eStmt 2017 03 31 1 (PDF)

File information

Author: Bank of America

This PDF 1.5 document has been generated by RAD PDF / RAD PDF 2.36.6.2 - http://www.radpdf.com, and has been sent on pdf-archive.com on 14/04/2017 at 02:42, from IP address 185.181.x.x.

The current document download page has been viewed 1961 times.

File size: 406.92 KB (6 pages).

Privacy: public file

File preview

P.O. Box 15284

Wilmington, DE 19850

Customer service information

1.888.BUSINESS (1.888.287.4637)

bankofamerica.com

FREE BAND FURNITURE, LLC

2400 E NIFONG BLVD APT 1507C

COLUMBIA, MO 65201-3821

Bank of America, N.A.

P.O. Box 25118

Tampa, FL 33622-5118

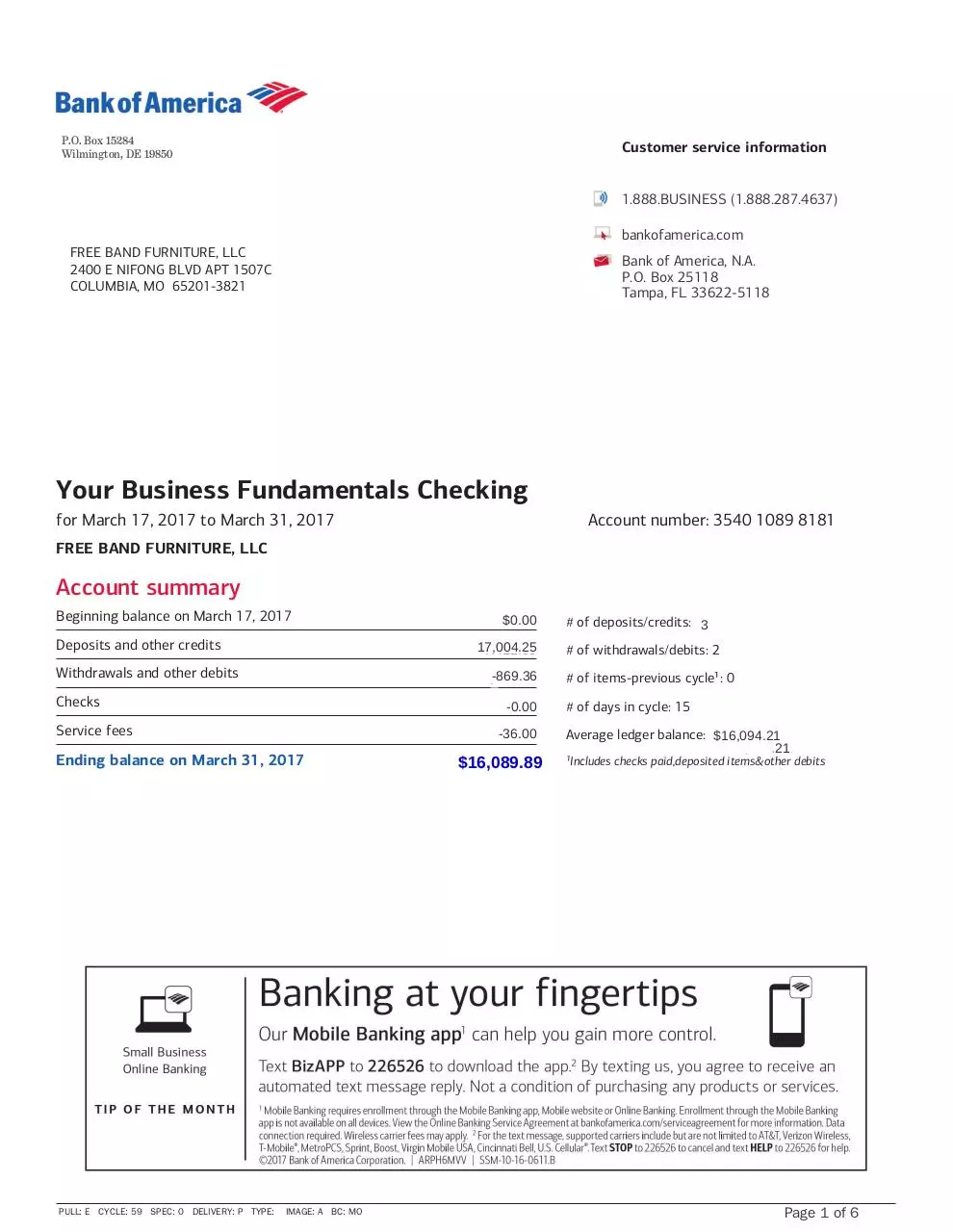

Your Business Fundamentals Checking

for March 17, 2017 to March 31, 2017

Account number: 3540 1089 8181

FREE BAND FURNITURE, LLC

Account summary

Beginning balance on March 17, 2017

$0.00

31.457.10

31.451.10

$0.00

0.00

# of deposits/credits: 133

Deposits and other credits

950.00

17,004.25

7.412.00

# of withdrawals/debits: 2

Withdrawals and other debits

-869.36

-869.36

4,450.09

Checks

-0.00

-0.00

Service fees

-36.00

-36.00

-31.00

Ending balance on March 31, 2017

PULL: E CYCLE: 59 SPEC: 0 DELIVERY: P TYPE:

