NewmansFoundation990 (PDF)

File information

This PDF 1.6 document has been generated by Canon iR7086-7105 / Adobe Acrobat Pro 11.0.3 Paper Capture Plug-in, and has been sent on pdf-archive.com on 16/08/2013 at 06:33, from IP address 173.175.x.x.

The current document download page has been viewed 1157 times.

File size: 2.75 MB (99 pages).

Privacy: public file

File preview

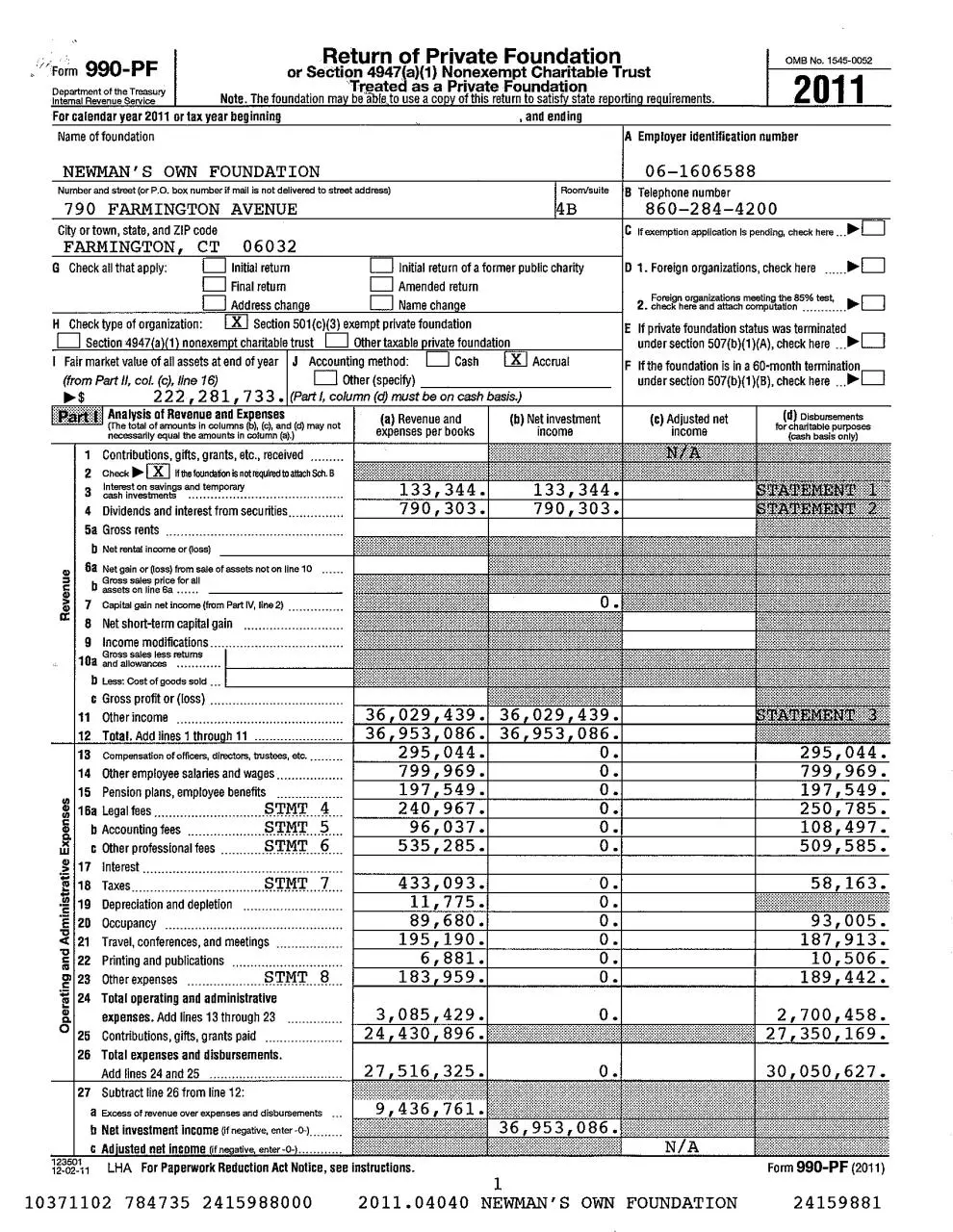

Return of Private Foundation

OMB No. 1545-0052

or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

Department of the Treasury

Internal Revenue Service

Note. The foundation ma be'·able to use a co

For calendar year 2011 or tax year beginning

2011

of this return to satis state re ortin re uirements.

, and ending

Name of foundation

A Employer identification number

NEWMAN'S OWN FOUNDATION

06-1606588

Number and street (or P.O. box number if mail is not delivered to street address)

Room/suite

790 FARMINGTON AVENUE

4B

860-284-4200

City or town, state, and ZIP code

C If exemption application Is pending, check here

FARMINGTON, CT

G Check all that apply:

.......

D

06032

D

D

D

H Check type of organization:

B Telephone number

Initial return

Final return

Address chan e

D

D

D

D 1. Foreign organizations, check here ...... ~D

Initial return of a former public charity

Amended return

Name chan e

Foreign organizations meeting the 85% test, ....._

.......•... ....-

2• check here and attach computation

l:Xl Section 501(c)(3) exempt private foundation

E If private foundation status was terminated

_,D=~Se~c~tio~n~4~9~4~7~a~1~n~o~ne~x=em=t~c~ha~n~·ta=bc;lertr~u~st~D=~ot=he~r~ta~x=ab~le'--"ir"'iv"atre~fo=u~nd~a~ti=;on""'~------1 under section 507(b )(1 )(A), check here .. -~

l:Xl

I Fair market value of all assetsat end of year J Accounting method: D Cash

Accrual

(from Part JI, cot. (c), fine 16)

D other (specity) _ _ _ _ _ _ _ _ _ _ _

~$

2 2 2 , 2 81, 7 3 3 • (Part I, column (cl) must be on cash basis.)

Analysis of Revenue and Expenses

(a) Revenue and

·· ··

· ·· · (The total of amounts in columns {b), (c), and (cl) may not

expenses per books

D

D

F If the foundation is in a 60·month terminationD

under section 507(b)(1)(B), check here ·--~

:::pJiiiitff:

necessarily equal the amounts in column (a).)

1 Contributions, gifts, grants, etc., received ........ .

2

Check )Ill-

[XI

if the foundation Is not required to attach Sch. B

3 ~hfn~::i,~~'&s a.~~.~~~~~~~............. .

4 Dividends and interest from securities.

5a Gross rents

b Net rental income or(loss)

6a Net gain or~oss) from sale of assets not on line 10

b ~:~ ~a~"n~ri~ ~~-~'.I

Cl)

2

~

7

Capital gain net income (from Part IV, Hne 2)

8 Net short-term capital gain

9 Income modifications ................. .

1Oa ~~s~l~=~s ~~-~~ ..... f - - - - - - b

Less: Cost of goods sold ..• ~-------

Gross profit or (loss) ..... .

11 other income .............................................

12 Total. Add lines 1 throu h 11

13 Compensation ofofficers, directors, trustees, etc. .. .

14 Other employee salaries and wages ................. .

15 Pension plans, employee benefits ................. .

1sa Legal tees ..............................

iii b Accounting fees ........

...S.'.J:.J):\'.J:....~---·

~ c other professional fees ............S.'.l:_l):l,?;'__ ji__ _

C

*

S.r.wr... A.. .

W

~ 17 Interest ...................... .

:1 ~: ~:~::~i;ti~~~;d d~~ietion

.. S'.J:.l):\T ... 7. ...

·e

20 Occupancy ........................ .

Travel, conferences, and meetings .

22 Printing and publications .................. .

g> 23 other expenses

.............. S.'.l:_l):l,?;'__

~ 24 Total operating and administrative

!l.

expenses. Add lines 13 through 23

0

25 Contributions, gifts, grants paid

26 Total expenses and disbursements.

Add lines 24 and 25

27 Subtract line 26 from line 12:

"

";

<C 21

8

36 029 439.

36 953 086.

295,044.

799,969.

197,549.

240,967.

96,037.

535,285.

439.

086.

433,093.

11,775.

89,680.

195,190.

6, 881.

183 959.

0.

0.

0.

0.

0.

o.

0.

o.

o.

0.

o.

o.

o.

3,085,429.

24 430 896.

295,044.

799,969.

197,549.

250,785.

108,497.

509,585.

93,005.

187,913.

10,506.

189,442.

2,700,458.

