

330

320

310

300

290

280

270

260

250

240

230

223.5840

220

210

Auto

RSI, .TRJCRB, 03/07/2015, 41.661

Value

USD

41.661

40

Auto

Q2

Q3

Q4

2010

Q1

Q2

Q3

2011

Q4

Q1

Q2

Q3

2012

Q4

Q1

Q2

Q3

2013

Q4

Q1

Q2

Q3

2014

Q4

Q1

Q2

2015

Q3

Why does slow global economic growth favour the US dollar? For one thing, trade makes up a smaller

portion of the US economy than it does for many other countries so the US is less reliant on foreign

buyers of its economic output. And because the US economy is outperforming, capital flows to the US

because of more attractive investment opportunities and rising bond yields. Also, commodities are

generally priced in USD so the US economy benefits more from falling commodity prices than other

countries whose currencies are falling relative to the US dollar. This dynamic becomes a positive

feedback loop causing commodity prices to fall and the US dollar to rise much more than expected as

we saw in the 1980’s when the dollar index rose over 100%.

The biggest risk to the bullish dollar outlook is the US Federal Reserve which is very dovish and will not

look favourably on a persistently rising dollar. If the US economy does continue to outperform, however,

the best the Fed will be able to do over the coming years is to slow the dollar down, not prevent its

inevitable appreciation. Odds favour a strong and likely strengthening US dollar for the foreseeable

future. However, as we saw recently, there will be USD retracements and corrections for dollar buys to

take advantage of.

USDCAD

The Canadian economy is in a tough spot relative to the US economy. Debt levels are higher in Canada,

export prices are falling and productivity is lower. Manufacturing has a hard time competing with the US

and Mexico since NAFTA so Ontario and Quebec are not yet seeing significant gains from the 20% fall in

the Canadian dollar over the past year. The Canadian economy actually shrank in Q1 and Q2 is not

looking much better.

The Canadian dollar is following commodity prices lower in an environment of slow global growth…

Weekly CADUSD=R, .TRJCRB

20/07/2012 - 10/07/2015 (GMT)

Price BarOHLC, CADUSD=R, 03/07/2015, 0.8102, 0.8126, 0.8054, 0.8075, -0.0038, (-0.47%), Line, .TRJCRB, 03/07/2015, 224.2842,

Price

USD -0.5956, (-0.26%)

USD

1.03

315

1.02

CADUSD

310

1.01

305

1

300

0.99

295

0.98

0.97

290

0.96

285

0.95

280

0.94

275

0.93

270

0.92

0.91

265

0.9

260

0.89

255

0.88

250

0.87

245

0.86

240

0.85

0.84

CRB

235

0.83

230

0.82

225

224.2842

220

0.81

0.8075

0.8

215

0.79

Auto

Auto

A

S O N D

Q3 12

Q4 12

J

F M

Q1 13

A

M J

Q2 13

J

A S O N D

Q3 13

Q4 13

J

F M A M J

Q1 14

Q2 14

J

A S O N D

Q3 14

Q4 14

J

F M

Q1 15

A M

J

Q2 15

J

Because economic growth is stronger in the US, US interest rates are rising relative to Canadian rates

and this favours the US dollar…

Weekly CAD=, US2YT=RR, CA2YT=RR

Value BarOHLC, CAD=, Bid, 03/07/2015, 1.2341, 1.2412, 1.2302, 1.2376, +0.0060, (+0.49%),

0.25 Spread, US2YT=RR, Bid Yield(Last), CA2YT=RR, Bid Yield(Last), 1.0, 1.0, 03/07/2015, 0.0746

06/12/2013 - 31/07/2015 (GMT)

Price

/USD

1.28

0.2

1.27

0.15

1.26

0.1

0.0746

0.05

1.25

1.24

1.2376

Weekly USDCAD

0

1.23

-0.05

1.22

-0.1

1.21

-0.15

1.2

1.19

-0.2

1.18

-0.25

1.17

-0.3

1.16

-0.35

1.15

-0.4

1.14

-0.45

1.13

-0.5

1.12

USDCAD 2Y IRD

-0.55

1.11

-0.6

1.1

-0.65

1.09

-0.7

1.08

1.07

-0.75

1.06

Auto

Auto

Dec Jan

Q4 13

Feb Mar

Q1 2014

Apr

May

Jun

Q2 2014

Jul

Aug

Sep

Q3 2014

Oct

Nov Dec

Q4 2014

Jan

Feb Mar

Q1 2015

Apr

May

Jun

Q2 2015

Jul

Q3 15

If the capital markets become unsettled because of fallout from Greece or other high risk events, US

interest rates could fall and the dollar rise in a flight to safety play. There is not always a positive

correlation between interest rate differentials and exchange rates; it depends on why interest rates are

rising or falling.

