Diesel endgame (PDF)

File information

Title: UNO Template

Author: Teng, Fei (VZDQ 411)

This PDF 1.5 document has been generated by Microsoft® Word 2010, and has been sent on pdf-archive.com on 19/07/2017 at 14:00, from IP address 217.111.x.x.

The current document download page has been viewed 459 times.

File size: 1.28 MB (29 pages).

Privacy: public file

File preview

23 November 2015

Europe

Equity Research

Auto Parts & Equipment (Automobiles & Components (Europe))

European diesel car market

Research Analysts

Fei Teng

44 20 7883 9978

fei.teng@credit-suisse.com

Alexander Haissl

44 20 7888 8507

alexander.haissl@credit-suisse.com

Stephanie MacAulay

44 20 7883 3958

stephanie.j.macaulay@credit-suisse.com

Specialist Sales: Andrew Bell

44 20 7888 0479

andrew.bell@credit-suisse.com

SECTOR REVIEW

Diesel endgame: single digit market share?

And why SCR growth is uncertain long term

■ Our scenario analysis suggests Europe diesel share could fall as low

as 9% within 10 years: Based on our total cost of ownership analysis, we

estimate diesel share could fall as low as 9% by 2024. This is driven by

increased aftertreatment component costs, diesel fuel taxes and

improvements in petrol powertrain efficiency. By 2024, we think it could be

more economical for any car in Europe driving less than 26,000 km/yr (91%

of cars) to be fuelled by petrol (gasoline). A more moderate scenario puts

diesel market share at 27% in 2024E.

■ Outlook for aftertreatment technologies uncertain: Selective catalytic

reduction (SCR) looks set to benefit from tighter emissions regulation, but

higher penetration ratio may ultimately be offset by a declining diesel market.

In effect, the volume peak in SCR may occur earlier than previously

anticipated if OEMs accelerate emissions control. However, growth looks

difficult to sustain unless the diesel market share can remain resilient.

■ Suppliers like Plastic Omnium (UP) set for short-term boost: Better

effectiveness of SCR compared to LNT is likely to boost penetration of SCR

technology. Plastic Omnium's SCR business is currently c. 2% of sales, but is a

key contributor to its overall revenue growth. We increase our target price to €20.

However, longer-term prospects remain uncertain as any material decline in

diesel share would immediately lead to the market for SCR to contract.

Figure 1: Western Europe diesel market share outlook

60%

Western Europe diesel market share %

Case 1

50%

50%

Case 2

40%

30%

27%

20%

Case 3

10%

9%

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015E

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

0%

Source: ACEA, Credit Suisse estimates

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST

CERTIFICATIONS, AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do

business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a

conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in

making their investment decision.

CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS

BEYOND INFORMATION®

Client-Driven Solutions, Insights, and Access

23 November 2015

NOx revelations likely to hasten end of diesel

Volkswagen puts spotlight on diesel

The reliability of emissions tests is not a new topic, but the method used by Volkswagen to

conduct emissions tests will have increased the focus on the regulatory framework. Unless

carmakers would part with diesel technology completely, they will be faced with rising

content costs for aftertreatment systems. But these costs reduce the value of diesel cars

for consumers, and are likely to accelerate the shift away from this fuel, in our view,

particularly by cost-conscious customers such as fleets.