27 350,169.

a Excess of revenue over expenses and disbursements

b Net investment income (if negative, enter-O.-J.

c Ad'usted net income 1fn ative. enter-a-.

~~~:-~ 1 LHA For Paperwork Reduction Act Notice, see instructions.

10371102 784735 2415988000

Form 990-PF (2011)

1

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

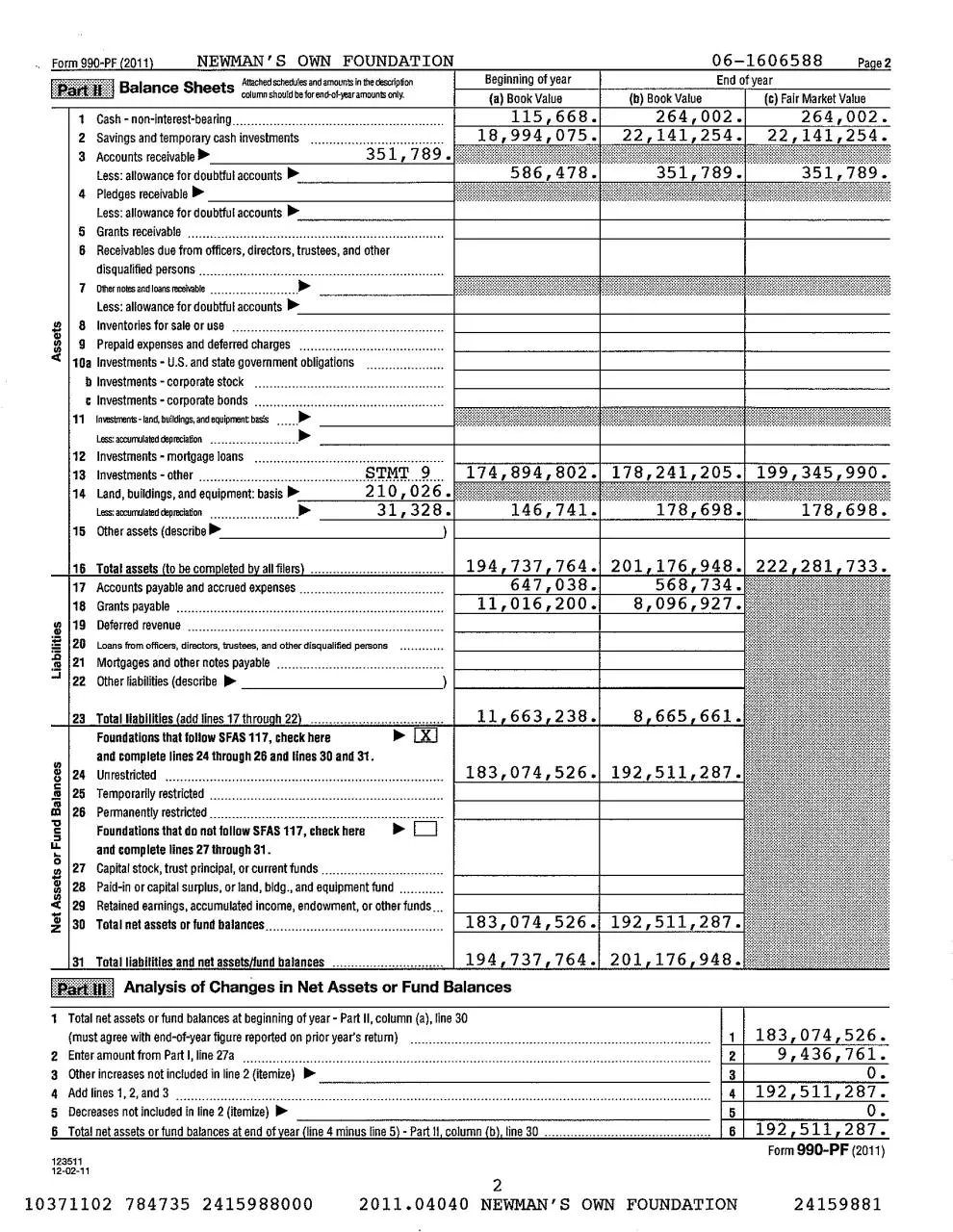

Form 990-PF 2011

pn=·=·'=~:::im:::~q

.,.rl.8r.:i:-::B:·:·:·

NEWMAN'S OWN FOUNDATION

Balance Sheets

06-1606588

Beginning of year

(a) Book Value

Attachedschedu!es and amounts in lhedescliption

column should be forend-of-}ear amounts only.

115,668.

18,994,075.

1 Cash - non-interest-bearing .................................... .

(b) Book Value

Pa e2

End of year

(c) Fair Market Value

264,002.

22,141,254.

264,002.

22,141,254.

5 Grants receivable ........ .

6 Receivables due from officers, directors, trustees, and other

disqualified persons ......................... .

7

Othernotesandloansreceivable ............................ - - - - - - - -

Less: allowance for doubtful accounts .....

I

8 Inventories for sale or use

---------+---------l---------l--l------~

g Prepaid expenses and deferred charges ..................................... .

10a Investments - U.S. and state government obligations

b Investments - corporate stock

c Investments - corporate bonds ............................................ .

11 lnwstmen1s-land,buildings,andequipmentbasis

.~ - - - - - - - Less:accum.ilateddepreciation

................~ - - - - - - - - f - - - - - - - - - + - - - - - - - - + - - - - - - - - 12 Investments - mortgage loans .................................... .

13 Investments-other.......................

.~.'.l'.~'.l'....

174,894,802. 178,241,205. 199,345,990.

14 Land, buildings, and equipment basis~

210 I 0 2 6 .

9.....

'"""""""''.""'"°''" ........................~

ii ;;;;:;;;m@E IL ; ... lMlliHililHHHMl liffin;;; ;nm. ff

31,328.

146,741.

178,698.

178,698.

15 Other assets (describe~-------------) f - - - - - - - - - + - - - - - - - - + - - - - - - - - 16 Total assets to be com leted b all filers

17 Accounts payable and accrued expenses .................. .

18 Grants payable ........................................................................

Deferred revenue

= 19

194 737 764. 201 176 948.

647,038.

568,734.

11,016,200.

8,096,927.

~ 20 Loans from officers, directors, tn.Jstees, and other disqualified persons

21 Mortgages and other notes payable ....................... .

-' 22 Other liabilities (describe ~ _ _ _ _ _ _ _ _ _ _ _ _,

:s

.!!!

..fl

23 Total llabllltles add lines 17 throu h 22

Foundations that follow SFAS 117, check here

and complete lines 24 through 26 and lines 30 and 31.

24 Un restricted .......................................................................... .

25 Temporarily restricted ..

~ 26 Permanently restricted

c

Foundations that do not follow SFAS 117, check here

and complete lines 27 through 31.

:;

"' 27 Capita! stock, trust principal, or current funds ..

28 Paid-in or capital surplus, or land, bldg., and equipment fund ........... .

..... 29 Retained earnings, accumulated income, endowment, or other funds .. .

c

11 663 238.

8 665 661.

183,074,526. 192,511,287.

.,,

."

j

~ 30 Total net assets or fund balances ..............................................

31

Total llabllHles and net assets und balances

lmiiifitiifl

183,074,526. 192,511,287.

194 737 764. 201 176 948.

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year- Part II, column (a), line 30

(must agree wlth end-of-year figure reported on prior year's return) ......... ... . .................. ···············································

2 Enter amount from Part I, line 27a .................... ...... .............. .... ...... ·········· . .................. . .. ············

3 other increases not included in line 2 (itemize) ~

4 Add lines 1, 2, and 3 ······· ..........

.............

............ . . ......................... ............. ...............................

5 Decreases not included in line 2 (itemize) ~

6 Total net assets or fund balances at end of vear fline 4 minus line 5\ - Part II column lb l. line 30 ........................................

....

1

2

3

4

5

6

183,074,526.

9,436, 761.

0.

192,511,287.

0.

192. 511. 287.

Form 990-PF (2011)

123511

12-02-11

2

10371102 784735 2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

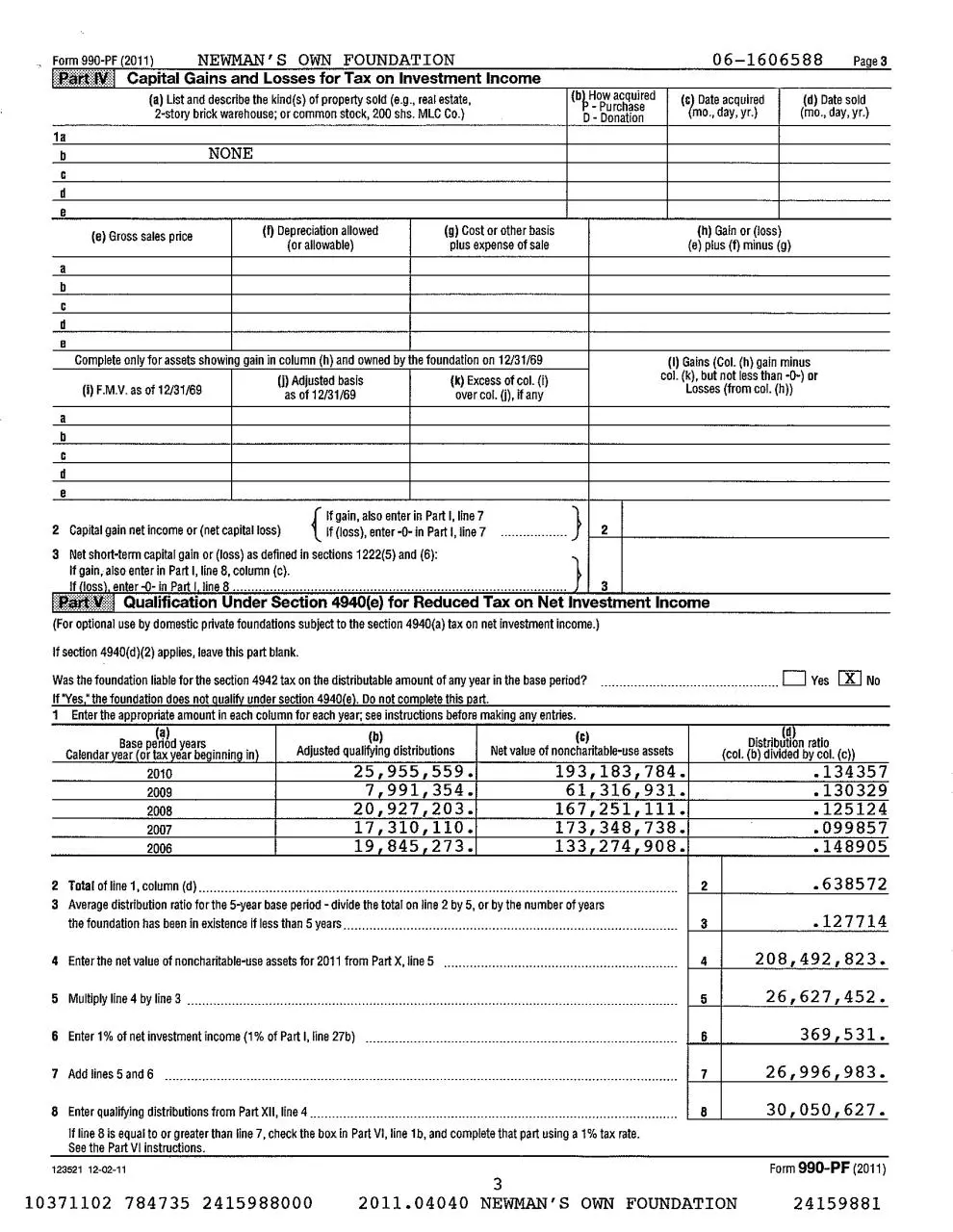

Form 990-PF (2011)

NEWMAN'S OWN FOUNDATION

06-1606588

Page 3

IP~IJNI Capital Gains and Losses for Tax on Investment Income

(b~How

acquired

- Purchase

D - Donation

(a) List and describe the kind(s) of property sold (e.g., real estate,

2-story brick warehouse; or common stock, 200 shs. MLC Co.}

1a

b

(d) Date sold

(mo., day, yr.)

(c/i Date acquired

mo., day, yr.)

NONE

c

d

e

(Q Depreciation allowed

(or allowable)

(e) Gross sales price

(g) Cost or other basis

(h) Gain or (loss)

(e) plus (f) minus (g)

plus expense of sale

a

b

c

d

e

Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69

(j) Adjusted basis

as of 12/31/69

(i) F.M.V. as of 12/31/69

(1) Gains (Col. (h) gain minus

col. (k), but not less than -0-) or

Losses (from col. (h))

(k) Excess of col. (i)

over col. (j), ~any

a

b

c

d

e

2 Capital gain net income or (net capital loss)

3

{ If gain, also enter in Part I, line 7

If (loss), enter-0- in Part I, line 7

