Winning Report 2015 2 (PDF)

File information

Author: Florian Domin

This PDF 1.6 document has been generated by Microsoft® Word 2013, and has been sent on pdf-archive.com on 05/12/2016 at 15:54, from IP address 130.223.x.x.

The current document download page has been viewed 2659 times.

File size: 3.38 MB (46 pages).

Privacy: public file

File preview

CFA Institute Research Challenge

hosted by

CFA Society Switzerland

University of Lausanne

Medtech, Switzerland

Sonova Holding AG (SOON.VX)

As of November 27th, 2014

Recommendation

HIGHLIGHTS

We issue a sell recommendation on Sonova with a target share price of CHF 122,

representing an expected downside of 16.8% on the closing price of November 27th. Sonova is

a well-managed company and possesses a market leading position within the hearing aid industry.

Nevertheless, we consider the company’s soaring multiple level – which exceeds the already high

valuation of the sector – as not intrinsically justified and therefore exaggerated.

Expectation treadmill. We take a conservative stance towards the three factors that arouse growth

expectations among market participants: a) supportive demographics: the 65+ section of population

is the fastest growing, but in developed countries growth boils down to a marginal CAGR of 2%

between 2010 and 2030; b) penetration rates: these are admittedly low but are stagnating in

developed countries (e.g. 24-25% in the US throughout last decade) and the exploitation of market

potential in developing countries requires price deductions; c) binaural fitting rates: comparable with

demographics and vary across markets, but no significant local rises have been observed thus far.

We claim that industry players and Sonova in particular will not be able to meet investors’ high

expectations reflected in current valuation levels. Our forecasted EPS figures are below analysts’

expectations for the main peers. Furthermore, the 3y share buyback program in the amount of CHF

500m (launched on December 1st) is only half of what many investors expected – an illustration of

the high expectations.

R&D imperative. Sonova’s management continously stresses the importance of research and

innovation for its future success. In view of its multi-brand portfolio, we confirm a potential to lever on

R&D. However, flagship projects such as “Lyric” and the cochlear business substantially derive from

acquisitions undertaken by the previous management in 2009/10. Moreover, the main players

shortened their product cycles throughout the last decade – now approaching two years, while R&D

spending remained stable. A confluence of increasingly complex advancements and high time

pressure provides a possible explanation. Investors’ disappointment concerning Sonova’s platform

release (Venture dual core processor) in October stands as testimony to this increasingly tense

relation.

Market approach: a double-edged sword. Besides the “special cycles” of product introductions as

strategic devices in order to buoy price levels and market shares, the group now expedites the retail

expansion and applies aggressive pricing. In fact, Sonova directly competes against independent

audiologists who still represent the most important distribution channel and appear as gate-keepers

to certain client groups. Its aggressive pricing – as reflected by selling premium products at low

prices through US big box retailer CostCo – has the potential to fuel price wars and put margins at

risk. For instance, the leading retailer Amplifon expects US independents’ renunciation of Phonak

products to reduce Sonova’s share of wallet in the single most important market by half (from 4050% to 25-30%). Furthermore, William Demant reduced its full year earnings target by 3% (EPS now

2-7%) blaming Sonova for turbulence in the US market – a possible vanguard of countermeasures.

Limited upside potential. Sonova trades at 28.9x its recent earnings and outreaches the already

high median (24.6x) of its closest peers. In the light of our intrinsic valuation and moderated

estimates of growth drivers for the industry, we expect a downward correction towards 21.4x P/E

rather than scope for multiple expansion or unexpected earnings upgrades.

Sales (m)

EBITA (%)

Net Income (%)

EPS

DPS

ROIC

ROE

12/13

13/14

14/15E

15/16E

16/17E

17/18E

18/19E

1'795

10%

6%

1.6

1.2

4%

7%

1'951

22%

18%

5.1

1.6

13%

20%

2'084

22%

18%

5.6

2.2

14%

19%

2'202

23%

19%

6.3

2.5

15%

19%

2'322

24%

20%

7.0

2.7

16%

20%

2'442

25%

21%

7.8

3.0

17%

21%

2'563

26%

21%

8.7

3.3

18%

22%

SELL

Share price (CHF)

146.6

Target price (CHF)

122.0

Downside

16.8%

General information

Ticker

SOON.VX

Exchange

SIX Swiss Exchange

Country

Switzerland

Industry

Healthcare

Sector

Equipment and service

Subsector

Medical equipment

Key figures

Closing price (CHF)

146.6

52w low (CHF)

116.4

52w high (CHF)

153.7

40’133

Avg. daily vol. (3months)

9’846

Market Cap (mCHF)

67’165

Number of shares (m)

Free float (%)

79%

41’932

Est. FY buybacks (kCHF)

Trailing P/E

28.9x

Financial year

April-March

IR website

Sonova.com

Next event

FY results, May 19th

Source: Sonova, Reuters Eikon

Business segments

Source: Sonova

Source: Sonova, Team assessment

Long-term share performance

Equity sell-offs in the

course of crisis

Resignation

of CEO, CFO

and chairman

New platform

“Venture” does not

meet expectations

German Cartel Office

blocks GN ReSound

takeover

FY guidance upgrade and

announcement of AB

acquisition

FDA approves

further implant

sales

Disappointing FYprojections: low

trading activity

Volume in 100

Share price in CHF

Delayed profit warning after

product recall and suspicions

of improper share sales: -20%

Source: Google finance, Berenberg

1

Fig. 1: 1y stock performance vs. SMI index

Global market leader from Switzerland

160

9'500

150

9'000

140

SOON (CHF)

