4OTC 2013 No convencionales final (PDF)

File information

Title: Presentación de PowerPoint

Author: jrromanr

This PDF 1.5 document has been generated by Acrobat PDFMaker 10.1 for PowerPoint / Adobe PDF Library 10.0, and has been sent on pdf-archive.com on 19/10/2016 at 23:07, from IP address 129.108.x.x.

The current document download page has been viewed 427 times.

File size: 2.33 MB (14 pages).

Privacy: public file

File preview

Mexico’s potential and exploratory strategy of

unconventional plays (shale oil and gas)

Ing. J. Antonio Escalera Alcocer

OTC 2013, 6-9 May, Houston, Texas

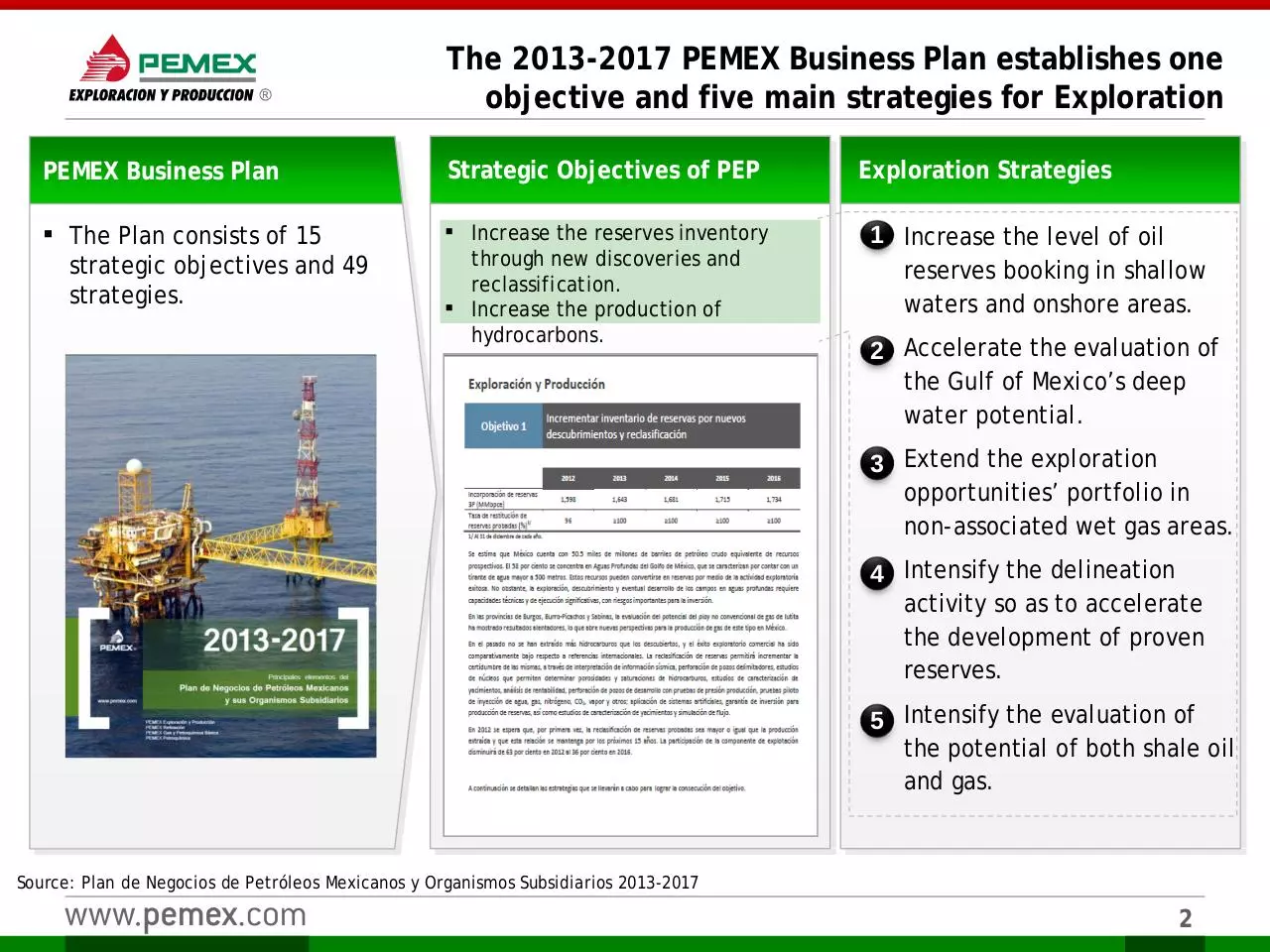

The 2013-2017 PEMEX Business Plan establishes one

objective and five main strategies for Exploration

PEMEX Business Plan

Strategic Objectives of PEP

▪ The Plan consists of 15

▪

strategic objectives and 49

strategies.

▪

Increase the reserves inventory

through new discoveries and

reclassification.

Increase the production of

hydrocarbons.

Exploration Strategies

1▪ Increase the level of oil

reserves booking in shallow

waters and onshore areas.

2▪ Accelerate the evaluation of

the Gulf of Mexico’s deep

water potential.

3▪ Extend the exploration

opportunities’ portfolio in

non-associated wet gas areas.

4▪ Intensify the delineation

activity so as to accelerate

