Quickfolio FranciscoCordeiro (PDF)

File information

This PDF 1.5 document has been generated by Adobe InDesign CS6 (Windows) / Adobe PDF Library 10.0.1, and has been sent on pdf-archive.com on 16/01/2017 at 16:33, from IP address 122.100.x.x.

The current document download page has been viewed 347 times.

File size: 3.78 MB (23 pages).

Privacy: public file

File preview

Quickfolio

Francisco Cordeiro

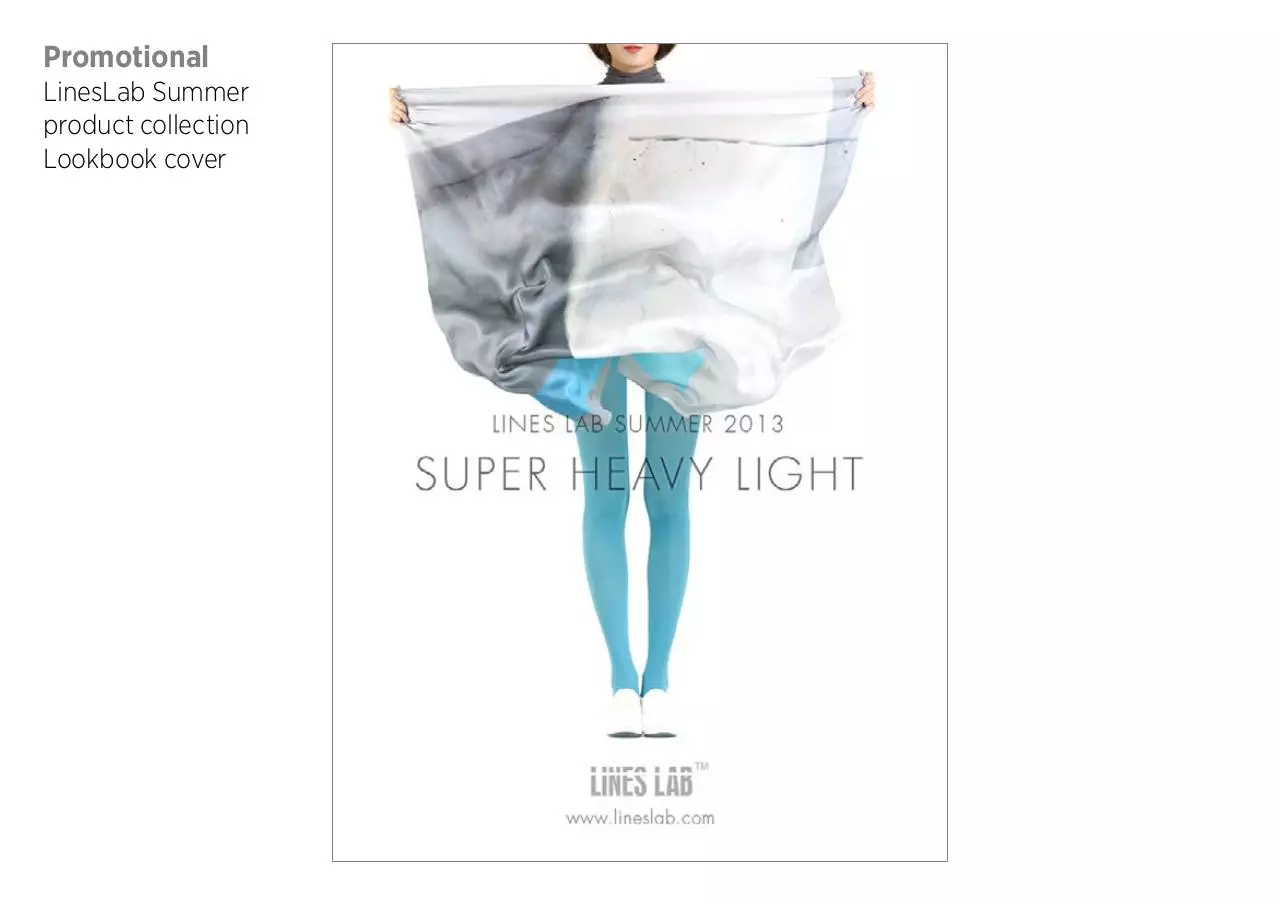

Promotional

Poster for RUTZ:

Global Generation Travel

feature documentary

Promotional

Australia Day

celebration event

poster at Blue Frog bar

Promotional

Seven Deadly Sins party

at Sky21 poster proposal

Promotional

LinesLab Summer

product collection

Lookbook cover

Promotional

Macau Fashion Link 2013

poster[L] and Lookbook[R]