IMAGE: A BC: MO

$44.64

$16,089.89

# of items-previous cycle¹: 0

# of days in cycle: 15

Average ledger balance: $48.96

$16,094.21

$16,094.21

¹Includes checks paid,deposited items&other debits

Page 1 of 6

FREE BAND FURNITURE, LLC ! Account # 3540 1089 8181 ! March 17, 2017 to March 31, 2017

IMPORTANT INFORMATION:

BANK DEPOSIT ACCOUNTS

Updating your contact information - We encourage you to keep your contact information up-to-date. This includes address, email

and phone number. If your information has changed, the easiest way to update it is by visiting the Help & Support tab of Online

Banking. Or, you can call our Customer Service team.

Deposit agreement - When you opened your account, you received a deposit agreement and fee schedule and agreed that your

account would be governed by the terms of these documents, as we may amend them from time to time. These documents are

part of the contract for your deposit account and govern all transactions relating to your account, including all deposits and

withdrawals. Copies of both the deposit agreement and fee schedule which contain the current version of the terms and

conditions of your account relationship may be obtained at our financial centers.

Electronic transfers: In case of errors or questions about your electronic transfers - If you think your statement or receipt is

wrong or you need more information about an electronic transfer (e.g., ATM transactions, direct deposits or withdrawals,

point-of-sale transactions) on the statement or receipt, telephone or write us at the address and number listed on the front of

this statement as soon as you can. We must hear from you no later than 60 days after we sent you the FIRST statement on

which the error or problem appeared.

-

Tell us your name and account number.

Describe the error or transfer you are unsure about, and explain as clearly as you can why you believe there is an error or

why you need more information.

Tell us the dollar amount of the suspected error.

For consumer accounts used primarily for personal, family or household purposes, we will investigate your complaint and will

correct any error promptly. If we take more than 10 business days (10 calendar days if you are a Massachusetts customer) (20

business days if you are a new customer, for electronic transfers occurring during the first 30 days after the first deposit is

made to your account) to do this, we will credit your account for the amount you think is in error, so that you will have use of the

money during the time it will take to complete our investigation.

For other accounts, we investigate, and if we find we have made an error, we credit your account at the conclusion of our

investigation.

Reporting other problems - You must examine your statement carefully and promptly. You are in the best position to discover

errors and unauthorized transactions on your account. If you fail to notify us in writing of suspected problems or an

unauthorized transaction within the time period specified in the deposit agreement (which periods are no more than 60 days

after we make the statement available to you and in some cases are 30 days or less), we are not liable to you for, and you agree

to not make a claim against us for the problems or unauthorized transactions.

Direct deposits - If you have arranged to have direct deposits made to your account at least once every 60 days from the same

person or company, you may call us at the telephone number listed on the front of this statement to find out if the deposit was

made as scheduled. You may also review your activity online or visit a financial center for information.