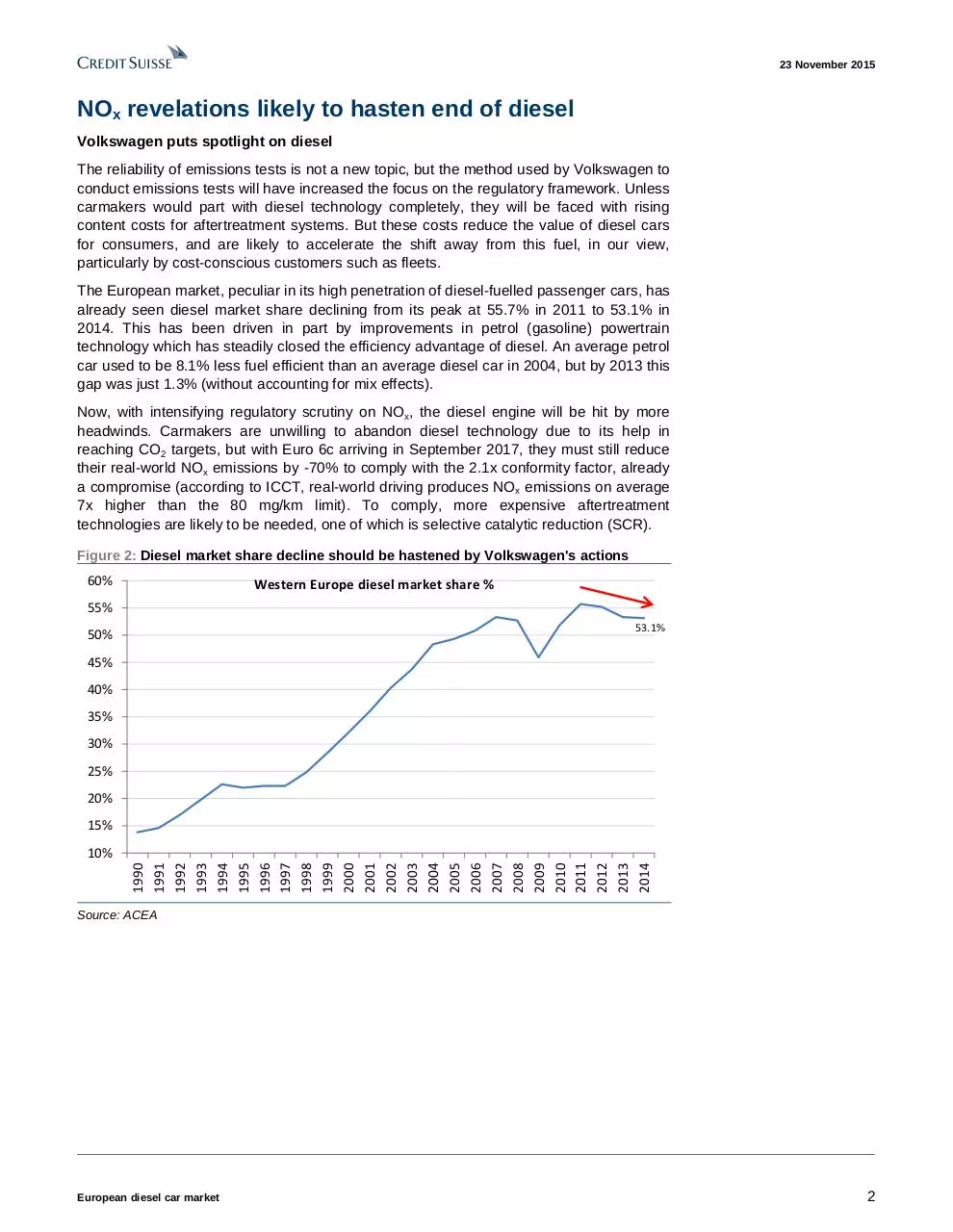

The European market, peculiar in its high penetration of diesel-fuelled passenger cars, has

already seen diesel market share declining from its peak at 55.7% in 2011 to 53.1% in

2014. This has been driven in part by improvements in petrol (gasoline) powertrain

technology which has steadily closed the efficiency advantage of diesel. An average petrol

car used to be 8.1% less fuel efficient than an average diesel car in 2004, but by 2013 this

gap was just 1.3% (without accounting for mix effects).

Now, with intensifying regulatory scrutiny on NOx, the diesel engine will be hit by more

headwinds. Carmakers are unwilling to abandon diesel technology due to its help in

reaching CO2 targets, but with Euro 6c arriving in September 2017, they must still reduce

their real-world NOx emissions by -70% to comply with the 2.1x conformity factor, already

a compromise (according to ICCT, real-world driving produces NOx emissions on average

7x higher than the 80 mg/km limit). To comply, more expensive aftertreatment

technologies are likely to be needed, one of which is selective catalytic reduction (SCR).

