Portfolio (PDF)

File information

Title: Quant Analyzer Portfolio Report

This PDF 1.4 document has been generated by PD4ML. HTML to PDF Converter for Java (398fx2), and has been sent on pdf-archive.com on 21/11/2016 at 16:12, from IP address 94.242.x.x.

The current document download page has been viewed 321 times.

File size: 1.13 MB (2 pages).

Privacy: public file

File preview

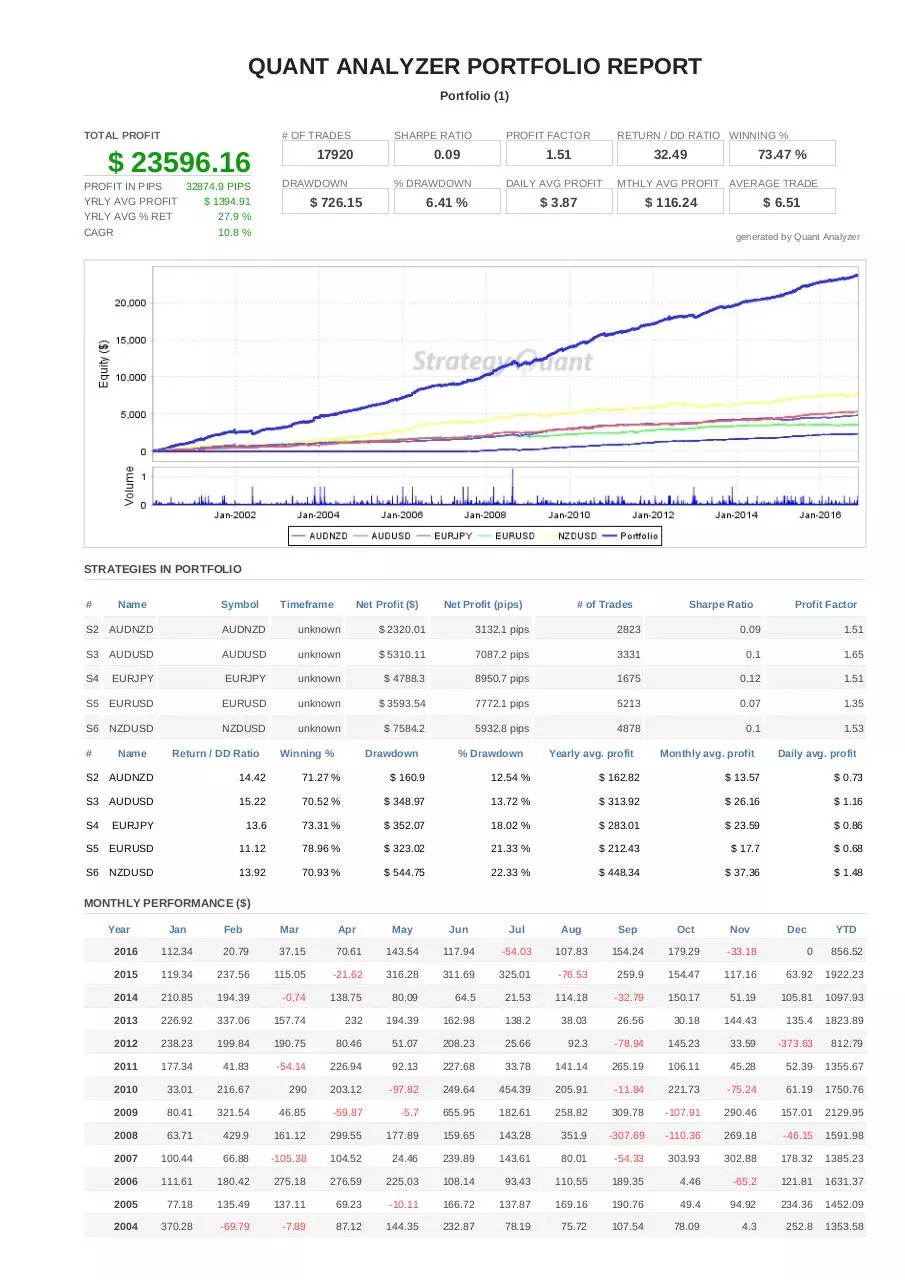

QUANT ANALYZER PORTFOLIO REPORT

Portfolio (1)

TOTAL PROFIT

# OF TRADES

17920

$ 23596.16

PROFIT IN PIPS

32874.9 PIPS

YRLY AVG PROFIT

$ 1394.91

YRLY AVG % RET

27.9 %

CAGR

10.8 %

SHARPE RATIO

PROFIT FACTOR

0.09

DRAWDOWN

1.51

% DRAWDOWN

$ 726.15

RETURN / DD RATIO WINNING %

32.49

DAILY AVG PROFIT

6.41 %

73.47 %

MTHLY AVG PROFIT AVERAGE TRADE

$ 3.87

$ 116.24

$ 6.51

generated by Quant Analyzer

STRATEGIES IN PORTFOLIO

#

Name

Symbol

Timeframe

Net Profit ($)