© 2017 Bank of America Corporation

Page 2 of 6

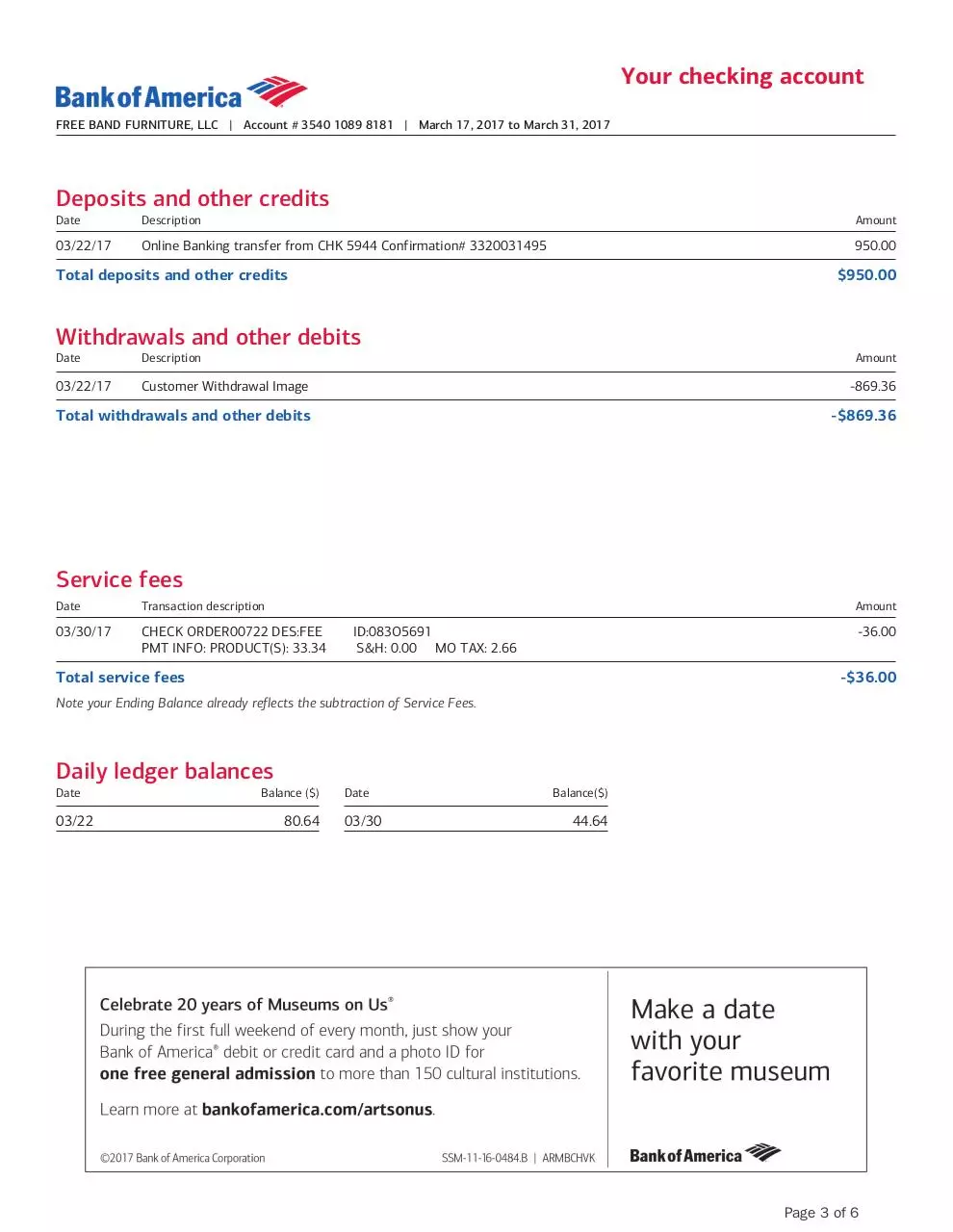

Your checking account

FREE BAND FURNITURE, LLC ! Account # 3540 1089 8181 ! March 17, 2017 to March 31, 2017

Deposits and other credits

Date

Description

Amount

03/22/17

Online Banking transfer from CHK 5944 Confirmation# 3320031495

950.00

Total deposits and other credits

$950.00

Withdrawals and other debits

Date

Description

Amount

03/22/17

Customer Withdrawal Image

-869.36

Total withdrawals and other debits

-$869.36

Service fees

Date

Transaction description

Amount

03/30/17

CHECK ORDER00722 DES:FEE

PMT INFO: PRODUCT(S): 33.34

ID:083O5691

S&H: 0.00 MO TAX: 2.66

-36.00

Total service fees

-$36.00

Note your Ending Balance already reflects the subtraction of Service Fees.

Daily ledger balances

Date

03/22

Balance ($)

80.64

Date

03/30

Balance($)

44.64

Page 3 of 6

FREE BAND FURNITURE, LLC ! Account # 3540 1089 8181 ! March 17, 2017 to March 31, 2017

This page intentionally left blank

Page 4 of 6

Welcome to Bank of America

Business Fundamentals® Checking

Thanks for opening your new business checking account with us. To learn more about all the features that

come with Business Fundamentals® checking, visit bankofamerica.com/getstartednow.

Use the New Account Checklist to help you set up everything you need to maximize your new account.

You will also learn account basics and the easiest ways to manage your account. And, if you have not already

done so:

Make the most of Online and Mobile Banking

With Online and Mobile Banking (footnote 1), you can do all this, conveniently and securely:

·

·

·

·

Gain 24/7 access to your account

Monitor account activity with alerts (footnote 2)

Download account data to QuickBooks®

Use Mobile Banking (footnote 1) and Text Banking (footnote 3) to bank on the go,

including the ability to deposit checks (footnote 4) with your smartphone or tablet

Start using your business debit card

Make $250 in new qualifying purchases with your business debit, credit or charge card each checking

statement cycle to avoid the monthly fee on your checking account. (footnote 5) You should receive

your debit card approximately 5 to 7 business days after you opened your account, mailed in a Bank

of America envelope with a Delaware return address. If you did not request a debit card when you

opened your account, you can order one at bankofamerica.com/ordermycard.