Stock prices in Canada are looking vulnerable meaning Canada may be less attractive to foreign

investors…

Weekly [.GSPTSE List 1 of 250] .GSPTSE

23/12/2011 - 31/07/2015 (TOR)

BarOHLC, .GSPTSE, 03/07/2015, 14,738.48, 14,738.48, 14,511.33, 14,514.78, -293.31, (-1.98%)

Price

CAD

15,300

15,000

14,700

14,514.78

14,400

Weekly TSX

14,100

13,800

13,500

13,200

12,900

12,600

12,300

12,000

11,700

11,400

Auto

RSI, .GSPTSE, 03/07/2015, 41.149

Value

CAD

41.149

40

Auto

J

F M A M J

J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

The US dollar has gained more than 25% relative to the Canadian dollar over the past few years. There is

serious resistance for the dollar around 1.28, an area that last held in 2009 during the credit crisis. Keep

in mind, however, that the 2009 dollar spike was a flight to safety play in a panicked market so it was

not sustainable and the US Federal Reserve came in and flooded the market with dollars. This time, the

dollar appreciation is due to US economic outperformance so it is more constructive and sustainable.

And the consolidation we’ve seen over the past few months looks like base building for another push

higher rather than a technical breakdown. Dollar momentum remains strong. Expectations are we will

see the US dollar at 1.35 before we see 1.15 again.

Risk

Let’s consider at a few charts we routinely look at for clues to potential currency developments.

Spanish bond yields are showing signs of market nervousness. With the turmoil in Greece the biggest

concern is the risk of contagion to other European countries and beyond. Global central banks have

done a good job protecting creditors from loan losses so governments have been able to borrow very

cheaply. If the investment community loses confidence in the ability of the central banks to continue to

protect them risk premiums and interest rates will rise sharply. Pick your country but keep an eye on

high risk debt for signs of a renewed flight to safety move which will favour the US dollar.

Weekly ES2YT=RR

06/09/2013 - 31/07/2015 (GMT)

Yield

2

BarOHLC, ES2YT=RR, Bid Yield, 03/07/2015, 0.387, 0.490, 0.335, 0.470

1.9

1.8

1.7

1.6

1.5

1.4

1.3

1.2

Weekly Spanish 2Y Bond

1.1

1

0.9

0.8

0.7

0.6

0.5

0.470

0.4

0.3

0.2

0.1

Auto

Sep Oct

Q3 13

Nov

Dec

Q4 2013

Jan

Feb Mar

Q1 2014

Apr

May

Jun

Q2 2014

Jul

Aug

Sep

Q3 2014

Oct

Nov Dec

Q4 2014

Jan

Feb Mar

Q1 2015

Apr

May

Jun

Q2 2015

Jul

Q3 15

Chinese shares have been on a tear once again, doubling over the past year in spite of a slowing

economy. A stock market correction in China could spill over into other global equity markets potentially

leading to a flight to USD safety.

Weekly [.SSEC List 1 of 1126] .SSEC

04/05/2012 - 18/09/2015 (SHA)

BarOHLC, .SSEC, 03/07/2015, 4,289.77130, 4,297.47470, 3,875.04990, 4,053.03040, -138.01660, (-3.29%)

Log

CNY

4,800

4,500

4,200

4,053.03040

3,900

Weekly Shanghai Stock Index

3,600

3,300

3,000

2,700

2,400

2,100

Auto

RSI, .SSEC, 03/07/2015, 52.337

Value

CNY

60

52.337

30

Auto

M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S

Q2 12 Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15 Q3 15

Download July Currency Matters

July Currency Matters.pdf (PDF, 577.44 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000284510.