Event

Engagement present

coupon for a bachelorette

party afternoon of shopping

Editorial

Business Daily newspaper

layout re-design

Dealers’ discounts push

car sales on Mainland

Online real estate firms in

Mainland gaining momentum

Tokyo and Shanghai markets join

world’s worst performers in 2016

AUTOMOTIVE SECTOR Page 10

PROPERTY Page 9

STOCK EXCHANGES Page 16

Wednesday, May 11 2016 YEAR V NR. 1040 MOP 6.00 PUBLISHER PAULO A. AZEVEDO CLOSING EDITOR KELSEY WILHEM

POLITICS

Coutinho calls new

proposals for Legislative

Assembly election

“political persecution” Page 3

GAMING

www.macaubusinessdaily.com

Bernstein analysts

predict 6 pct to 8 pct

decline in gaming

revenue for May Page 7

Tuesday, March 29 2016 YEAR IV NR. 1011 MOP 6.00 PUBLISHER PAULO A. AZEVEDO CLOSING EDITOR JOANNE KUAI

Friday, April 29 2016 YEAR V NR. 1032 MOP 6.00 PUBLISHER PAULO A. AZEVEDO CLOSING EDITOR JOANNE KUAI

www.macaubusinessdaily.com

TREASURY

PRESIDENTIAL ELECTION

Duterte claims big

Philippines win and hints

at sweeping parliamentary

changes Page 11

Fiscal surplus falls

31.2 pct to MOP11.6 bln

as at end-March Page 4

MGTO COURTS

INTERNATIONAL

TOURISM MARKET

The Tailor

of Panama

Luso countries tourism

professionals intern in Macau

TOURISM Page 2

www.macaubusinessdaily.com

TAP

Tuesday, May 17 2016 YEAR V NR. 1044 MOP 6.00 PUBLISHER PAULO A. AZEVEDO CLOSING EDITOR JOANNE KUAI

MONETARY POLICY

GREYHOUNDS

Bank of Japan stands pat

in latest meeting, refuses

to deploy more stimuli Page 11

Portuguese lawyer

connected with Stanley Ho

under investigation Page 5

Global campaign

launched to end

transportation of

dogs to Macau Page 4

Asian low-budget

airlines integrate

services, announcing

alliance Page 16

BAD LOANS

Chinese central bank

to investigate accuracy

of non-performing

loans data Page 8

WHALE WATCHING

EXCLUSIVE INTERVIEW Greener on the other side. Especially when it comes to splashing

the greenbacks. Imperial Pacific drops its Macau operations and food business to focus

on its Saipan Integrated Resort. Which made US$3.2 bln from a ‘temporary’ casino in

April, CEO Mark Brown tells Business Daily in an exclusive interview. The winning

formula involves three-to-five hour international commutes, VIPs but no fixed junkets

(so far), a strictly regulated gaming environment plus yachts and villas. Page 5

Cops in

firing line

PANAMA PAPERS High profile local residents’ company details have also been exposed.

Legislator and lawyer Vong Hin Fai and auditor Leong Kam Chun number among

those named as the International Consortium of Investigative Journalists posts the full

database of Mossad Fonseca leaks. Revealing 25 offshore companies, 342 officers, 16

intermediaries and 299 addresses that tie the British Virgin Isles to the MSAR. Page 6

www.macaubusinessdaily.com

BUDGET CARRIERS

SECURITY The Security Forces Disciplinary Committee

(CFD) has received 73 complaints about the city’s security departments. Up 65 pct

y-o-y, according to its 2015

report. Most complaints target the Public Security Police

Force (PSP), especially the

traffic department. Page 3

PROTEST International Workers Day. To be

celebrated this Sunday. With local labour unions staging demonstrations per well established

tradition. According to police, ten groups plan to

march from several venues on May 1 demanding

local workers’ job security, compensation for unpaid

holidays, work related injuries and demands for a

non-smoking working place. Page 6

TEN GROUPS TO

MARCH ON MAY 1

Page 4

Page 7

PERSONAL DATA Page 5

Feels like home

TODAY

THU

BD-2016-May-11.indd 1

FRI

SAT

SUN

Source: Bloomberg

Source: AccuWeather

REAL ESTATE Commercial properties

throughout the SAR located in residential

areas performed better in Q1. And were

in higher demand than those in tourist

areas, says Centaline Macau. Page 4

25° 28° 25° 28° 25° 28° 25° 28° 24° 30°

Problematic gambling gaining ground

The Social Welfare Bureau has

observed a growing number of

gambling disorder cases. Particularly in

the last three years. Research is trying

to cope with the problem and better

allocate social services resources.

Flat inflation

CHINESE CPI China’s consumer price index

grew 2.3 pct y-o-y in April. Flat from the

previous two months, new data revealed

yesterday. Growth remains at its highest

level since July 2014 for a third month. Page 8

HK Hang Seng Index May 10, 2016

20,242.68 +85.87 (0.43%)

China Mobile Ltd

+1.64%

Power Assets Holdings Ltd

Cathay Pacific Airways Ltd

+1.49%

China Overseas Land &

+1.44%

-1.32%

Want Want China Holdings

-2.72%

Lenovo Group Ltd

-8.25%

I SSN 2226-8294

HK HSI March 24, 2016

20,345.61 -269.62 (1.31%)

Tingyi Cayman Islands

+0.67%

Hengan International

+0.32%

Hong Kong & China Gas

+0.28%

Power Assets Holdings Ltd

+0.19%

Cheung Kong Infrastruc-

+0.07%

Li & Fung Ltd

0.00%

China Resources Power

0.00%

New World Development

-3.68%

China Life Insurance Co

-3.93%

PetroChina Co Ltd

-4.28%

17° 20° 19° 22° 19° 23° 19° 23° 20° 23°

WED

THU

FRI

SAT

GAMBLING DISORDER Page 6

BD-2016-March-29.indd 1

COMMERCE Page 3

28/03/2016 22:21

CHEONG KAM KA

Bye bye, Sin Fong

The Sin Fong saga is coming to a close.

