Ryan (2) (PDF)

File information

This PDF 1.5 document has been generated by / TCPDF 6.2.5 (http://www.tcpdf.org), and has been sent on pdf-archive.com on 30/10/2016 at 01:20, from IP address 73.116.x.x.

The current document download page has been viewed 318 times.

File size: 1.29 MB (6 pages).

Privacy: public file

File preview

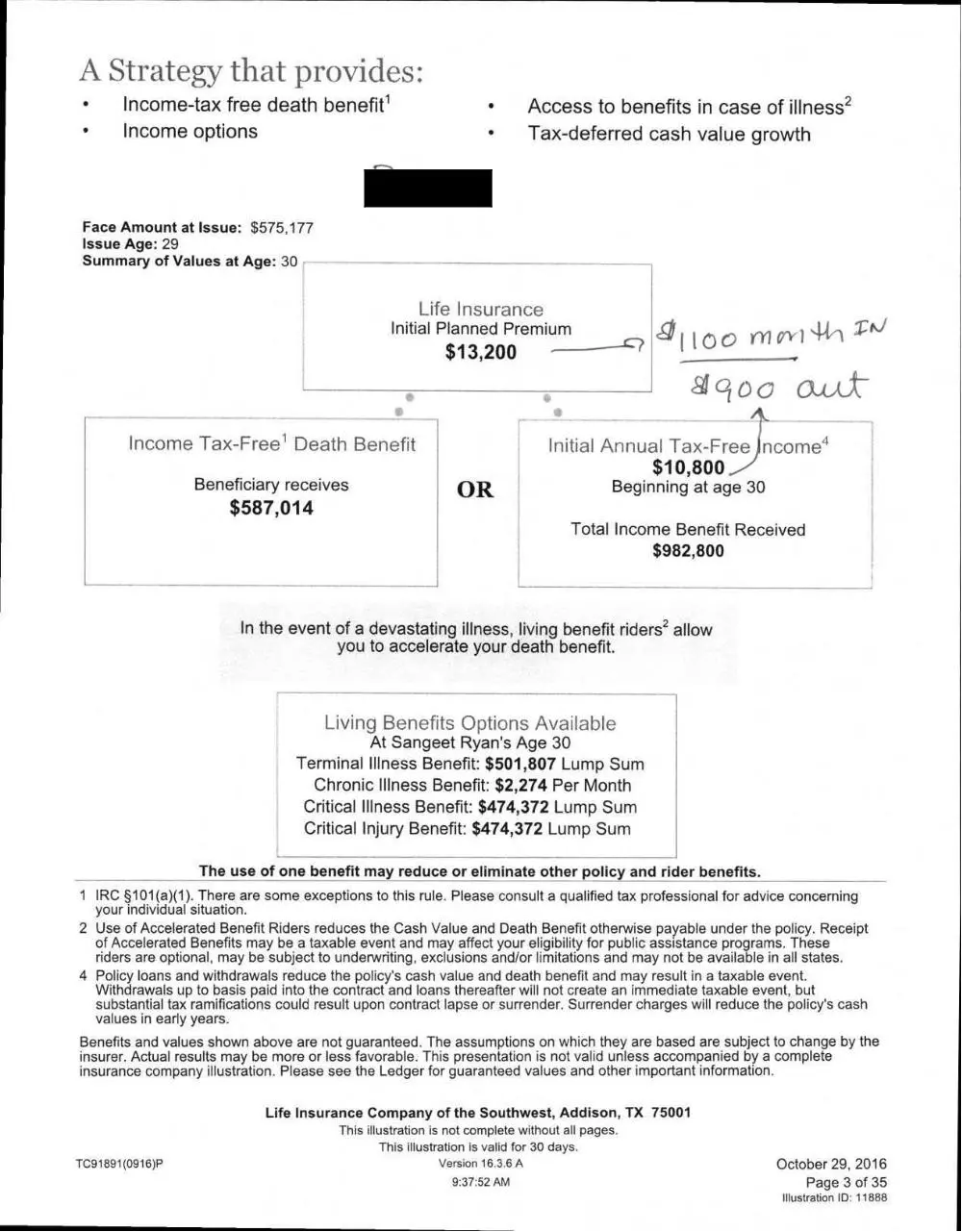

A Strategy that provides:

•

•

Income-tax free death benefit'

Income options

•

•

Access to benefits in case of illness 2

Tax-deferred cash value growth

acrl

Face Amount at Issue: $575,177

Issue Age: 29

Summary of Values at Age: 30

Life Insurance

Initial Planned Premium

(ton

$13,200

90so

*_

Initial Annual Tax-Free ncome 4

Income Tax-Free' Death Benefit

$10,800

Beneficiary receives

]

$587,014

CUAt-

Beginning at age 30

OR

Total Income Benefit Received

$982,800

In the event of a devastating illness, living benefit riders 2 allow

you to accelerate your death benefit.

Living Benefits Options Available

At Sangeet Ryan's Age 30

Terminal Illness Benefit: $501,807 Lump Sum

Chronic Illness Benefit: $2,274 Per Month

Critical Illness Benefit: $474,372 Lump Sum

Critical Injury Benefit: $474,372 Lump Sum

The use of one benefit may reduce or eliminate other policy and rider benefits.

1 IRC §101(a)(1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning

your individual situation.

2 Use of Accelerated Benefit Riders reduces the Cash Value and Death Benefit otherwise payable under the policy. Receipt

of Accelerated Benefits may be a taxable event and may affect your eligibility for public assistance programs. These

riders are optional, may be subject to underwriting, exclusions and/or limitations and may not be available in all states.

4 Policy loans and withdrawals reduce the policy's cash value and death benefit and may result in a taxable event.

Withdrawals up to basis paid into the contract and loans thereafter will not create an immediate taxable event, but

substantial tax ramifications could result upon contract lapse or surrender. Surrender charges will reduce the policy's cash

values in early years.

Benefits and values shown above are not guaranteed. The assumptions on which they are based are subject to change by the

insurer. Actual results may be more or less favorable. This presentation is not valid unless accompanied by a complete

insurance company illustration. Please see the Ledger for guaranteed values and other important information.

Life Insurance Company of the Southwest, Addison, TX 75001

TC91891(0916)P

This illustration is not complete without all pages.

This illustration is valid for 30 days.

Version 16.3.6 A

9:37:52 AM

October 29, 2016

Page 3 of 35

Illustration ID: 11888

FlexLife II

Indexed Universal Life

Narrative Summary

Face Amount: $575,177

Sangeet Ryan

Death Benefit Option: B (Increasing)

Male 29 Preferred Non-Tobacco

Initial Premium: $1,100.00 Monthly (EFT)

Riders: ABR, CMG, DBPR, ICSR. LIBR, OPR, SAR, BSB

State: California

Indexed Strategies Disclosure (continued)

othetical Returns b Strate

Indexed

Indexed

Indexed

Loan

Strategy 2,

Indexed

Strategy 1,

Account,

S&P 500' I

Strategy 3,

S&P 500"

Pt-to-Pt

S&P 500

Pt-to-Pt

S&P 500'

Par Rate

Pt-to-Pt

Pt-to-Pt

Cap Focus

Focus

Cap Focus

No Cap

Cap:

Cap:

Cap:

Par:

12.00%

12.00%

9.75

Par:

55.00%

Par%

Par:

:

100.00%

140.00%

100.00%

S&P 500'

Pt-to-Ave

Growth

Rate

Indexed

Strategy 4,

S&P soo®

Pt-to-Ave

No Cap

Par:

110.00%

Year

S&P 500'

