Why Invest In Off Plan Properties Whitepaper (PDF)

File information

This PDF 1.4 document has been generated by Adobe InDesign CC 2017 (Windows) / Adobe PDF Library 15.0, and has been sent on pdf-archive.com on 19/05/2017 at 13:51, from IP address 37.157.x.x.

The current document download page has been viewed 411 times.

File size: 2.2 MB (8 pages).

Privacy: public file

File preview

WHY INVEST

IN OFF-PLAN

PROPERTIES?

WHY PUT YOUR MONEY INTO OFF-PLAN PROPERTIES?

Purchasing a property off-plan typically involves

Other advantages of investing in new-build

acquiring an apartment in a large development

off-plan properties include:

in advance of its completion. It is only in the last

•

They generally come with a warranty

20 years or so that off-plan property investments

•

They require less time and money to be

have spread beyond exclusive developments in

locations such as the Middle East to the cities

spent on maintenance than older properties

•

of the UK.

The market value could increase from the

moment the proposed property is purchased

•

Paying upfront typically entitles the purchaser

This mode of purchase has brought two key

to a wider choice of available properties as

advantages to the UK property market. First, it

well as a discount on the buying price

generates finance for new developments to be

•

Getting involved at such an early stage

built. And second, it attracts property investors

allows the owner to request bespoke

by creating an opportunity for greater capital

modifications from the builder to improve

growth as well as future rental income.

rental opportunities.