~~~;;?!~t~:~~~~~il; l~~:r~~l~~?r~)edinsectio~s~22.2(~) a~d

·······- .........

}

2

(6):··································· }

3

HP~IYW! Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

.......................................... 0

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period?

If "Yes," the foundation does not qualify under section 49401el. Do not complete this part.

1 Enter the appropriate amount in each column for each year; see instructions before making any entries.

(a)

(b)

(c)

Base period years

Adjusted qualifying distributions

Net value of noncharitable-use assets

Calendarvear !or tax vear beainnino in)

25,955,559.

7,991,354.

20,927,203.

17,310,110.

19,845,273.

2010

2009

2008

2007

2006

Yes

00 No

DistribJflin ratio

(col. (b) divided by col. (c))

193,183,784.

61,316,931.

167,251,111.

173,348,738.

133,274,908.

.134357

.130329

.125124

.099857

.148905

2 Total of line 1, column (d). .................................. ............................................................... ...........

3 Average distribution ratio for the 5-year base period -divide the total on line 2 by 5, or by the number of years

the foundation has been in existence if less than 5 years ................................................................................. ........

2

.638572

3

.127714

4 Enter the net value of noncharitable-use assets for 2011 from Part X, line 5 .................................... .................

4

208,492,823.

5

26,627,452.

6

369,531.

...............

7

26,996,983.

···························································

8

30,050,627.

5 Multiply line 4 by line 3 .... ... .......

..................... ................... ............ ·····················-·······

6 Enter 1°/o of net investment income (1 % of Part I, line 27b)

7 Add lines 5 and 6 ···········

. .....

...................... ································-··

............. .................................................................... ...........................

8 Enter qualifying distributions from Part XII, line 4

......................................

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.

See the Part VI instructions.

Form 990-PF (2011)

123521 12-02-11

10371102 784735 2415988000

3

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form990-PF 2011

:p@tt:w:

06-1606588

NEWMAN'S OWN FOUNDATION

Pa e4

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions)

1a Exempt operating foundations described in section 4940(d)(2), check here ~ D and enter "N/A" on line 1.

}

Date of ruling or determination letter:

(attach copy of letter if necessary-see Instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check here ..,.

and enter 1o/a

00

of Part I, line 27b ......................

......................................... .

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col. (b).

2 Tax under section 51 f (domestic section 4947(a)(1) trusts and taxable foundations only. others enter-0-) ......................... .

3 Add lines 1 and 2

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. others enter-0-)

............... .

5 Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter-0.................. .

6 Credits/Payments:

385,466.

a 2011 estimated tax payments and 2010 overpayment credited to 2011

&a

b Exempt foreign organizations -tax withheld at source

................................. .

6b

c Tax paid with application for extension of time to file (Form 8868) .. .

&c

6d

d Backup withholding erroneously withheld ..............................................................

7 Total credits and payments. Add lines 6a through 6d ................................................

8 Enter any penalty for underpayment of estimated tax. Check here D if Fonm 2220 is attached .

~ 1--9"-l----~~~~9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed ..........................................

1O Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid

............................. ~ >-'1~0-+_ _ _ _1_5~,_9_1_8~.

11 Entertheamountofline10tobe:CredHedto2012estlmatedtax ~

15 918 •Refunded~ 11

0•

:f!iirt!AHAJ

Statements Regarding Activities

1a During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it participate or intervene in

any political campaign? ..

...............................

.......................

...................................... .

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)?

If the answer is "Yes" to taor tb, attach a detailed description of the activities and copies of any materials published or

distributed by the foundation in connection with the activities.

c Did the foundation file Form 1120-POL for this year? ............................................. .

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:

(1) On the foundation. ~ $

0 • (2) On foundation managers.~ $

0•

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on foundation

managers.~ $

0•

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? ........................................... .

If "Yes," attach a detailed description of the activities.

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, or

bylaws, or other similar instruments? If "Yes," attach a conformed copy of the changes

..............

.............. .

4a Did the foundation have unrelated business gross income of $1 ,000 or more during the year? .

......................................................

......................................

................NI.IA ..

b If "Yes,' has it filed a tax return on Form 990-T forth is year? .......

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? ............................................................... .

If "Yes," attach the statement required by General Instruction

T.

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:

•By language in the governing instrument, or

•By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing instrument? ................................ ...........................................................

.................. .

7 Did the foundation have at least $5,000 in assets at any time during the year? .................

......................................................

If "Yes," complete Part II, col. (c}, and Part XV.

8a Enter the states to which the foundation reports or with which it is registered (see instructions) ..... - - - - - - - - - - - - -

DE, CT

b If the answer is "Yes' to line 7, has the foundation furnished a copy of Fonm 990-PF to the Attorney General (or designate)

of each state as required by General Instruction G? If "No," attach explanation ......................................... .

9 Is the foundation claiming status as a private operating foundation within the meaning of section 49420)(3) or 4942(j)(5) for calendar

year 2011 or the taxable year beginning in 2011 (see instructions for Part XIV)? If "Yes," complete Part XIV ..

10 Did an ersons become substantial contributors durin the tax ear? If ·ves ·attach a schedule llstln their names and addresses

Form 990-PF (2011)

123531

12-02-11

4

10371102 784735 2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

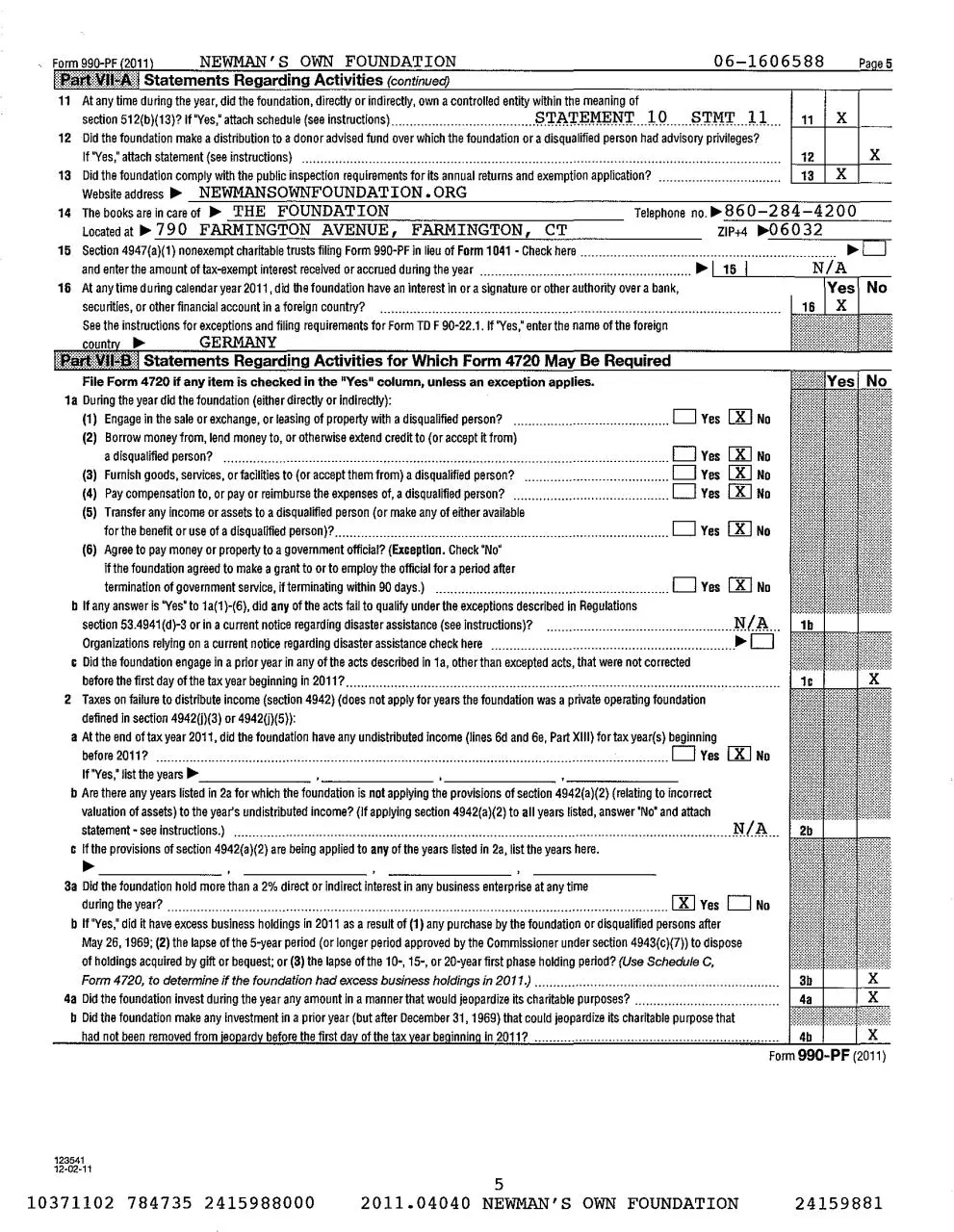

Form 990-PF 12011)

