BWA 10 3Q StrongFutureSlides (PDF)

File information

Title: PowerPoint Presentation

This PDF 1.4 document has been generated by Acrobat PDFMaker 8.1 for PowerPoint / Acrobat Distiller 8.1.0 (Windows), and has been sent on pdf-archive.com on 10/11/2016 at 16:23, from IP address 217.111.x.x.

The current document download page has been viewed 326 times.

File size: 804.32 KB (37 pages).

Privacy: public file

File preview

A Proud Past

A Strong Future

October 2010

Our Beliefs

Respect

Collaboration

Excellence

Integrity

Community

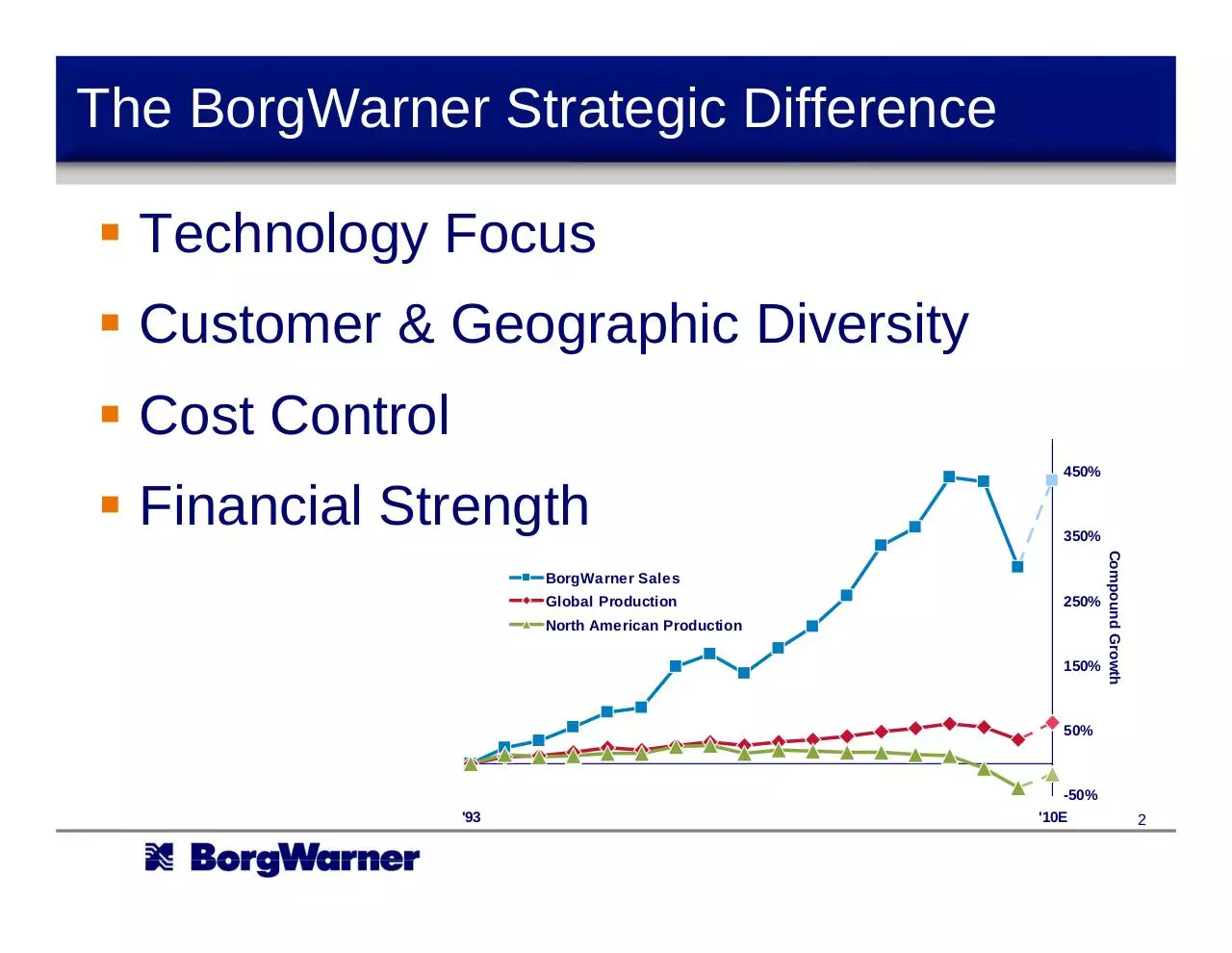

The BorgWarner Strategic Difference

Technology Focus

Customer & Geographic Diversity

Cost Control

Financial Strength

450%

350%

Global Production

250%