With DSSOPT greenlighting demolition of the

decrepit residential building. According to

Jiangmen Communal Society - who pledged

to help - rebuilding will take around two years.

TOURISM Some

564,000 visitors on

package tours visited

Macau in March. Representing a slump of 36.2

pct YoY. Occupancy

rates for local hotels and

guesthouses dipped 0.9

pct to 76.5 pct. Page 2

SOCIETY Page 2

Notice Due to the holiday on Sunday May 1, 2016, Business Daily will not be published on Monday. We will be back on Tuesday May 3, 2016 and wish all our readers a very enjoyable holiday.

HK Hang Seng Index April 28, 2016

I SSN 2226-8294

10/05/2016 21:40

profits announcement

revealing. Highlighting the heavy weight of

bad loans on Mainland

books. ICBC confirms

joining Bank of China in adopting looser

stance on reserve ratio.

Pages 10&16

-3.18%

China Merchants Holdings

TODAY

Bad debt

Package

accumulating tour visitors

RESULTS Chinese banks dropping

Pioneering entrepreneurs

Young entrepreneurs from Portugal want to

tap into the China market. A week-long trip to

different cities will whet the appetite from May 1.

With cultural understanding the bedrock of

business opportunity.

+1.83%

MTR Corp Ltd

21,388.03 +26.43 (0.12%)

PetroChina Co Ltd

+1.89%

Sino Land Co Ltd

+1.79%

Galaxy Entertainment Group

-2.54%

China Petroleum & Chemical

+1.82%

China Unicom Hong Kong

-1.49%

Cathay Pacific Airways Ltd

-4.84%

BD-2016-04-29.indd 1

22° 25° 23° 26° 24° 27° 24° 28° 24° 28°

TODAY

SAT

SUN

MON

TUE

I SSN 2226-8294

28/04/2016 21:32

23° 25° 24° 27° 24° 27° 24° 28° 25° 28°

TODAY

WED

BD-2016-May-17.indd 1

THU

FRI

SAT

Source: Bloomberg

Page 5

Macau businesses

shortlisted for

Laos casino

Source: AccuWeather

GAMING

Taipa transport

interchange hopefully

completed this year

Source: Bloomberg

INFRASTRUCTURE

US$59 million

‘Life Science Park’

in Zhuhai in 2018

Source: Bloomberg

FTZ

CAPEX Mainland firms reduced capital expansion this

quarter. This, according to a

private poll. The survey also showed that firms hired

fewer people. While just 33

pct increased expenditure.

Pages 8&9

Source: AccuWeather

Hide and seek

Restructuring. The Personal Data Protection Bureau tries to

keep up with the paperless times. Cross-border information

sharing. Junket player blacklists. Communicating information

for medical and banking purposes. And how to properly and

efficiently create legislation that helps citizens is all part of the

Bureau’s remit.

Hiring less

Source: AccuWeather

TOURISM

Newly launched flights between Macau

and Fukuoka. The Southern Japan tourist

market is ripe for development, says MGTO.

With the Macao Government Tourism

Office expressing high hopes for more

international visitors overall. Page 3

HK Hang Seng Index May 16, 2016

Home on

the range

Nothing

personal

REAL STATE Chinese just

became the main foreign

buyers of U.S. property.

Mainlanders are splashing out on residential and

commercial real estate. Last

year took their five-year

investment total to more

than US$110 billion. Page 9

GAMING Gaming consultant David Green says

it’s just business. Not a

lack of confidence in the

market. James Packer’s

sale of shares in Melco

Crown is a strategic move

back to home turf and

Vegas, says Green. Page 6

19,883.95 +164.66 (0.84%)

Want Want China Holdings

+4.55%

Lenovo Group Ltd

+3.40%

China Resources Power

-0.79%

Belle International Holdings

+3.43%

Wharf Holdings Ltd/The

-0.72%

China Construction Bank

-0.87%

I SSN 2226-8294

16/05/2016 21:36

Editorial

Business Daily newspaper

layout re-design

4 Business Daily Wednesday, May 18 2016

14 Business Daily Tuesday, May 17 2016

MACAU

INTERNATIONAL

OPINION

BANK CARDS

UnionPay International, a subsidiary of the state-backed

UnionPay card brand, claims that the transaction

volume of overseas-issued UnionPay cards accounted

for about half of UnionPay’s total international business

as at the end of the first quarter of this year, compared

to 27 per cent as at the end of 2013. In particular, the

transaction number of overseas-issued UnionPay cards

in Mainland China jumped 30 per cent year-on-year.

Nevertheless, the card issuer does not indicate related

figures in its latest press release. It said over 55 million

UnionPay cards have been issued in 40 overseas

countries and regions, of which Hong Kong, Macau,

Japan and South Korea are major regions for UnionPay

card-issuance outside the Mainland.

Words matter

Last week, I raised questions

about the usage of the word

‘eugenics’ in the Five-Year

document under public review. (Reminder: the document states, on page 55 of the

Portuguese version, as part

of the demographic policy,

the government’s intention

to ‘incentivise couples to

have more children applying

the concept of eugenics’.)