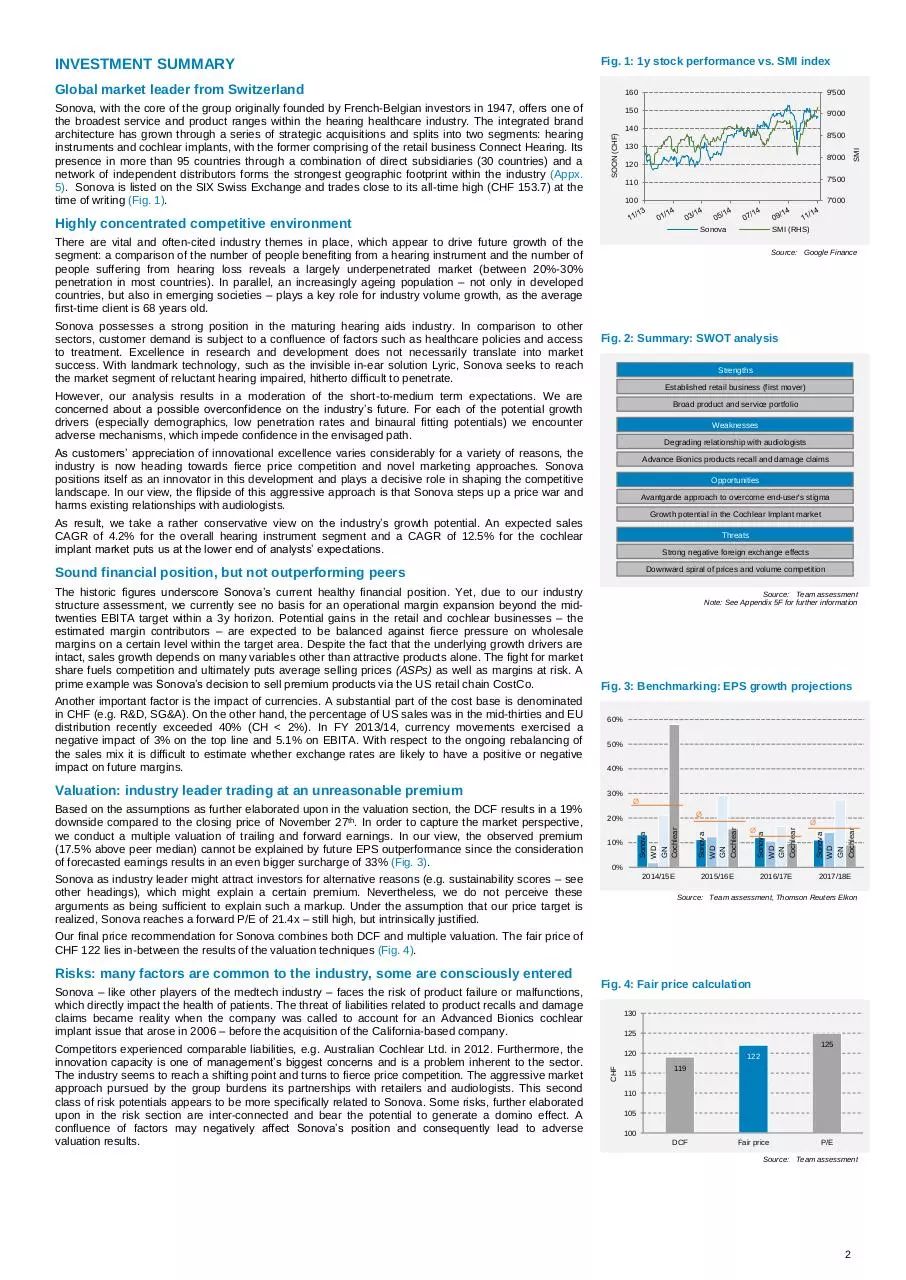

Sonova, with the core of the group originally founded by French-Belgian investors in 1947, offers one of

the broadest service and product ranges within the hearing healthcare industry. The integrated brand

architecture has grown through a series of strategic acquisitions and splits into two segments: hearing

instruments and cochlear implants, with the former comprising of the retail business Connect Hearing. Its

presence in more than 95 countries through a combination of direct subsidiaries (30 countries) and a

network of independent distributors forms the strongest geographic footprint within the industry (Appx.

5). Sonova is listed on the SIX Swiss Exchange and trades close to its all-time high (CHF 153.7) at the

time of writing (Fig. 1).

8'500

130

8'000

120

110

7'500

100

7'000

Highly concentrated competitive environment

Sonova

SMI (RHS)

There are vital and often-cited industry themes in place, which appear to drive future growth of the

segment: a comparison of the number of people benefiting from a hearing instrument and the number of

people suffering from hearing loss reveals a largely underpenetrated market (between 20%-30%

penetration in most countries). In parallel, an increasingly ageing population – not only in developed

countries, but also in emerging societies – plays a key role for industry volume growth, as the average

first-time client is 68 years old.

Source: Google Finance

Fig. 2: Summary: SWOT analysis

Strengths

Established retail business (first mover)

However, our analysis results in a moderation of the short-to-medium term expectations. We are

concerned about a possible overconfidence on the industry’s future. For each of the potential growth

drivers (especially demographics, low penetration rates and binaural fitting potentials) we encounter

adverse mechanisms, which impede confidence in the envisaged path.

Broad product and service portfolio

Weaknesses

Degrading relationship with audiologists

As customers’ appreciation of innovational excellence varies considerably for a variety of reasons, the

industry is now heading towards fierce price competition and novel marketing approaches. Sonova

positions itself as an innovator in this development and plays a decisive role in shaping the competitive

landscape. In our view, the flipside of this aggressive approach is that Sonova steps up a price war and

harms existing relationships with audiologists.

Advance Bionics products recall and damage claims

Opportunities

Avantgarde approach to overcome end-user's stigma

Growth potential in the Cochlear Implant market

As result, we take a rather conservative view on the industry’s growth potential. An expected sales

CAGR of 4.2% for the overall hearing instrument segment and a CAGR of 12.5% for the cochlear

implant market puts us at the lower end of analysts’ expectations.

Threats

Strong negative foreign exchange effects

Downward spiral of prices and volume competition

Sound financial position, but not outperforming peers

Based on the assumptions as further elaborated upon in the valuation section, the DCF results in a 19%

downside compared to the closing price of November 27th. In order to capture the market perspective,

we conduct a multiple valuation of trailing and forward earnings. In our view, the observed premium

(17.5% above peer median) cannot be explained by future EPS outperformance since the consideration

of forecasted earnings results in an even bigger surcharge of 33% (Fig. 3).

60%

50%

40%

30%

Ø

Ø

20%

Ø

10%

2014/15E

2015/16E

Ø

Sonova

WD

GN

Cochlear

Valuation: industry leader trading at an unreasonable premium

Fig. 3: Benchmarking: EPS growth projections

Sonova

WD

GN

Cochlear

Another important factor is the impact of currencies. A substantial part of the cost base is denominated

in CHF (e.g. R&D, SG&A). On the other hand, the percentage of US sales was in the mid-thirties and EU

distribution recently exceeded 40% (CH < 2%). In FY 2013/14, currency movements exercised a

negative impact of 3% on the top line and 5.1% on EBITA. With respect to the ongoing rebalancing of

the sales mix it is difficult to estimate whether exchange rates are likely to have a positive or negative

impact on future margins.

Source: Team assessment

Note: See Appendix 5F for further information

Sonova

WD

GN

Cochlear

The historic figures underscore Sonova’s current healthy financial position. Yet, due to our industry

structure assessment, we currently see no basis for an operational margin expansion beyond the midtwenties EBITA target within a 3y horizon. Potential gains in the retail and cochlear businesses – the

estimated margin contributors – are expected to be balanced against fierce pressure on wholesale

margins on a certain level within the target area. Despite the fact that the underlying growth drivers are

intact, sales growth depends on many variables other than attractive products alone. The fight for market

share fuels competition and ultimately puts average selling prices (ASPs) as well as margins at risk. A

prime example was Sonova’s decision to sell premium products via the US retail chain CostCo.

Sonova

WD

GN

Cochlear

Sonova possesses a strong position in the maturing hearing aids industry. In comparison to other

sectors, customer demand is subject to a confluence of factors such as healthcare policies and access

to treatment. Excellence in research and development does not necessarily translate into market

success. With landmark technology, such as the invisible in-ear solution Lyric, Sonova seeks to reach

the market segment of reluctant hearing impaired, hitherto difficult to penetrate.

SMI

INVESTMENT SUMMARY

2016/17E

2017/18E

0%

Sonova as industry leader might attract investors for alternative reasons (e.g. sustainability scores – see

other headings), which might explain a certain premium. Nevertheless, we do not perceive these

arguments as being sufficient to explain such a markup. Under the assumption that our price target is

realized, Sonova reaches a forward P/E of 21.4x – still high, but intrinsically justified.

Source: Team assessment, Thomson Reuters EIkon

Our final price recommendation for Sonova combines both DCF and multiple valuation. The fair price of

CHF 122 lies in-between the results of the valuation techniques (Fig. 4).

Sonova – like other players of the medtech industry – faces the risk of product failure or malfunctions,

which directly impact the health of patients. The threat of liabilities related to product recalls and damage

claims became reality when the company was called to account for an Advanced Bionics cochlear

implant issue that arose in 2006 – before the acquisition of the California-based company.

Competitors experienced comparable liabilities, e.g. Australian Cochlear Ltd. in 2012. Furthermore, the

innovation capacity is one of management’s biggest concerns and is a problem inherent to the sector.

The industry seems to reach a shifting point and turns to fierce price competition. The aggressive market

approach pursued by the group burdens its partnerships with retailers and audiologists. This second

class of risk potentials appears to be more specifically related to Sonova. Some risks, further elaborated

upon in the risk section are inter-connected and bear the potential to generate a domino effect. A

confluence of factors may negatively affect Sonova’s position and consequently lead to adverse

valuation results.

Fig. 4: Fair price calculation

130

125

125

120

CHF

Risks: many factors are common to the industry, some are consciously entered

115

122

119

110

105

100

DCF

Fair price

P/E

Source: Team assessment

2

BUSINESS DESCRIPTION

Fig. 5: Sales by product group 2013/14

The group positions itself as the leading manufacturer of innovative hearing care solutions. Driven by its

vision of a world in which everyone enjoys the delight of hearing, Sonova aims to provide a specific

solution for everyone suffering from hearing impairment.