North American Production

150%

Compound Growth

BorgWarner Sales

50%

'93

-50%

'10E

2

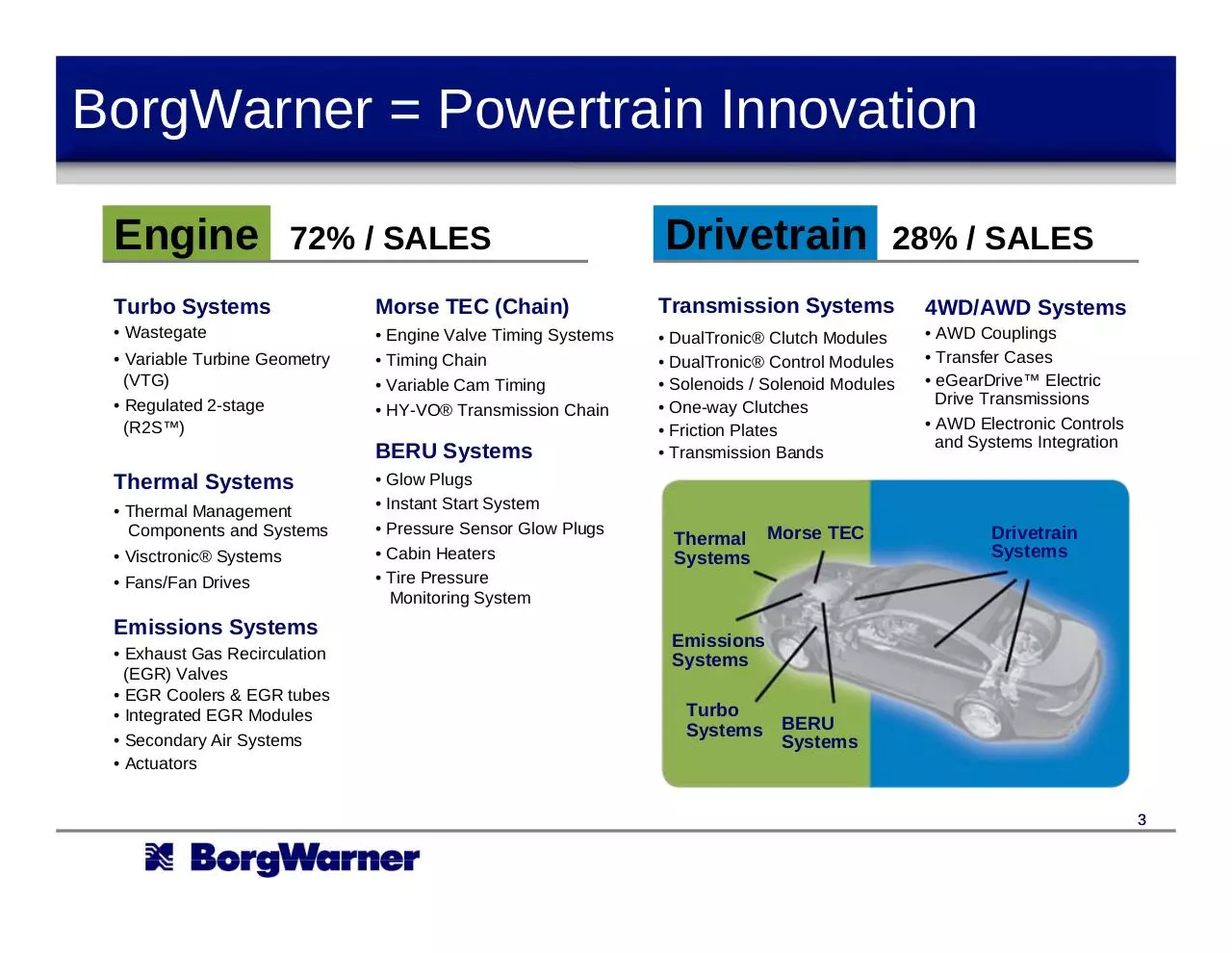

BorgWarner = Powertrain Innovation

Engine

72% / SALES

Drivetrain

28% / SALES

Turbo Systems

Morse TEC (Chain)

Transmission Systems

4WD/AWD Systems

• Wastegate

• Engine Valve Timing Systems

• Timing Chain

• Variable Cam Timing

• HY-VO® Transmission Chain

• DualTronic® Clutch Modules

• DualTronic® Control Modules

• Solenoids / Solenoid Modules

• One-way Clutches

• Friction Plates

• Transmission Bands

• AWD Couplings

• Transfer Cases

• eGearDrive™ Electric

Drive Transmissions

• AWD Electronic Controls

and Systems Integration

• Variable Turbine Geometry

(VTG)

• Regulated 2-stage

(R2S™)