2

CHANGING HOUSE PRICES BY REGION

OFFICE FOR NATIONAL STATISTICS http://bit.ly/2m2Fe1J

3

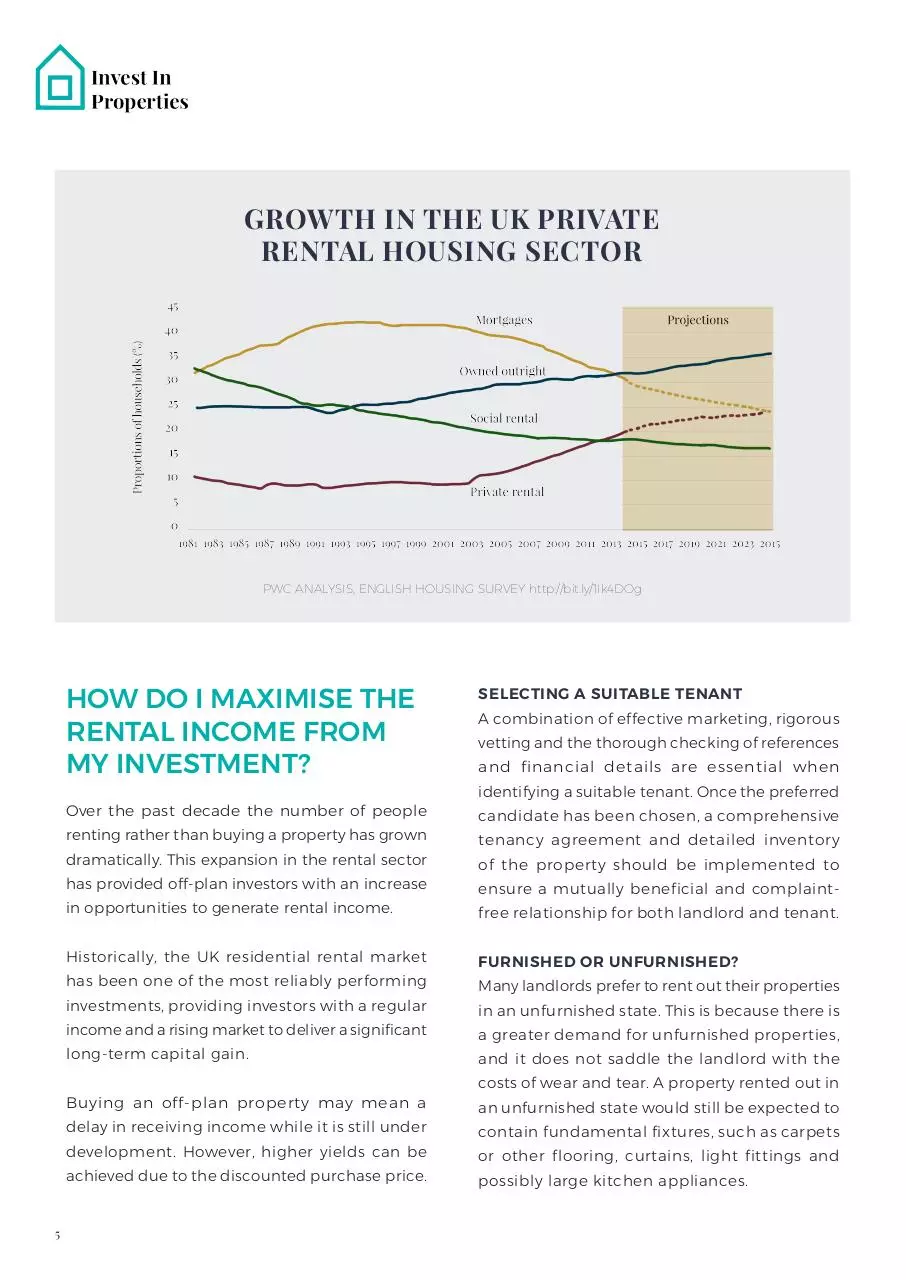

GROWTH IN THE UK PRIVATE

RENTAL HOUSING SECTOR

PWC ANALYSIS, ENGLISH HOUSING SURVEY http://bit.ly/1Ik4DOg

HOW DO I MAXIMISE THE

RENTAL INCOME FROM

MY INVESTMENT?

SELECTING A SUITABLE TENANT

Over the past decade the number of people

candidate has been chosen, a comprehensive

renting rather than buying a property has grown

dramatically. This expansion in the rental sector

has provided off-plan investors with an increase

in opportunities to generate rental income.

Historically, the UK residential rental market

has been one of the most reliably performing

investments, providing investors with a regular

income and a rising market to deliver a significant

long-term capital gain.

Buying an off-plan property may mean a

delay in receiving income while it is still under

development. However, higher yields can be

achieved due to the discounted purchase price.

5

A combination of effective marketing, rigorous

vetting and the thorough checking of references

and financial details are essential when

identifying a suitable tenant. Once the preferred

tenancy agreement and detailed inventory

of the property should be implemented to

ensure a mutually beneficial and complaintfree relationship for both landlord and tenant.

FURNISHED OR UNFURNISHED?

Many landlords prefer to rent out their properties

in an unfurnished state. This is because there is

a greater demand for unfurnished properties,

and it does not saddle the landlord with the

costs of wear and tear. A property rented out in

an unfurnished state would still be expected to

contain fundamental fixtures, such as carpets

or other flooring, curtains, light fittings and

possibly large kitchen appliances.