NEWMAN'S OWN FOUNDATION

06

I RiiHJll!EA I Statements Regarding Activities (continued)

- 1606588

Paae5

11 At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the meaning of

section 512(b)(13)? If "Yes," attach schedule (see instructions) ..... ............... ··············· $.'.I'~,';J;'.J!:~J!:l!l'.I' ... lQ

$.'.I'Wr JJ ... 11

12 Did the foundation make a distribution to a donor advised fund over which the foundation or a disqualified person had advisory privileges?

If "Yes," attach statement {see instructions) ................. ..................................

12

........... ···················· ......

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? .............. ··················

13

Website address ~ NEWMANSOWNFOUNDATION. ORG

14 The books are in care of ~ THE FOUNDATION

Telephone no.~860-284-4200

Located at~ 790 FARMINGTON AVENUE, FARMINGTON, CT

ZIP+4 ~06032

15 Section 4947(a)(1) nonexempt charltable trusts filing Form 990-PF in lieu of Form 1041 - Check here ........................................................ .

~o

N/A

and enter the amount of tax-exempt interest received or accrued during the year .

~ 15

16 At anytime during calendaryear2011, did the foundation have an interest in or a signature or other authority over a bank,

securities, or other financial account in a foreign country? ........................................... .

See the instructions for exceptions and filing requirements for Form TD F 90-22.1. If "Yes," enter the name of the foreign

count

~

GERMANY

Il~dtt:Vms.:: Statements Regarding Activities for Which Form 4720 May Be Required

x

x

x

~~~~~~~~~~~~~~~~~~~~~~~-

File Form 4720 if any item is checked in the 11 Yes 11 column, unless an exception applies.

1a During the year did the foundation (either directly or indirectly):

(1) Engage in the sale orexchange, or leasing of property with a disqualified person?

.......................... D

(2) Borrow money from, lend money to, orotherwise extend credit to (or accept It from)

a disqualified person? ..............

............................................................

.......................... D

(3) Furnish goods, services, orfacillties to (or accept them from) a disqualified person?

..................... D

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? ......................................... D

(5) Transfer any income or assets to a disqualified person {or make any of either available

Yes

[Kl

No

Yes

Yes

Yes

[Kl

[Kl

[Kl

No

No

No

D

forthe benefit or use of a disqualified person)?.......

.......................................................................

Yes [Kl No

(6) Agree to pay money or property to a government official? (Exception. Check "No"

if the foundation agreed to make a grant to or to employ the official fora period afier

termination of government service, if terminating within 90 days.) ..............................................

......... D Yes [Kl No

b If any answer is "Yes' to 1a(1)-(6), did any of the acts fail to qualify undertheexceptions described in Regulations

section 53.4941(d)-3 or in a current notice regarding disaster assistance (see instructions)? ..

..................... .l!ll:f'. ...

Organizations relying on a current notice regarding disaster assistance check here

~D

c Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that were not corrected

before the first day ofthe tax year beginning in 2011? .......................

..............................

................................. .

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundation

defined in section 4942(j)(3) or 4942(j)(5)):

a At the end of tax year 2011, did the foundation have any undistributed income (lines 6d and 6e, Part XIII) for tax year(s) beginning

.................................

before 2011?

.......................... ..................... .............................................

...... D Yes

If "Yes,' list the years~------b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2) (relating to incorrect

valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to all years listed, answer 'No' and attach

statement - see instructions.) .....

.................................................

.......................................

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, listthe years here.

[Kl

No

NI A

~ -------

3a Did the foundation hold more than a 2o/o direct or indirect interest in any business enterprise at any time

during the year? ........................... ..............

............................................................

............. [Kl Yes D

b If "Yes," did It have excess business holdings in 2011 as a result of (1) any purchase by the foundation or disqualified persons afier

May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to dispose

of holdings acquired by gifi or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C,

Form 4720, to determine if the foundation had excess business holdings in 2011.) ................ .

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes?

b Did the foundation make any investment in a prior year (but afier December 31, 1969) that could jeopardize its charitable purpose that

had not been removed from ·eo ard before the first da of the tax ear be innin in 2011? ...

No

Form 990-PF (2011)

5

10371102

784735

2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form990-PF 2011

:'RalitVilliSt

06-1606588

NEWMAN'S OWN FOUNDATION

Statements Regarding Activities for Which Form 4720 May Be Required

Pa e6

(continued}

5a During the year did the foundation pay or incur any amount to:

(1) Garry on propaganda, or otherwise attempt to influence legislation (section 4945(e))?

......................... D

(2) Influence the outcome of any specific public election (see section 4955); or to carry on, directly or indirectly,

any voter registration drive? ........ . ..................................................................................................... 0

(3) Provide a grant to an individual for travel, study, or other similar purposes? .............. .

(4) Provide a grant to an organization other than a charitable, etc., organization described in section

Yes

IXJ No

Yes

Yes

1XJ No

509(a)(1), (2), or(3), or section 4940(d)(2)? ...........................

...............

......................... D

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educational purposes, or for

Yes

IXJ No

the prevention of cruelty to children or animals? .........................

.................................................. D

b If any answer is 'Yes' to 5a(1 )-(5), did any of the transactions fail to quality under the exceptions described in Regulations

Yes

IXJ No

......................... D

IXJ No

section 53.4945 or in a current notice regarding disaster assistance (see instructions)? ..........

..........................................N/.'/A

Organizations relying on a current notice regarding disaster assistance check here

.................... ......................... .... 1111c If the answer is ''Yes· to question 5a(4), does the foundation claim exemption from the tax because lt maintained

D

N/.11,

expenditure responsibility for the grant?.........................

.......................

...........

If "Yes," attach the statement required by Regulations section 53.4945-S(d).

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums on

.. DYes 0No

a personal benefit contract? ..................................................................................................................... D

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

Yes

IXJ No

If "Yes" to 6b, file Form 8870.

IXJ

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction?

............. D Yes

No

b If "Yes• did the foundation receive an roceeds or have an net income attributable to the transaction? ......................................NIA ..

if:IJ!ili<it;,jj--:!P lnf!>rmation About Officers, Directors, Trustees, Foundation Managers, Highly

l

_.,.,.,.J Paid Employees, and Contractors

0

-'··· ····''''"''""

1 List all officers, directors, trustees, foundation managers and their compensation.

(b) Title, and averaae

hours rier week devo ed

o position

(a) Name and address

SEE STATEMENT 12

(c) Compensation

(If not pa~r·

enter ·O·

(~ Con1ributlonsto

emp ~=iflans

compensation

295,044. 29,409.

2 Compensation of five h1ghest-pa1d employees (other than those included on hne 1) If none, enter 11 NONE

(a) Name and address of each employee paid more than $50,000

0.

11

(b) Tltle, and average

hours ~er week

devoted o position

(e) Exrense

accoun , other

allowances

(c) Compensation

~~~<Conbibutions to

emp o~b~lans

and de

compensation

~ANAGING DIRE :::TOR

LISA WALKER - 246 POST ROAD EAST,

WESTPORT, CT 06881

45.00

209,000. 53,659.

PAM PAPAY - 246 POST ROAD EAST,

-OUNSELOR TO II'HE PRES I DENT

WESTPORT, CT 06881

37.50

144,476. 33,861.

JAN SCHAEFER - 246 POST ROAD EAST,

JIRECTOR OF CJMMUNICAT IONS

WESTPORT, CA 06881

34.00

89,260. 34,861.

KELLY GIORDANO

246 POST ROAD EAST, 3RANTS MANAGER

WESTPORT, CA 06881

37.50

81,577. 37,686.

SAMANTHA BURGAN - 246 POST ROAD

:::OMMUNICATION S ASSOCill rE

EAST, WESTPORT, CA 06881

37.50

62,115. 20,070.

Total number of other emolovees oaid over $50 000 •·•························•·•··•·•••• ····························· .... ······················

........... ~I

-

(el Exrense

accoun , other

allowances

0.

o.

0.

o.

0.

2

Form 990-PF (2011)

123551

12-02-11

10371102 784735 2415988000

6

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

Form 990-PF (2011 l

l:PaffVllPil

_..-...-. · .- . .-..- ......-..-..-..-_

3 Five

06-1606588

highest~paid

independent contractors for professional services. If none, enter 11 NONE. 11

(a) Name and address of each person paid more than $50,000

(c) Compensation

(b) Type of service

ERNST & YOUNG LLP - 1001 PENNSYLVANIA AVE NW,

WASHINGTON, DC 20004

CONSULTANTS

MORGAN, LEWIS & BOCKIUS, LLP

uEGAL

PO BOX 8500, PHILADELPHIA, PA 19178-6050

ROBINSON & COLE

280 TRUMBULL STREET, HARTFORD, CT 06103

uEGAL

J.H. COHN LLP

~CCOUNTING

180 GLASTONBURY BLVD, GLASTONBURY, CT 06033

SUNSHINE, SACHS & ASSOCIATES - 149 FIFTH

'ONSULTANTS

AVENUE, 7TH FLOOR, NEW YORK, NY 10010

200,000.