The core of the company was founded in 1947 as “AG für Elektroakustik” by French-Belgian investors.

After the acquisition by Ernst Rihs and Beda Diethelm in 1965 they shaped the company pursuing their

vision of an integrated full service provider. In 2007 the group was renamed to its current name Sonova

Holding AG. Being present in over 95 countries worldwide and counting a workforce of over 9’500

employees, Sonova achieved sales of CHF 1.95 billion in 2013/14. The group is headquartered in

Staefa, Switzerland and is listed on the SIX Swiss Exchange since 1994.

Advanced HI 22%

13% Miscellaneous

4% Wireless

10% Cochlear

Premium HI 22%

Value creation within 4 brands & 2 segments: a fully-fledged solution provider

29% Standard HI

Sonova’s operations split into the segments hearing aids (hearing instruments – HI, 90% of sales in

2013/14) and cochlear implants (CI). The hearing aid segment comprises the globally recognized

manufacturing brands Phonak and Unitron, as well as the group’s retail operations brand Connect

Hearing.

Following the acquisition of Los Angeles-based Advanced Bionics in 2009/10, the manufacturing of

cochlear implant systems forms the second segment of the group. Though it recently accounted for only

10% of sales, this segment experiences the fastest growth (4-year CAGR of 66.8%). Due to past

acquisitions, specific HQs and research facilities of Advanced Bionics, Lyric (operating under Phonak

brand) and Unitron remain in Northern America (Appx. 5B). While administrative functions are located in

Western countries, Asia is the most important hub for manufacturing – accounting for ~70% of suppliers

in terms of volume and counting two operation centers in Vietnam and China. All brands within the group

are ultimately led by CEO Dr. Lukas Braunschweiler and his executive team (Appx. 8).

Source: Sonova

Note: See Appendix 1 for further information

Fig. 6: Sonova: Regional sales split 2013/14

37%

Northern

America

11%

Americas

11%

ASIAP

By means of its distinctive brand approach – Phonak as the most innovative brand in hearing aids and

Unitron with leading customer service – the group provides the broadest spectrum of products within the

industry, spreading across all performance levels (from basic to premium) and degrees of impairment.

Through its retail arm Connect Hearing, a growing international network, the group provides professional

services to end-users. As one of the early movers into the retail business, Sonova seeks to strengthen

both its positioning across the value chain and its relationship with end-users, while supporting its

manufacturing business (Fig. 5 & 7, Appx. 5H).

41%

EMEA

Source: Sonova

Note: See Appendix 6B for further information

Market strategy: 4 main growth vectors

Fig. 7: Corporate strategy

Penetrate

existing

markets

Expansion into accessible markets renders the second pillar of Sonova’s market strategy: the group

plans to enforce its position in emerging countries, which exhibit attractive growth opportunities. Through

establishing distribution channels in these markets, thus shaping the infrastructure, it aims to exploit the

promising perspectives of largely untapped user groups. Up until now, Americas and ASIAP were only

minor contributors to the sales total. (Fig. 6).

Develop

consumer

base

Market

strategy

Sonova aims to further integrate service channels – analysts’ estimated more than 2000 companyowned outlets in 2013. The initiative in the US serves as an example: over 300 healthcare centers are

now to be incorporated under the Connect Hearing brand. Moreover, Sonova announced expansion

plans in its retail business through further store openings and selected acquisitions.

Integrate

service

channels

Finally, Sonova seeks to develop the consumer base and to reach new client groups. By means of

interactive online platforms, the group sensitises potential end-users by providing first information and

professional advice. This targeted customer insight reveals customer needs and simultaneously

encourages face-to-face consultations – supporting present and future sales.

According to the World Health Organization, 360 million people worldwide suffer from hearing

impairment, representing 5.3% of global population. It is estimated that 6% of the highly populated

developing countries are concerned. Throughout the last 10 years, the demand for hearing aids grew at

a CAGR of around 4%, recently reaching 10-11 million units sold per year and a market value of CHF

15-16 billion. Industry experts expect an accelerated annual volume growth between 4.5-5% over the

next 5 years. However, we think that the optimistic future perspectives should be taken with a

pinch of salt considering the major factors driving the anticipated volume growth.

Source: Sonova

Note: See Appendix 5 for further information

Fig. 8: Developed countries – age structure

1'400

30%

1'200

172

199

247

297

327

342

1'000

million people

INDUSTRY OVERVIEW

Expand

accessible

markets

Demographics: dynamics of ageing

25%

20%

800

15%

600

805

834

817

795

775

753

10%

400

% of population

Sonova aims at a higher penetration of existing markets by levering its strong global presence. This

primarily focuses on mature markets such as North America and Western Europe. The action plan is to

increase market share of treated clients, as well as to penetrate new groups of end-users. Based on high

levels of customer satisfaction and consistent product introductions, Sonova seeks to overcome the

perception of high economic costs associated to wearing hearing aids (“stigmatisation”).

5%

200

217

203

207

199

194

195

The causes of hearing loss separate into three main categories: congenital, acquired and predominantly

0

0%

2000

2010

2020

2030

2040

2050

age-related impairment (avg. client is 68 years old). It is estimated that 35-40% of the population aged

15-64 (%)

65+ (%)

0-14 (abs.)

15-64 (abs.)

65+ (abs.)

65 and over are hearing impaired to varying extents. Driven by the global increase of life expectancy and0-14 (%)

Source: US census bureau, UN

the “baby boomers” generation, the age pyramids are progressively reversing (Fig. 8). In developed

Note: See Appendix 6H for further information

countries, this group is expected to account for more than 27% of the population by 2050. In our view,

the positive impact of demographics appears to be overestimated: on a year-to-year basis and in

contrast to the long horizon, the effect becomes marginal since the age structure of a population shifts

Fig. 9: Penetration rate by region

slowly over time. Annual growth between 2010 and 2030 amounts to 2% in the developed world and

3.9% in emerging countries. We therefore think that this low single digit growth rate can easily be offset

40%

by lower prices, upon which we elaborate in the following section.