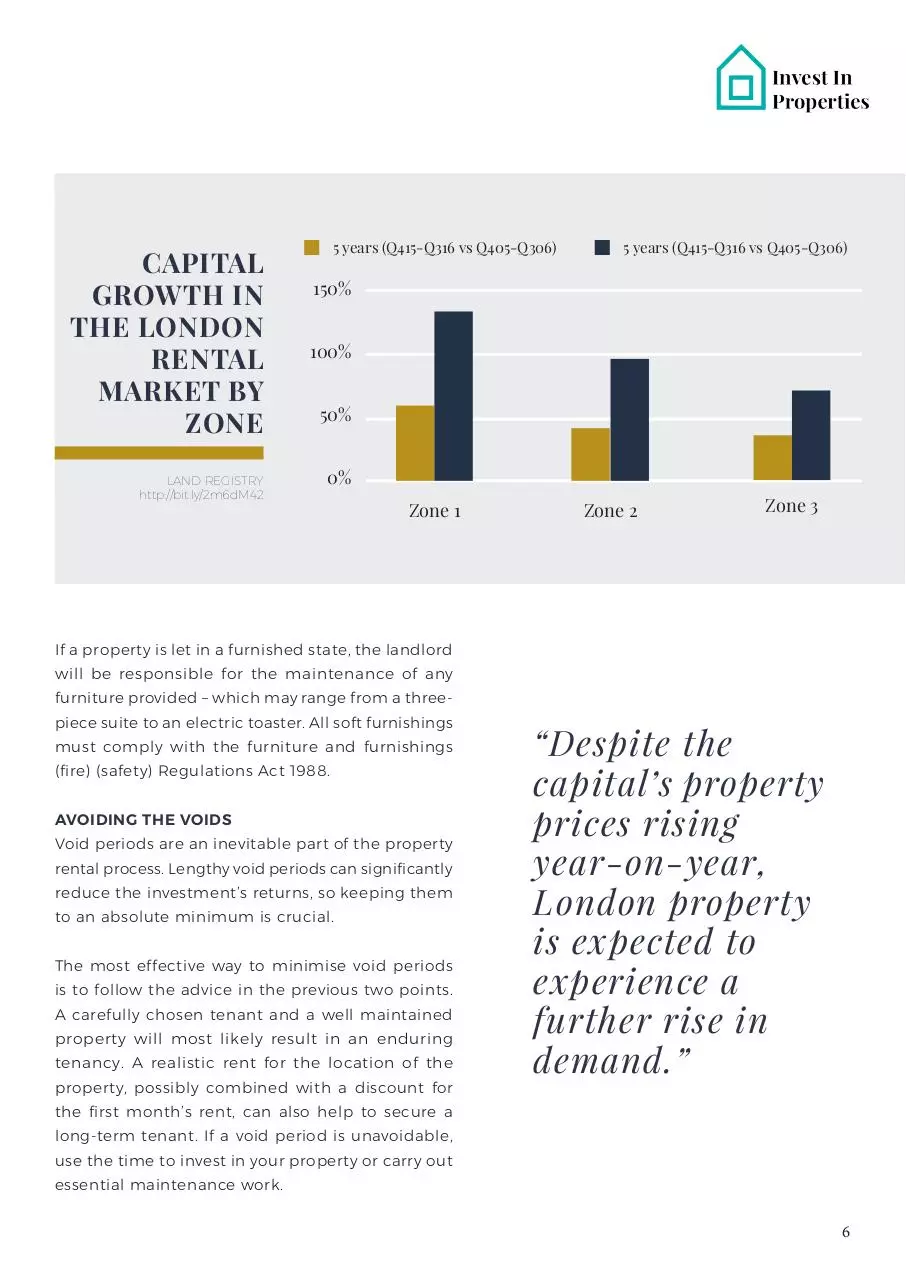

CAPITAL

GROWTH IN

THE LONDON

RENTAL

MARKET BY

ZONE

LAND REGISTRY

http://bit.ly/2m6dM42

5 years (Q415-Q316 vs Q405-Q306)

5 years (Q415-Q316 vs Q405-Q306)

150%

100%

50%

0%

Zone 1

Zone 2

Zone 3

If a property is let in a furnished state, the landlord

will be responsible for the maintenance of any

furniture provided – which may range from a threepiece suite to an electric toaster. All soft furnishings

must comply with the furniture and furnishings

(fire) (safety) Regulations Act 1988.

AVOIDING THE VOIDS

Void periods are an inevitable part of the property

rental process. Lengthy void periods can significantly

reduce the investment’s returns, so keeping them

to an absolute minimum is crucial.

The most effective way to minimise void periods

is to follow the advice in the previous two points.