123,933.

106,147.

76,540.

Total number of others receivina over S50 000 for orofessional services .................................. ·······················- ··································· ~

1PiiiiilX¥itl

60,031.

1

Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as the

number of organizations and other beneficiaries served, conferences convened, research papers produced, etc.

,

Page 7

lnf!lrmation About Officers, Directors, _Trustees, Foundation Managers, Highly

Paid Employees, and Contractors (contmued}

Expenses

N/A

2

3

4

11\!ifli'!Kfl'U Summarv of Proaram·Related Investments

Describe the two largest programMrelated investments made by the foundation during the tax year on lines 1 and 2.

1

Amount

N/A

2

All other programMrelated investments. See instructions.

3

Total. Add lines 1 throuah 3

····-························

~

·····-·

0.

Form 990-PF (2011)

123561

12-02-11

7

10371102 784735 2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form 990-PF (2011)

NEWMAN'S OWN FOUNDATION

06-1606588

Page 8

W~i\flJ)!@flj Minimum Investment Return (All domestic foundations must comple1e this part. Foreign foundations, see instructions.)

1

Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

a Average monthly fair market value of securities ................. .

b Average of monthly cash balances

187,120,396.

24,249,534.

297 911.

211, 667, 841.

c Fair market value of all other assets ..................................................................................

d Total (add lines 1a, b, and c) ............................ .. .......................... ..

,.

e Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation) ...................

.. ............................ .

2 Acquisition indebtedness applicable to line 1 assets .............................................................. .............................. r-2=--+--~~-~~~-.,..;0'-'-.

3 Subtract line 2 from line 1d . .. .. ........ ..... .. .. ...... ...... ...... .. .. ...... .. .... .. .. .... .. .... .. .. ...... .. .... .. .... .. .... .. ..

>-'3'-',__2_1_1~,_6_6_7~,~8_4_1_.

4 Cash deemed held for charitable activities. Enter 1 1/2% ofline 3 (for greater amount, see instructions)

,_4~+--"""=-"3~1~7'=5,..._0.,,_,1'"'8"'-'-.

5 Net value of noncharltable-use assets. Subtract line 4 from line 3. Enter here and on Part V, line 4

r-5~,___2_0~8~,_4_9~2~'~8-2_3_.

6 Minimum investment return. Enter 5% of line 5 ..........................................

....................

6

10 4 2 4 6 41 •

l:PliflHllkll Distributable Amount (see instructions) (Section 4942(j)(3) and (j)(5) private operating foundations and certain

........................... foreign organizations check here ~

and do not complete this part.)

l

D

Minimum investment return from Part X, line 6 ...................................................................................................

2a Tax on investment income for 2011 from Part VI, line 5 ............. ...................

2a

3 6 9 , 5 31 •

b Income tax for 2011. (This does not include the tax from Part VI.) .

'-"2._b_.__ _ _ _ _ _ _ __

c Add lines 2a and 2b

3 Distributable amount before adjustments. Subtract line 2c from line 1

1

10, 424, 641.

2c

369 531.

10,055,110.

3

4

0.

5

6

10,055,110.

7

10

0.

055

110.

WPaft'.®ltl Qualifying Distributions (see instructions)

Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:

a Expenses, contributions, gifts, etc. -total from Part I, column (d), line 26 ................................................................

b Program-related investments -total from Part IX-B .................................................................................. ..

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes .................... ..

3 Amounts set aside for specific charitable projects that satisfy the:

a Suitability test (prior IRS approval required) .......................................................................... ..

b Cash distribution test (attach the required schedule) .............................................................................................

4 Qualifying distributions. Add lines 1a through Sb. Enter here and on Part V, line 8, and Part XIII, line 4 ..

5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

6

30,050,627.

o.

3a

3b

4

30,050,627.

369 531.

5

income. Enter 1% of Part I, line 27b ...............................................................................................................

29,681,096.

Adjusted qualtlying distributions. Subtract line 5 from line 4 .............................................................. .

6

Note. The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section

4940(e) reduction of tax in those years.

Form 990-PF (2011)

123571

12-02-11

10371102

784735

2415988000

2011.04040

8

NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

06-1606588

Page 9

Undistributed Income (see instructions)

(d)

2011

1 Distributable amount for 2011 from Part XI,

line 7

2 Undistributed income, if any, as of the end of2011:

a Enter amount for 2010 only

b Total for prior years:

3 Excess distributions carryover, if any, to 2011:

aFrom2006

13,591, 726.

bFrom2007

9,075,509.

c From2008

13, 094, 021. '.,-:

dFrom2009

5, 655, 881. fo.::,

eFrom2010

16 948 796 •.. , .

f Total of lines 3a through e .

4 Qualifying distributions for 2011 from

PartXll,line4: ... $ 30 050 627.

a Applied to 2010, but not more than line 2a ...

b Applied to undistributed income of prior

years (Election required~ see instructions) ...

c Treated as distributions out of corpus

(Election required· see instructions)

d Applied to 2011 distributable amount

e Remaining amount distributed out of corpus

5

Excess distributions carryover applied to 2011

...•..

Of an amount appears in column (d), the same amount

must be shown in column (a).)

6 Enter the net total of each column as

Indicated below:

8 Corpus. Add Unes 3f, 4c, and 4e. Subtract line 5 ....

b Prior years' undistributed income. Subtract

line 4b from line 2b ..................... .

c Enter the amount of prior years'

undistributed income for which a notice of

deficiency has been issued, or on which

the section 4942(a) tax has been previously

assessed ............................................

d Subtract line 6c from line 6b. Taxable

amount~ see instructions ....................... .

e Undistributed income for 2010. Subtract line

4a from line 2a. Taxable amount~ see instr..

f Undistributed income for 2011. Subtract

lines 4d and 5 from line 1. This amount must

be distributed in 2012

7 Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or4942(g)(3) ........... .

8 Excess distributions carryover from 2006

not applied on line 5 or line 7 ................... .

9 Excess distributionscarryover to 2012.

Subtract lines 7 and 8 from line 6a

10 Analysis of line 9:

9,075,509.

a Excess from 2007 ..

b Excess from 2008 .. 13,094,021.

5, 655, 881.

c Excess from 2009 ..

d Excess from 2010 .. 16,948,796 ...'

19,995 517.

e Excess from 2011

13,591,726.

Form 990-PF (2011)

123581

12-02-11

9

10371102 784735 2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form 990-PF 2011

NEWMAN'S OWN FOUNDATION

:::Q~IX''~'llM Private Operating Foundations (see instructions and Part Vll·A, question 9)

1

06-1606588

Page 1o

N/A

a lf the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2011, enter the date of the ruling ............. .

b Check box to indicate whether the foundation is a orivate ooeratino foundation described in section

Prior 3 years

Tax year

2 a Enter the lesser of the adjusted net

(a) 2011

(b) 2010

(c) 2009

income from Part r or the minimum

investment retu m from Part X for

each year listed

4942/;\/3\ or

(d) 2008

4942/;\/5)

(e) Total

b 85o/o of line 2a ..............................

c Qualifying distributions from Part XII,

line 4 for each year listed ...............

d Amounts included in line 2c not

used directly for active conduct of

exempt activities .

e Qualifying distributions made directly

for active conduct of exempt activities.

Subtract line 2d from line 2c .. ........

3 Complete 3a, b, or c for the

alternative test relied upon:

a "Assets" alternative test - enter:

(1) Value of all assets ................

(2) Value of assets qualifying

under section 4942(j)(3)(B)(i) ...

b "Endowment" alternative test - enter

2/3 of minimum investment return

shown in Part X, line 6 for each year

listed ··········································

c 'Support' alternative test- enter;

(1) Total support other than gross

investment income (interest,

dividends, rents, payments on

securities loans (section

512(a)(5)), or royalties) ...........

(2) Support from general public

and 5 or more exempt

organizations as provided in

section 4942(j)(3)(B)(iii) .........

(3) Largest amount of support from

an exempt organization ...........

14} Gross investment income .

l!PgJ'il!¥i@ Supplementary

this part only if the foundation had $5,000 or more in assets

.

.Information (Complete

.

.

at any time during the year-see 1nstruct1ons.)

1

Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax

year (but only~ they have contributed more than $5,000). (See section 507(d)(2).)

NONE

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 10% or greater interest.

NONE

2

Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

00

Check here ..,_

if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If

the foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

Form 990-PF (2011)

123601 12-02-11

10371102 784735 2415988000

10

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

IP~ftl(l(II

s

06 - 1606588

NEWMAN'S OWN FOUNDATION

Form 990-PF 12011 l

Page 11

Supplementary Information (continued)

Grants and Contributions Paid DurinQ the Year or Annroved for Future

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

Pa~ ...... ent

Foundation

Purpose of grant or

contribution

status of

recipient

Amount

**

a Paid during the year

lt FOR THE PL.ANET

~ONE

501(C)(3)

:>PERATIONS

P.O. BOX 650

WAITSFIELD VT 05673

20 000.

826 SEATTLE

P.O. BOX 30764

SEATTLE WA 98113

~ONE

826LA

685 VENICE BLVD.

VENICE CA 90291

~ONE

A BETTER CHANCE OF WESTPORT, INC.

PO BOX 2153

~ONE

WESTPORT

501(C)(3)

3ENERAL OPERATING

2 500.

501(C)(3)

~FTER-SCHOOL

TUTORING

5 000.