EU

11 – 13%

USA

2- 4%

10%

21 – 23%

20%

23 – 25%

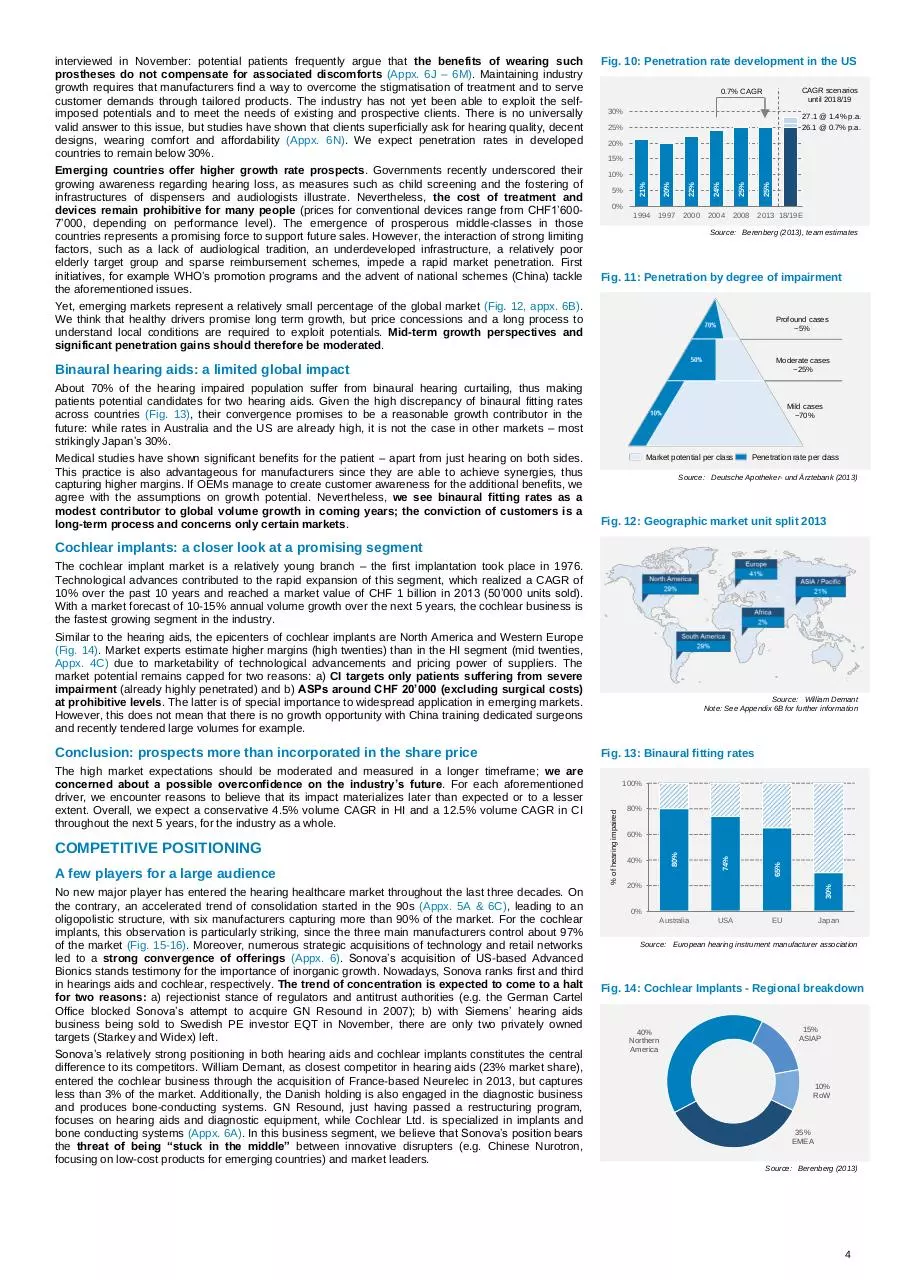

Global production output is estimated to cover less than 10% of the potential demand. This indicates low

penetration rates, especially in developing countries where rates fall below 2.5% (Fig. 9). Consequently,

one of the industry’s key issues is how manufacturers manage to expand the future pie and their

respective slice. This particularly refers to developed countries, where penetration remained stable

over the past decades – despite technological improvements and reimbursement schemes being in

place (Fig. 10). To understand this stagnation, the severity of hearing loss has to be taken into account:

market penetration increases with the degree of impairment (Fig. 11). The perception of inconvenience

and high economic costs relatively to gains of carrying a hearing aid is prevalent in cases of less severe

impairment – which represent ~95% of cases. This reluctance was confirmed by an audiologist we

30%

36 - 38%

Increasing the penetration rate: an arduous task

0%

Australia

Japan

China

Source: Sonova

Note: See Appendix 6 for further information

3

CAGR scenarios

until 2018/19

0.7% CAGR

30%

27.1 @ 1.4% p.a.

26.1 @ 0.7% p.a.

25%

20%

15%

25%

1994

1997

2000

2004

2008

25%

24%

5%

22%

10%

20%

Emerging countries offer higher growth rate prospects. Governments recently underscored their

growing awareness regarding hearing loss, as measures such as child screening and the fostering of

infrastructures of dispensers and audiologists illustrate. Nevertheless, the cost of treatment and

devices remain prohibitive for many people (prices for conventional devices range from CHF1’6007’000, depending on performance level). The emergence of prosperous middle-classes in those

countries represents a promising force to support future sales. However, the interaction of strong limiting

factors, such as a lack of audiological tradition, an underdeveloped infrastructure, a relatively poor

elderly target group and sparse reimbursement schemes, impede a rapid market penetration. First

initiatives, for example WHO’s promotion programs and the advent of national schemes (China) tackle

the aforementioned issues.

Fig. 10: Penetration rate development in the US

21%

interviewed in November: potential patients frequently argue that the benefits of wearing such

prostheses do not compensate for associated discomforts (Appx. 6J – 6M). Maintaining industry

growth requires that manufacturers find a way to overcome the stigmatisation of treatment and to serve

customer demands through tailored products. The industry has not yet been able to exploit the selfimposed potentials and to meet the needs of existing and prospective clients. There is no universally

valid answer to this issue, but studies have shown that clients superficially ask for hearing quality, decent

designs, wearing comfort and affordability (Appx. 6N). We expect penetration rates in developed

countries to remain below 30%.

0%

2013 18/19E

Source: Berenberg (2013), team estimates

Fig. 11: Penetration by degree of impairment

Yet, emerging markets represent a relatively small percentage of the global market (Fig. 12, appx. 6B).

We think that healthy drivers promise long term growth, but price concessions and a long process to

understand local conditions are required to exploit potentials. Mid-term growth perspectives and

significant penetration gains should therefore be moderated.

Profound cases

~5%

Moderate cases

~25%

Binaural hearing aids: a limited global impact

About 70% of the hearing impaired population suffer from binaural hearing curtailing, thus making

patients potential candidates for two hearing aids. Given the high discrepancy of binaural fitting rates

across countries (Fig. 13), their convergence promises to be a reasonable growth contributor in the

future: while rates in Australia and the US are already high, it is not the case in other markets – most

strikingly Japan’s 30%.

Medical studies have shown significant benefits for the patient – apart from just hearing on both sides.

This practice is also advantageous for manufacturers since they are able to achieve synergies, thus

capturing higher margins. If OEMs manage to create customer awareness for the additional benefits, we

agree with the assumptions on growth potential. Nevertheless, we see binaural fitting rates as a

modest contributor to global volume growth in coming years; the conviction of customers is a

long-term process and concerns only certain markets.

Mild cases

~70%

Market potential per class

Penetration rate per class

Source: Deutsche Apotheker- und Ärztebank (2013)

Fig. 12: Geographic market unit split 2013

Cochlear implants: a closer look at a promising segment

The cochlear implant market is a relatively young branch – the first implantation took place in 1976.

Technological advances contributed to the rapid expansion of this segment, which realized a CAGR of

10% over the past 10 years and reached a market value of CHF 1 billion in 2013 (50’000 units sold).

With a market forecast of 10-15% annual volume growth over the next 5 years, the cochlear business is

the fastest growing segment in the industry.

Similar to the hearing aids, the epicenters of cochlear implants are North America and Western Europe

(Fig. 14). Market experts estimate higher margins (high twenties) than in the HI segment (mid twenties,

Appx. 4C) due to marketability of technological advancements and pricing power of suppliers. The

market potential remains capped for two reasons: a) CI targets only patients suffering from severe

impairment (already highly penetrated) and b) ASPs around CHF 20’000 (excluding surgical costs)

at prohibitive levels. The latter is of special importance to widespread application in emerging markets.

However, this does not mean that there is no growth opportunity with China training dedicated surgeons

and recently tendered large volumes for example.

Sonova’s relatively strong positioning in both hearing aids and cochlear implants constitutes the central

difference to its competitors. William Demant, as closest competitor in hearing aids (23% market share),

entered the cochlear business through the acquisition of France-based Neurelec in 2013, but captures

less than 3% of the market. Additionally, the Danish holding is also engaged in the diagnostic business

and produces bone-conducting systems. GN Resound, just having passed a restructuring program,

focuses on hearing aids and diagnostic equipment, while Cochlear Ltd. is specialized in implants and

bone conducting systems (Appx. 6A). In this business segment, we believe that Sonova’s position bears

the threat of being “stuck in the middle” between innovative disrupters (e.g. Chinese Nurotron,

focusing on low-cost products for emerging countries) and market leaders.