Figure 2: Diesel market share decline should be hastened by Volkswagen's actions

60%

Western Europe diesel market share %

55%

53.1%

50%

45%

40%

35%

30%

25%

20%

15%

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

10%

Source: ACEA

European diesel car market

2

23 November 2015

Carmakers turn to SCR

LNT not as effective as required

Volkswagen's emissions investigation also highlighted deficiencies in diesel aftertreatment

technologies, particularly LNT. The justification for LNT had been lower costs, smaller

size, and better convenience compared to SCR (no diesel exhaust fluid top-ups).

However, LNT requires regular doses of fuel to clean NOx emissions ("regeneration"), thus

reducing fuel efficiency by a small amount. Precise calibration of the engine control unit is

required to effectively manage both emissions and fuel economy – however, Volkswagen

appeared to struggle to optimise this trade off, and this was likely one of the reasons which

led to the implementation of emissions-reducing software.

SCR will likely be favoured going forward

Due to LNT's shortcomings, we think the more effective selective catalytic reduction (SCR)

technology is likely to become the main emission-control solution for carmakers under

pressure from regulations. To this end, Volkswagen already announced on 13 October the

switch to all-SCR on its European and North America vehicles "as soon as possible", while

PSA already uses SCR on all of its Euro 6-compliant vehicles.

■

LNT normally preferred for smaller cars: The lower NOx capacity of LNT means it is

normally preferred for smaller cars, and SCR for larger cars, due to the higher NO x

loads in larger vehicles (hence predominant use of SCR in heavy commercial

vehicles).

■

SCR is substantially more effective in terms of NOx conversion: At optimal

operation, the conversion efficiency of SCR reaches 95%, while LNT reaches 70-90%.

Because of LNT's need for regeneration, it also has a worse impact on fuel economy

compared to SCR.

■

Biggest SCR drawback is in-use compliance: The biggest drawback of SCR is the

need to maintain in-use compliance by regular refills of diesel exhaust fluid (DEF).

Normally the frequency of refills is low and can be done at regular servicing intervals.

However, it adds incremental cost of €43 per year based on our estimates of 15,000

km travelled per year, in addition to €31 per year in depreciation.

■

SCR also suffers from poor low-temperature performance: Another issue of SCR

relates to low-temperature operation. Vanadium catalysts, which are normally

employed in SCR systems, have low effectiveness at low exhaust temperatures (e.g.

at engine start). However, the alternative zeolite catalysts are more expensive.

Additionally, low exhaust temperature means the SCR system sometimes needs to

draw extra power to heat the DEF, causing a small reduction in fuel economy.

■

SCR system adds complexity and weight: A complete SCR system consists of

several main parts – catalyst, urea (DEF) tank, injector, pump, heating and sensors,

among other components. An SCR system with a tank holding c.10 litres of DEF is

also likely to add some weight to a car, causing a small reduction in fuel economy.

Plastic Omnium is a producer of the urea tank and dosing unit.

■

SCR adds around €500 per cars of costs: According to ICCT, the total cost per

vehicle of an SCR system, including labour and warranty provision, ranges between

$523-657 (€489-614) depending on the size of the engine. In comparison, the cost of

an LNT system ranges between $400-752 (€374-703) per vehicle.