BERU Systems

Thermal Systems

• Thermal Management

Components and Systems

• Visctronic® Systems

• Fans/Fan Drives

Emissions Systems

• Exhaust Gas Recirculation

(EGR) Valves

• EGR Coolers & EGR tubes

• Integrated EGR Modules

• Secondary Air Systems

• Actuators

• Glow Plugs

• Instant Start System

• Pressure Sensor Glow Plugs

• Cabin Heaters

• Tire Pressure

Monitoring System

Thermal Morse TEC

Systems

Drivetrain

Systems

Emissions

Systems

Turbo

Systems

BERU

Systems

3

Customer Diversity Worldwide

2010 Sales Outlook*

Toyota 6%

VW/Audi 16%

Daimler

6%

Ford

4%

BMW

3%

3%

Fiat

Renault/

3%

Nissan

1%

GM

1%

PSA

Commercial

Vehicles 3%

10%

Other

Americas

Asia

Europe

~25%* 29%**

~25%* 15%**

~50%* 56%**

Hyundai/Kia 3%

Honda 2%

Renault/Nissan 1%

China 5%

Other 7%

Ford

GM

Chrysler

Asian OEMs

Aftermarket

Commercial Vehicles

Other

7%

3%

2%

2%

1%

6%

5%

4

*

**

NSK-Warner included

NSK-Warner excluded

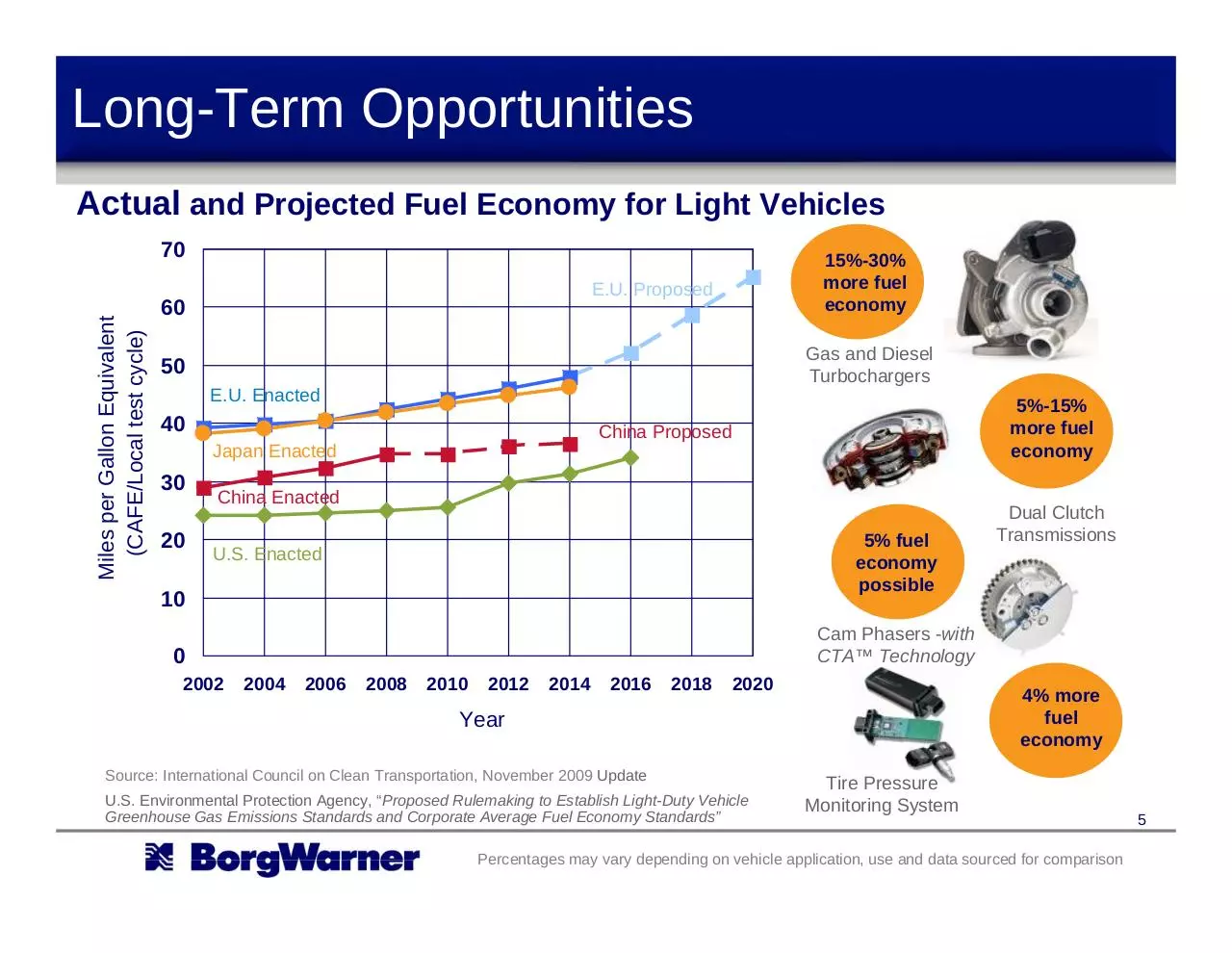

Long-Term Opportunities

Actual and Projected Fuel Economy for Light Vehicles

Miles per Gallon Equivalent

(CAFE/Local test cycle)