Eugenics is a politically and

historically charged word,

even if we leave the Nazi

connotations aside.

The Portuguese language

newspaper Ponto Final approached the department in

charge and got some answers.

They failed, however, to allay

the concerns and added a

couple of them. What did they

say? First, that the intended meaning of the Chinese

expression was - I quote - to

“improve the health of newborns through medicine and

prenatal care.” Second, that

a Portuguese-Chinese dictionary (unidentified) and the

Encyclopedia Britannica both

supported such (neutral?) interpretation and made no link

to Nazi-era policies.

I cannot check and comment

upon the undisclosed dictionary, obviously. But Britannica

is easily accessible. The first

paragraph of the related online

article starts by declaring that

‘Eugenics [is] the selection of

desired heritable characteristics in order to improve future

generations, typically in reference to humans’. And ends

by saying ‘it ultimately failed

as a science in the 1930s and

’40s, when the assumptions

of eugenicists became heavily

criticised and the Nazis used

eugenics to support the extermination of entire races’.

Therefore, the justification

(or dismissal) fails patently

on both counts. The status

and pedigree of the idea are

fully explained in the first

paragraph. Nowhere is there

any reference to perinatal care. They also claimed

the characters used in the

Chinese version have a different meaning. Maybe. My

Chinese skills, or lack thereof, prevent me from going

too far down that road. It

still mystifies me that all the

Chinese dictionaries I could

find online that include the

word translate it, consistently, as ‘eugenics’.

We must conclude that, at

the very least, the concept, as

used in the plan, is fuzzy, not

fully defined. It would be wiser, may I suggest, dropping it.

And improving perinatal care,

a worthy and desirable aim,

should be better dealt together

with health topics.

Words matter, ideas matter:

what the government actually means and what are

the policy implications of

the wording choices are not

trivial matters. Proper use

of words - and the clarity of

ideas and purpose that comes

with it – does matter.

EXPO G2E ASIA KICKS OFF, RUNS UNTIL THURSDAY

Gathering of the Asian

gaming industry

Striding into the 10th

edition, G2E Asia kicked

off with 180 exhibitors.

The three-day event

anticipates 12,000 visitors.

Joanne Kuai

joannekuai@macaubusinessdaily.com

G

LOBAL Gaming Expo (G2E)

Asia kicked off yesterday

at The Venetian Macao

casino resort. The threeday event, co-organised

by Reed Exhibitions and the American Gaming Association (AGA), welcomed 6,500 pre-registered visitors

from 95 countries, according to the

organisers, who previously revealed

they are expecting 12,000 visitors for

this year’s edition.

“The Asian gaming industry is currently undergoing a transformation

that is presenting numerous exciting

opportunities,” said Hu Wei, President of Reed Exhibitions, Greater

China, at the opening ceremony of

the event yesterday. “G2E Asia is the

perfect place for industry professionals to meet and discuss business

opportunities.”

The tradeshow debuted in 2007,

defining itself as the premier show

for the Asian gaming entertainment

industry. According to the organiser,

all casinos in Asia have a presence

at the event. The co-organiser also

expressed strong confidence in the

market.

“We have more exhibitors here than

ever before. More buyers here than

ever before. Interest is at its peak.

This market continues to have great

potential. When you look at China,

the penetration within China is still

quite minimal. The sky, the potential here, is enormous,” said Geoff

Freeman, President and CEO of the

American Gaming Association, on the

sidelines of the opening ceremony.

Bullish outlook

With regard to the gaming revenue

downturn, the AGA President, despite the worries, claims that uncertainty exists in every market and

that despite short-term decisions the

investments made here are for the

long run. He also expressed faith in

non-gaming developments and that

of the region in general.

“The market in Macau is stabilising.

We are seeing that. The number is

still quite strong. This is still a US$27

billion market, the largest market in

the world. I know there are members that are here - they are making

investments for the long-term. They

intend to be here for many, many

years to come and they are very optimistic about the future,” said Mr.

Freeman.

“Macau is already generating billions of dollars in non-gaming revenue. Different properties have a different emphasis here,” said Freeman.

“In Macau, there is a bright future for

non-gaming. It has great potential.

But it has to move in concert with the

customers. It’s what the customers

are interested in. It’s developing here

in Macau. People should feel very

good about the development that’s

already happening on the non-gaming front. We’re very excited for what

they would do in the future.”

“We have 1,000 casinos in the United States. There is plenty of room for

growth across Asia. Japan is obviously

a market that people are interested

in. Korea is doing some new things.

There is plenty of room for Macau

to grow and other markets to grow

simultaneously,” he added.

A decade of networking

Striding into the 10th edition this

year, G2E Asia kicks off with 180

exhibitors, representing a 12 per cent

increase from the previous edition,

with over 40 per cent of them joining

for the first time, and 80 per cent

from overseas. The exhibition area

has also tripled in size since it started 10 years ago to more than 9,200

square metres now. The organiser is also expecting more than 800

VIPs and buyers, and around 4,000

conference delegates, in addition to

over 12,000 visitors from all major

gaming operators and regulators in

Asia and beyond.