European diesel car market

3

23 November 2015

Diesel market to determine course of SCR market

Rising penetration offset by declining market

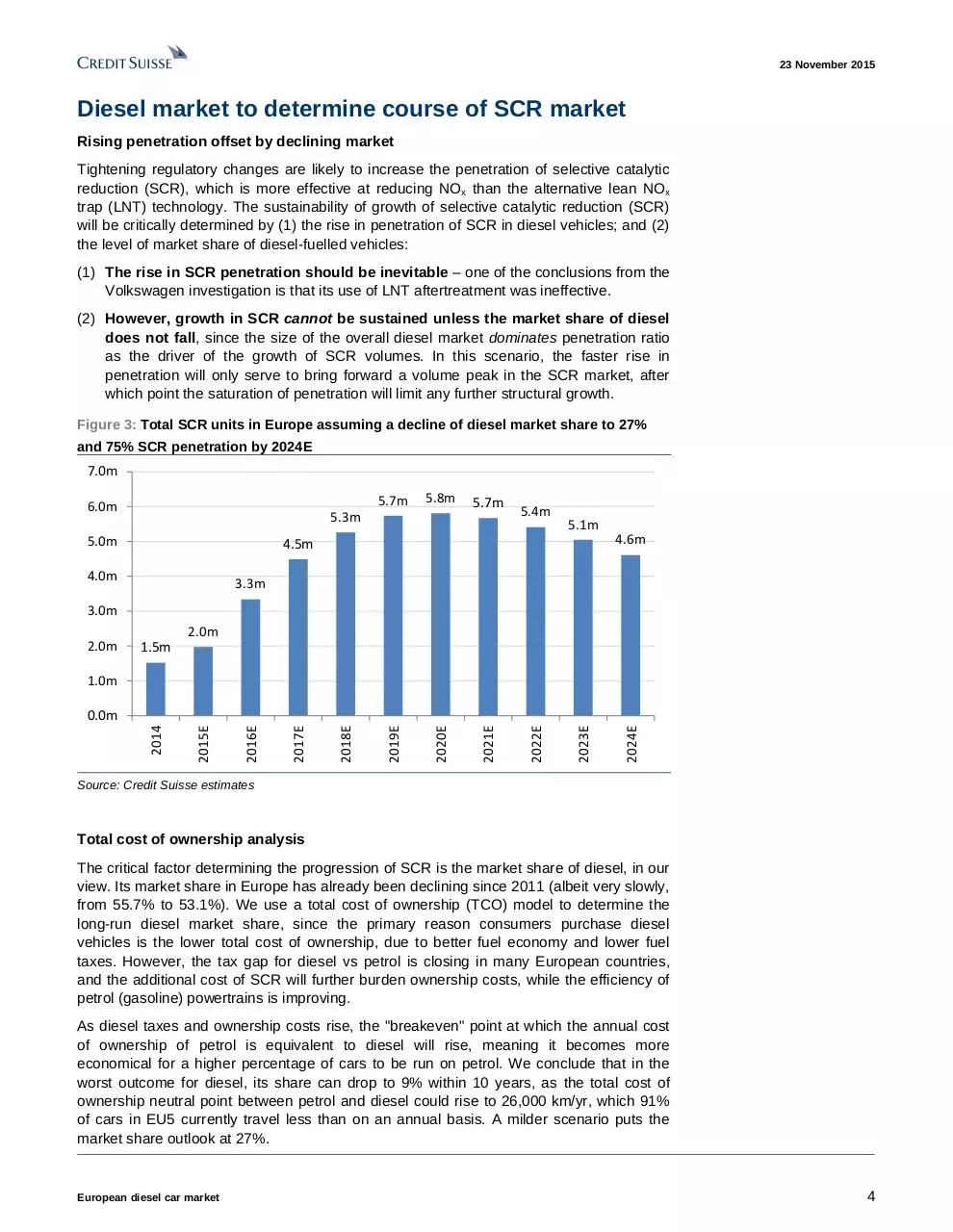

Tightening regulatory changes are likely to increase the penetration of selective catalytic

reduction (SCR), which is more effective at reducing NOx than the alternative lean NOx

trap (LNT) technology. The sustainability of growth of selective catalytic reduction (SCR)

will be critically determined by (1) the rise in penetration of SCR in diesel vehicles; and (2)

the level of market share of diesel-fuelled vehicles:

(1) The rise in SCR penetration should be inevitable – one of the conclusions from the

Volkswagen investigation is that its use of LNT aftertreatment was ineffective.

(2) However, growth in SCR cannot be sustained unless the market share of diesel

does not fall, since the size of the overall diesel market dominates penetration ratio

as the driver of the growth of SCR volumes. In this scenario, the faster rise in

penetration will only serve to bring forward a volume peak in the SCR market, after

which point the saturation of penetration will limit any further structural growth.

