Supposed GOP Tax Bill Friday night at 614pm (PDF)

File information

This PDF 1.6 document has been generated by Canon / Adobe Acrobat Pro 11.0.21 Paper Capture Plug-in, and has been sent on pdf-archive.com on 02/12/2017 at 00:15, from IP address 208.87.x.x.

The current document download page has been viewed 32945 times.

File size: 11.65 MB (479 pages).

Privacy: public file

File preview

S.L.C.

O:\MCG\MCGl 7C67.xml [file 1 of 5]

AMENDMENT NO.- - - -

Calendar No. - - -

Purpose: To provide a perfecting amendment.

IN THE SENATE OF THE UNITED STATES-115th Cong., 1st Sess.

H.R.1

To provide for reconciliation pursuant to titles II and V

of the concurrent resolution on the budget for fiscal

year 2018.

Referred to the Committee on - - - - - - - - - and

ordered to be printed

Ordered to lie on the table and to be printed

intended

to

be

proposed

by

_ _ _ _ _ _ _ _ _ to the amendment (No. ___ )

proposed by _ _ _ _ _ _ _ __

AMENDMENT

Viz:

1

Strike all after the first word and insert the following:

S.L.C.

O:\OTT\OTTl 7834.xml [file 2 of 5]

2

TITLE I

1

2 SEC. 11000. SHORT TITLE, ETC.

3

(a) SHORT TITLE.-This title may be cited as the

4 "Tax Cuts and Jobs Act".

5

(b) AMENDMENT OF 1986 CoDE.-Except as other-

6 wise expressly provided, whenever in this title an amend7 ment or repeal is expressed in terms of an amendment

8 to, or repeal of, a section or other provision, the reference

9 shall be considered to be made to a section or other provi10 sion of the Internal Revenue Code of 1986.

11

Subtitle A-Individual Tax Reform

12

PART I-TAX RATE REFORM

13 SEC. 11001. MODIFICATION OF RATES.

14

(a) IN GENERAL.-Section 1 is amended by adding

15 at the end the following new subsection:

16

"(j) MODIFICATIONS FOR TAXABLE YEARS 2018

17 THROUGH 2025.18

"(l) IN GENERAL.-In the case of a taxable

19

year beginning after December 31, 2017, and before

20

January 1, 2026-

21

"(A) subsection (i) shall not apply, and

22

'' (B) this section (other than subsection

23

(i)) shall be applied as provided in paragraphs

24

(2) through (7).

25

"(2) RATE TABLES.-

S.L.C.

O:\OTT\OTTl 7834.xml [file 2 of 5]

3

1

"(A) MARRIED INDIVIDUALS FILING JOINT

2

RETURNS AND SURVIVING SPOUSES.-The fol-

3

lowing table shall be applied in lieu of the table

4

contained in subsection (a):

"If taxable income is:

The tax is:

Not over $19,050 ......................................

Over $19,050 but not over $77,400 ..........

Over $77,400 but not over $140,000 ........

Over $140,000 but not over $320,000 ......

Over $320,000 but not over $400,000 ......

Over $400,000 but not over $1,000,000 ...

Over $1,000,000 ........................................

10% of taxable income.

$1,905, plus 12% of the excess over

$19,050.

$8,907, plus 22% of the excess over

$77,400.

$22,679, plus 24% of the excess

over $140,000.

$65,879, plus 32% of the excess

over $320,000.

$91,479, plus 35% of the excess

over $400,000.

$301,479, plus 38.5% of the excess

over $1,000,000.

5

"(B) HEADS OF HOUSEHOLDS.-The fol-

6

lowing table shall be applied in lieu of the table

7

contained in subsection (b):

"If taxable income is:

The tax is:

Not over $13,600 ......................................

Over $13,600 but not over $51,800 ..........

Over $51,800 but not over $70,000 ..........

Over $70,000 but not over $160,000 ........

Over $160,000 but not over $200,000 ......

Over $200,000 but not over $500,000 ......

Over $500,000 ...........................................

8

"(C)

10% of taxable income.

$1,360, plus 12% of the excess over

$13,600.

$5,944, plus 22% of the excess over

$51,800.