The more you know about your account, the more you will get out of it. So please take a few moments to

explore. Our Clarity Statement® describes key features and policies, including fees, and how you can avoid

them. You can find it at bankofamerica.com/SBCheckingClarity.

Get off to a great start with your new account at

bankofamerica.com/getstartednow or call 888.BUSINESS (888.287.4637).

Page 5 of 6

Answers to questions you may have

Q:What benefits and services are included with my account?

A: As a Bank of America Business Fundamentals customer, you are eligible for a wide range of benefits and

services:

· A Business Investment Account (a business savings account with limited check writing capability) with

no additional monthly fee

· Small Business Online Banking with account alerts (footnote 2) and Online Bill Pay

· Mobile (footnote 1) and Text Banking (footnote 3)

· Debit card with Total Security Protection®

· Additional debit cards for employees with spending limits you control

· Get a $200 statement credit on select new business credit cards when you make at least $500 in new

purchases within the first 60 days of the credit card account opening (footnote 6)

· The option to request Business Deposit Cards, which allow employees to securely make deposits for

your business at the ATM, without being able to see your balances

Visit bankofamerica.com/getstartednow to learn more about your new account.

Q:Why should I request a Bank of America debit card linked to my account?

A: If you use your business debit, credit or charge card to make $250 in net new qualifying purchases each

checking statement cycle, you will avoid the monthly fee on your checking account. (footnote 5) You can use

your card to check balances, transfer and withdraw funds, and make deposits at thousands of Bank of

America ATMs. Plus, your card comes with chip technology that adds an extra layer of security when used at

chip-enabled terminals.

For more information and to request your card, visit bankofamerica.com/ordermycard.

Q:What are the advantages of Online Banking?

A: Small Business Online Banking (footnote 7) provides convenient access to your account information when

you need it. And you can complete many banking functions from your home or office. View and track

balance information, monitor account activity and download transaction reports. Plus, you can make online

payments for bills, taxes and other expenses.

Find out more at bankofamerica.com/businessonlinebanking.

If you have any questions or need assistance adding any of these services, please call: 888.BUSINESS

(888.287.4637).

1. Mobile Banking requires enrollment through the Mobile Banking app, Mobile website or Online Banking. Enrollment through the Mobile Banking

app is not available on all devices. View the Online Banking Service Agreement at bankofamerica.com/serviceagreement for more information.

Data connection required. Wireless carrier fees may apply.

2. Alerts received as text messages on your mobile access device may incur a charge from your mobile access service provider. This feature is

not available on the Mobile website. Data connection required. Wireless carrier fees may apply.

3. Bank of America does not charge for Text Banking. However, your mobile service provider may charge for sending and receiving text messages

on your mobile phone. Check with your service provider for details on specific fees and charges that may apply.

4. Mobile Check Deposits are subject to verification and not available for immediate withdrawal. In the Mobile Banking app, select Help &

Support, then Mobile Check Deposit for details, including funds availability, deposit limits, proper disposal of checks, restrictions and terms and

conditions. Requires at least a 2-megapixel camera. Data connection required. Wireless carrier fees may apply.

5. Spend $250 or more in net new purchases each statement/billing cycle using a linked Bank of America business debit, credit or charge card.

Purchases must post to that card account to qualify. To link your Business card to your Business Fundamentals® checking account, please visit

your local financial center or call 888.BUSINESS (888.287.4637). Purchases must be made on only one of either the debit, credit or charge card

accounts; purchases on any combination of debit, credit and charge cards cannot be aggregated to reach the monthly spend. See Business

Schedule of Fees at bankofamerica.com/businessfeesataglance for an explanation of how the monthly fee waiver is applied and how the card

spend is determined.

6. To qualify for the statement credit, you must open a new small business credit card account and make at least $500 in retail Net Purchases

with your card that post to your account within 60 days from the credit card account opening. Net Purchases exclude any transaction fees,

returns and adjustments. The statement credit will be applied to the company's business card account. One $200 statement credit allowed per

company. Please allow 10-12 weeks after the qualifying transaction posts to your account to receive your statement credit. Offer subject to

change without notice.

7. Small Business Online Banking requires Internet access and Internet service provider fees may apply.

QuickBooks® is a registered trademark of Intuit Inc., used under license. Business Fundamentals, Total Security Protection, Clarity Statement,

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Bank of America, N.A. Member FDIC. ©2016 Bank of America Corporation.

ARY53VPQ

SSM-08-16-0474.D

Page 6 of 6

Download eStmt 2017-03-31 1

eStmt_2017-03-31__1.pdf (PDF, 406.92 KB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000582877.