Figure 3: Total SCR units in Europe assuming a decline of diesel market share to 27%

and 75% SCR penetration by 2024E

7.0m

5.7m

6.0m

5.8m

5.3m

5.0m

5.7m

5.4m

5.1m

4.6m

4.5m

4.0m

3.3m

3.0m

2.0m

2.0m

1.5m

1.0m

2024E

2023E

2022E

2021E

2020E

2019E

2018E

2017E

2016E

2015E

2014

0.0m

Source: Credit Suisse estimates

Total cost of ownership analysis

The critical factor determining the progression of SCR is the market share of diesel, in our

view. Its market share in Europe has already been declining since 2011 (albeit very slowly,

from 55.7% to 53.1%). We use a total cost of ownership (TCO) model to determine the

long-run diesel market share, since the primary reason consumers purchase diesel

vehicles is the lower total cost of ownership, due to better fuel economy and lower fuel

taxes. However, the tax gap for diesel vs petrol is closing in many European countries,

and the additional cost of SCR will further burden ownership costs, while the efficiency of

petrol (gasoline) powertrains is improving.

As diesel taxes and ownership costs rise, the "breakeven" point at which the annual cost

of ownership of petrol is equivalent to diesel will rise, meaning it becomes more

economical for a higher percentage of cars to be run on petrol. We conclude that in the

worst outcome for diesel, its share can drop to 9% within 10 years, as the total cost of

ownership neutral point between petrol and diesel could rise to 26,000 km/yr, which 91%

of cars in EU5 currently travel less than on an annual basis. A milder scenario puts the

market share outlook at 27%.