$9,948, plus 24% of the excess over

$70,000.

$31,548, plus 32% of the excess

over $160,000.

$44,348, plus 35% of the excess

over $200,000.

$149,348, plus 38.5% of the excess

over $500,000.

UNMARRIED

INDIVIDUALS

OTHER

9

THAN SURVIVING SPOUSES AND HEADS OF

10

HOUSEHOLDS.-The following table shall be ap-

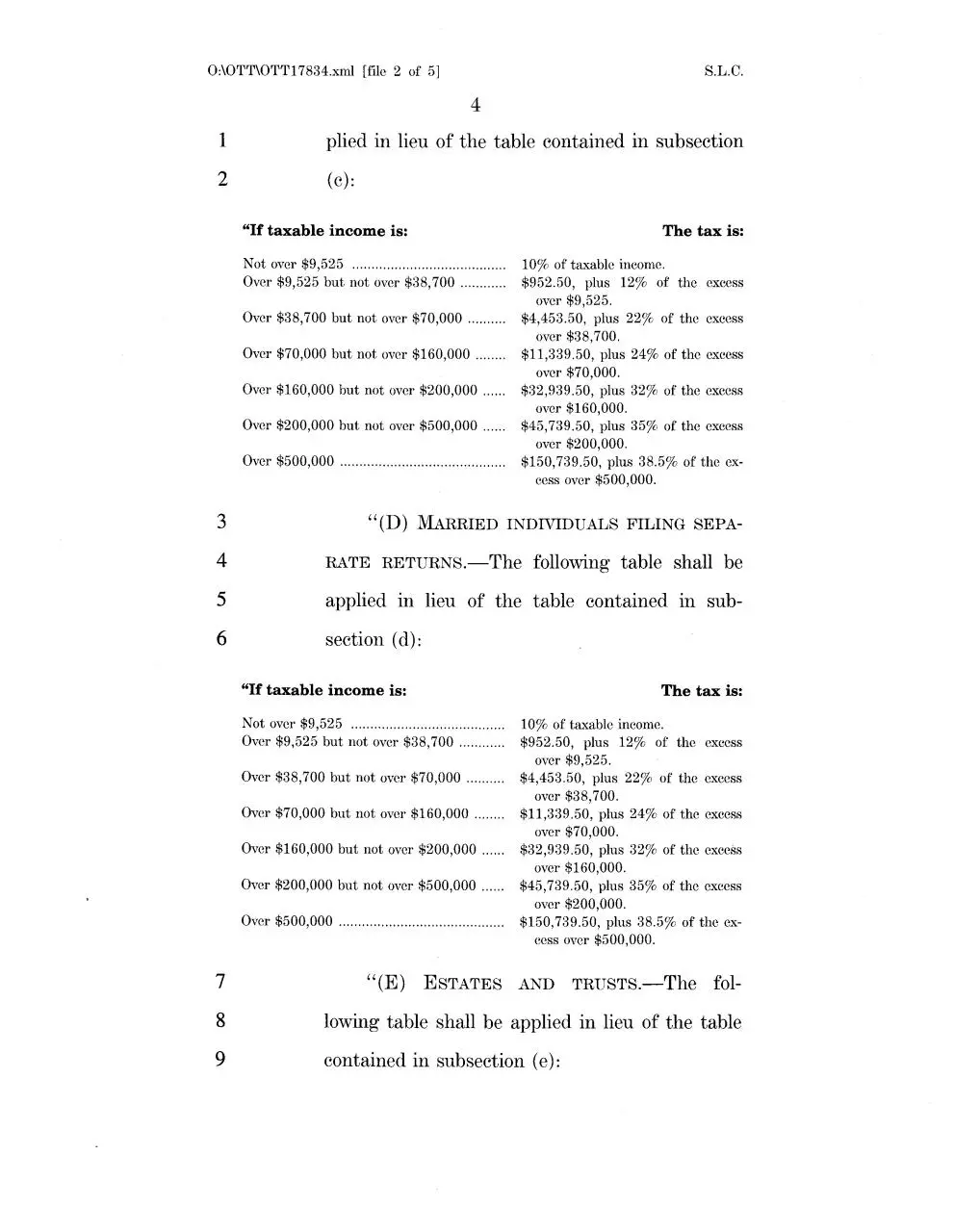

O:\OTT\OTTl 7834.xml [file 2 of 5]

S.L.C.