60%

40%

Australia

USA

20%

30%

No new major player has entered the hearing healthcare market throughout the last three decades. On

the contrary, an accelerated trend of consolidation started in the 90s (Appx. 5A & 6C), leading to an

oligopolistic structure, with six manufacturers capturing more than 90% of the market. For the cochlear

implants, this observation is particularly striking, since the three main manufacturers control about 97%

of the market (Fig. 15-16). Moreover, numerous strategic acquisitions of technology and retail networks

led to a strong convergence of offerings (Appx. 6). Sonova’s acquisition of US-based Advanced

Bionics stands testimony for the importance of inorganic growth. Nowadays, Sonova ranks first and third

in hearings aids and cochlear, respectively. The trend of concentration is expected to come to a halt

for two reasons: a) rejectionist stance of regulators and antitrust authorities (e.g. the German Cartel

Office blocked Sonova’s attempt to acquire GN Resound in 2007); b) with Siemens’ hearing aids

business being sold to Swedish PE investor EQT in November, there are only two privately owned

targets (Starkey and Widex) left.

80%

65%

A few players for a large audience

100%

74%

COMPETITIVE POSITIONING

Fig. 13: Binaural fitting rates

80%

The high market expectations should be moderated and measured in a longer timeframe; we are

concerned about a possible overconfidence on the industry’s future. For each aforementioned

driver, we encounter reasons to believe that its impact materializes later than expected or to a lesser

extent. Overall, we expect a conservative 4.5% volume CAGR in HI and a 12.5% volume CAGR in CI

throughout the next 5 years, for the industry as a whole.

% of hearing impaired

Conclusion: prospects more than incorporated in the share price

Source: William Demant

Note: See Appendix 6B for further information

0%

EU

Japan

Source: European hearing instrument manufacturer association

Fig. 14: Cochlear Implants - Regional breakdown

40%

Northern

America

15%

ASIAP

10%

RoW

35%

EMEA

Source: Berenberg (2013)

4

Innovation imperative and its limitations

Sonova repeatedly emphasizes its claim on innovation leadership – achieved through acquisitions of

cutting-edge knowledge and constant R&D-to-sales ratios of ~7%. The shortening of product cycles is

a dominant trend: as 80% of Sonova’s revenues stem from products which were introduced in a 2y

timeframe, R&D efficiency is essential for the creation of competitive advantages.

Sonova markets a multi-brand portfolio based on a platform strategy, which grants the potential of R&D

synergies and rapid product introduction. By launching recent platforms on all performance levels at

once, Sonova has departed from industry patterns. Usually, new technologies are introduced in a

descending order of performance categories. The Flex concept within the Unitron brand landscape

represents another marketing novelty: it allows customers to upgrade their existing device by means of

software add-ons.

Moreover, the group sets high expectations into the landmark product Lyric, an unparalleled in-ear

technology acquired in 2010. It is sold on a subscription base and accounts for one fifth of our sales

growth forecast until 2018/19 (Appx. 1 & 5D). Its features, including invisibility and extended battery life,

reduce the perceived inconvenience of wearing a hearing aid and contribute to the reaching of clients

who have been reluctant so far. Despite these differentiating characteristics, the audiologist we

interviewed in November expressed some caveats: Lyric does not fit into every hear canal and its high

cost (2-3 times a conventional solution) turns out to be prohibitive (Appx. 6O). The fact that the

underlying technology has been externally acquired (Insound, 2010), supports our hypothesis of

limitations on organic growth.

Furthermore, analysts were not convinced by Sonova’s new range of products providing connectivity to

external devices, which are not based on the 2.4 gigahertz wireless technology (Bluetooth bandwidth).

This reaction suggests that there is a viable threat of aspirations differing from perceptions and

gives inadequate answers to customer needs.

We consider technological innovation as a necessary but not sufficient condition to future success

in a market environment of fierce competition. Recently, Sonova and OEMs in general created “artificial”

product cycles without real technological breakthrough. In last year’s strategic moves we identify a shift

towards competition in distribution channels and intensified use of marketing instruments (such as

aggressive pricing) in order to secure growth.

Fig. 15: HI – market shares 2013

95%

100%

87%

76%

80%

64%

60%

40%

47%

24%

100%

8%

5%

11%

12%

17%

23%

20%

24%

0%

Source: Finanz & Wirtschaft

Note: See Appendix 6H for further information

Fig. 16: CI – market shares 2013

100%

80%

97%

99%

100%

15%

2%

1%

82%

62%

20%

60%

40%

62%

20%

0%

Access to distribution channels is key

Retail reaps 60 to 70% of the total market value of CHF 15-16 billion (Fig. 18). The highly fragmented

intermediate level historically consisted of independent distributors, large purchasing groups and retail

chains, as well as governmental entities. Throughout the last decade, OEMs have strengthened their

retail operations through acquisitions and store openings, thus circumventing intermediaries and

securing part of the ~4x retail markup. Yet, independents still represent the most important sales

channel (Fig. 19) and their recommendation has strong influence on end-user’s purchase. We attribute

crucial importance to strong partnerships with these gatekeepers.

Direct OEM retail reaches levels of efficiency and capacity utilization, which are unachievable for

independent clinics. Our forecast reflects positive impacts on sales volume and margins induced by a

rebalancing distribution channels (adding up to the wholesale markup of ~3x) and thus partly

compensating for pressure on prices. The downside of this practice lies in the direct competition to

important independent resellers and strategic reactions of competitors.

Aggressive pricing strategy

In addition to the great impact of governmental decisions in terms of public health systems, public

entities appear as large volume buyers within tenders. These purchasing processes of lower

performance devices result in highly competitive prices. Overall, public tenders’ contribution to increase

market penetration comes at the extent of increased pressure on selling prices which industry

experts estimate to fall in a range of 1 to 3% in 2015. Manufacturers’ restrictive information policy on

units sold and prices prevents independents from calculating ASPs and thus strengthening their

bargaining position.

Sonova’s inroad to sell premium products of its brand Phonak through US wholesale chain CostCo

shows the group’s aggressive market approach and readiness for concessions in the fight for

market shares. This move triggered harsh backlash from competitors and independent audiologists:

Amplifon recently stated that a majority of US retailers have decided to abandon Phonak. In addition

to this, Sonova already rivals independent dispensers through its growing inhouse retail business. It

remains to be seen whether these ventures result in strategic alliances and retaliation against

Sonova – ultimately fuelling price wars.

Source: German Medical Technology Association (2014)

Note: See Appendix 6H for further information

Fig. 17: Summary – Porter’s 5 forces

-

+

+

+

+

+

Industry rivalry

Threat of new entrants

Threat of substitutes

Power of suppliers

Power of buyers

Source: Team assessment

Note: See Appendix 6 for further information

Fig. 18: Industry value chain

Wholesale

Market

Size:

Retail

20-30%

60-70%

CHF

15-16bn

5-8%

Conclusion: a double edged sword market strategy

Component

manufacturers

Sonova possesses a strong position in the maturing hearing aids industry. In difference to other sectors,

customer demand is subject to a confluence of factors such as healthcare policies and access to

treatment. We see the industry reaching a turning point in which the growth drivers – organic

innovation and strategic OEM acquisitions – are deprived of their substance.

The group enters price competition and simultaneously enforces expansion of its retail activities. In the

traditional setup, OEMs benefited from low prices for end-users and high penetration rates – assuming

stable wholesale markups. With an increasing importance of OEM-owned retail, this mathematics

changes, as manufacturers directly benefit from high retail prices, which were previously earned by

independents. We balance between value maximizing effects and downsides of these changes,

expecting sales CAGR of 4.2% for the overall HI segment and sales CAGR of 12.5% for CI over the next

5 years. In our view, Sonova’s market approach steps up a price war and harms the group’s

relationships with audiologists. Furthermore, we believe that the company will not be able to find

better solutions to industry challenges than its competitors, but possesses a higher valuation.

Source: Berenberg (2013)

Fig. 19: Dispensing channels by market shares

22%

Public entities

8%

Purchasing

groups

24%

Retail chains

8%

OEM retail

FINANCIAL ANALYSIS

Sonova appears as a well-managed company with the sound financial stability of a market leader within

the hearing aid industry. We considered the following competitors in our analysis: William Demant (DK)

and GN Store Nord (DK), with hearing aids accounting for 86% and 62% of total revenues in 2013.