501(C)(3)

~TER

SCHOOL TUTORING

3 000.

CT 06880

A CHILD'S PLACE

l!ONE

501(C)(3)

PPERATIONS

90 HILLSPOINT ROAD

WESTPORT CT 06880

Total

..

2 500.

···-··-···················-

........S.E.E. ...CONT.INUAT.ION ...SHE.E.T.l S} .. ···-········· ··········-·······-·····-····-··

~ Sa

27.350 169.

b Approved for future payment

~ONE

ACHIEVEMENT FIRST

501(C)(3)

~ROGRAM

SERVICES

SEE NOF, 790 FARMINGTON AVE, SUITE 4B

FARMINGTON CT 06032

AMERICA EAST CONFERENCE - COMMUNITY

200 000.

~ONE

501(C) (3)

~ROGRAM SERVICES

SERVICE CHALLENGE 2012

SEE NOF, 790 FARMINGTON AVE, SUITE 4B

FARMINGTON, CT 06032

AMERICAN AGORA FOUNDATION

SEE NOP, 790 FARMINGTON AVE, SUITE 4B

FARMINGTON

150 000.

NONE

501(C) (3)

~ROGRAM

SERVICES

CT 06032

Total .................

**

········· . . SE.E. CONTINUATION SHE.ET LS}

........

............

...

·-· .........

~ Sb

SEE PURPOSE OF GRANT CONTINUATIONS

11

10371102 784735 2415988000

2011.04040 NEWMAN'S OWN FOUNDATION

123611 12-02-11

30.000.

-2 919 273.

Form 990-PF (2011)

24159881

IIR@it®YIY!i!I

06-1606588

NEWMAN'S OWN FOUNDATION

Form 990-PF (2011)

Page 12

Analysis of Income-Producing Activities

Enter gross amounts unless otherwise indicated.

Unrelated business income

!al

1 Program service revenue:

Busmess

code

Excluded b section 512, 513, or514

c

(b)

Amount

Excuslon

ood•

(d)

Amount

(e)

Related or exempt

function income

a

b

c

d

e

I

g Fees and contracts from government agencies

2 Membership dues and assessments ............. .

3 Interest on savings and temporary cash

investments ................................ .

4 Dividends and interest from securities

5 Net rental income or (loss) from real estate:

a Debt-financed property ..................................... .

b Not debt-financed property .............. .

6 Net rental income or (loss) from personal

property

............... .

7 Other investment income ............................... .

B Gain or (loss) from sales of assets other

than inventory .............................................. .

9 Net income or (loss) from special events .................... .

10 Gross profit or (loss) from sales of inventory

11 other revenue:

14

14

133,344.

790,303.

15

36,029,439.

a

b

c

d

e

12 Subtotal. Add columns (b), (d), and (e) ................ .

13 Total. Add line 12, columns (b), (d), and (e) ..................................... .

(See worksheet in line 13 instructions to verify calculations.}

IJRi!liiitXVIUUI

Line No.

T

o.

36 953 086.

....................................................... 13 _

0.

_:3:..:6:..J''-"9:..:5=-3=,..::0..::8..::6~.

Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to the accomplishment of

the foundation's exempt purposes (other than by providing funds for such purposes).

123621

12-02-11

10371102 784735 2415988000

Form 990-PF (2011)

12

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form990-PF 2011

iR1ilblXWU

1

NEWMAN'S OWN FOUNDATION

06-1606588

Pa e13

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations

Did the organization directly or indirectly engage in any of the following wtth any other organization described in section 501(c) of

the Code (other than section 501(c)(3) organizations) or in section 527, relating to polttical organizations?

a Transfers from the reporting foundation to a noncharitable exempt organization of:

(1) Cash ...........................................................................................................•................................................................. 1al11

(2) Other assets .......................................................................................................•............................................................ 1al21

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization ............................................................................................................ 1bl1l

(2) Purchases of assets from a noncharitable exempt organization ................................................................................................... 1bl21

(3) Rental of faciltties, equipment, or other assets ............. .................................... ...... ............... ... ... ...... ... .. ... ....... ....... ................ 1bl3l

(4) Reimbursement arrangements............................................................................................................................................. 1bl4l

(5) Loans or loan guarantees ................................................................................................................................................... 1bl5

(6) Pertormance of services or membership orfundraising solicttations .......................................................................•.................. 1b(6

1c

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees ····-····--·--·-··- ....................................................

d If the answer to any of the above is 'Yes; complete the following schedule. Column {b) should always show the fair market value of the goods, other assets,

X

X

X

X

X

X

X

X

X

or services given by U1e rapurling ruundalion. UU1e fuuruJalio11 received less Ulan fair niarket value in any transaction or sharing arrangement, show In

column (d) the value of the goods, other assets, or services received.

(a) Line no.

(b) Amount involved

(c) Name of noncharitable exempt organization

(d)

Description of transfers, transactions, and sharing arrangements

N/A

.

2a Is the foundation directly or indirectly affiliated wtth, or related to, one or more tax-exempt organizations descrlbed

in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? .....................•........................................................

Yes

I te th eI oII owmasc

.

hedue.

I

b lf'Yes," como,e

(a) Name of organization

(b) Type of organization

(c) Description of relationship

D

[X]

No

N/A

Sign

Here

Under penalties of perjury, l declare that I have examined this return, including aceompanylng schedules and statements, and to the best of my knowledge

and belief, it Is true, conect, and complete. Declaration of preparer(otherthan taxpayer) is based on all lnfonnatlon of Which preparer has any knowledge.

~{

Signature of officer or trustee

Print/Type preparers name

1/

Date

PrAnarer'S4iianature

Paid

ALAN LARKIN

Preparer Firm's name ~ COHNREZNICK LLP

Use Only

Firm's address ~

18 0 GLASTONBURY BOULEVARD

GLASTONBURY. CT 06033

~EXEC

Title

Date

VP/COO

00Yes

D

if

Check

seif- employed

~

May the IRS discuss this

return with the preparer

shown below (see instr.)?

D

No

PTIN

Firm'sEIN ~

P00297957

22-14 78099

Phone no.

1860\ 633-3000

Form 990-PF (2011)

123622

12-02-11

10371102 784735 2415988000

13

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

Form 8868 (Rev. 1·2012)

Page 2

• If you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II and check this box .............................. ,.._

Note. Only complete Part 11 if you have already been granted an automatic 3-month extension on a previously filed Form 8868.

• If you are filing for an Automatic 3-Month Extension,·complete only Part I (on page 1).

l:eaiiEllH

00

Additional (Not Automatic) 3-Month Extension of Time. Only file the original (no copies needed).

Enter filer's identifvina number see instructions

Type or

Name of exempt organization or other filer, see instructions

Employer identification number (EIN) or

File by the

due date for

fi!ingyour

return. See

Instructions.

[XI

NEWMAN'S OWN FOUNDATION

Number, street, and room or suite no. If a P.0. box, see instructions.

06-1606588

Social security number (SSN)

D

790 FARMINGTON AVENUE, NO. 4B

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

~ARMINGTON, CT

06032

Enter the Return code for the return that this application is for (file a separate application for each return)

Application

Return

Is For

Code

Fonn 990

01

Fonn 990-BL

02

Form 1041-A

08

Fonn 990·EZ

01

Fonn 4720

09

Fonn 990·PF

04

Form 5227

10

05

Form 6069

11

06

Fonn 8870

12

Form 990·T trust other than above

STOP! Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8868.

•

THE FOUNDATION

Thebooksareinthecareof JI> 790 FARMINGTON AVENUE, NO. 4B - FARMINGTON, CT 06032

TelephoneNo.11> 860-284-4200

FAXNo.JI>

•

If the organization does not have an office or place of business in the United States, check this box . ... .. . .. ... ... ... .. . ... .. .... .. . .. .

•

If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN)

~~~~~~~~~~~~~

box .....

4

D . If it is for part of the group. check this box ..... D

and attach a list with the names and EINs of all members the extension is for.

5

For calendar year

6

If the tax year entered in line 5 is for less than 12 months, check reason:

D

7

D

NOVEMBER 15 , 2012.

I request an additional 3-month extension of time until

2011 , or other tax year beginning

.....

. If this is for the whole group, check this