Pt-to-Pt

Growth

Rate

1996

20.26%

12.00%

12.00%

9.75%

11.15%

8.86%

9.74%

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

31.01%

26.67%

19.53%

-10.14%

-13.04%

-23.37%

26.38%

8.99%

3.00%

13.62%

3.53%

-38.49%

23.45%

12.78%

0.00%

13.41%

29.60%

11.39%

-0.73%

12.00%

12.00%

12.00%

0.00%

0.00%

0.00%

12.00%

8.99%

3.00%

12.00%

3.53%

0.00%

12.00%

12.00%

12.00%

9.75%

0.00%

12.00%

12.00%

11.39%

0.00%

0.00%

12.00%

12.00%

11.39%

0.00%

9.75%

9.75%

0.00%

0.00%

0.00%

9.75%

9.75%

4.20%

9.75%

4.94%

0.00%

9.75%

9.75%

0.00%

9.75%

9.75%

9.75%

0.00%

17.05%

14.67%

10.74%

0.00%

0.00%

0.00%

14.51%

4.95%

1.65%

7.49%

1.94%

17.91%

12.00%

12.00%

0.00%

0.00%

0.00%

12.00%

8.99%

3.00%

12.00%

3.53%

0.00%

12.00%

12.00%

19.70%

13.04%

8.78%

0.00%

0.00%

0.00%

10.68%

1.85%

0.00%

5.48%

4.57%

0.00%

5.46%

2.45%

0.87%

10.65%

16.78%

5 Year Avg

10 Year Avg

15 Year Avg

10.20%

6.92%

5.10%

3.00%

7.35%

6.45%

6.92%

7.35%

20 Year Avg

6.20%

2008

2009

2010

2011

2012

2013

2014

2015

Maximum Illustrated Rate

1

0.00%

12.90%

7.03%

0.00%

7.37%

16.28%

6.26%

0.00%

11.86%

7.98%

-2.86%

-9.55%

-13.43%

9.71%

1.68%

-0.39°/0

4.98%

4.15%

-16.91%

4.96%

2.23%

0.80%

9.68%

15.26%

4.49%

0.11%

5.90%

5.60%

2.80%

4.90%

4.15%

5.60%

6.21%

6.00%

6.91%

6.26%

6.27%

30.31%

29.18%

36.48%

-54.48%

74.50%

16.36%

-20.41%

2.06%

5.24%

0.80%

2.70%

7.21%

0.00%

10.75%

0.00%

0.00%

0.00%

10.75%

10.75%

10.75%

10.75%

10.75%

0.00%

-7.20%

1.20%

2.70%

7.21%

-27.52%

63.70%

-31.80%

-4.91%

-7.97%

51.59%

22.45%

4.94%

0.12%

6.49%

5.02%

5.22%

6.53%

3.91%

15.15%

-4.98%

-4.63%

-16.96%

5.90%

6.45%

3.91%

-13.41%

0.00%

10.75%

10.75%

0.00%

10.75%

0.00%

0.00%

0.00%

5.82%

5.80%

5.74%

6.25%

5.72%

MSCI EM

Pt-to-Pt

Growth

Rate

Indexed

Strategy 5,

MSCI EM

Pt-to-Pt

Cap Focus

Cap:

10.75%

Par:

100.00%

6.54%

5.96%

1 The Maximum Illustrated Rate for the Indexed Loan Account and all Indexed Strategies is defined as the lesser of the

average annual look-back rate for the Benchmark Indexed Account using all of the possible 25-year periods from the

most recent 65 calendar years, or the average annual look-back on the current parameters of the specific strategy.

The maximum illustrated rate for the indexed loan account is capped at 100 basis points (1.00%) above the current

fixed loan interest rate.

Life Insurance Company of the Southwest, Addison, TX 75001

TC91891(0916)P

This illustration is not complete without all pages.

This illustration is valid for 30 days.

Version 16.3.6 A

9:47:35 AM

October 29, 2016

Page 17 of 35

Illustration ID: 11888

FlexLife II

Indexed Universal Life

Distributions Ledger

Sangeet Ryan

Face Amount: $575,177

Male 29 Preferred Non-Tobacco

Death Benefit Option: B (Increasing)

Riders: ABR, CMG, DBPR, ICSR, LIBR, OPR, SAR, BSB

Initial Premium: $1,100.00 Monthly (EFT)

State: California

This illustration of FlexLife II values assumes payments are made in the amounts shown and that the illustrated rates and

monthly deductions will continue in the future. The interest rate used in the calculation of current values is the weighted

average rate shown below.