One of the highlights of this year’s

showcase is the fast-growing iGaming Zone which has more than

doubled the number of exhibitors

since 2015. Over 65 per cent of those

are new companies. The zone gives

the growing iGaming community

direct market access and a networking platform with over 50 iGaming

exhibitors showcasing their latest

solutions and products from Asia

and abroad.

Today, Macau’s gaming regulator,

Paulo Martins Chan, Director of the

Gaming Inspection and Co-ordination Bureau (DICJ), is expected to

deliver a talk on ‘Transformation in

Changing Conditions’ and will also

attend the 1st Gaming Regulators

Networking Luncheon with his counterparts from Asia and beyond to

exchange views, share updates and

export co-operation opportunities

at a time when the gaming market

in Asia is fast-changing and rapidly

growing.

BD-2016-May-18.indd 4

Brazil’s interim president,

Michel Temer, said in a

televised interview Sunday

that he hopes to reduce

unemployment and bring

economic and political calm

to Latin America’s biggest

country. Temer, a centrist

who took over as interim

president last week after

Brazil’s senate voted to

suspend Dilma Rousseff

and try her for irregularities

in the government budget,

said his government would

cut public spending where

possible and that a reform

of Brazil’s pension system

was essential. Repeating

a pledge made last week,

Temer said the cost-cutting

would not affect popular

social programs.

STOCK MARKETS

Philips eyes almost billion

euro windfall in IPO

Dutch electronics giant

Philips announced yesterday it would float 25 percent of its shares in a highly

anticipated IPO set for May

27 which could raise almost one billion euros. The

Amsterdam-based company

said it would release some

37.5 million shares - with an

option of releasing more if

the offer is over-subscribed

- aiming at raising between

694 million euros to 970 million euros (US$784 million

to US$1.09 billion). Philips in

September 2014 announced

it was selling off its core

lighting business - a mainstay of its income for more

than a century - to focus

more on medical equipment.

EU ANTITRUST

Google faces record 3

billion euro fine

Google faces a record antitrust fine of around 3 billion

euros (US$3.4 billion) from

the European Commission

in the coming weeks,

British newspaper The

Sunday Telegraph said. The

European Union has accused

Google of promoting its

shopping service in Internet

searches at the expense of

rival services in a case that

has dragged on since late

2010. Several people familiar

with the matter told Reuters

last month they believed that

after three failed attempts

at a compromise in the past

six years Google now had no

plans to try to settle the allegations unless the EU watchdog changed its stance.

Russia’s Sberbank lowers

rates on consumer loans

Russia’s top bank Sberbank

said yesterday it had lowered the interest rates it

charges on consumer loans

to below the level they

were at before an economic

crisis and that it saw higher

demand for such loans. “In

our opinion the economy in

general is ready for a lowering of rates, since inflation

has slowed and is continuing to slow,” Sberbank said

in a statement. The bank, a

dominant player in Russia

with around a third of total

banking assets, lowered rates

on its main line of consumer

loans by between 1.1 and 4.1

percentage points, it said.

17/05/2016 18:30

BD-2016-May-17.indd 14

Business Daily Friday, May 13 2016

15

OPINION

BUSINESS WIRES

Reserve Bank of India Governor Raghuram Rajan

BRAZIL IMPEACHMENT

The Times of India

Interim government says

jobs, confidence priorities

BANKING

José I. Duarte is an economist

and permanent contributor

to this newspaper.

11

ASIA

IN BRIEF

UnionPay: Overseas-issued cards

contribute half int’l business

José I. Duarte

Business Daily Monday, March 14 2016

The government may have plugged the

tax loophole in the double-tax avoidance

agreement (DTAA) with Mauritius and

Singapore, but it may need to amend the

treaty with Cyprus and the Netherlands

to ensure that all gaps are filled to ensure

that companies pay tax at least in one

jurisdiction. Tax consultants said that the

current tax treaty with Cyprus provides

for exemption from payment of capital

gains tax. But being a non-cooperative

tax jurisdiction, there is a 30% withholding tax on certain income. Cyprus

is one of the tax havens which investors

globally tap.

INVESTMENT TREND

Central bankers’ wisdom faulted

as gold holdings surge

Philstar

Gold is the best-performing major metal this year after silver amid rising

concern over negative rates in Europe and Japan.

Ranjeetha Pakiam

T

HE great gold rush of 2016

is gathering pace. Holdings

in exchange-traded funds

have now surged by a quarter, with investors taking

advantage of lower prices over the

past two weeks to enlarge stakes on

rising concern about central bank

policy making worldwide.

The holdings have increased to

1,822.3 metric tons, the most since

December 2013, according to data

compiled by Bloomberg, after bottoming at a seven-year low in January. In the past two weeks, as prices

lost 1.6 percent, ETFs swelled 63.2

tons, rising every day.

Gold is the best-performing major metal this year after silver amid

rising concern over negative rates

in Europe and Japan and whether

the Federal Reserve will be able to

tighten further. Demand jumped to

the second-highest level ever in the

first quarter, according to the World

Gold Council, and billionaire hedge

fund manager Paul Singer has said

gold’s rally may just be beginning.

Investors are being driven to gold

on a structural shift in investment

demand, according to Bernard Aw,

a strategist at IG Asia Pte.