~~~~~~~~~~~~

D

, and ending

Initial return

D

~~~~~~~~~~~~

Rnal return

Change in accounting period

State in detail why you need the extension

ALL OF THE INFORMATION NEEDED TO FILE A COMPLETE AND ACCURATE RETURN IS

STILL NOT YET AVAILABLE.

Ba

If this application is for Form 990·BL, 990-PF, 990·T, 4720, or 6069, enter the tentative tax, less any

$

340,000.

Sb

$

340,000.

Sc

$

0.

nonrefundable credits. See instructions.

b

If this application is for Form 990·PF, 990·T, 4720, or 6069, enter any refundable credits and estimated

tax payments made. Include any prior year overpayment allowed as a credit and any amount paid

reviousl with Form 8868.

c

Balance due. Subtract line 8b from line Ba. Include your payment with this form, if required, by using

EFTPS Electronic Federal Tax Pa ment S stem. See instructions.

Signature and Verification must be completed for Part II only.

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete, and that I am authorized to prepare this form.

Signature JI>

Title JI>

EVP /COO

Date JI>

Form 8868 (Rev. 1·2012)

123842

01-06-12

10371102 784735 2415988000

99

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

1eaaxv1

3

NEWMAN'S OWN FOUNDATION

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation}

Recipient

Name and address {home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

ACHIEVEMENT FIRST INC

403 JAMES STREET

NEW HAVEN CT 06513

~ONE

ACHIEVEMENT FIRST INC

403 JAMES STREET

NEW HAVEN CT 06513

~ONE

ACHIEVEMENT FIRST INC

403 JAMES STREET

NEW HAVEN. CT 06513

~ONE

ADDISON CTY HUMANE SOCIETY INC

236 BOARDMAN STREET

MIDDLEBURY VT 05753 ·

~ONE

AFRICA BRIDGE

PO BOX 115

MARYL HURST OR 97036

~ONE

AIND / GIANT STEPS CT

309 BARBERRY ROAD

SOUTHPORT CT 06890

~ONE

AIND I GIANT STEPS CT

309 BARBERRY ROAD

SOUTHPORT. CT 06890

~ONE

AIND / GIANT STEPS CT

309 BARBERRY ROAD

SOUTHPORT CT 06890

NONE

AIND / GIANT STEPS CT

309 BARBERRY ROAD

SOUTHPORT CT 06890

~ONE

AIND / GIANT STEPS CT

309 BARBERRY ROAD

SOUTHPORT CT 06890

NONE

Total from continuation sheets .. .......... .....

Foundation

status of

recipient

501(C)(3)

501(C)(3)

Purpose of grant or

contribution

BRIDGEPORT ACADEMY

~IDDLE SCHOOL CAPITAL

PROJECT

Amount

100

ooo.

BRIDGEPORT ACADEMY

5 000.

501(C) (3)

BRIDGEPORT ACADEMY

50 000.

501(C)(3)

501(C)(3)

PHARMACEUTICAL AND

~EDICATION MANAGEMENT

SERVICES

KEDICAL SERVICES FOR

t(FQMBO AND MASOKO

•ARDS

501(C)(3)

10 000.

25

ooo.

::!APACITY BUILDING

125 000.

501(C) (3)

BEYOND THE YELLOW

BRICK ROAD GALA

15.000.

501(C)(3)

!ROOF REPAIR

2 500.

501(C)(3)

~PADS FOR TEACHERS AND

tr'HERAPISTS

10 000.

~Ol(C) (3)

PT ROOM

.......................................

50 000.

27 317 169.

123631 08-03-11

10371102 784735 2415988000

14

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

IPbd®YI

3

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation)

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

AKRON-CANTON REGIONAL FOODBANK

350 OPPORTUNITY PKWY

AKRON. OH 44307

NONE

ALL CHILDREN'S HOSPITAL FOUNDATION

PO BOX 3142

SAINT PETERSBURG FL 33731-3142

NONE

ALLIANCE FOR CHILDHOOD

PO BOX 444

COLLEGE PARK MD 20741

NONE

ALLIANCE FOR CHILDREN'S RIGHTS

3333 WILSHIRE BLVD. 1=550

LOS ANGELES. CA 90010

NONE

AL'S ANGELS

342 GREEENS FARMS ROAD

WESTPORT. CT 06880

NONE

ALZHEIMER'S DISEASE & RELATED

DISORDERS INC.

2075 SILAS DEANE HIGHWAY

ROCRY HILL CT 06067

NONE

ALZHEIMER'S DISEASE & RELATED

DISORDERS INC.

2075 SILAS DEANE HIGHWAY

ROCRY HILL CT 06067

~ONE

ALZHEIMER'S DISEASE AND RELATED

DISORDERS ASSOCIATION

225 N. MICHIGAN AVE.

CHICAGO IL 60601-7633

'10NE

AMAZON CONSERVATION TEAM (ACT)

4211 NORTH FAIRFAX DRIVE

ARLINGTON, VA 22203

'10NE

AMERICA EAST

215 FIRST STREET

CAMBRIDGE. MA 02142

Total from continuation sheets

Foundation

status of

recipient

501(C) (3)

Purpose of grant or

contribution

Amount

bPERATIONS

5 000.

501(C)(3)

~UDITORY

NEUROPATHY

(AN)

12.000.

501(C) (3)

~ESTORING

CHILDREN'S

WLAY

20

501(C) (3)

ooo.

~EXTSTEP PRGM FOR

~RANSITIONING

YOUTH

25 000.

~Ol(C)

(3)

WHANKSGIVING MEAL

PISTRIBUTION

2.500.

~Ol(C)(3)

CONNECTICUT CHAPTER

RESPITE

20 000.

~Ol(C)

(3)

RELPLINE

2 500.

~Ol(C)(3)

THE JUDY FUND

10 000.

'10NE

501(C)(3)

501(C)(3)

EXPANDING TRIO WOMEN'S

SUSTAINABLE PEPPER

.1.NCOME IN SURINAME'S

~ZON RAINFOREST

25 000.

:AMPUS COMMUNITY

CHALLENGE

~ERVICE

30 000.

·······-·· .....................................•.

.... ··················

.............

123631 OS-.Q3-.11

10371102 784735 2415988000

15

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

l!mff*VI

3

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation)

Recipient

Name and address (home or business)

AMERICAN AGORA FOUNDATION INC

33 IRVING PLACE

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

~ONE

Foundation

Purpose of grant or

contribution

status of

Amount

recipient

501(C) (3)

uAPHAM'S QUARTERLY

10 000.

NEW YORK. NY 10003

AMERICAN AGORA FOUNDATION INC

33 IRVING PLACE

NEW YORK. NY 10003

NONE

AMERICAN CANCER SOCIETY - MILFORD

NONE

501(C)(3)

~APl!AM'S

QUARTERLY

15 000.

501(C) (3)

~BLAY

FOR LIFE OP

"IL FORD

CHAPTER

825 BROOK STREET

ROCKY HILL CT 06067

5

AMERICAN CANCER SOCIETY HAWWAII

PACIFIC, INC.

EAST HAWAII FIELD OFFICE

HILO HI 96720

NONE

AMERICAN DIABETES ASSOCIATION

NONE

501(C) (3)

ooo.

~9TH ANNUAL RELAY FOR

~IFE

OF HILO COMMUNITY

5 000.

SOl(C) (3)

875 WAIMANU STREET

HONOLULU. HI 96813

~TEP OUT TO FIGHT

PIABETES

3 500.

AMERICAN FRIENDS OF JORDAN RIVER

VILLAGE

228 PARR AVENUE SOUTH t97

NEW YORK. NY 10003

NONE

AMERICAN FRIENDS OF MAGGIE'S CTRS

3 7 HALDEMAN ROAD

SANTA MONICA CA 90402

•ONE

AMERICAN HEART ASSOCIATION

2007 0 STREET

SACRAMENTO CA 95811

•ONE

AMERICAN HEART ASSOCIATION - WESTERN

STATES AFFILIATE- SERVING HAWAII

677 ALA MOANA BLVD

HONOLULU HI 96813

~ONE

AMERICAN PUBLIC MEDIA/MINNESOTA

PUBLIC R

480 CEDAR STREET

SAINT PAUL MN 55101

~ONE

~Ol(C)

(3)

$PONSOR ONE CHILDE

2 500.

~Ol(C)

(3)

MAGGIE'S SOUTHWEST

WALES

25.000.

~Ol(C)

(3)

OPERATIONS

5 000.

~Ol(C)

(3)

8TH ANNUAL OAHU

START! HEART WALK

3 500.

501(C)(3)

"HALLENGE GRANT

100 000.

Total from continuation sheets ·······························-········-··············

........ ······-·· ...................... .....

........

......

123631 08-03-11

10371102 784735 2415988000

16

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

iP,iifX\tl

3

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation)

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

AMERICAN RED CROSS OF VERMONT AND THE

NEW HAMPSHIRE VALLEY

29 MANSFIELD AVENUE

BURLINGTON VT 05401

•ONE

AMERICAN RED CROSS, HAWAII STATE

•ONE

Foundation

Purpose of grant or

contribution

status of

recipient

~Ol(C)(3)

~!CANE

IRENE RELIEF

~FFORTS

30 000.

~Ol(C)

(3)

CHAPTER

DISASTER PREPAREDNESS

~ RESPONSE

4155 DIAMOND HEAD ROAD

HONOLULU. HI 96816

AMERICAN RIVERS

432 BROAD STREET

NEVADA CITY, CA 95959

Amount

5 000.

•ONE

~Ol(C)

(3)

PROTECTING THE SAN

GREGORIO WATERSHED FOR

WILDLIFE AND

~GRICULTURAL SECURITY

AMFAR

120 WALL STREET

NEW YORK NY 10005-3908

~ONE

ANGEL VIEW CRIPPLED CHILDRENS

FOUNDATION

12379 MIRACLE HILL RD.

DESERT HOT SPRINGS CA 92240

NONE

ANGEL WINGS INTERNATIONAL

401 E. LAS OLAS BOULEVARD

FORT LAUDERDALE. FL 33301

~ONE

ANGELIGHT FILMS INCORPORATED

96 MORTON STREET

NEW YORK NY 10014

NONE

ANGIOGENESIS FOUNDATION

ONE BROADWAY