Net Profit (pips)

# of Trades

Sharpe Ratio

Profit Factor

S2

AUDNZD

AUDNZD

unknown

$ 2320.01

3132.1 pips

2823

0.09

1.51

S3

AUDUSD

AUDUSD

unknown

$ 5310.11

7087.2 pips

3331

0.1

1.65

S4

EURJPY

EURJPY

unknown

$ 4788.3

8950.7 pips

1675

0.12

1.51

S5

EURUSD

EURUSD

unknown

$ 3593.54

7772.1 pips

5213

0.07

1.35

S6

NZDUSD

NZDUSD

unknown

$ 7584.2

5932.8 pips

4878

0.1

1.53

#

Name

Return / DD Ratio

Winning %

Drawdown

% Drawdown

Yearly avg. profit

Monthly avg. profit

Daily avg. profit

S2

AUDNZD

14.42

71.27 %

$ 160.9

12.54 %

$ 162.82

$ 13.57

$ 0.73

S3

AUDUSD

15.22

70.52 %

$ 348.97

13.72 %

$ 313.92

$ 26.16

$ 1.16

S4

EURJPY

13.6

73.31 %

$ 352.07

18.02 %

$ 283.01

$ 23.59

$ 0.86

S5

EURUSD

11.12

78.96 %

$ 323.02

21.33 %

$ 212.43

$ 17.7

$ 0.68

S6

NZDUSD

13.92

70.93 %

$ 544.75

22.33 %

$ 448.34

$ 37.36

$ 1.48

MONTHLY PERFORMANCE ($)