Current Illustrated Rate*

Planned

Annualized

Premium

Illustrated Loan Rate: 5.00%

Planned

Annual

Income

Planned

Annual

Loan

Accumulated

Loan

Amount

Weighted

Average

Interest

Rate

Accumulated

Value

Cash

Surrender

Value

Ne

Death

Benefi

Policy

Year

Age

1

29

$13,200.00

$0

$0

$0

6.48 %

$11,328

$11,328

$586,505

2

30

13,200.00

10,800

10,800

11,340

6.23 %

23,177

11,837

587,014

3

31

13,200.00

10,800

11,340

23,247

6.14 %

35,570

12,323

587,500

4

32

13,200.00

10,800

11,907

35,749

6.10 %

48,536

12,787

587,964

5

33

13,200.00

10,800

12,502

48,877

6.07 %

62,106

13,229

588,406

6

34

13,200.00

10,800

13,127

62,661

6.05 %

76,310

13,650

588,827

7

35

13,200.00

10,800

13,784

77,134

6.03 %

91,166

14,032

589,209

8

36

13,200.00

10,800

14,473

92,330

6.01 %

106,703

14,373

589,550

9

37

13,200.00

10,800

15,197

108,287

6.00 %

122,946

14,659

589,836

10

38

13,200.00

10,800

15,957

125,041

6.00 %

139,925

14,883

590,060

$132,000.00

$97,200

$119,087

594,239

11

39

13,200.00

10,800

16,754

142,633

6.06 %

161,696

19,062

12

40

13,200.00

10,800

17,592

161,105

6.06 %

184,887

23,782

598,959

13

41

13,200.00

10,800

18,472

180,500

6.07 %

209,589

29,089

604,266

14

42

13,200.00

10,800

19,395

200,865

6.07 %

235,910

35,044

610,221

15

43

13,200.00

10,800

20,365

222,249

6.08 %

263,961

41,713

616,890

16

44

13,200.00

10,800

21,383

244,701

6.08 %

293,854

49,152

624,329

17

45

13,200.00

10,800

22,452

268,276

6.08 %

325,710

57,434

632,611

18

46

13,200.00

10,800

23,575

293,030

6.09 %

359,657

66,627

641,804

19

47

13,200.00

10,800

24,754

319,021

6.09 %

395,825

76,804

651,981

20

48

13,200.00

10,800

25,991

346,312

6.09 %

434,362

88,050

663,227

$264,000.00

$205,200

$329,820

21

49

13,200.00

10,800

27,291

374,968

6.10 %

475,415

100,447

675,624

22

50

13,200.00

10,800

28,656

405,056

6.10 %

519,145

114,088

689,265

23

51

13,200.00

10,800

30,088

436,649

6.10%

565,725

129,076

704,253

24

52

13,200.00

10,800

31,593

469,822

6.11%

615,326

145,505

720,682

25

53

13,200.00

10,800

33,172

504,653

6.11 %

668,126

163,473

738,650

26

54

13,200.00

10,800

34,831

541,226

6.11 %

724,303

183,078

758,255

* Benefits and values are not guaranteed. The assumptions on which they are based are subject to change by the insurer.The

rates for the Percent of Premium Expense Charge, Monthly Cost of Insurance, Monthly Expense Charge, Monthly Policy Fee,

Monthly Percent of Accumulated Value Charge and Rider Charge, if any, will be determined by the Company and may

change from time to time based on expectations of future anticipated experience. Future anticipated experience can include,

but is not limited to, investment earnings, mortality, persistency, taxes and expenses which may affect these assumptions.

Actual results may be more or less favorable. See prior pages for guaranteed values.

Life Insurance Company of the Southwest, Addison, TX 75001

TC91891(0916)P

This illustration is not complete without all pages.

This illustration is valid for 30 days.

Version 16.3.6 A

9:37:52 AM

October 29, 2016

Page 27 of 35

Illustration ID: 11888

FlexLife II

Indexed Universal Life

Distributions Ledger

Sangeet Ryan

Face Amount: $575,177

Male 29 Preferred Non-Tobacco

Death Benefit Option: B (Increasing)

Riders: ABR, CMG, DBPR, ICSR, LIBR, OPR, SAR, BSB

Initial Premium: $1,100.00 Monthly (EFT)

State: California

This illustration of FlexLife II values assumes payments are made in the amounts shown and that the illustrated rates and

monthly deductions will continue in the future. The interest rate used in the calculation of current values is the weighted

average rate shown below.