European diesel car market

4

23 November 2015

Diesel cost incentives start to diminish

Diesel fuel taxes start to get more expensive

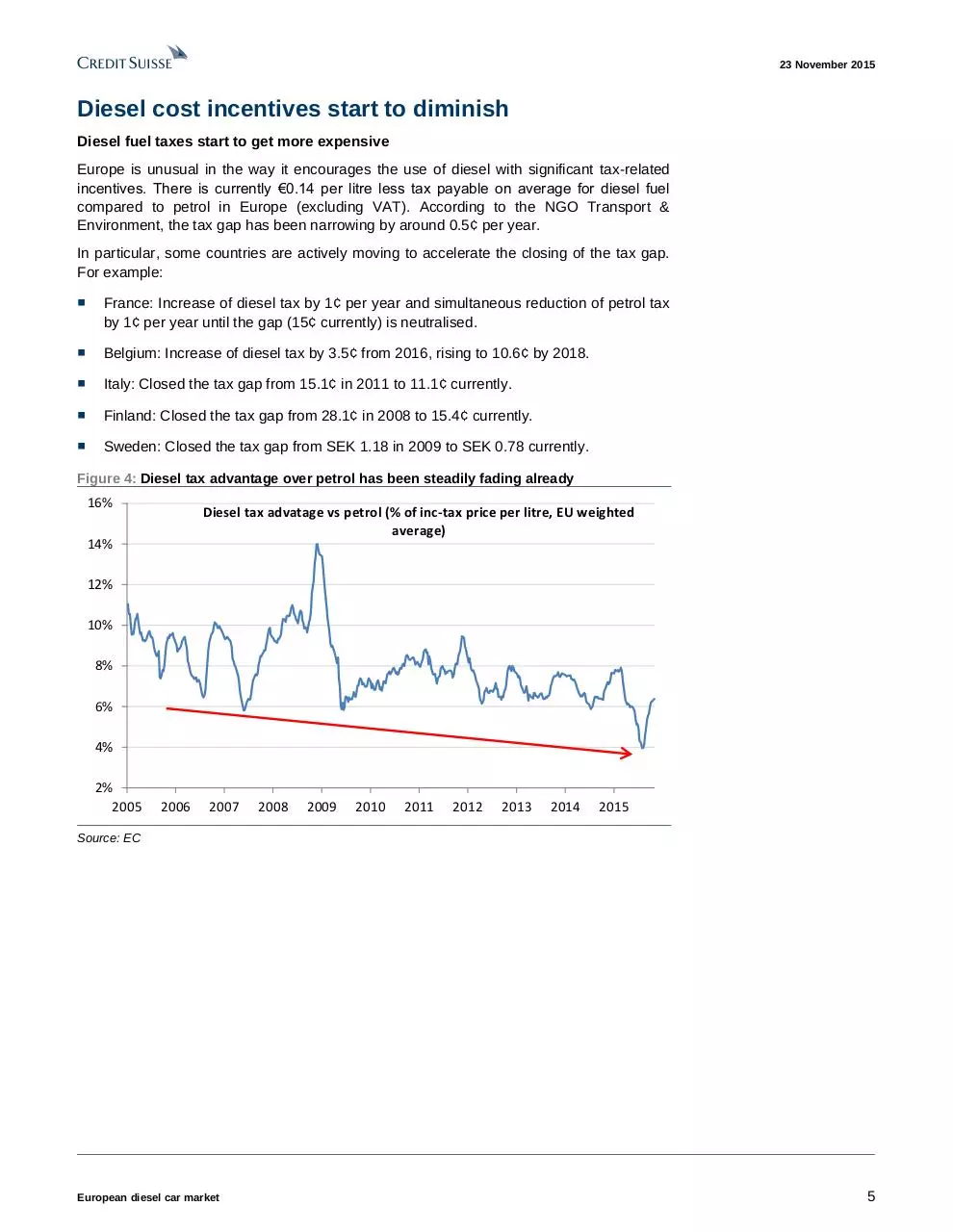

Europe is unusual in the way it encourages the use of diesel with significant tax-related

incentives. There is currently €0.14 per litre less tax payable on average for diesel fuel

compared to petrol in Europe (excluding VAT). According to the NGO Transport &

Environment, the tax gap has been narrowing by around 0.5¢ per year.

In particular, some countries are actively moving to accelerate the closing of the tax gap.

For example:

■

France: Increase of diesel tax by 1¢ per year and simultaneous reduction of petrol tax

by 1¢ per year until the gap (15¢ currently) is neutralised.

■

Belgium: Increase of diesel tax by 3.5¢ from 2016, rising to 10.6¢ by 2018.

■

Italy: Closed the tax gap from 15.1¢ in 2011 to 11.1¢ currently.

■

Finland: Closed the tax gap from 28.1¢ in 2008 to 15.4¢ currently.

■

Sweden: Closed the tax gap from SEK 1.18 in 2009 to SEK 0.78 currently.

Figure 4: Diesel tax advantage over petrol has been steadily fading already

16%

Diesel tax advatage vs petrol (% of inc-tax price per litre, EU weighted

average)

14%

12%

10%

8%

6%

4%

2%

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Source: EC

European diesel car market

5

23 November 2015

Local authorities move to limit diesels in cities

While national treasuries are moving to increase relative tax rates on diesel fuel, local

authorities are moving to limit the use of diesel cars in major cities through the broad

implementation of low-emission zones (LEZ), which reduces the practicality of owning

diesel vehicles in certain areas.

■

Paris: intends to ban entry of pre-Euro 6 diesel cars from 2020 onwards, with ongoing

discussions to potentially ban all diesel cars.

■

London: intends to charge a fee (£12.50) for Euro 6 diesel cars entering low-emissionzone from 2016. Diesel parking surcharge in borough of Islington.

■

Madrid: city parking charges determined by level of NOx emissions in scheme

introduced in 2014.

■

Prague: only Euro 3 and above diesel vehicles allowed in low-emissions-zone from

2016, Euro 4 and above from 2018. Euro 1 and above for petrol cars.

■

Milan: only Euro 4 and above diesel vehicles allowed in city centre since 2011. Euro 1

and above for petrol cars.

■

Stuttgart: only Euro 4 and above diesel vehicles allowed in low-emissions-zone from

2012. Euro 1 and above for petrol cars.

Though many cities with low-emission zones have fairly lenient regulations limiting only

pre-Euro 4 cars, in our view this is likely to tighten over time. One consequence of this

could be in lowered residual values due to the lowered utility value of older diesel cars,

which could then in turn pressure new car prices and make it unprofitable to produce some

smaller diesel cars.