Year

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

YTD

2016

112.34

20.79

37.15

70.61

143.54

117.94

-54.03

107.83

154.24

179.29

-33.18

0

856.52

2015

119.34

237.56

115.05

-21.62

316.28

311.69

325.01

-76.53

259.9

154.47

117.16

63.92

1922.23

2014

210.85

194.39

-0.74

138.75

80.09

64.5

21.53

114.18

-32.79

150.17

51.19

105.81

1097.93

2013

226.92

337.06

157.74

232

194.39

162.98

138.2

38.03

26.56

30.18

144.43

135.4

1823.89

2012

238.23

199.84

190.75

80.46

51.07

208.23

25.66

92.3

-78.94

145.23

33.59

-373.63

812.79

2011

177.34

41.83

-54.14

226.94

92.13

227.68

33.78

141.14

265.19

106.11

45.28

52.39

1355.67

2010

33.01

216.67

290

203.12

-97.82

249.64

454.39

205.91

-11.84

221.73

-75.24

61.19

1750.76

2009

80.41

321.54

46.85

-59.87

-5.7

655.95

182.61

258.82

309.78

-107.91

290.46

157.01

2129.95

2008

63.71

429.9

161.12

299.55

177.89

159.65

143.28

351.9

-307.69

-110.36

269.18

-46.15

1591.98

2007

100.44

66.88

-105.38

104.52

24.46

239.89

143.61

80.01

-54.33

303.93

302.88

178.32

1385.23

2006

111.61

180.42

275.18

276.59

225.03

108.14

93.43

110.55

189.35

4.46

-65.2

121.81

1631.37

2005

77.18

135.49

137.11

69.23

-10.11

166.72

137.87

169.16

190.76

49.4

94.92

234.36

1452.09

2004

370.28

-69.79

-7.89

87.12

144.35

232.87

78.19

75.72

107.54

78.09

4.3

252.8

1353.58

2003

39.76

126.3

88.66

15.76

407.22

90.73

74.11

-2.03

22.41

171.1

394.6

-32.08

1396.54

2002

74.77

10.74

19.4

97.93

-353.36

143.67

261.46

155.64

78.87

27.31

29.37

18.18

563.98

2001

331.9

39.22

80.05

270.46

139.98

171.81

-0.32

138.37

134.07

129.48

-12.85

-78.83

1343.34

2000

-67.52

114.94

201.57

94.76

163.43

173.38

128.72

87.36

54.75

101.87

123.01

-47.96

1128.31

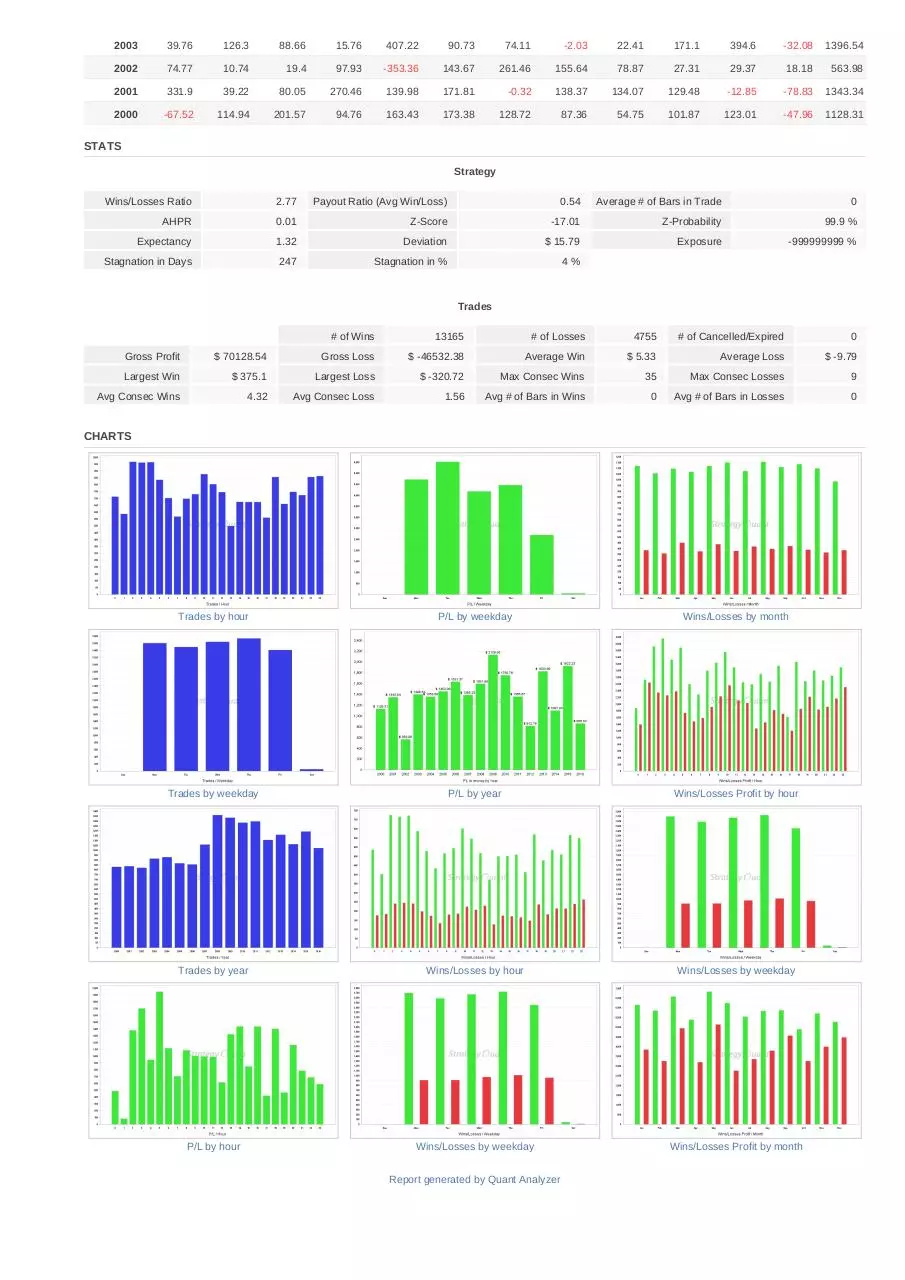

STATS

Strategy

Wins/Losses Ratio

2.77

Payout Ratio (Avg Win/Loss)

0.54

Average # of Bars in Trade

0

AHPR

0.01

Z-Score

-17.01

Z-Probability

99.9 %

Expectancy

1.32

Deviation

$ 15.79

Exposure

-999999999 %

Stagnation in Days

247

Stagnation in %

4%

Trades

# of Wins

13165

# of Losses

4755

# of Cancelled/Expired

0

Gross Profit

$ 70128.54

Gross Loss

$ -46532.38

Average Win

$ 5.33

Average Loss

$ -9.79

Largest Win

$ 375.1

Largest Loss

$ -320.72

Max Consec Wins

35

Max Consec Losses

9

Avg Consec Wins

4.32

Avg Consec Loss

1.56

Avg # of Bars in Wins

0

Avg # of Bars in Losses

0

CHARTS

Trades by hour

P/L by weekday

Wins/Losses by month

Trades by weekday

P/L by year

Wins/Losses Profit by hour

Trades by year

Wins/Losses by hour

Wins/Losses by weekday

P/L by hour

Wins/Losses by weekday

Wins/Losses Profit by month

Report generated by Quant Analyzer

Download Portfolio

Portfolio.pdf (PDF, 1.13 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000510634.