Current Illustrated Rate*

Policy

Year Age

Illustrated Loan Rate: 5.00%

Planned

Annualized

Premium

Planned

Annual

Income

Planned

Annual

Loan

Accumulated

Loan

Amount

Weighted

Average

Interest

Rate

Accumulated

Value

Cash

Surrender

Value

Ne

Death

Benefi

$779,709

27

55

$13,200.00

S10,800

$36,573

$579,627

6.12 %

$784,159

$204,532

28

56

13,200.00

10,800

38,401

619,948

6.12 %

847,931

227,983

803,160

29

57

13,200.00

10,800

40,321

662,286

6.12 %

915,874

253,588

828,765

30

58

706,740

6.13 %

988,254

281,514

856,691

13,200.00

10,800

42,337

$396,000.00

$313,200

$673,083

31

59

13,200.00

10,800

44,454

753,417

6.13 %

1,065,358

311,941

887,118

32

60

13,200.00

10,800

46,677

802,428

6.13 %

1,147,482

345,054

920,231

33

61

13,200.00

10,800

49,011

853,889

6.13 %

1,234,937

381,048

956,225

34

62

13,200.00

10,800

51,461

907,923

6.14 %

1,328,062

420,139

995,316

35

63

13,200.00

10,800

54,034

964,660

6.14 %

1,427,209

462,549

1,037,726

36

64

13,200.00

10,800

56,736

1,024,233

6.14 %

1,532,750

508,517

1,083,694

37

65

13,200.00

10,800

59,573

1,086,784

6.15 %

1,645,078

558,294

1,133,471

38

66

13,200.00

10,800

62,552

1,152,463

6.15 %

1,764,609

612,146

1,187,323

39

67

13,200.00

10,800

65,679

1,221,427

6.15 %

1,891,774

670,348

1,245,525

40

68

1,293,838

6.15%

2,027,033

733,195

1,308,372

13,200.00

10,800

68,963

$528,000.00

$421,200

$1,232,223

41

69

13,200.00

10,800

72,411

1,369,870

6.16 %

2,170,869

801,000

1,376,177

42

70

13,200.00

10,800

76,032

1,449,703

6.16 %

2,323,790

874,087

1,449,264

43

71

13,200.00

10,800

79,833

1,533,528

6.16 %

2,486,329

952,801

1,527,978

44

72

13,200.00

10,800

83,825

1,621,545

6.16 %

2,659,047

1,037,502

1,612,679

45

73

13,200.00

10,800

88,016

1,713,962

6.16 %

2,842,538

1,128,576

1,703,753

46

74

13,200.00

10,800

92,417

1,811,000

6.17 %

3,037,420

1,226,420

1,801,597

47

75

13,200.00

10,800

97,038

1,912,890

6.17 %

3,244,350

1,331,460

1,906,637

48

76

13,200.00

10,800

101,890

2,019,875

6.17 %

3,464,014

1,444,139

2,019,316

49

77

13,200.00

10,800

106,985

2,132,208

6.17 %

3,697,133

1,564,924

2,140,101

50

78

2,250,159

6.17%

3,944,469

1,694,310

2,269,487

2,374,007

6.17 %

4,206,827

1,832,820

2,407,997

51

79

13,200.00

10,800

112,334

$660,000.00

$529,200

$2,143,004

13,200.00

10,800

117,950

* Benefits and values are not guaranteed. The assumptions on which they are based are subject to change by the insurer.The

rates for the Percent of Premium Expense Charge, Monthly Cost of Insurance, Monthly Expense Charge, Monthly Policy Fee,

Monthly Percent of Accumulated Value Charge and Rider Charge, if any, will be determined by the Company and may

change from time to time based on expectations of future anticipated experience. Future anticipated experience can include,

but is not limited to, investment earnings, mortality, persistency, taxes and expenses which may affect these assumptions.

Actual results may be more or less favorable. See prior pages for guaranteed values.

Life Insurance Company of the Southwest, Addison, TX 75001

This illustration is not complete without all pages.

TC91891(0916)P

This illustration is valid for 30 days.

Version 16.3.6 A

9:37:52 AM

October 29, 2016

Page 28 of 35

Illustration ID: 11888

FlexLife II

Indexed Universal Life

Distributions Ledger

Sangeet Ryan

Face Amount: $575,177

Male 29 Preferred Non-Tobacco

Death Benefit Option: B (Increasing)

Riders: ABR, CMG, DBPR, ICSR, LIBR, OPR, SAR, BSB

Initial Premium: $1,100.00 Monthly (EFT)

State: California

This illustration of FlexLife II values assumes payments are made in the amounts shown and that the illustrated rates and

monthly deductions will continue in the future. The interest rate used in the calculation of current values is the weighted

average rate shown below.