European diesel car market

6

23 November 2015

Total cost of ownership decides fuel choice

Taxes, SCR to burden diesel cost of ownership

In our view, the long-run diesel market share in Europe should be determined by the

relative costs of ownership of diesel cars compared with petrol cars. In the worst case

outcome for diesel-engine cars, we think market share could fall as low as 9% within 10

years in Europe if taxes rise, costs of aftertreatment components become burdensome,

and petrol cars' efficiencies improve. If fuel taxes do not rise as we expect, then the market

share of diesel cars could still fall to 27% due to aftertreatment component costs, based on

our estimates.

We think the cost of ownership of diesel will increase relative to petrol for three reasons:

■

Increased depreciation and running costs for aftertreatment systems (SCR): We

estimate that the additional capital cost of an SCR system amounts to €500 which

depreciates to zero over the vehicle lifetime. In addition, the cost of DEF adds €2.86

per 1,000 km based on Volkswagen's data.

■

Increasing in taxation on diesel fuel: We assume that the price of diesel would rise

significantly in France and Germany to reduce (but not eliminate) the current price gap

to petrol. In both countries, diesel is currently 17% cheaper than petrol. In Spain and

Italy (where the difference is less) we assume a smaller but material price increase,

and in the UK (where there is no difference) the smallest rise.

■

Improvement in relative fuel economy: From 2004 until 2013, the difference in fuel

economy between the average petrol car and the average diesel car fell from 8.1% to

just 1.3% in Europe. While this figure does not adjust for mix (hence diesel models are

still generally c. 20% more efficient than their comparable petrol counterparts), we

think efficiency gains on petrol vehicles can continue to drive a narrowing in this gap.

Diesel market share to fall as ownership costs rise

We expect the total cost of ownership (TCO) differential between petrol and diesel to

gradually narrow though not disappear since diesel engines are inherently more efficient

than petrol. However, the proportion of drivers for which petrol becomes the more

economically logical choice should increase.

In the case of higher diesel taxes, higher exhaust aftertreatment costs, and improved

petrol fuel economy, we estimate that cars in EU5 travelling annual distances below

26,000 km will have a lower cost of ownership using petrol rather than diesel. This

compares with 8,000 km/yr at current petrol efficiency and diesel costs. Since 91% of cars

in EU5 currently travel less than 26,000 km/yr based on distance travelled data, we expect

the economically logical market share for diesel in this scenario to thus drop to 9%. This

compares to 32% of cars which currently travel less than 8,000 km/yr.

Full explanation of methodology given page 9.

European diesel car market

7

23 November 2015

Worst outcome: diesel market share could fall as low

as 9%

In the most pessimistic outlook for the diesel market, we estimate that within 10 years, the

rise in total cost of ownership (TCO) will make it uneconomical for 91% of the cars in EU5

to run on diesel fuel. In a more moderate case, if we assume no change in the relative

taxation on diesel and petrol fuel (unlikely in our view), our TCO model still suggests a

27% long-run diesel market share compared with 53% currently.

Figure 5: TCO neutral point (km/yr) – the annual distance travelled at which point the cost per year is equal between

petrol and diesel, based on a VW Golf

Petrol scenario

Petrol

Petrol + 10% efficiency

Petrol

Petrol + 10% efficiency

Petrol

Petrol + 10% efficiency

Diesel scenario

Diesel

Diesel

Diesel + SCR

Diesel + SCR

Diesel + taxes + SCR

Diesel + taxes + SCR

Germany

7,000

9,000

9,000

13,000

12,000

22,000

France

7,000

9,000

9,000

14,000

12,000

23,000

UK

10,000

21,000

15,000

35,000

16,000

35,000

Spain

9,000

13,000

12,000

20,000

14,000

27,000

Italy

8,000

13,000

10,000

16,000

11,000

21,000

EU5

8,000

12,000

10,000

17,000

13,000

26,000

Spain

50%

72%

67%

91%

76%

96%

Italy

47%

75%

59%

86%

66%

93%

EU5

32%

55%

47%

73%

61%

91%

Source: Credit Suisse estimates

Figure 6: Percentage of cars whose annual km driven is below the TCO neutral point (%)