Additionally, the leader in cochlear implants Cochlear Ltd. (AUS) represents the closest peer to Sonova’s

second segment. Siemens (global number four) has been excluded due to its conglomerate structure

without disclosure on its hearing aid business and the distorting effects of the recent takeover. Along

with the assessment of the industry outlined hitherto, the following financial analysis prepares the

foundation upon which we build our future estimates (valuation section).

37%

Independents

Source: William Demant (2014)

5

Historic top line growth not to be maintained

Sonova substantially gained market shares in the course of the consolidation trend of the hearing aid

industry, which intensified since the 1990s. The mix of organic and acquired growth pushed its 1994

market shares of approx. 6% towards 24% in 2013, making Sonova the world leading hearing aid

supplier. In a shorter timeframe, by realizing sales growth of 8.7% in 2013/14 (10.8% in 2012/13), it

recently generated absolute revenues of CHF 1’951m. The most recent figures are suggestive of a

convergence of competitors’ growth rates (Fig. 20). Indeed, Sonova’s relative sales expansion still takes

place on a larger absolute scale compared to smaller competitors, but H1 2014/15’s sales figures of

CHF 990.2m (+4.5% yoy) fell below the average expectation of analysts. With a FY sales growth

forecast of 6.8%, we are below management guidance of 7-9%.

Our cautious view is based on the discount policy in order to boost market shares in the US and the

strong decline in the Northern American market of 5.3% yoy. Sales were bolstered by an 18.1% yoy

growth in EMEA, although we doubt that this impressive growth due to favourable amendments of

reimbursement schemes (especially in Germany and UK) is of an enduring nature.

Fig. 20: Benchmarking - Sales growth 2010-2014

25%

William Demant

20%

15%

GN Store Nord

10%

5%

Sonova

Cochlear

0%

-5%

'10/'11

'11/'12

'12/'13

'13/'14

Source: Sonova

Fig. 21: Benchmarking - EBIT margin

Operating margins: high under “normal” conditions

Ø

Ø

Ø

GN Store Nord

Cochlear

Sonova

William Demant

GN Store Nord

Cochlear

Sonova

Willam Demant

GN Store Nord

5%

Cochlear

Sonova

10%

William Demant

15%

0%

2011/12

2012/13

2013/14

Source: Annual reports, Reuters Eikon

Fig. 22: EBITA decomposition 2013/14

2'000

611

1'200

800

126

590

400

195

430

1'600

1'340

EBITA is one of Sonova’s key management variables. The aforementioned normalization effect and its

influence on margins became clear in 2012/13 (Fig. 24), when the adjustment amounted to CHF 203m

and pulled down EBITA margins down to 10.1% (normalized 21.5%).

20%

1'951

The margin bridge depicted in Fig. 22 shows Sonova’s operating margin drivers for 2013/14. The single

most important components are COGS (31.3%) and Sales and Marketing (30.2%). In relative terms as

percentage of sales, both of them remained in a narrow corridor between 2009/10 and 2013/14.

Leverage on R&D – as a key element of future profitability – could be achieved by spreading synergies

over several brands. In our view, Sonova and William Demant exhibit potential to this approach because

of their multi-brand strategy and presence in the cochlear segment. R&D consistently accounted for 67% of Sonova’s sales. According to management statements, this ratio is going to be maintained (7-8%

on a incurred basis) (Fig. 23). The comparison might be somewhat skewed with regard to different

capitalization policies applied and the importance of the retail business in the revenue mix. Sonova’s

expensed R&D relative to sales appears to be low compared to GN Resound and William Demant. One

reason might be a more efficient R&D set-up, as Sonova gained market shares regardless of fewer

relative spendings on innovation. However, we believe that returns on R&D will be subject to the law

of diminishing returns due to increasingly complex advancements in an environment of shrinking

product lifecycles.

25%

mCHF

Due to varying key performance metrics across our peer group, we take EBIT as a proxy for operational

efficiency. It forms the largest common denominator. The EBIT volatility throughout the periods under

consideration illustrates the inherent risk of product callbacks and recognition of provisions in this

industry, which add on top to paramount performance drivers. Normalization and exclusion of one-off

cost turn out to be dictums when reading annual statements (e.g. Cochlear 2012). Sonova was not

protected from these risks, as depicted in Fig. 21. Nevertheless, the group was able to achieve leading

positions in periods of “normal” business activity, approaching an EBIT margin of 20.7% in 2013/14.

G&A

EBITA

0

Retail and Cochlear: hitting the sweet spot?

Throughout the last 5 years net working capital as a percentage of sales oscillated in a narrow

bandwidth of around 10%. A strong increase of working capital has been offset by the growth of

Sonova’s cash position. With its 142 days of cash conversion, Sonova testifies a solid working capital

management compared to its competitors (Fig. 25). Due to its proven capability to generate cash flow

from operations (avg. CHF 194.7m versus avg. NWC of CHF 178.1m throughout the last four years), we

do not believe that working capital gives rise to concern.

Cash sources and utilization: changes ahead

Sonova’s fairly conservative approach towards debt is an important feature of the company – the

borrowing of funds for the acquisition of AB in 2009/10 marked an extraordinary move. On the outflow

side throughout the last five years, acquisitions in the amount of CHF 941m (50.3%) are an impressive

illustration of Sonova’s aggressive strategy of external growth.

Gross

Profit

R&D

S&M

Fig. 23: Benchmarking: Expensed R&D

10%

GN Resound

9%

8%

William Demant

7%

6%

Sonova

5%

4%

2010

2011

2012

2013

Source: Annual reports

Note: See Appendix 4L for capitalization rates and further information

Fig. 24: EBITA margin development

700

600

500

30%

Normalized

EBITA (margin)

25%

20%

400

15%

300

200

10%

100

5%

0

0%

EBITA margin

Cash flow and working capital

COGS

Source: Sonova

Note: See Appendix 2H for further information

as % of sales

Following the acquisition of Advanced Bionics in 2009/10 for CHF 510m, an AB product callback in 2006

forced Sonova to build up provisions totalling CHF 250m (CHF 198m increase in 2012/13 after a

Kentucky court adjudged high punitive damages to a patient). The management considers the liabilities

associated with this product malfunction as being sufficiently covered by existing provisions. With its

tremendous sales growth (4-year CAGR of 66.8%), EBITA break-even in 2012/13 (6.6% EBITA margin

2013/14), and a 10% share of total sales, Cochlear (CI) now turns into a profitable business. We further

elaborate on future sales growth and margin expansion in the valuation section.

Sales

EBITA (mCHF)

Sonova does not reveal performance figures for its retail business which comprised more than 2’000

outlets in 2013 and is assumed to be more profitable than sales through other channels. According to

management statements in the course of November’s H1 result presentation, the company-owned

stores account for approx. 10% of its entire hearing instrument sales. Analysts attribute significant

higher weight to this distribution channel – expecting it to account for up to 30% of revenues. The

company’s reserved disclosure corresponds to William Demant (expected to run more than 1’000

stores), as the OEM’s retail advances represent direct invasions into territory occupied by independents.

Sonova’s ongoing consolidation initiative, first initiated in Northern America, aims at the harmonization of

branding and the IT-landscape. Due to management’s commitment to retail expansion, we expect this

streamlining to spill over into other markets – swaying EBITA margins, but to a declining extent in the

later half of the forecast period (counteracting standardization gains and scale effects).

Source: Sonova, Team assessment

Note: See Appendix 2 for further information

Source: Sonova, Team assessment

6

400

99

DIH

192

DSO

-118

DPO

65

95

100

162

123

0

73

-45

-52

-67

William

Demant

Sonova

-200

GN

Resound

Cochlear

Source: Reuters Eikon, Team assessment

20%

0.5

10%

1.98

1.0

2.02

30%

2.06

40%

1.5

2.10

2.0

2.15

50%

1.94

2.5

0.0

Cash as % of current assets

Fig. 26: Liquidity development

Another important factor that has to be taken into account is the impact of currencies. A substantial part

of the cost base is denominated in CHF (e.g. R&D, SG&A). On the other hand, US sales were in the

mid-thirties and EU distribution recently exceeded 40% (CH < 2%). In FY 2013/14, currency

movements exercised a negative impact of 3% on the top line and 5.1% on EBITA. With respect to

the ongoing rebalancing of the sales mix it is difficult to estimate whether FX are supporting or burdening

future margins.