Current Illustrated Rate*

Policy

Year Age

Illustrated Loan Rate: 5.00%

Planned

Annualized

Premium

Planned

Annual

Income

Planned

Annual

Loan

Accumulated

Loan

Amount

Weighted

Average

Interest

Rate

Accumulated

Value

Cash

Surrender

Value

Ne

Death

Benefi

$2,556,178

52

80

$13,200.00

S10,800

$123,848

$2,504,047

6.18 %

$4,485,048

$1,981,001

53

81

13,200.00

10,800

130,040

2,640,590

6.18 %

4,779,921

2,139,332

2,714,509

54

82

13,200.00

10,800

136,542

2,783,959

6.18 %

5,092,355

2,308,396

2,883,573

55

83

13,200.00

10,800

143,369

2,934,497

6.18 %

5,423,307

2,488,810

3,063,987

56

84

13,200.00

10,800

150,538

3,092,562

6.18 %

5,773,777

2,681,215

3,256,392

57

85

13,200.00

10,800

158,065

3,258,530

6.18 %

6,144,446

2,885,916

3,461,093

58

86

13,200.00

10,800

165,968

3,432,796

6.18 %

6,536,227

3,103,431

3,678,608

59

87

13,200.00

10,800

174,267

3,615,776

6.18 %

6,950,048

3,334,272

3,909,449

60

88

3,807,905

6.18 %

7,386,732

3,578,827

4,154,004

13,200.00

10,800

182,980

$792,000.00

$637,200

$3,626,571

61

89

13,200.00

10,800

192,129

4,009,640

6.18 %

7,847,135

3,837,494

4,412,671

62

90

13,200.00

10,800

201,735

4,221,462

6.17 %

8,332,420

4,110,957

4,686,134

4,974,563

63

91

13,200.00

10,800

211,822

4,443,875

6.17 %

8,843,261

4,399,386

64

92

13,200.00

10,800

222,413

4,677,409

6.17 %

9,380,977

4,703,568

5,278,745

65

93

13,200.00

10,800

233,534

4,922,620

6.17 %

9,946,998

5,024,378

5,599,555

66

94

13,200.00

10,800

245,210

5,180,091

6.17 %

10,543,449

5,363,358

5,938,535

67

95

13,200.00

10,800

257,471

5,450,435

6.16 %

11,173,362

5,722,927

6,298,104

68

96

13,200.00

10,800

270,345

5,734,297

6.16 %

11,838,309

6,104,012

6,679,189

69

97

13,200.00

10,800

283,862

6,032,352

6.16 %

12,540,835

6,508,483

7,083,660

70

98

6,345,309

6.16 %

13,282,069

6,936,760

7,511,937

13,200.00

10,800

298,055

$924,000.00

$745,200

$6,043,147

71

99

13,200.00

10,800

312,958

6,673,915

6.16 %

14,063,478

7,389,563

7,964,740

72

100

13,200.00

10,800

328,605

7,018,951

6.16 %

14,887,884

7,868,934

8,444,111

73

101

13,200.00

10,800

345,036

7,381,238

6.15 %

15,758,761

8,377,523

8,952,700

74

102

13,200.00

10,800

362,288

7,761,640

6.15 %

16,680,148

8,918,508

9,493,685

75

103

13,200.00

10,800

380,402

8,161,062

6.15 %

17,656,850

9,495,788

10,070,965

76

104

13,200.00

10,800

399,422

8,580,455

6.15 %

18,693,993

10,113,538

10,688,715

77

105

13,200.00

10,800

419,393

9,020,818

6.15 %

19,796,510

10,775,692

11,350,869

* Benefits and values are not guaranteed. The assumptions on which they are based are subject to change by the insurer.The

rates for the Percent of Premium Expense Charge, Monthly Cost of Insurance, Monthly Expense Charge, Monthly Policy Fee,

Monthly Percent of Accumulated Value Charge and Rider Charge, if any, will be determined by the Company and may

change from time to time based on expectations of future anticipated experience. Future anticipated experience can include,

but is not limited to, investment earnings, mortality, persistency, taxes and expenses which may affect these assumptions.