CAMBRIDGE MA 02142-1100

NONE

ANN'S PLACE - HOME OF I CAN

80 SAW MILL ROAD

DANBURY CT 06810

~ONE

~Ol(C)(3)

30.000.

MATHILDE RRIM FELLOWS

PROGRAM

10 000.

$Ol(C)(3)

RESIDENTIAL NURSING

CARE FOR

DEVELOPMENTALLY DISAB

10 000.

501(C) (3)

HEALTH AND HOPE FOR

HAITI

2 500.

501(C)(3)

~GELIGHT

SHORT FILM

SERIES

20 000.

501(C) (3)

E:AT TO DEFEAT CANCER

10.000.

501(C)(3)

APPALACHIAN MOUNTAIN ADVOCATES, INC.

~Ol(C) (3)

NONE

PO BOX 507

LEWISBURG WV 24901-0507

Total from continuation sheets ·········-································································ .... ·······

"IDS KAN

~CAL

5

ooo.

30

ooo.

MINING

~CCOUNTABILITY

OAMFAIGN

•·•···································•·•·•••••••••••

123631 08-03-11

10371102 784735 2415988000

17

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

1et1axv1

3

NEWMAN'S OWN FOUNDATION

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year {Continuation)

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

APPLIED BEHAVIORAL REHABILITATION

INSTITUTE, INC.

655 PARK AVENUE

BRIDGEPORT CT 06604-4634

•ONE

ARC OF MARTIN COUNTY

2001 s. KANNER HWY

•ONE

STUART

Foundation

status of

recipient

501(C)(3)

Purpose of grant or

contribution

!FEMALE SOLDIERS

WORGOTTEN HEROES

25,000.

~Ol(C) (3)

i>-BLE

FL 34994

ARC OF SAN DIEGO

3030 MARKET STREET

Amount

11

~ONE

~Ol(C)(3)

ooo.

MUSIC THERAPY

SAN DIEGO. CA 92102

2 500.

ARTISTS STRIVING TO END POVERTY

165 WEST 46TH STREET

NEW YORK NY 10036

~ONE

ARTS FOR HEALING

24 GROVE STREET

NEW CANAAN CT 06840

~ONE

ARTS HORIZONS

1 GRAND AVENUE

ENGLEWOOD NJ 07631

~ONE

ARZU STUDIO HOPE

875 N. MICHIGAN AVENUE

CHICAGO. IL 60611

NONE

ASIAN AMERICAN WRITERS' WORKSHOP

112 w. 27TH STREET

NEW YORK NY 10001

•ONE

ASSISTANCE LEAGUE OF BOISE

•oNE

~Ol(C) (3)

1\RT-IN-ACTION

EXPERIENCE

5 000.

~Ol(C)(3)

l"'!RCLE OP HOPE

5 000.

501(C) (3)

501(C)(3)

OPERATIONS

~PERATION

10

ooo.

25

ooo.

SUSTAINABLE

~OPE

501(C) (3)

bPERATIONS

5.000.

501(C)(3)

bPERATION SCHOOL BELL

P. o. BOX 140104

GARDEN CITY

ID 83714-0104

ASSOCIATED HUMANE SOCIETIES

124 EVERGREEN AVENUE

NEWARK NJ 07114

2.500.

•ONE

~Ol(C)

(3)

~ow COST SPAY/NEUTER

MOBILE VETERINARY UNIT

10 000.

Total from continuation sheets .... .... ................. ............. ................................................................................

123631 08-03-11

10371102 784735 2415988000

18

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

llPa!itX'VI

3

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation}

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

ASSOCIATION TO BENEFIT CHILDREN

419 EAST 86TH STREET

NEW YORK NY 10028

•ONE

AUSTIN COMMUNITY FOUNDATION

P. o. BOX 684746

AUSTIN TX 78768~4746

•ONE

AUTISM SPEAKS

1 EAST 33RD STREET

•ONE

Foundation

status of

recipient

501(C) (3)

Purpose of grant or

contribution

Amount

!ROSIE AND HARRY'S CAMP

30 000.

501(C) (3)

~ENTRAL TEXAS WILDFIRE

~UND

25 000.

501(C) (3)

WACE OFF FOR A CURE

NEW YORK. NY 10016

50.000.

BACK ON MY FEET

1520 LOCUST STREET

PHILADELPHIA PA 19102

•ONE

BACK ON MY FEET

1520 LOCUST STREET

PHILADELPHIA PA 19102

•ONE

BACKCOUNTRY JAZZ

15 EAST PUTNAM AVENUE

GREENWICH CT 06830

•ONE

BATTENKILL KITCHEN

P.O. BOX 784

SALEM. NY 12865

•ONE

BERKSHIRE TACONIC COMMUNITY FN

271 MAIN STREET, SUITE 1

GREAT BARRINGTON MA 01230-1972

•ONE

BERKSHIRE THEATRE FESTIVAL

P.O. BOX 797

STOCKBRIDGE MA 01262

~ONE

BERLIN FREE LIBRARY

834 WORTHING LANE

BERLIN CT 06037

~ONE

501(C) (3)

PPERATING EXPENSES

5

501(C) (3)

ooo.

PPERATIONS

15 000.

~Ol(C) (3)

~RIDGEPORT

PUBLIC

SCHOOL

15 000.

~Ol(C) (3)

YOUTH COOKING CLASSES

2.500.

~Ol(C)

(3)

21ST CENTURY FUND FOR

aoUSATONIC VALLEY RHS

20 000.

~01(C)(3)

OPERATIONS

10 000.

~01(C)(3)

~HILDREN'S

LITERARY

'"'ENTER

2 500.

Total from continuation sheets ........... ............... ............ ......

................

...... ........

........................... ····························

123631 08-03-11

10371102 784735 2415988000

19

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

NEWMAN'S OWN FOUNDATION

I Raif XVI

3

06-1606588

Supplementary Information

Grants and Contributions Paid During the Year (Continuation)

Recipient

Name and address (home or business}

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

BERLIN HISTORICAL SOCIETY

1142 CHAMBERLAIN HWY

KENSINGTON CT 06037

•ONE

BEST BUDDIES MASSACHUSETTS

45 BROMFIELD STREET, THIRD FLOOR

BOSTON MA 02108

•ONE

BEST DAY FOUNDATION, INC.

567 AUTO CENTER DR

•ONE

Foundation

Purpose of grant or

contribution

status of

Amount

recipient

~Ol(C)

(3)

jBERLIN HISTORICAL

~SEUM

5 000.

Ml(C) (3)

kIDDLE AND HIGH SCHOOL

~RIENDSHIP PROJECT

7 500.

~Ol(C)(3)

WATSONVILLE. CA 95076-3727

BETHANY HOUSE SERVICES

1841 FAIRMOUNT AVENUE

CINCINNATI OH 45214

•ONE

BEYOND SHELTER

205 SOUTH BROADWAY, SUITE 608

LOS ANGELES CA 90012

•ONE

BIG APPLE CIRCUS LTD.

ONE METROTECH CENTER

BROOKLYN. NY 11201-3949

•ONE

BIG SUR LAND TRUST

P. O. BOX 4071

MONTEREY. CA 93942

•ONE

BILLINGS FORGE COMMUNITY WORKS

140 RUSS STREET SUITE

HARTFORD CT 06106

•ONE

BIRMINGHAM CIVIL RIGHTS INSTITUTE

520 16TH STREET NORTH

BIRMINGHAM AL 35203

•ONE

BLOOD BANR OF HAWAII

2043 DILLINGHAM BOULEVARD

HONOLULU HI 96819

~ONE

~Ol(C)(3)

!EQUIPMENT SELF

lsUFFICIENCY IN

SOUTHERN CALIFORNIA

10,000.

~HILD/PARENT

i:::ONNECTION

10 000.

~Ol(C)(3)

~HE

HOUSING FIRST

FOR HOMELESS

!FAMILIES

~ROGRAM

~Ol(C)

(3)

~LOWN

25 000.

CARE

25 000.

~Ol(C)

(3)

l<AJlKS RANCH

30 .ooo.

~Ol(C)(3)

THE GARDEN

5 000.

~Ol(C)(3)

EDUCATION PROGRAMS FOR

K-12 STUDENTS

11 000.

501(C) (3)

OPERATING

5 000.

Total from continuation sheets ...................................

..... . ....... ... .....

......................

.........

123631 08-03-11

10371102 784735 2415988000

20

2011.04040 NEWMAN'S OWN FOUNDATION

24159881

06-1606588

NEWMAN'S OWN FOUNDATION

IR~®MI

3 Grants and Contributions Paid During the Year (Continuation)

Supplementary Information

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

BLOOMINGTON PLAYWRIGHTS PROJECT

107 W 9TH STREET

BLOOMINGTON IN 47404

NONE

BOYS & GIRLS CLUB OF BINGHAMTON

90 CLINTON STREET

BINGHAMTON. NY 13905

NONE

BOYS & GIRLS CLUB OF MANCHESTER

555 UNION STREET

MANCHESTER NH 03104

NONE

BOYS & GIRLS CLUB OF STONEHAM

~ONE

Foundation

status of

recipient

Ml(C) (3)

Amount

8PP YOUTH EDUCATION

20 000.

50l(C) (3)

GENERAL OPERATING

15 000.

~Ol(C) (3)

YOUTH LEADERSHIP

20

50l(C) (3)

15 DALE COURT

STONEHAM

Purpose of grant or

contribution

ooo.

JR. STAFF CENTER

DEVELOPMENT PROGRAM

7 500.

MA 02180

BOYS AND GIRLS CLUB OF GREATER NEW

BEDFORD

166 JENNEY STREET

NEW BEDFORD MA 02740

NONE

BOYS AND GIRLS CLUB OF GREATER NEW

BEDFORD

166 JENNEY STREET

NEW BEDFORD MA 02740

~ONE

BOYS AND GIRLS CLUBS OF BOSTON

30 WILLOW STREET

CHELSEA MA 02150

~ONE

BOYS AND GIRLS CLUBS OF HARTFORD

170 SIGOURNEY STREET

HARTFORD CT 06105

NONE

BRADY CENTER TO PREVENT GUN VIOLENCE

1225 EYE STREET NW

WASHINGTON DC 20005

NONE

BREAST CANCER RESEARCH FOUNDATION

60 EAST 56TH STREET

NEW YORK NY 10022

Total from continuation sheets ........

NONE

~Ol(C) (3)

OUTREACH

"'RANSPORTATION

5

501(C)(3)

ooo.

OUTREACH

I'RANSPORTATION

15 000.

501(C)(3)

SOl(C) (3)

JORDON BOYS AND GIRLS

"'LUB CULTURAL AND

ERFORMING ARTS

20 000.

DOWER HOUR

30.000.

501(C)(3)

CAMPAIGN

COMMUNITIES AND

:!OLLEGE CAMPUSES

~ATIONAL