70

15%-30%

more fuel

economy

E.U. Proposed

60

Gas and Diesel

Turbochargers

50

E.U. Enacted

40

5%-15%

more fuel

economy

China Proposed

Japan Enacted

30

20

China Enacted

5% fuel

economy

possible

U.S. Enacted

10

Cam Phasers -with

CTA™ Technology

0

2002

Dual Clutch

Transmissions

2004

2006

2008

2010

2012

2014

2016

2018

2020

4% more

fuel

economy

Year

Source: International Council on Clean Transportation, November 2009 Update

U.S. Environmental Protection Agency, “Proposed Rulemaking to Establish Light-Duty Vehicle

Greenhouse Gas Emissions Standards and Corporate Average Fuel Economy Standards”

Tire Pressure

Monitoring System

Percentages may vary depending on vehicle application, use and data sourced for comparison

5

Net New Business 2010 thru 2012

$1.8 Billion of Net New Business

Americas*: 20%

Europe: 50%

Asia**: 30%

Chrysler

• Transfer cases

• Engine timing

Ford

•Turbochargers

•Diesel cold start

•DualTronic®

Japanese OEMs

• Engine timing

• Variable cam timing

Ford

• Engine timing

• Variable cam timing

• Turbochargers

BMW

•Turbochargers

•Diesel cold start

Commercial Vehicles

• Emissions

• Turbochargers

• Thermal systems

VW/Audi

•DualTronic®

•Turbochargers

•Beru systems

•Diesel cold start

GM

• Emissions

• Transfer cases

• Turbochargers

• Engine timing

GM

• Transmission components

Daimler

•Turbochargers

•Transmission components

Hyundai/Kia

• Engine timing

• Transmission components

New OEMs

• eGearDriveTM transmissions

Fiat

•Turbochargers

•DualTronic®

•Engine timing

•Diesel cold start

Hyundai/Kia

• Transmission components

• Turbochargers

• Engine timing

Chinese OEMs

• Turbochargers

• Engine timing

• DualTronic®

VW

• Turbochargers

Renault/Nissan

•Turbochargers

•Beru systems

6

* Net new business with GM, Ford and Chrysler in the U.S. is 9% of total net new business

** Net new business in China and Korea is ~18% and ~5% of total net new business, respectively

Net New Business 2010 thru 2012

$1.8 Billion of Net New Business—By Product

DCT

13%

GDI, VTG & R2S

Turbochargers

35%

Transmission

Components

2%

AWD

5%

eGearDriveTM for EV

1%

VCT & Engine Timing

14%

Turbo & Emissions

16%

Drivetrain: ~20%

Engine: ~80%

Ignition Systems

6%

Thermal

8%

7

Global Engine Downsizing

Light Vehicle Engines Produced—by Engine Size

100.0

90.0

2.4

80.0

Millions of Engines

70.0

60.0

2.7

4.7

2.9

2.3

8.8

7.3

8.1

7.7

7.9

5.8

50.0

40.0

30.0

8.0

2.5

8.0

2.8

3.2

10.5

2.5

61.8

51.6

54.0

64.4

66.6

58.1

48.6

48.8

4.0

4.0

4.0

4.3

5.2

6.4

8.0

8.9

9.4

2007

2008

2009

2010E

2011E

2012E

2013E

2014E

2015E

44.0

20.0

10.0

0.0

8 and 10 cylinder engines

6 cylinder engines

4 cylinder engines

2 and 3 cylinder engines

Other

4 cylinder engines account for more than 70% of

total engine growth 2010-2015

8

Source: CSM Worldwide, BorgWarner forecasts (July 2010)

Global Light Vehicle Engine Market

Light Vehicle Engines Produced—by Technology Type

100

2-10%

90

1%

5%

Millions of Engines

80

20%

20%

70

60

50

5%

5%

20%

23%

7%

~20%

HEVs

35%

30%-50%

HEVs

40

~6%

HEVs

30

20

68%

51%

33%

2010E

2015E

2020E

10

0

Alternative Fuel

Gasoline—Port Fuel Injection and Other

Diesel

PEV and PHEV

9

Gasoline—Direct Injection

Source: BorgWarner forecasts, CSM, JD Power, Global Insight, others (July 2010)

Download BWA 10 3Q StrongFutureSlides

BWA_10_3Q_StrongFutureSlides.pdf (PDF, 804.32 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000505812.