Actual results may be more or less favorable. See prior pages for guaranteed values.

Life Insurance Company of the Southwest, Addison, TX 75001

TC91891(0916)P

This illustration is not complete without all pages.

This illustration is valid for 30 days.

Version 16.3.6 A

9:37:52 AM

October 29, 2016

Page 29 of 35

Illustration ID: 11888

FlexLife II

Indexed Universal Life

Distributions Ledger

Sangeet Ryan

Face Amount: $575,177

Male 29 Preferred Non-Tobacco

Death Benefit Option: B (Increasing)

Riders: ABR, CMG, DBPR, ICSR, LIBR, OPR, SAR, BSB

Initial Premium: $1,100.00 Monthly (EFT)

State: California

This illustration of FlexLife II values assumes payments are made in the amounts shown and that the illustrated rates and

monthly deductions will continue in the future. The interest rate used in the calculation of current values is the weighted

average rate shown below.

Current Illustrated Rate*

Policy

Year Age

Illustrated Loan Rate: 5.00%

Planned

Annualized

Premium

Planned

Annual

Income

Planned

Annual

Loan

Accumufated

Loan

Amount

Weighted

Average

Interest

Rate

Accumufated

Value

Cash

Surrender

Value

Ne

Death

Benefi I

$12,061,530

78

106

$13,200.00

$10,800

$440,363

$9,483,199

6.15 %

$20,969,552

$11,486,353

79

107

13,200.00

10,800

462,381

9,968,699

6.15%

22,218,362

12,249,663

12,824,840

80

108

13,200.00

10,800

485,500

10,478,474

6.15%

23,550,309

13,071,835

13,647,012

$1,056,000.00

$853,200

$9,979,495

81

109

13,200.00

10,800

509,775

11,013,737

6.15 %

24,971,689

13,957,951

14,533,128

82

110

13,200.00

10,800

535,264

11,575,764

6.15 %

26,489,250

14,913,486

15,488,663

83

111

13,200.00

10,800

562,027

12,165,892

6.16 %

28,111,020

15,945,128

16,520,305

84

112

13,200.00

10,800

590,128

12,785,527

6.16 %

29,844,251

17,058,724

17,633,901

85

113

13,200.00

10,800

619,635

13,436,143

6.16 %

31,696,711

18,260,567

18,835,744

86

114

13,200.00

10,800

650,616

14,119,291

6.16 %

33,676,710

19,557,420

20,132,597

87

115

13,200.00

10,800

683,147

14,836,595

6.17 %

35,793,150

20,956,555

21,531,732

88

116

13,200.00

10,800

717,305

15,589,765

6.17 %

38,055,559

22,465,795

23,040,972

89

117

13,200.00

10,800

753,170

16,380,593

6.17 %

40,474,141

24,093,548

24,668,725

90

118

17,210,963

6.18 %

43,059,818

25,848,855

26,424,032

13,200.00

10,800

790,828

$1,188,000.00

$961,200

$16,391,390

91

119

13,200.00

10,800

830,370

18,082,851

6.18 %

45,824,290

27,741,439

28,316,616

92

120

13,200.00

10,800

871,888

18,998,333

6.18 %

48,780,085

29,781,752

30,356,929

$1,214,400.00

$982,800

$18,093,648

* Benefits and values are not guaranteed. The assumptions on which they are based are subject to change by the insurer.The

rates for the Percent of Premium Expense Charge, Monthly Cost of Insurance, Monthly Expense Charge, Monthly Policy Fee,

Monthly Percent of Accumulated Value Charge and Rider Charge, if any, will be determined by the Company and may

change from time to time based on expectations of future anticipated experience. Future anticipated experience can include,

but is not limited to, investment earnings, mortality, persistency, taxes and expenses which may affect these assumptions.

Actual results may be more or less favorable. See prior pages for guaranteed values.

Life Insurance Company of the Southwest, Addison, TX 75001

TC91891(0916)P

This illustration is not complete without all pages.

This illustration is valid for 30 days.

Version 16.3.6 A

9:37:52 AM

October 29, 2016

Page 30 of 35

Illustration ID: 11888

Powered by TCPDF (www.tcpdf.org)

Download Ryan (2)

Ryan (2).pdf (PDF, 1.29 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000501468.