“Firstly, the negative interest rate

environment and quantitative-easing

policies are reducing the pool of suitable investment options, and making

gold less costly to hold,” Aw said by

e-mail yesterday, adding that while

there may be more U.S. rate hikes in

the pipeline, prevailing rates remain

very low. “Second, lingering fears of

competitive currency devaluations

and potentially fresh bouts of market volatility encourage safe-haven

demand.”

Rates outlook

After the Fed raised rates in December, investors have been scaling back

expectations of further increases

amid concern about the strength of

“Lingering fears

of competitive

currency

devaluations

and potentially

fresh bouts of

market volatility

encourage

safe‑haven

demand”

Bernard Aw,

Strategist at IG Asia

the U.S. recovery. The chances of a

hike at next month’s policy meet are

just 4 percent, down from 75 percent

at the start of the year, according to

Bloomberg data. Higher U.S. borrowing costs typically hurt gold prices

while boosting the dollar.

INDIA

Bullion for immediate delivery has

rallied 21 percent this year, gaining to

US$1,303.82 an ounce on May 2, the

highest price since January 2015. The

metal traded at US$1,281.43 an ounce

at 2:51 p.m. in Singapore, according

to Bloomberg generic pricing.

Among bulls, Singer - whose firm

Elliott Management Corp. oversees

about US$28 billion - told clients in

a letter last month that if investors’

confidence in central bankers’ “judgment continues to weaken, the effect

on gold could be very powerful.”

Stan Druckenmiller, the billionaire

investor, said this month that while

the bull market in stocks is exhausted,

gold is his largest currency allocation.

Reserve Bank Governor wants global

rules of conduct for central banks

Rajan has been

a vocal critic of

easing policies,

saying central

banks are ignoring

the impact of their

actions on the

global economy

Rajesh Kumar Singh and Rafael Nam

Bankers buying

While central bank policies may have

contributed to gold’s gains this year,

some countries’ banks - notably in

China, Russia and Kazakhstan - have

also been substantial and consistent buyers. The World Gold Council

estimates that nations are expected to buy 400 to 600 tons this year,

compared with 566.3 tons in 2015,

according to Alistair Hewitt, head

of market intelligence.

Even some the of leading bullion

bears have had to backpedal this year

as prices advanced and expectations

for U.S. rates shifted. Goldman Sachs

Group Inc. and Singapore-based

Oversea-Chinese Banking Corp.

beefed up their price forecasts last

week, though both said they maintained their bearish views. BLOOMBERG NEWS

R

ESERVE Bank of

India Governor

Raghuram Rajan

called on Saturday

for global central

banks to adopt a system for

assessing the wider impact

of their actions, including

unconventional monetary

policies now in use.

Rajan proposed that a group

of academics should measure

and analyse the "spillover"

effects of monetary policies

and indicate which should be

used and which avoided. He

suggested a traffic light system, grading policies green,

orange or red.

The monitoring system

could be implemented

through an international

agreement along the lines of

the Bretton Woods currency

accord or via the International

Monetary Fund.

Rajan's speech was the

highlight of a three-day

International Monetary Fund

event in New Delhi, attended by IMF chief Christine

Lagarde and Indian Prime

Minister Narendra Modi, at

which worries about the

global economy were front

and centre.

"The international community has a choice," Rajan

said. "We can pretend all is

well with the global financial

non-system and hope that

nothing goes spectacularly

wrong. Or we can start building a system for the integrated world of the 21st century."

Rajan's speech came days

after the European Central

Bank eased monetary policy

further by cutting all its main

interest rates, expanding asset purchases and launching a

loan programme which could

see it pay banks to lend to

firms and households.

The Bank of Japan has also taken interest rates into

negative territory for the first

time while the U.S. Federal

Reserve is expected to tighten

monetary policy only gradually after years of near-zero

rates and quantitative easing.

Rajan has been a vocal critic

of such policies, saying central banks seeking to fulfil

“We need new rules of the

game, enforced impartially

by multilateral organisations,

to ensure countries adhere to

international responsibilities”

Raghuram Rajan, Reserve Bank of India Governor

domestically focused mandates are ignoring the impact

of their actions on the global

economy.

Saturday's speech was the

most comprehensive given on the subject by Rajan,

who is widely credited with

having predicted the global

financial crisis that began in

2007.

The former IMF economist, tipped by local media

as a potential successor to

Lagarde, also called on the

Fund to take a lead role in

ensuring policies adopted

by its members do not have

"beggar-thy-neighbour"

consequences.

Rajan's policies

When Rajan became RBI

Governor in September 2013,

India was in the midst of its

worst currency crisis in more

than two decades as fears the

Fed would begin tightening

policy exposed the country's

weak finances and big current account deficit.

India eventually stabilised

the rupee, partly by building up its foreign exchange

reserves, but his ringside

view of the crisis has made

him a strong critic of the kind

of stimulus measures adopted by developed economies

in recent years.

On Saturday, he warned

that such policies spook people into fearing "calamity is

around the corner", leading

them to save rather than to

spend and thus diminishing

any benefits.

Rajan has stated India will

not follow other countries

and devalue its currency, a

view endorsed on Saturday

by Prime Minister Narendra

Modi, who ruled out 'beggar

thy neighbour' policies.

Early in his tenure, Rajan

raised interest rates to tackle

double-digit inflation but the

RBI cut by 125 basis points

last year as consumer prices eased, to help boost an

economy growing fast by

global standards but below

its potential.