Petrol scenario

Petrol

Petrol + 10% efficiency

Petrol

Petrol + 10% efficiency

Petrol

Petrol + 10% efficiency

Diesel scenario

Diesel

Diesel

Diesel + SCR

Diesel + SCR

Diesel + taxes + SCR

Diesel + taxes + SCR

Germany

20%

28%

28%

52%

45%

83%

France

24%

35%

35%

53%

64%

90%

UK

40%

85%

67%

99%

72%

99%

Source: Credit Suisse estimates

Figure 7: If petrol engine efficiency improves by 10%, and diesel cars become subject to SCR costs and additional fuel

taxes, then the rise in TCO would make it uneconomic for 91% of EU5 cars to be run on diesel vs the current 32%

100%

91%

Petrol + 10% efficiency vs diesel + taxes + SCR

80%

73%

Petrol + 10% efficiency vs diesel + SCR

61%

60%

Petrol vs diesel + taxes + SCR

55%

Petrol + 10% efficiency vs diesel

47%

Petrol vs diesel + SCR

40%

32%

Petrol vs diesel

20%

EU5 weighted average km driven, cumulative % of cars

0%

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Source: Company data, Credit Suisse estimates

European diesel car market

8

23 November 2015

Methodology: total cost of ownership analysis

Diesel cars, compared to gasoline cars, generally exhibit lower running costs due to better

fuel economy but higher capital cost due to more expensive engine technology. Thus, for

low annual mileage, petrol cars are more economic than diesel cars. The breakeven point

("TCO neutral point") determines the annual distance travelled above which diesel cars

are the more economical purchase.

We determine the petrol vs. diesel TCO neutral point under several scenarios using the

ubiquitous Volkswagen Golf as the reference vehicle.

■

Petrol scenario 1: Petrol (gasoline) engine at "official" fuel economy.

■

Petrol scenario 2: Petrol (gasoline) engine at 10% better fuel economy than "official"

figure. We make this assumption on the expectation that advancement of powertrain

technology will continue to erode the comparative fuel economy advantage of diesel

(as it has been doing already for some time).

■

Diesel scenario 1: Diesel engine at "official" fuel economy.

■

Diesel scenario 2: Diesel engine plus the cost of SCR aftertreatment technology

including urea fluid, assuming the car does not already contain such a system.

■

Diesel scenario 3: As scenario 2, but assuming that the tax advantage of diesel

narrows, such as is happening in France, Italy and several other countries (Figure 8).

Figure 8: Comparative fuel cost advantage of diesel

Diesel price (€c/l)

Petrol price (€c/l)

Difference

Germany

124.40

145.27

16.8%

France

120.60

140.82

16.8%

UK

161.87

155.46

-4.0%

Spain

118.88

128.96

8.5%

Italy

148.28

160.54

8.3%

12%

139.33

12%

135.07

1%

163.49

5%

124.82

5%

155.69

Diesel scenario 3: tax/surcharge increase %

Diesel scenario 3: price (€c/l)

Source: Company data, Credit Suisse estimates

To generate results we follow the parameters and conditions set out below:

■

■

Reference vehicle: New Volkswagen Golf Mk7 (2012 SOP). Prices from official

Volkswagen Germany site. We take the lowest base model in each fuel type to retain

comparability.

o

Petrol (gasoline) version: "Trendline" 1.2L TSI, €17,650; 4.9l/100km.

o

Diesel version: "Trendline" 1.6L TDI, €21,875; 3.8l/100km.

Depreciation: Straight-line to scrap value.

o

Gasoline: Over 14 years to €400

o

Diesel: Over 16 years to €500

■

SCR: Assume additional €500 in capital cost per car, to account for unit cost plus

relevant development and manufacturing costs. We assume this depreciates to zero

over the lifetime of the car. In addition, we assume running costs of urea fluid (DEF) at

€2.86 per 1,000km, based on VW figures.

■

Other ownership costs: Assume diesel model insurance is 4% more expensive than

for petrol (based on Germany insurance quotes); but all other cost differences (such

as maintenance) are negligible.

European diesel car market

9

Download Diesel endgame

Diesel endgame.pdf (PDF, 1.28 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000626422.