4

1

plied in lieu of the table contained in subsection

2

(c):

"If taxable income is:

Not over $9,525 ........................................

Over $9,525 but not over $38, 700 ............

Over $38,700 but not over $70,000 ..........

Over $70,000 but not over $160,000 ........

Over $160,000 but not over $200,000 ......

Over $200,000 but not over $500,000 ......

Over $500,000 ...........................................

The tax is:

10% of taxable income.

$952.50, plus 12% of the excess

over $9,525.

$4,453.50, plus 22% of the excess

over $38,700.

$11,339.50, plus 24% of the excess

over $70,000.

$32,939.50, plus 32% of the excess

over $160,000.

$45,739.50, plus 35% of the excess

over $200,000.

$150,739.50, plus 38.5% of the excess over $500,000.

3

"(D) MARRIED INDIVIDUALS FILING SEPA-

4

RATE RETURNS.-The following table shall be

5

applied in lieu of the table contained in sub-

6

section (d):

"If taxable income is:

Not over $9,525 ........................................

Over $9,525 but not over $38, 700 ............

Over $38,700 but not over $70,000 ..........

Over $70,000 but not over $160,000 ........

Over $160,000 but not over $200,000 ......

Over $200,000 but not over $500,000 ......

Over $500,000 ...........................................

The tax is:

10% of taxable income.

$952.50, plus 12% of the excess

over $9,525.

$4,453.50, plus 22% of the excess

over $38,700.

$11,339.50, plus 24% of the excess

over $70,000.

$32,939.50, plus 32% of the excess

over $160,000.

$45,739.50, plus 35% of the excess

over $200,000.

$150,739.50, plus 38.5% of the excess over $500,000.

7

"(E) ESTATES AND TRUSTS.-The fol-

8

lowing table shall be applied in lieu of the table

9

contained in subsection (e):

S.L.C.

O:\OTT\OTTl 7834.xml [file 2 of 5]

5

"If taxable income is:

Not over $2,550 ........................................

Over $2,550 but not over $9,150 ..............

Over $9,150 but not over $12,500 ............

Over $12,500 .............................................

The tax is:

10% of taxable income.

$255, plus 24% of the excess over

$2,550.

$1,839, plus 35% of the excess over

$9,150.

$3,011.50, plus 38.5% of the excess over $12,500.

1

"(F) REFERENCES TO RATE TABLES.-

2

Any reference in this title to a rate of tax under

3

subsection (c) shall be treated as a reference to

4

the corresponding rate bracket under subpara-

5

graph (C) of this paragraph, except that the

6

reference in section 3402(q)(l) to the third low-

7

est rate of tax applicable under subsection (c)

8

shall be treated as a reference to the fourth

9

lowest rate of tax under subparagraph (C).

10

"(3) ADJUSTMENTS.-

11

"(A) No ADJUSTMENT IN 201s.-The ta-

12

bles contained in paragraph (2) shall apply

13

without adjustment for taxable years beginning

14

after December 31, 2017, and before January

15

1, 2019.

16

"(B) SUBSEQUENT YEARS.-For taxable

17

years beginning after December 31, 2018, the

18

Secretary shall prescribe tables which shall

19

apply in lieu of the tables contained in para-

20

graph (2) in the same manner as under para-

O:\OTT\OTTI 7834.xml [file 2 of 5]

S.L.C.

6

1

graphs (1) and (2) of subsection (f), except that

2

in prescribing such tables-

3

"(i) subsection (f)(3) shall be applied

4

by substituting 'calendar year 2017' for

5

'calendar year

6

(A)(ii) thereof,

2016'

in

subparagraph

7

"(ii) subsection (f)(7)(B) shall apply

8

to any unmarried individual other than a

9

surviving spouse or head of household, and

10

"(iii) subsection (f)(8) shall not apply.