the development of proven

reserves.

5▪ Intensify the evaluation of

the potential of both shale oil

and gas.

Source: Plan de Negocios de Petróleos Mexicanos y Organismos Subsidiarios 2013-2017

2

2

Regional perspective of oil and gas shales in Mexico

Studies are based on the information of

EUA

USA

Haynesville

Sierra Marathon

Ouachita

Eagle Ford

BurroPicachos

Sabinas

Burgos

Mz

Golfo de Mexico

Gulf of Mexico

Océano

Pacífico

Tampico Misantla

Veracruz

Upper

Jurassic

shale

area Superior

Área de

Lutitas del

Jurásico

Esc.: 1:9,000,000

100

200

Upper

Jurassic plays (La Casita and

Pimienta) from the Chihuahua, Sabinas,

Burgos and Tampico-Misantla basins are

equivalent to the producing Haynesville

Formation in the USA.

Technically

Upper

Cretaceous

area

Área de

Lutitas del shale

Cretácico

Superior

0

Upper Cretaceous plays in the Chihuahua,

Sabinas, Burro Picachos and Burgos basins

in northeastern Mexico represent the

continuations of the productive Eagle Ford

Formation in southeastern USA.

Chihuahua

México

1,000+ wells, as well as geological and

geophysical information generated in 75

years of Pemex exploration.

400

Kms

recoverable

prospective

resources were estimated through the

integration of the results of regional

geological-geochemical studies.