In conclusion, past performance cannot be the only reason for high market expectations on

Sonova. As the depicted performance benchmarks reveal, the group did not outperform its peers.

Looking ahead, the comparison of analysts’ consensus on peer earnings and our estimates on Sonova’s

bottom line shows that high expectations remain in force (Fig. 3).

172

-100

Current ratio

The historic figures underscore Sonova’s healthy financial position. In light of our industry structure

assessment, we currently see no basis for an operational margin expansion beyond the stated

target in the mid-twenties within a 3y horizon. Potential gains in the retail and cochlear business,

which are assumed to be margin contributors, are expected to be settled out against fierce pressure on

wholesale margins. Despite the fact that the underlying growth drivers are intact, topline growth depends

on many variables other than attractive products alone. The fight for market shares fuels competition

– e.g. Sonova’s decision to sell premium products via the US retail chain CostCo – and puts average

selling prices, as well as margins at risk

100

85

200

We introduce ROIC in order to analyse Sonova’s ability to deploy capital into attractive returns from

operations. Except for the circumstances in 2012/13, Sonova was constantly able to create economic

profits (ROIC > WACC). However, it becomes clear that the company performed below the peer

group average throughout the last 3 years (Fig. 28) due to its profit collapse following the AB product

liability issue and the integration efforts of acquired businesses. Recently, Sonova reached a FY ROIC of

16.4%. Comparably, William Demant achieved stable margins of around 26%. This prepares an

interesting point of departure for the hereinafter discussed multiple valuation.

Sound performance, but not drowning out peers

194

142

300

2.36

The final repayment of debt in H1 2014/15 renders the company debt free. Referring to the low tax rate

the management assumes to maintain and a healthy position in any negotiations with banks in order to

finance possible future acquisitions, we do not consider this as an inefficient capital structure.

Fig. 25: Cash conversion cycle 2013/14

Days

Returns to shareholders through dividends and buybacks account for “only” 23.7% – the now proclaimed

shift towards a TSR strategy (CHF 500m repurchases until 2017 and a 40% target dividend ratio – see

Appx. 5E) marks a change, as large OEM deals become less probable due to regulatory reasons and

Siemens’ hearings aids business being sold. Meanwhile, Sonova projects retail acquisitions in the

amount of CHF 50-70m p.a.

0%

Source: Sonova, Team assessment

Note: See Appendix 4 for further information

Fig. 27: Utilization of cash: last 5 years

Absolute values in parenthesis (mCHF)

VALUATION

24% (457)

CAPEX

Our price target results from the combination of the Discounted Cash Flow Method (DCF) and the P/E

multiple analysis. We consider the P/E multiple preferable over EV/EBITDA for two reasons: a) Sonova’s

key performance metric is EBITA, b) EBITDA ratios do not reflect Sonova’s low tax rate and thus distorts

the comparison. By contemplating DCF and P/E analysis we expect to capture both our view on

fundamental performance and the market perspective on the sector and Sonova in particular.

DCF analysis yields a price target of CHF 119

22% (412)

Dividends

2% (26)

Interest and

other Fin.

CF

50% (941)

Acquisitions

& other Inv.

CF

Based on the underlying assumptions described in the following, we obtain a 19% downside compared

to the closing price of November 27th.

2% (32)

Buybacks

Sales lower than consensus expectations

30%

25%

20%

Mid-twenties EBITA margin achievable in a 4-year timeframe

We expect the progressing shift of sales mix including a more prominent role of sophisticated CI

Ø

Cochlear

GN

William Demant

Sonova

Cochlear

GN

William Demant

Sonova

0%

2011/12

2012/13

2013/14

Source: Sonova, Team assessment

Note: See Appendix 4 for further information

Fig. 29: Revenue expectations

CAGR = 5.3%

3'000

2'500

500

2'563

2'442

2'322

2'202

1'000

990

1'500

1'093

2'000

1'951

mCHF

It all adds up to a topline CAGR of 5.3% until 2019. Within our sales forecast, the impact of the

postulated price pressure varies across segments and results in a conservative growth assumption.

Cochlear implants (CHF +183m), standard HI (CHF +156m) and premium HI (CHF +110m) are the

strongest contributors to 2018/19’s revenue forecast amounting to CHF 2’563m. (Fig. 29, Appx. 1F).

Notwithstanding the preceding, there are two main factors bearing the potential to invalidate our

assumptions: a) negative spill over effects of the recent aversion displayed by US independent

dispensers, b) unexpected sales mix shifts possibly unfolding uplifts.

Cochlear

5%

GN

10%

4.2% CAGR in Standard HI: Due to the relatively low level of technical sophistication, centralized

purchase volumes and geographic sales shift, this product category is most prone to intensified price

pressure. However, we estimate this downside pressure to be fully compensated by volume growth –

largely driven by the development of a “first-time” customer base in emerging economies. Thus, we

expect standard devices to grow at a CAGR in a narrow corridor around our market expectation of 4.2%.

12.2% CAGR in Cochlear Implants: We expect the overall cochlear market to grow at a CAGR of

12.5%. Sonova, as the incumbent 3rd power (15% market share in 2013) in the highly concentrated

cochlear implant business, might face different challenges compared to its dominating role within the HI

market – neither being the market leader nor the disruptive newcomer. For this reason we expect

Sonova to face price competition from Med-El and strategic offenses from newcomers such as William

Demant. Moreover, strategic moves might be retaliated by the Australian market leader Cochlear.

Ø

Ø

15%

William Demant

4.1% CAGR in Advanced HI: The advanced HI segment is expected to grow at a marginally slower

pace than the market. As Sonova CEO admitted “standard HI brings market share, premium HI brings

value and advanced HI is located somewhere in the middle”. Caught between those segments, we

attribute a higher impact of price pressure than for the premium segment and less amplified volume

growth opportunities compared to the standard segment – ultimately pushing the growth rate 20bp below

the overall expected CAGR throughout the forecast period.

Fig. 28: Benchmarking – ROIC

Sonova

4.7% CAGR in Premium HI: We expect growth in the Premium HI market to be driven mainly by a)

expansion of retail business, b) benefits from Lyric, c) sales mix-induced mitigation of price pressure

compared to other product categories. Industry estimates are ranging from 1% to 3% downward

pressure on ASP. We therefore believe that this segment will grow at a faster pace than the overall HI

market. (please see Appx. 1 for further details)

Source: Sonova, Team assessment

1'795

In the two preceding financial years, Sonova has achieved growth rates above 8% on the top line, which

we believe will not be sustained in the medium term. We expect a CAGR of 5.3% until 2019 in group’s

total sales, resulting from a CAGR of 4.3% and 12.2% for HI and CI business respectively (Fig. 29).

0

Source: Sonova, Team assessment

Note: See Appendix 1 for further information

7

products and retail as a contraposition to larger improvements of COGS. Positive effects of volume

growth are interfered by factors such as labour cost for higher-end products (compared to standard

devices) and input parts, which sway over increased bargaining power. Connect Hearing and further

retail acquisitions might temporarily increase staff costs. We assume occasional shifts towards higher

depreciation in association with shorter product cycles and extended retail operations. Therefore, we

anticipate COGS to contribute 260bp to 2018/19’s EBITA margin, equaling 28.7% of sales by the end of

the forecast period (Fig. 30).