Markets expect another 25

bps cut in the next month

after the government stuck

to its fiscal deficit target for

the year starting in April.

That pledge was praised on

Saturday by Rajan, although

he declined to comment on

whether it would affect the

central bank's monetary policy stance. REUTERS

British banking giant Hong Kong and

Shanghai Banking Corp. (HSBC) and

Dutch financial conglomerate ING Bank

said they expect Philippine economic

growth rebounding in the first quarter

of the year on the back of robust private

consumption and higher investments.

HSBC economist Joseph Incalcaterra

said growth likely accelerated in the first

quarter to above seven percent from 6.3

percent in the fourth quarter of last year.

“We think growth may exceed seven percent year-on-year in the first quarter – its

best performance in nearly three years,”

he said.

The Star

A seasoned fund manager, Mark Mobius

expressed optimism that the ringgit will

improve and that issues surrounding

1Malaysia Development Bhd (1MDB) will

not have a long-term impact on Malaysia.

According to Mobius, who is the executive chairman of Templeton Emerging

Markets Group, foreign funds would

eventually return to Malaysia given the

undervaluation of the ringgit and the inexpensive valuations of Malaysia’s market. “The ringgit is so undervalued now...

a lot of companies here are doing well, so

funds will come back,” he explained at

a press conference at the Global Islamic

Finance Forum 5.0 here yesterday.

SALES STRATEGY

Algeria, Africa’s

biggest natural gas

producer, has invited

international companies

to help develop its

oil and gas fields.

Mohammad Tayseer

Algeria will supply oil and other

energy products to Jordan for the

first time under a memorandum of

understanding signed yesterday, as

the OPEC member seeks to diversify sales after years of stagnating oil

production.

The agreement with Algeria’s staterun Sonatrach Group covers crude

oil, liquefied natural gas and liquefied

petroleum gas, Hasan Hiari, head of

the natural gas department at Jordan’s

Ministry of Energy & Mineral Resources, said in an interview in Amman.

Shipments will start this year, he said.

Algeria, Africa’s biggest natural gas

producer, has invited international

companies to help develop its oil and

gas fields as Sonatrach has struggled

to raise production after a corruption

probe at the company and a deadly

al-Qaeda terrorist attack in 2013 at

the In Amenas gas field. The nation

operated 55 oil rigs in April, an increase in each month since November, according to Baker Hughes Inc.

Algeria pumped 1.1 million barrels a

day of crude in April, its output little

changed little since 2013.

“This is the first time that we are

going to get fuel and gas from Algeria,” Hiari said. “We have been

seeking this MOU with Algeria as we

are keen on diversifying our energy

sources.” Algeria is a member of the

Organization of Petroleum Exporting

Countries, while Jordan has almost

no energy resources of its own.

Jordan is also looking at solar, wind

and nuclear power for future energy

needs. By 2025, 48 percent the nation’s electricity will be generated

by nuclear reactors, up from 4 percent today, Prime Minister Abdullah

Ensour said Monday at an energy

conference in Amman. It plans to

have 500 megawatts of solar and wind

power capacity operational by the

end of this year. BLOOMBERG NEWS

“We have been

seeking this MOU

with Algeria as

we are keen on

diversifying our

energy sources”

Hasan Hiari,

Head of the natural gas department

at Jordan’s Ministry of Energy

& Mineral Resources

16/05/2016 18:51

Lagarde urges Asia to take bigger

role guiding global economy

Broadening access

to health and financial

services is essential to

unlocking the potential

of the region’s 4.4 billion

people, she said

Asia needs to take a leadership

role in the global economy that

reflects the continent’s growing

clout, International Monetary Fund

Managing Director Christine Lagarde

said.

Asian officials should keep monetary policy supportive, while using fiscal policy to boost growth and

macro-prudential measures to protect financial stability, Lagarde said

in a speech Saturday in New Delhi.

BD_2016-March-14.indd 11

Adopting structural reforms to boost

competitiveness, growth and jobs

will be key, she said.

Lagarde, who was reappointed last

month for a second five-year term,

called Asia the “world’s most dynamic region,” noting it accounts

for 40 percent of the world economy

and will deliver nearly two-thirds

of global growth over the next four

years.

“Asia now affects the world more

than ever before,” Lagarde said, according to the text of her remarks.

“By the same token, Asia is now more

deeply affected by global economic

developments than ever before -and must respond to them.”

Economic ‘miracles’

Lagarde, 60, said Asia’s rapid integration was one of the most striking

global developments of the past generation. Many countries in the continent pulled off economic "miracles,"

and several became world powerhouses, she said.

Still, policy makers need to step

up their response to a range of global

challenges, including volatile markets and capital flows, financial tightening and low commodity prices,

she said. In a speech this week in

Washington, the IMF’s No. 2 official, David Lipton, warned that global growth is weakening, and called

on the world to revive the “spirit

of action” that followed the 2008

financial crisis.

Despite Asia’s growth, income inequality has increased in 15 of 22

Asian economies since 1990, Lagarde

said. Broadening access to health

and financial services is essential to

unlocking the potential of the region’s

4.4 billion people, she said.