3

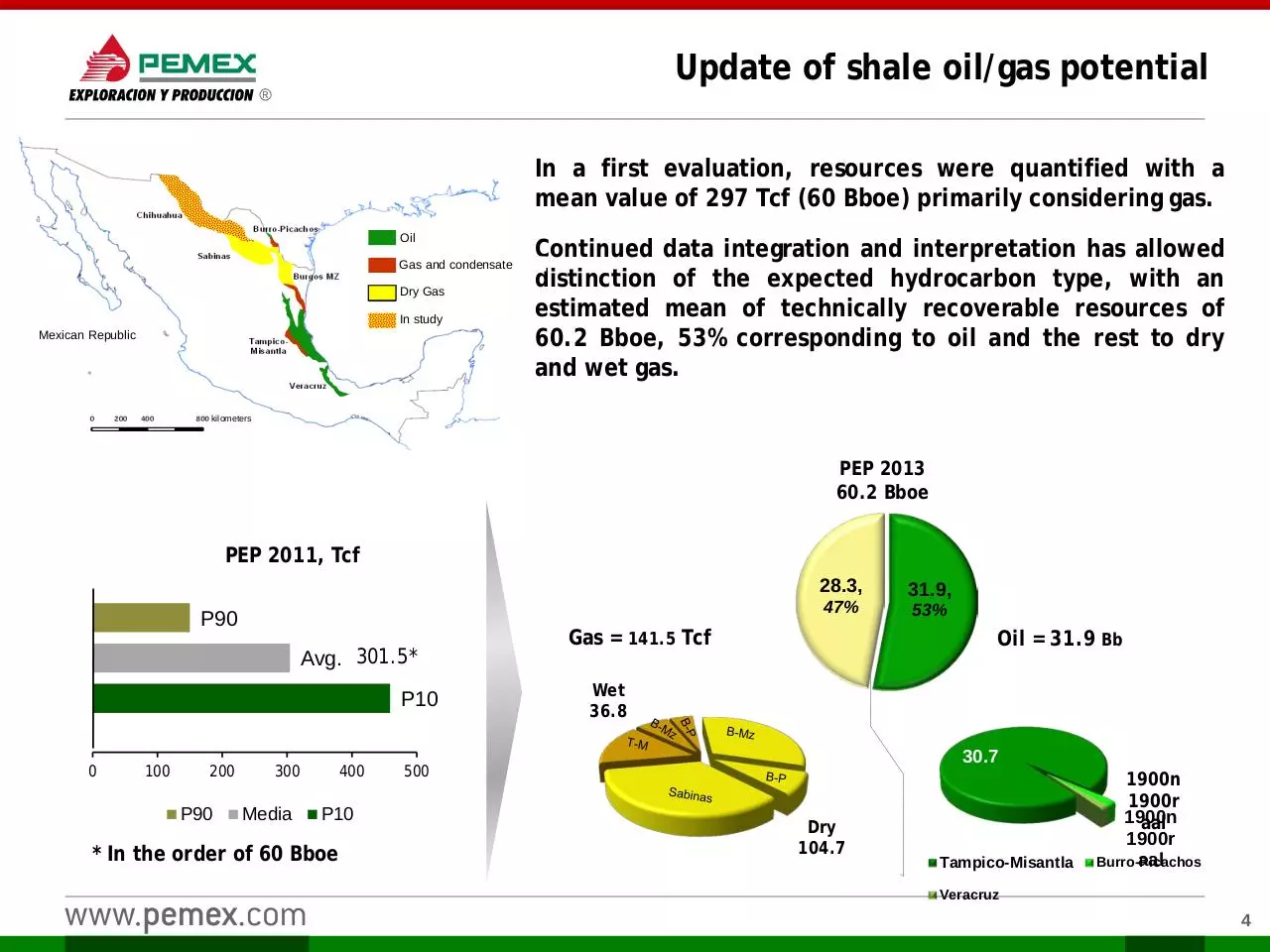

Update of shale oil/gas potential

In a first evaluation, resources were quantified with a

mean value of 297 Tcf (60 Bboe) primarily considering gas.

Oil

Gas and condensate

Dry Gas

In study

Mexican Republic

Continued data integration and interpretation has allowed

distinction of the expected hydrocarbon type, with an

estimated mean of technically recoverable resources of

60.2 Bboe, 53% corresponding to oil and the rest to dry

and wet gas.

kilometers

PEP 2013

60.2 Bboe

PEP 2011, Tcf

P90

Avg. 301.5*

P10

0

100

200

P90

300

Media

400

P10

* In the order of 60 Bboe

28.3,

31.9,

47%

53%

Gas = 141.5 Tcf

Oil = 31.9 Bb

Wet

36.8

30.7

500

Dry

104.7

Tampico-Misantla

1900n

1900r

1900n

aal

1900r

aal

Burro-Picachos

Veracruz

4

The assessment methodology follows current

international standards

Presence of hydrocarbons

Organic richness

Example: Pimienta Formation (Tithonian)

Maturity

Key parameters

Area

Thickness

Depth

Depth

Sw

P

Fairway

Thicknesses

Porosity

T

Producer

Focus

Shc

HC

Prospective areas

In-situ

IH

S2

COT

Organic

Richness

Ro

Tmax

Thermal

maturity

Bo

Bg

RGA

ρ

Hydrocarbons

Retained

Lithology

Mineralogy

Fracturability

Volumetric Assessment (petrophysical method):

Overlapping geological, geochemical and

conventional production element maps are

the basis for the definition of unconventional

plays and prospective areas.