A carefully chosen tenant and a well maintained

property will most likely result in an enduring

tenancy. A realistic rent for the location of the

property, possibly combined with a discount for

“Despite the

capital’s property

prices rising

year-on-year,

London property

is expected to

experience a

further rise in

demand.”

the first month’s rent, can also help to secure a

long-term tenant. If a void period is unavoidable,

use the time to invest in your property or carry out

essential maintenance work.

7

6

INVESTING IN OFF-PLAN

PROPERTIES IN LONDON

There is a large and varied off-plan property

INVESTING IN OFF-PLAN

PROPERTIES OUTSIDE

LONDON

market in London thanks to the diversity of the

developments taking place and the seemingly

insatiable demand for property in the capital.

Off-plan investment provides a convenient way

to gain exposure to this vibrant and potentially

In recent years, emerging regional markets

lucrative market. High yielding regions of

have proved to be excellent investment options

the capital, such as regeneration areas and

for investors looking for off-plan property

locations with fast-growing employment, are

opportunities. Improved transport links, including

particularly advantageous for the off-plan

the proposed High Speed 2 (HS2) linking London,

property investor.

Birmingham, Leeds, Sheffield and Manchester,

are encouraging the once localised housing

Despite the capital’s property prices rising

market to expand further afield. This includes

year-on-year, London property is expected

regions where an investor’s purchasing power is

to experience a further rise in demand as its

far greater than that in London and the South

economy grows and foreign investors benefit

East of England. In many of these locations,

from the fall in value of the pound.

rental yields can be greater than those in London.

5.02%

4.98%

4.97%

4.91%

4.87%

4.86%

4.79%

Luton

South-On-Sea

Outer London

Richmond/Medway

5.10%

Sunderland

5.16%

Oldham

6

Coventry

6.02%

3

2

Liverpool

4

Manchester

5

1

0

Rental Yield%

7

RENTAL

YIELDS

FROM

AROUND

THE UK

LANDLORD TODAY

http://bit.ly/2m658Tf

GROWTH IN THE NUMBERS

OF PEOPLE RENTING,

BY UK REGION*

There are lower entry levels for investors

purchasing off-plan properties outside London.

The availability and accessibility is superior and

it gives investors the opportunity to diversify

their property portfolio beyond high-value

London properties.

%

2017*

8

2016

7

2015

impressive rental prices relative to their

6

investment costs. Areas including Manchester,

5

Birmingham, Liverpool, Bristol, Brighton,

4

nd

Sc

ot

la

th

No

r

al

es

W

s

nd

la

id

h

ut

M

W

es

st

Ea

So

th

n

lL

on

do

do

ra

nt

te

rL

on

Ce

Captec typically expects to achieve a significant

Gr

ea

When looking at off-plan property investments,

t

-1

n

than those in London.

1

0

st

rental yields climb at a much higher rate

3

2

So

u

Burnley, Barnsley and Wrexham have seen

2014

Ea

Regional property markets are experiencing

2018*

discount at purchase, placing investors in a very

strong financial position. Various structures

and agreements have been created to further

mitigate the risks of investing in off-plan

COUNTRYWIDE RESEARCH LETTINGS INDEX http://bit.ly/2jXyEdt

* Data based on forecasts

properties and increase investor returns.

Offering a bespoke service, we are continually working on your behalf,

sourcing the most effective investment opportunities to suit investors

requirements.

We collaborate closely with you to ensure your portfolio earns the highest

returns within the risk boundaries you are comfortable with.

9

8

Download Why Invest In Off Plan Properties Whitepaper

Why_Invest_In_Off_Plan_Properties Whitepaper.pdf (PDF, 2.2 MB)

Download PDF

Share this file on social networks

Link to this page

Permanent link

Use the permanent link to the download page to share your document on Facebook, Twitter, LinkedIn, or directly with a contact by e-Mail, Messenger, Whatsapp, Line..

Short link

Use the short link to share your document on Twitter or by text message (SMS)

HTML Code

Copy the following HTML code to share your document on a Website or Blog

QR Code to this page

This file has been shared publicly by a user of PDF Archive.

Document ID: 0000599297.