11

"( 4) SPECIAL RULES FOR CERTAIN CHILDREN

12

WITH UNEARNED INCOME.-

13

"(A) IN GENERAL.-In the case of a child

14

to whom subsection (g) applies for the taxable

15

year, the rules of subparagraphs (B) and (C)

16

shall apply in lieu of the rule under subsection

17

(g)(l).

18

"(B)

MODIFICATIONS

TO

APPLICABLE

19

RATE BRACKETS.-In determining the amount

20

of tax imposed by this section for the taxable

21

year on a child described in subparagraph (A),

22

the income tax table otherwise applicable under

23

this subsection to the child shall be applied with

24

the following modifications:

O:\OTT\OTTl 7834.xml [file 2 of 5]

S.L.C.

7

1

"(i)

24-PERCENT

BRACKET.-The

2

maximum taxable income which is taxed at

3

a rate below 24 percent shall not be more

4

than the earned taxable income of such

5

child.

6

"(ii)

35-PERCENT

BRACKET.-The

7

maximum taxable income which is taxed at

8

a rate below 35 percent shall not be more

9

than the sum of-

10

11

" (I) the earned taxable income of

such child, plus

12

"(II) the minimum taxable in-

13

come for the 35-percent bracket in the

14

table under paragraph (2)(E) (as ad-

15

justed under paragraph (3)) for the

16

taxable year.

17

"(iii) 38.5-PERCENT BRACKET.-The

18

maximum taxable income which is taxed at

19

a rate below 38.5 percent shall not be

20

more than the sum of-

21

22

'' (I) the earned taxable income of

such child, plus

23

"(II) the minimum taxable in-

24

come for the 38.5-percent bracket in

25

the table under paragraph (2)(E) (as

S.L.C.

O:\OTT\OTTl 7834.xml [file 2 of 5]

8

1

adjusted under paragraph (3)) for the

2

taxable year.

3

"(C) COORDINATION WITH CAPITAL GAINS

4

RATES.-For purposes of applying section l(h)

5

(after the modifications under paragraph (5))-

6

"(i) the maximum zero rate amount

7

shall not be more than the sum of-

8

" (I) the earned taxable income of

9

such child, plus

10

''(II) the amount in effect under

11

paragraph (5)(B)(i)(IV) for the tax-

12

able year, and

13

"(ii) the maximum 15-percent rate

14

amount shall not be more than the sum

15

of-

16

"(I) the earned taxable income of

17

such child, plus

18

''(II) the amount in effect under

19

paragraph (5)(B)(ii)(IV) for the tax-

20

able year.

21

"(D)

EARNED

TAXABLE

INCOME.-For

22

purposes of this paragraph, the term 'earned

23

taxable income' means, with respect to any

24

child for any taxable year, the taxable income

25

of such child reduced (but not below zero) by

S.L.C.

O:\OTT\OTTl 7834.xml [file 2 of 5]

9

1

the net unearned mcome (as defined m sub-

2

section (g)(4)) of such child.

3

"(5) APPLICATION OF CURRENT INCOME TAX

4

5

6

BRACKETS TO CAPITAL GAINS BRACKETS."(A) IN GENERAL.-Section l(h)(l) shall

be applied-

7

"(i) by substituting 'below the max-

8

imum zero rate amount' for 'which would

9

(without regard to this paragraph) be

10

taxed at a rate below 25 percent' in sub-

11

paragraph (B)(i), and

12

"(ii) by substituting 'below the max-

13

imum 15-percent rate amount' for 'which

14

would (without regard to this paragraph)

15

be taxed at a rate below 39.6 percent' in

16

subparagraph (C)(ii)(I).

17

"(B) MAxrMUM AMOUNTS DEFINED.-For

18

purposes of applying section l(h) with the

19

modifications described in subparagraph (A)-

20

"(i)

MAxrMUM

21

AMOUNT.-The

22

amount shall be-

23

24

ZERO

maximum

zero

RATE

rate

"(I) in the case of a joint return

or surviving spouse, $77,200,

Download Supposed GOP Tax Bill - Friday night at 614pm

Supposed GOP Tax Bill - Friday night at 614pm.pdf (PDF, 11.65 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000703853.