Resources = A·T·Ф·So,g·RF/FVFo,g

A – Area

T– Average thickness

Ф – Porosity

So,g – Oil or gas saturation

RF– Recovery factor

FVF– Formation volume factor

(FVF Boi (oil); FVF Bgi (gas))

5

Oil and Gas Shales Exploration Project

Strategy

N

Give certainty to the quantified

prospective resources, the hydrocarbon

type and appraise productivity in the

prospective areas.

Chihuahua

Burro-Picachos

Sabinas

Burgos

GulfGolfo

of

de

México

Mexico

Tampico Misantla

Área de las

Basin

cuencas

areas

Prospective

Áreas prospectivas

prioritarias

areas

0

250

Veracruz

Continue geological and geochemical

studies to increase the understanding of

unconventional petroleum systems.

Apply state-of-the-art technology

reduce uncertainty in these plays.

500

kilometers

Kilómetros

Escala Gráfica

Preferential assessment of oil and wet

gas prone areas.

to

Project Exploration Oil and Gas Shales

Goals

Total area: 200,000 km2

Prospective area: ~120,000 km2

Available production facilities in TampicoMisantla, Burgos and Veracruz basins

In a 4-year horizon:

Drill 175 wells

Acquire ~10,000 km2 of 3D seismic

Invest ~3,000 million USD

6

PEMEX Exploration Stages for Shale oil/gas basins

Pemex has defined an exploration process to reduce uncertainty on the resource

estimation and has set the basis for commercial development, taking environmental

regulations and sustainability into account for the entire process.

Stage1

Stage2

Stage3

Prospectivity, identification of

resources

Geological characterization and

uncertainty reduction

Commercial development

Regional analysis

Shale plays studies

Plan development

Potential plays

identification

Sweet fairways

identification and

delineation

Well fracturing design for high

production

Cost efficiency

Ranking basins

and shale levels

Resources

assessment

Sustainability

Drilling of pilot well

Concept test

Pilot leads

portfolio

Results evaluation of

pilot well

Drilling appraisal

and fairway wells

delineation

Initial reservoir

characterization

studies

Pozos

Horizontales

Well data acquisition for geochemical and geomechanical properties

Multi-fracturing design efficiency

Well fracturing results monitoring and performance production

7

Sabinas – Burro-Picachos – Burgos provinces

Hydrocarbon type: dry gas, wet gas and oil.

Estimated technically recoverable resources in the Cretaceous

(Eagle Ford and Agua Nueva) and Jurassic (La Casita and

Pimienta) plays amount to 8.5 and 15.3 Bboe, respectively.

Sabinas

Basin

Producing Wells USA

Black Oil

volatile oil

Condensed

Eagle Ford/Agua Nueva

Wet Gas

Dry Gas

Basin

Burgos

Play Eagle Ford / Agua Nueva

Gulf

of

Mexico

Five wells have been drilled along the continuation of the

dry and wet gas trends from south Texas, with a 60%

commercial success and booking 51 million boe of 3P

reserves.

In order to test the continuity of the wet gas trend, two

wells are in completion and two more will be drilled.

La Casita/Pimienta

The Arbolero-1 well, proved the shale gas concept in La

Casita and Pimienta formations.

The Anhelido-1 well tested 35°API oil in the Pimienta and

the Nuncio-1 well will test the extension of this play to the

north.

Mesozoic

Burgos

Reserves at Anhelido-1 and Arbolero-1 are estimated around

63 million bboe.

8

The Anhelido-1 well is the first producer of shale oil in Mexico

Anhelido-1 Well

ANHELIDO 1

NW

SE

1100-

1200-

Initial production: 429 bpd of oil and 1.3 MMcfd of

gas.

Cumulative production: 23,000 barrels.

Estimated ultimate recovery: 250-500 (M) barrels.

45 Development wells are expected to be drilled in

a 20 km2 area.

longitud=1635 m

1300-

Navegación=1435 m

1400-

J. PIMIENTA

1500-

H=52.7 m

J. OLVIDO

1600-

Production forecast

Proved reserves (3 Wells)

probable reserves (12 Wells)

2000

m

Possible ReserveE (30 Wells)

17 Hydraulic fractures were made in order to

improve the flow capacity and recovery

9

Download 4OTC 2013 No convencionales final

4OTC 2013 No convencionales final.pdf (PDF, 2.33 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000496473.