R&D expenses are projected to oscillate between 7-8% (gross) of revenues or 6.7% in expensed terms

– accounting for a negative effect of 24bp on 2018/19’s EBITA margin. This factors in our critical stance

on R&D leverage, which is assumed to be offset by shortening product launch intervals and more

complex research projects (Appx. 2B & 4L). The ongoing consolidation of retail activities, as well as

comparable initiatives of future acquisitions lead to a negative effect of 83bp until 2016. According to the

CFO, Dr. Grevener, a large proportion of the associated expenses is already considered in actual

figures. For the latter half of the forecast period, we expect efficiency gains to unfold and S&M catching

29.5% (-70bp) of sales. A G&A efficiency gain by means of process streamlining is factored in by a

decrease of 90bp. This rather conservative assumption is explained by potentially more complex

administrative tasks induced by the corporate strategy, such as government relation work due to

geographic rebalancing.

In conclusion, we believe that the 25% EBITA margin is realistically achievable and is more than

accounted for in the share price. Our prediction suggests the achievement of the target in the

financial year 2017/18 – one year later than predicted (Fig. 24).

From EBIT to FCF estimations

Over the period of analysis, we forecast capital expenditures to represent a higher percentage of sales

than during the previous three years (5.5% vs. avg. 4.8%), mainly due to the proclaimed annual

acquisitions in the amount of CHF 50-70m. The expansion strategy is reflected in our CAPEX forecast,

which exceeds annual D&A by approx. 22% – therewith assuming inorganic expansion opportunities

to be exploited. Furthermore, we expect net working capital (Appx. 4B) to remain at a relative constant

level of sales (~10.5%). The tax rate applied to our adjusted operating income has been kept constant at

13.5%, in line with Sonova’s expectations (reaffirmed in H1 analyst call).

Estimating the risk-adjusted discount rate

We apply a WACC of 7.9% for discounting the FCF (Fig. 31). The company has a negative net debt

position, hence considered zero for the computation of the risk-adjusted discount rate. Operating leases

are considered as debt – with a PV approximated by discounting obligations with an after-tax cost of

debt of 4% under a lease contract perpetuity assumption. The computation of cost of equity bases on

CAPM using the following inputs: a) both risk free rate (30y govt. bonds) and market risk premium

weighted for Sonova’s regional activities (Switzerland, DE, UK, US) and investor provenience, b)

adjusted raw beta (Bloomberg metric) by means of regressing daily excess returns of Sonova and SMI

throughout the last 3 years (Appx. 3B).

Fig. 30: EBITA margin bridge 2018/19

mCHF

666

31.3%

6.4%

30.2%

% of sales 18/19:

28.7%

6.7%

29.5%

-0.2%

0.7%

R&D

S&M

10.0%

9.1%

26%

26%

24%

22%

22%

0.9%

2.6%

20%

18%

16%

14%

2013/14

COGS

G&A

2018/19E

Source: Team assessment

Note: See Appendix 2 for further information

Fig. 31: WACC computation

30-year government bond (rf)

Market risk premium (rm-rf)

Adjusted beta (βu)

Cost of equity (re)

Pre-tax cost of debt (rd)

After-tax cost of debt (rdt)

Tax rate (tc)

Net cash (mCHF)

Market cap (mCHF)

Lease value (mCHF)

Debt + Equity + Leases

WACC

2.1%

5.8%

1.0

7.9%

4.5%

4.0%

13.5%

311’525

9’814’241

130’839

9’945’080

7.9%

Source: Team assessment

Note: See Appendix 3B for further information

Fig. 32: Sensitivity analysis

WACC / Terminal growth matrix and share price effect

WACC

Conservative views on terminal growth

The hearing aid industry is characterized by shortening product cycles. At the same time our

assessment leads to moderated penetration rates estimates and diminishing returns on R&D. In order to

reconcile between these forces, we are convinced that a conservative terminal growth rate of 2.4%,

reflects a maturing market characterized by price developments, which are offsetting volume

growth, a structural limit of penetration rates and a convergence of competitors’ offerings. Admittedly, as

the terminal value represents a massive 80% of the firm value, even small changes to the perpetual

growth exercise a tremendous impact on our valuation.

430

% of sales 13/14:

8.7%

2.0%

-32%

2.1%

-32%

2.2%

-31%

Perpetual growth rate

2.3% 2.4% 2.5%

-30% -29% -28%

2.6%

-28%

2.7%

-27%

2.8%

-26%

8.5%

-30%

-29%

-29%

-28%

-27%

-26%

-25%

-24%

-23%

8.3%

-28%

-27%

-26%

-25%

-24%

-23%

-22%

-21%

-20%

8.1%

-26%

-25%

-24%

-23%

-22%

-20%

-19%

-18%

-17%

7.9%

-23%

-22%

-21%

-20%

-19%

-17%

-16%

-15%

-14%

7.7%

-20%

-19%

-18%

-17%

-15%

-14%

-13%

-11%

-10%

7.5%

-17%

-16%

-15%

-13%

-12%

-11%

-9%

-8%

-6%

7.3%

-14%

-13%

-11%

-10%

-8%

-7%

-5%

-4%

-2%

7.1%

-10%

-9%

-8%

-6%

-4%

-3%

-1%

1%

3%

Source: Team assessment

Note: See Appendix 3D for further information

From firm value to equity value

In order to account for the effects of operating leases (lower EBIT figure and higher capital productivity)

we reconcile EBIT for the interest component of lease expenses. By definition, this does not change the

value of the company, but provides the freedom to adjust profitability figures. Neither of the proxies for

the PV of leased assets (industry multiple and discounting method) increases the WACC. The PV of

lease obligations is deducted from EV. As further adjustments, we subtract minorities, unfunded pension

obligations and non-operative derivatives. We add investments in associates and cash to the value of

core operations – the latter one implicitly by deducting net debt from EV (Appx. 3C). The division of

equity value and the diluted number of shares results in a share price of CHF 119.

Fig. 33: Implied DCF

Sales growth forecast vs. sales CAGR

15%

12%

9%

DCF analysis reveals considerably inflated price

6%

In order to assess the robustness of our DCF valuation, we sensitized the result for the most influential

inputs, namely WACC and the terminal growth rate. The most conservative scenario marks a downside

of -32.4%. An optimistic combination of a 7.1% discount rate and a terminal growth rate of 2.8% results

in an upside of 2.9%. These results reinforce our opinion that the moderated view on industry growth

rates and Sonova’s strategic agenda offer little scope for share prices beyond the current level (Fig.

32).

3%

The implied DCF valuation reveals a required annual revenue growth of 12.2% for the period under

consideration in order to justify the current share price (Fig. 33). Such an expansion appears to be

unachievable. Well aware of the fact that this “coarse” method does not comprise accompanying

margin improvements, our business analysis does not reveal operational efficiency gains, which

intrinsically justify the contemporary market valuation. We identify potential future margin improvements

as a result of a more prominent role of the cochlear business and Lyric within the sales mix.

0%

10/11 11/12 12/13 13/14 14/15E 15/16E 16/17E 17/18E 18/19E

Sales growth

Fig. 34: Trailing P/E vs. EPS growth

35

Cochlear

The multiple valuation focuses on the P/E ratio as metric of comparison. From our perspective, this

widely used relation offers the broadest base for comparison, even though earnings are subject to

different accounting treatments under managerial discretion. For the composition of the peer group we

followed a two-pillared approach: first, a larger European med-tech basket, which is fine-tuned by means

of a revenue correlation for the preceding five periods – ultimately resulting in seven publicly listed

peers.

Secondly, a sample of three direct competitors provides insight into the market valuation of hearing aid

companies: the sector group consists the publicly listed competitors William Demant, GN Store Nord and

Cochlear Ltd., the latter one being considered for Sonova’s growing importance of the CI business

(estimated to approach 15% in 2018/19). The weighting of two close competitors and the pure-play

Trailing P/E

30

P/E analysis: an over-expensive company in an expensive industry

Implied CAGR

Source: Team assessment

Note: Required sales CAGR implied by current share price

See Appendix 3 for further information

Sonova

25

GN ReSound

20

William Demant

15

10

5

0

0%

5%

10%

15%

20%

25%

30%

EPS growth

Source: Team assessment

Notes: Bubble size represents market capitalization

See Appendix 3 for further information

8

Download Winning Report 2015-2

Winning Report 2015-2.pdf (PDF, 3.38 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000517444.