Policy makers should focus social

spending on the neediest, and make

taxes more progressive, the IMF chief

said. Barriers facing women should

be removed, access to infrastructure

such as water and electricity should

be improved, and Asian countries

should pursue greater trade integration, she said, adding that Asia

has a “massive stake” in combating

climate change. BLOOMBERG NEWS

“Asia now affects

the world more

than ever before”

Christine Lagarde,

Managing Director of the

International Monetary Fund

13/03/2016 22:16

T

HERE IS WIDESPREAD AGREEMENT ON

two facts about the Chinese economy. First,

the slowdown has ended and growth is

picking up. Second, not all is well financially.

But there is no agreement on what happens next.

The good news is that domestic demand continues

to grow. Car sales were up nearly 10% in March

over the same month in 2015. And retail spending

grew at an annual clip of 10% in the first quarter.

The most dramatic increase, though, is in investment. Real estate investment is growing again,

following its collapse in 2015. Industrial investment, especially by state-owned enterprises, has

been rallying strongly.

At the root of this turnaround is enormous credit

growth, as the authorities, concerned that the earlier slowdown was excessive, encourage China’s

banks to lend. Credit growth, known in China as

“total social financing,” grew at an annual rate of

13% in the fourth quarter of 2015 and again in the

first quarter of this year – that is, double the rate

of annual GDP growth. Since the financial crisis

erupted in September 2008, China has had the

fastest credit growth of any country in the world.

Indeed, it is hard to point to another credit boom

of this magnitude in recorded

history.

The bad news is that credit

booms rarely end well, as the

economists Moritz Schularick

and Alan Taylor have reminded

us. China’s credit tsunami is

financing investment in steel

and property, sectors already

burdened by massive excess capacity. The companies doing the borrowing, in other words, are

precisely those least capable of repaying.

The International Monetary Fund, which tends to

adopt a conservative posture on such matters (not

least to avoid antagonizing powerful governments),

estimates that 15% of Chinese loans to nonfinancial corporations are at risk. With nonfinancial

corporations’ debt currently standing at 150% of

GDP, the book value of the bad loans could be a

quarter of national income.

It still may be possible to sell off vacant apartments

for a fraction of their construction cost. It may be

possible to sell off rolling mill machinery to other

countries, or as scrap. But where the loans at risk

are concentrated – in steel, mining, and real estate

– suggests that losses will be substantial.

This is why the supposedly painless solution,

debt-for-equity swaps, will not be painless. Yes,

bad loans can be purchased by asset-management companies, which can package them up

and sell them off to other investors. But if the

asset managers pay full book value for those

“

Barry Eichengreen

Professor at the University of California, Berkeley,

and the University of Cambridge

loans, they will incur losses, and the government will have to foot the bill. If they pay only

market value, it will be the banks that incur

losses, and the government will have to repair

their balance sheets.

This leaves three unpalatable options. First, the

authorities can issue bonds to raise the funding

needed to recapitalize the banks. In doing so,

they would effectively transform the corporate

debt problem into a public debt problem. This

would place the financial burden squarely on the

shoulders of future taxpayers, which would not

enhance consumer confidence.

It also would not enhance confidence in the public

finances. Public debt in China is still relatively

low; but, as any citizen of Ireland can tell you, it

can balloon when banking crises strike.

Alternatively, the central bank could finance the

repair by providing credit. But, while the authorities relied on this approach in

1999, the last time they were

faced with a serious bad-loan

problem, running the money

printing press is not compatible with officials’ other stated

goal: a stable exchange rate. We

saw last August how investors

can panic when the renminbi

exchange rate moves unexpectedly. Currency depreciation may not only precipitate a destabilizing

spiral of capital flight; it could also destabilize the

banks, from which money leaving the country

must first be withdrawn.

The final option is to imagine that the bad-loan

problem will solve itself. The banks would be

encouraged to “evergreen” their loans: to roll

them over when repayment falls due. The fiction

that the banks are well capitalized will be maintained. Borrowers that need to be liquidated or

reorganized will instead stay alive, thanks to the

drip-feed of bank finance. The result will look

familiar to aficionados of Japan’s banking crisis:

zombie banks lending to zombie firms, which

apply artificial pressure on viable firms, stifling

their growth.

Financing bank recapitalization through bond

issuance is probably the least bad option. This

doesn’t mean that it will be painless. Nor is there

any assurance that Chinese policymakers will opt

for it. But if they don’t, the consequences could

be dire. PROJECT SYNDICATE

THE BAD NEWS

IS THAT CREDIT

BOOMS RARELY

END WELL

IMF

Algeria signs

oil, gas deal

Rescaling China’s

debt mountain

The Korea Herald

The Korean economy is facing pressure

from all sides that will make it harder to

sustain growth amid high youth unemployment, rapidly changing demographics and slow manufacturing growth. With

cash-strapped companies in conventional

industries expected to go through restructuring soon, more people of all ages

will be out of jobs and face difficulties in

finding work in a slow market. This will

increase Korea’s unemployment rate,

while growing costs for restructuring and

welfare will add burden to fiscal spending

as the country will have to finance them

with debts to maintain its socioeconomic

well-being.

BD-2016-May-13.indd 15

”

12/05/2016 19:49

Download Quickfolio FranciscoCordeiro

Quickfolio_FranciscoCordeiro.pdf (PDF, 3.78 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000537522.